Author: DWF Labs

Compiled by: TechFlow

Introduction

The cryptocurrency market has just experienced one of the most anticipated events of 2024 - the successful election of Trump. This event has led to drastic changes in the market, not only pushing Bitcoin (BTC) to a new all-time high, but also driving a broad-based rally across most cryptocurrencies.

Currently, the trading price of BTC is approaching $100,000. This target had become a much-discussed prediction by speculators as early as 2021.

This report will focus on analyzing the key indicators and trends of BTC price movements, DeFi activity, stablecoin market capitalization, and Altcoin performance.

These indicators can provide us with important references to better grasp the opportunities of the new market cycle.

BTC Trend Analysis

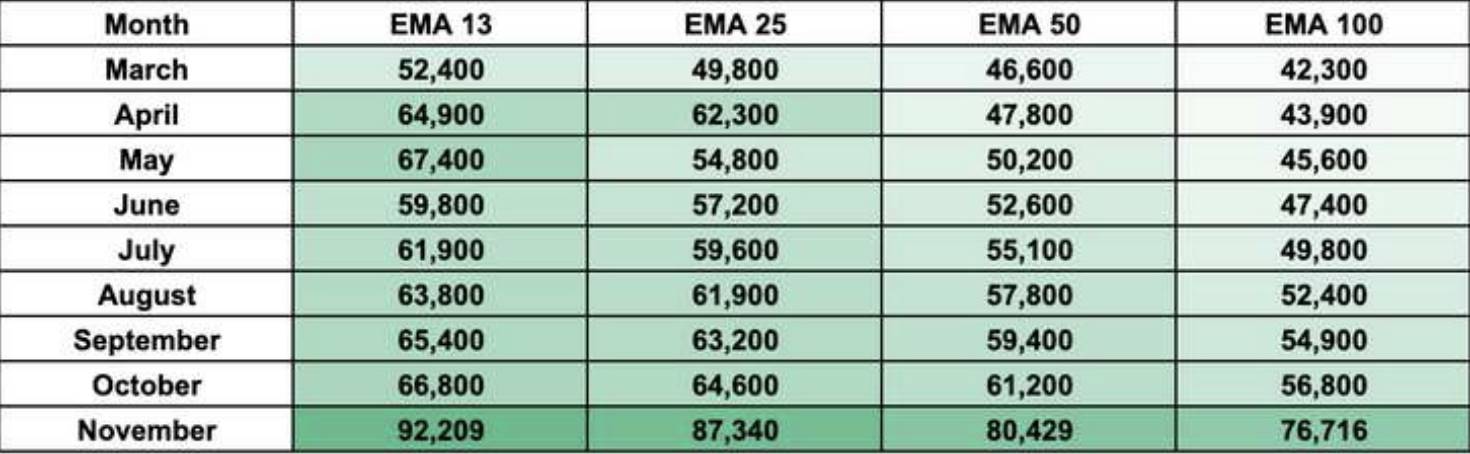

Since the launch of the ETF, Bitcoin (BTC) has maintained a strong upward momentum. Overall, the Exponential Moving Average (EMA) exhibits a clear upward trend.

In the short term (EMA 13 and EMA 25), the EMA has maintained a stable positive expansion from August to the eve of the November elections. The medium-term trend (EMA 50) provided important support during the correction period, with BTC prices consistently staying above the EMA 50 since September.

For the long-term trend, the expansion of the 100-day EMA has continued to increase since July, indicating a clear bullish signal in the market.

The market trend shows a positive stance: BTC's price trend indicates that the short-term, medium-term, and long-term trends are all exhibiting a bullish overlay, and the market structure also remains healthy.

