This is not a fleeting phenomenon, the super cycle of meme coins has arrived. We are being escorted to the land of dreams. There is no retreat under the new paradigm.

—— All the people on Twitter predicting the price of meme coins

Introduction

Since our last discussion on meme coins in March this year, the overall market size and attention in this field have shown a continuous growth trend, without any obvious signs of stagnation. Undoubtedly, this makes it the fastest "racehorse" on the track.

The emergence of this phenomenon can be attributed to the following factors:

- Viral spread driven by social media

- Extremely low participation threshold

- Constantly emerging new narratives that attract the continued attention of speculators

However, many (if not most) of these narratives are difficult to maintain real attention for a longer period of time. But market participants have become accustomed to this, frequently switching between short-term high-return trends, while maintaining more loyalty to well-thought-out and more durable high-conviction investments. Although some are reluctant to admit it, in the current environment, the possibility of an existing meme coin going to zero is much lower than people's expectations for such purely hype-driven and useless assets.

While Solana may not be the sole contributor to the massive total market capitalization of these tokens, most of the activity in the meme coin space indeed takes place in the "trenches" of its on-chain ecosystem. Therefore, this article will focus on Solana, exploring the landscape of this field from a more macro perspective.

Respect the "Pump"

Since the birth of the Pump.fun platform, the Solana native meme coin incubation ecosystem has brought about a significant change in the dynamics of the local market. Interacting with speculative tokens has become simpler, cheaper, and more secure than ever before. Through a user-friendly interface, the platform has standardized token deployment in a controlled environment, allowing anyone to create new tokens based on a common configuration, eliminating potential risks from malicious actors hiding vulnerabilities in smart contracts. This process requires little more than the creator providing some creative input, without any technical skills. All complexities are shielded, and users' attention naturally focuses on what really matters—massive speculation.

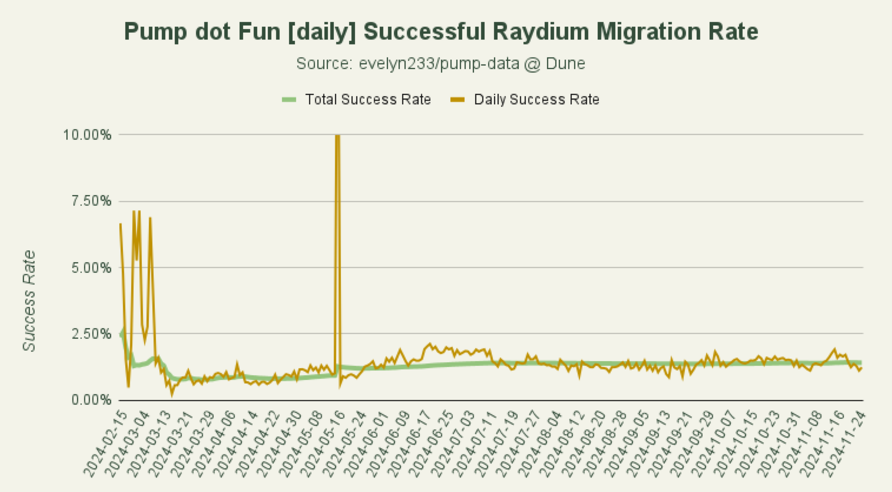

Once a tokenized meme is generated, it is immediately traded on the platform's internal market. When its market capitalization reaches around $69,000, it is automatically deployed to Raydium. However, most tokens fail to reach this threshold and remain trapped within the "circle".

Approximately one out of every hundred tokens manages to "graduate" from Pump.fun's "academy". This phenomenon is due to factors such as high market saturation and limited liquidity (beyond the scope of this article). To stand out in the highly competitive environment, participants must present content that is interesting, impactful, or unique enough to capture the attention of these "trench warriors". Nevertheless, the Pump.fun protocol has quickly established itself as the de facto portal for micro-cap token trading and new token issuance, surpassing other platforms in this field.

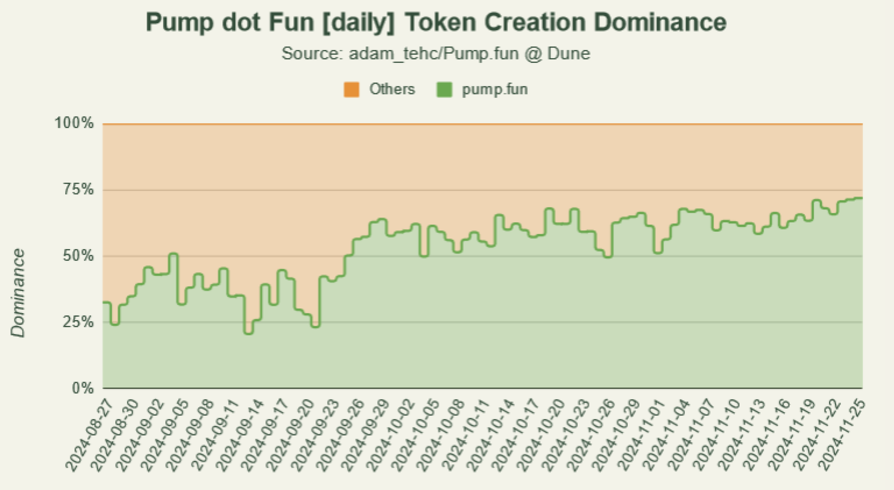

To date, the platform has an astonishing 71.9% market share in token deployments, demonstrating its widespread popularity and far-reaching influence. Recent developments, such as attracting a large number of new users through TikTok who harbor "get-rich-quick" ambitions, have further fueled the entire market.

