Bitcoin (BTC) has recently experienced a slight retreat from its upward trend and is having difficulty reaching the expected $100,000 price range. This cryptocurrency has been consolidating below this price range for the past few days, and investors are speculating about short-term price movements.

However, several prominent cryptocurrency analysts are optimistic about Bitcoin's outlook in December. This analysis explores their predictions.

Many believe $100,000 can be easily surpassed

According to Juan Pellicer, senior research analyst at the on-chain data platform IntoTheBlock, December will be bullish for Bitcoin. This bullish bias will be driven by "unprecedented institutional demand through Bitcoin ETF inflows," which will push the coin's price above $100,000.

"As we approach December, we are observing a very bullish scenario for Bitcoin. This is primarily driven by unprecedented institutional demand through Bitcoin ETF inflows. The surge in this institutional participation, combined with the noticeable easing of macroeconomic pressures, puts BTC in a favorable position to break above $100,000. The current market structure suggests a strong accumulation phase," the analyst told BeInCrypto.

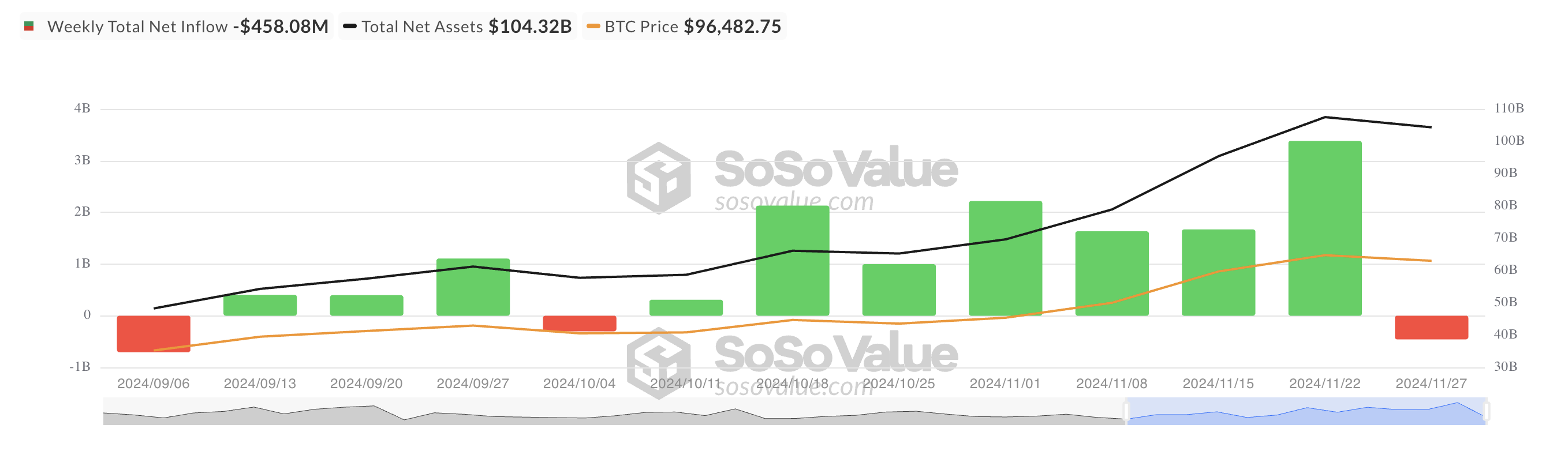

Interestingly, BTC ETFs recorded net outflows this week. This is the first time in two months. According to SoSoValue, the outflows from these funds amounted to $458 million. This decrease occurred after a significant drop in BTC price, with the coin trading as low as $92,000 earlier this week. This price decline may have prompted institutional investors to withdraw funds from these ETFs in response to market changes.

Nevertheless, another analyst, Brian Quinlivan, the senior analyst at the cryptocurrency on-chain data platform Santiment, also predicted a bullish December for Bitcoin. According to Quinlivan, this growth will be driven by Bitcoin whales continuing to accumulate the king coin.

"Bitcoin's key stakeholders (wallets holding 10+ BTC) added 63,922 more BTC in November alone, worth $606 million. Despite hitting new highs on Friday, they have not slowed their accumulation pace at all. This should be viewed as a positive signal that this slight dip is simply a mini-correction to shake out weak hands and traders who bought at $98,000/$99,000," Quinlivan said.