Although the market outlook is optimistic, we still need to pay attention to changes in market dynamics. Using simple trend indicators such as EMA, we can identify the following potential risk signals:

Price falls below the short-term or medium-term trend line

Long-term EMA crosses below the short-term EMA

EMA shows contraction after an uptrend

Analysis of BTC's Binance and Coinbase Spot Premium

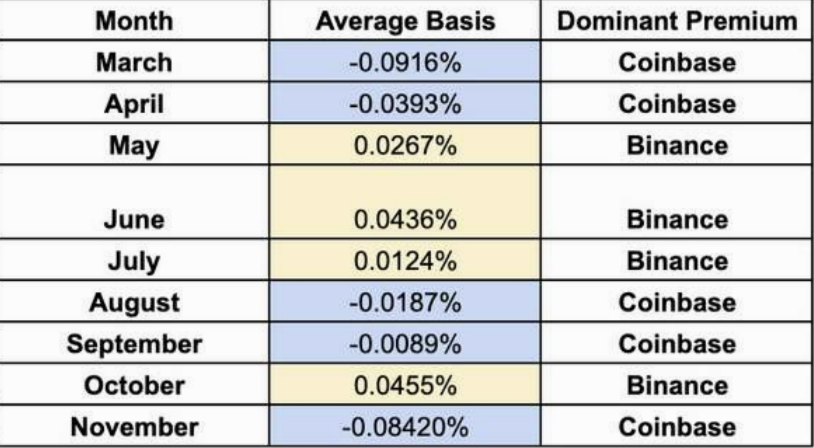

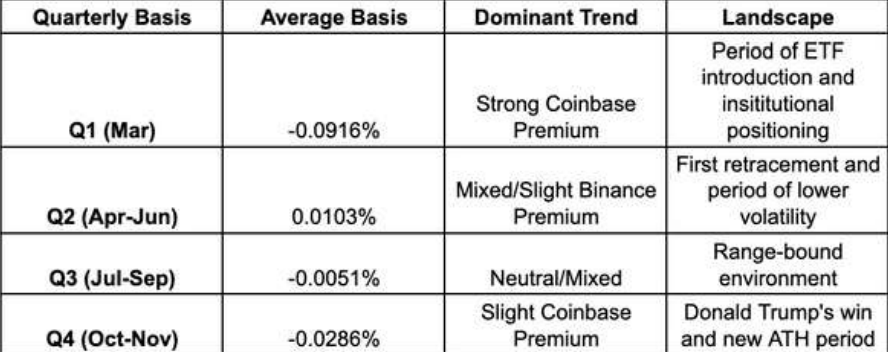

The recent BTC rally is closely related to the return of the Coinbase premium. The Coinbase premium refers to the spot price of BTC on the Coinbase platform being higher than the spot price on the Binance platform. This phenomenon is often seen as a signal of increased institutional investor interest and capital inflows. When the Coinbase premium disappears, the market often experiences a price correction. Therefore, using the Coinbase premium as a key market indicator is very important.

Generally speaking, persistent Coinbase premium often signals the arrival of a trending market, while Binance premium reflects a broader increase in market participation.

The table below summarizes how changes in the Binance and Coinbase basis affect BTC's price movements and the transformation of market conditions.

Stablecoins, DeFi, and Industry Trends

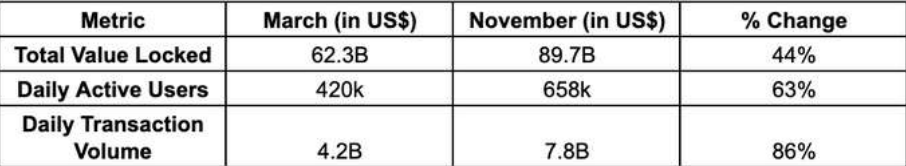

Trump's victory has brought the possibility of "deregulation" in the cryptocurrency field. After the election, DeFi's performance has been particularly outstanding, which may be the market's expectation of a more relaxed regulatory environment, and also driven by Trump's own launch of the stablecoin project World Liberty Finance.

From the growth trends of stablecoins and DeFi, user adoption is constantly increasing. Combined with future market analysis, the continued proliferation of USDT and USDC will further increase the overall liquidity of the cryptocurrency market. This trend is in line with the potentially relaxed regulatory policies that may emerge after Trump's victory, further supporting the optimistic outlook for the cryptocurrency market.