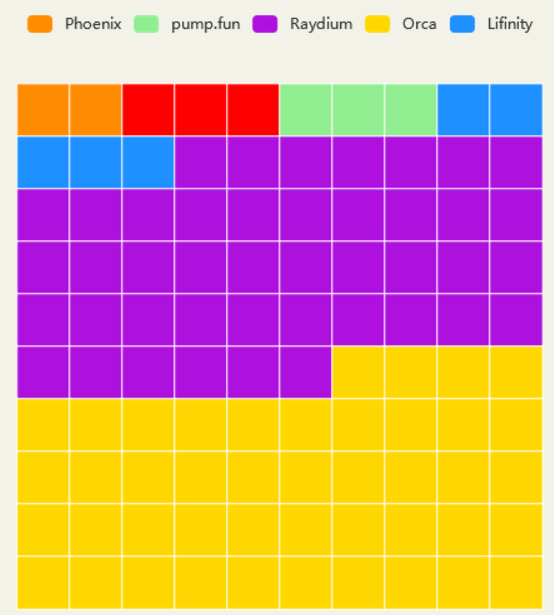

All Roads Lead to Raydium

Whether it's secretly launched tokens, tokens issued by the Pump.fun platform, or pre-sale tokens, the vast majority of meme coin liquidity pools are concentrated on Raydium. The influx of meme coins into the market has significantly increased Raydium's market share, becoming an important component of the current on-chain trading volume on Solana.

In the gold rush, the people selling shovels usually make the most money. This analogy also applies to the topic discussed in this article. Regardless of the performance of meme coins, the platforms that facilitate trading activity will greatly benefit from the increased trading volume driven by speculation.

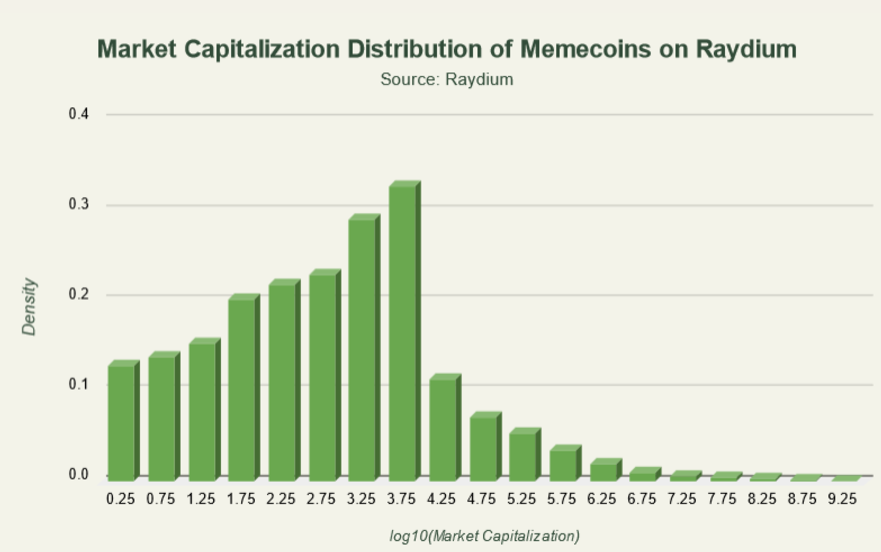

Based on common sense and some anecdotal evidence, only a few tokens can stand out, while most are destined to fade into obscurity. This view can be verified or refuted by observing the market capitalization distribution of all existing trading pairs.

Distinguishing meme coins from non-meme coins is somewhat challenging, as data providers lack an efficient labeling mechanism. After careful consideration, the approach taken in this data compilation is to collect all liquidity pool information on Raydium as of November 25, 2024, filter out pools with non-zero liquidity, and exclude official token listings and legitimate projects listed on CoinGecko. The remaining 493,203 liquidity pools cover 474,161 unique tokens, and these data will serve as the basis for the analysis in this section.