BTC Price Prediction: Surpassing $100,000, but Holding $105,000 is Key

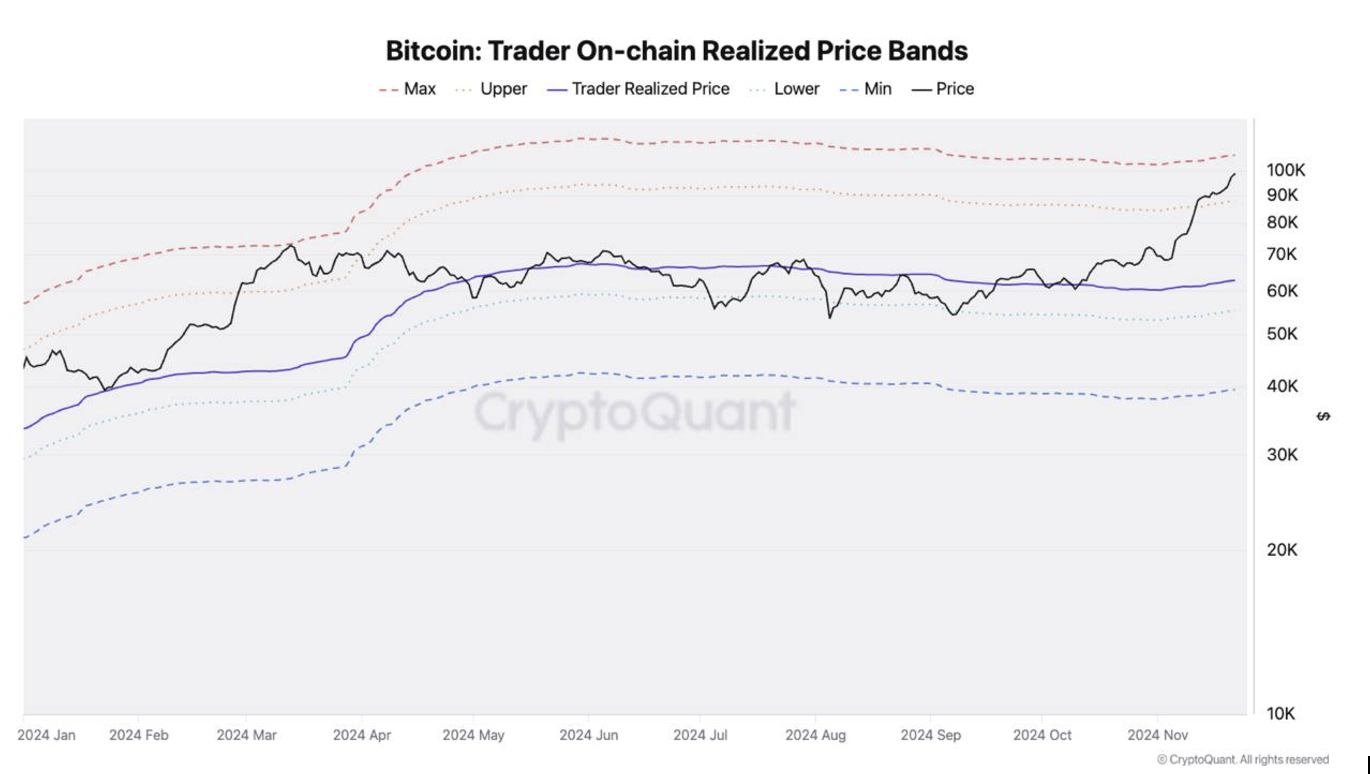

However, while agreeing that Bitcoin's price could rise above $100,000 in December, Julio Moreno, the research lead at the on-chain platform CryptoQuant, mentioned that the coin could face resistance in the short term at around $105,000.

According to Moreno, an evaluation of BTC's on-chain realized price bands revealed that the price band (the upper band) around $105,000 was a crucial resistance level when Bitcoin briefly reached $74,000 in March. This historical resistance could now influence the coin's future price action.

This means that as BTC's price approaches this upper band of $105,000, the price could potentially decline.