(Note: Data source: Coingecko and defillama)

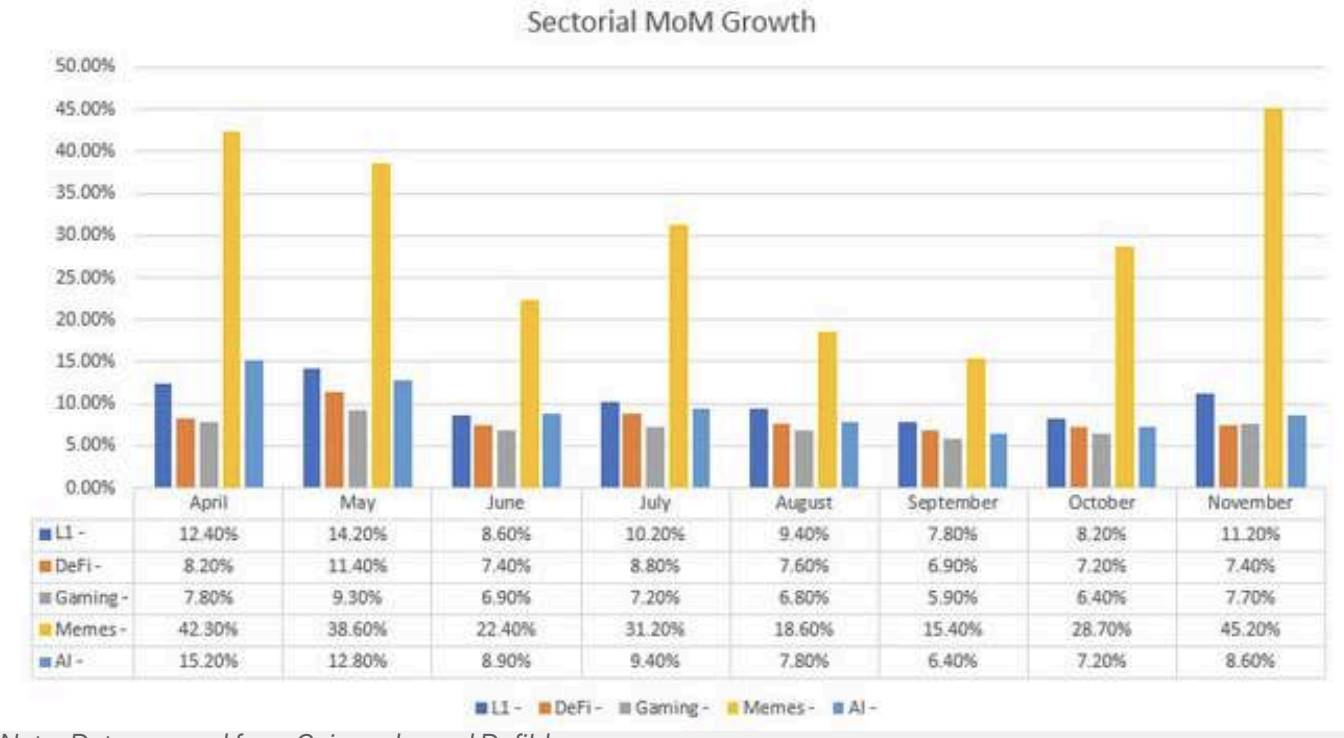

It is worth noting that although the overall industry performance is strong, MEME tokens are leading in terms of returns. This may be because retail investors prefer assets that focus on attracting attention. In contrast, the decrease in volatility in other areas may reflect these areas gradually entering a mature stage.

Changes in investment themes and trends in the cryptocurrency market often exhibit cyclical characteristics. Therefore, focusing on areas such as DeFi and Layer 1, perhaps can help identify early signals of institutional adoption. Meanwhile, the combination with real-world assets (RWA) and infrastructure-type projects or applications may also become an important guide for industry development.

As the cryptocurrency market themes and narratives continue to diversify, the use of data-driven methods to track these changes becomes increasingly important.

Conclusion

In 2024, the cryptocurrency market has shown a significant trend of maturity. The performance of various sectors is distinctive, and the behavioral patterns of institutional and retail investors are also becoming more apparent. The strong performance of Bitcoin has driven the growth of multiple sectors, with MEME tokens being particularly outstanding.

The market structure shows that the institutionalization process is steadily progressing, but at the same time it provides opportunities for retail investors to participate. At DWF, we continue to focus on core indicators such as the Total Value Locked (TVL) in DeFi and stablecoin growth. These data not only can depict the overall landscape of industry development, but also provide insights into future trends.

In addition, tracking the capital flows of major cryptocurrency assets is an important indicator for measuring market momentum. Through these indicators, investors can better manage risks and formulate investment strategies.