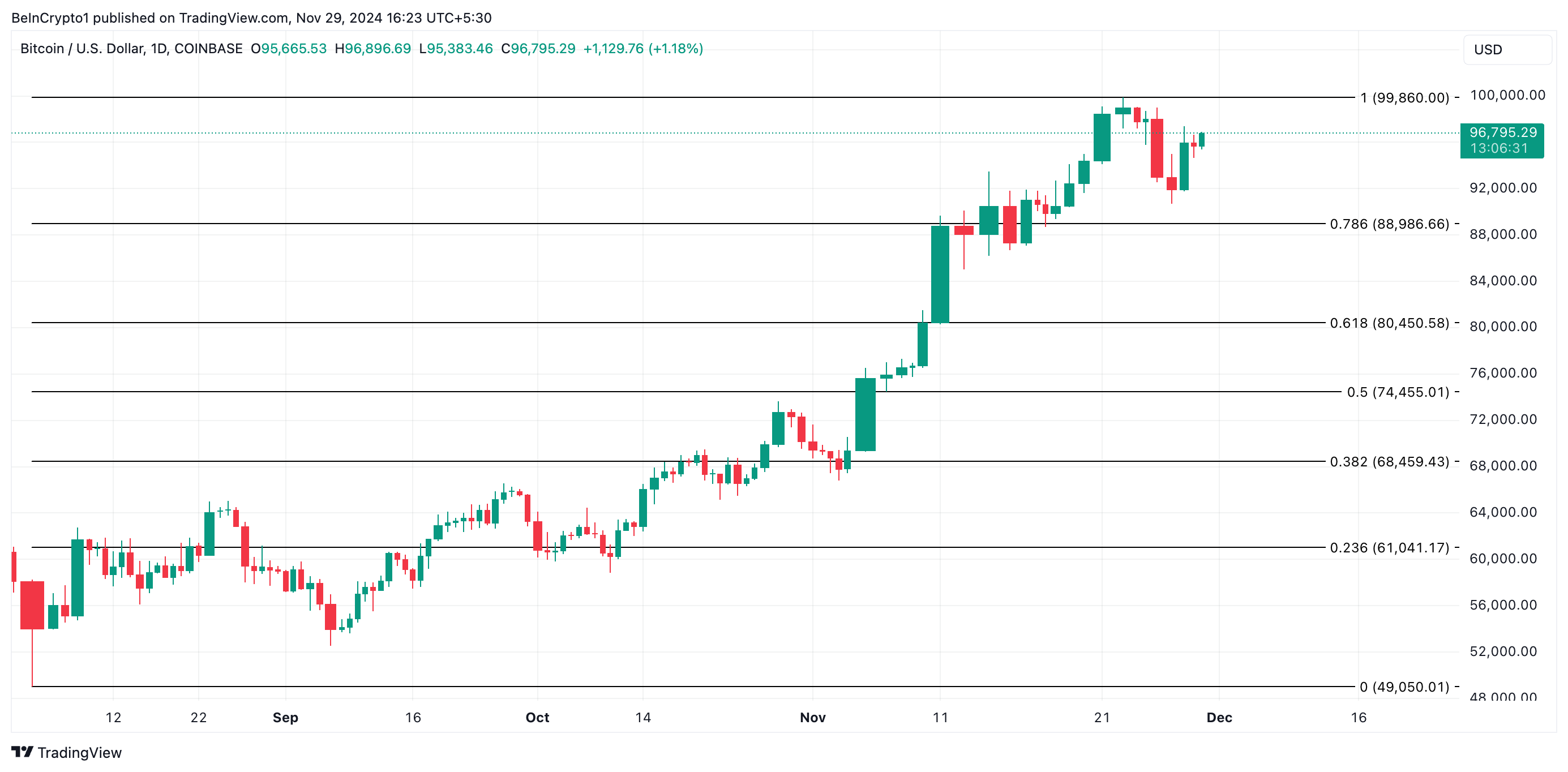

Bitcoin is currently trading at $96,795. For the $100,000 prediction to materialize, the coin needs to reclaim and hold the all-time high of $99,588 as support. If this is achieved, the coin could potentially rise above $100,000 in December.

However, if selling pressure surges, BTC's price could drop to $88,986. This could invalidate the analysts' bullish predictions.