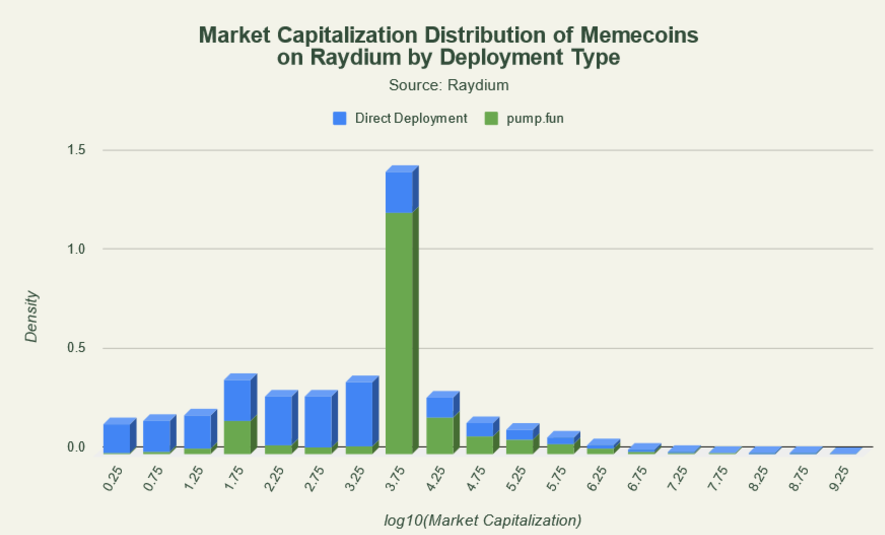

Among these tokens, most have market capitalizations typically concentrated in the $100 to $10,000 range, with a significant peak forming at the lower thousands of dollars, even if they have experienced some trading volatility during their lifecycle. This indicates that the data exhibits a clear right-skewed distribution, with the tail gradually tapering off, representing a smaller number of higher-valued tokens. This is not surprising, as maintaining a moderate market capitalization is a challenge in a market that is highly dependent on attention.

While the above examples encompass the entire dataset, it is also meaningful to explore the structural differences in the distribution between tokens generated by Pump.fun and those directly deployed to Raydium.

Analyzing them separately not only provides insights into the overall distribution patterns but also reveals their respective performances and some unique characteristics.

Pump.fun

Since tokens on the Pump.fun platform need to reach a certain market capitalization threshold to obtain liquidity pool support, these tokens are often assigned higher valuations at launch due to their relatively abundant liquidity, with market capitalizations concentrated in the $5,000 to $15,000 range. However, most successful "graduates" struggle to maintain or exceed this valuation after migrating to Raydium. These tokens are more commonly found in the medium to high market capitalization range (tens of thousands to low millions of dollars), as the platform's deployment process filters out unappealing memes while allowing the community to leverage the visibility or hype gained on the platform as a growth catalyst.

Direct Deployment

In the lower market capitalization range, tokens directly deployed are significantly more dense, indicating that many smaller and less popular tokens struggle to gain significant attention. This may be partly due to market saturation, the timing of these token releases, or a lack of effective narratives, originality, and Twitter promotion. While less obvious, there are more rare instances of meme coins listed on centralized exchanges in the higher market capitalization range, which were created even before the Pump.fun platform came into existence.

The persistent clustering of the dataset's tokens around lower valuations confirms the previously mentioned points: trend exhaustion and the bursting of speculative bubbles are major hurdles faced by meme coins, while misaligned incentives have greatly accelerated the instant collapse and subsequent death of many tokens.

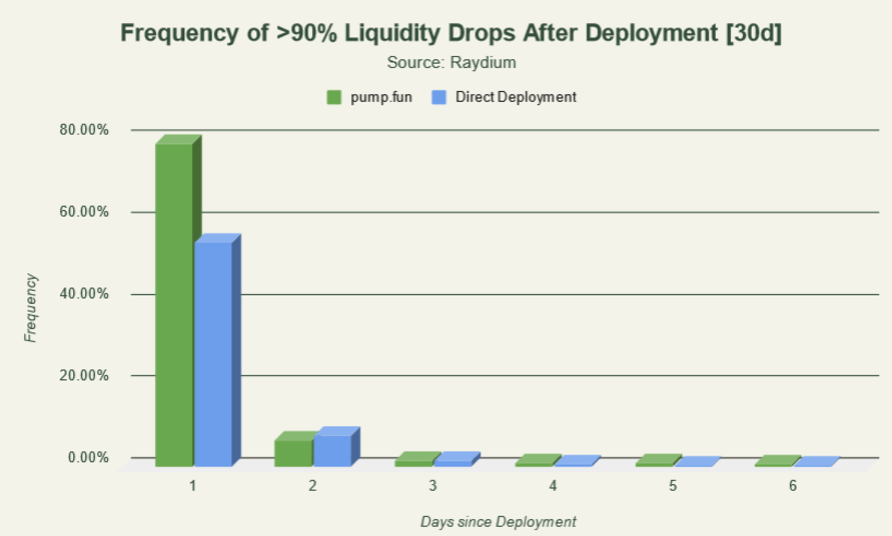

In the field of meme coin, pseudonymous scammers who mislead the audience and malicious "developers" face almost no consequences, making blatant fraud gradually seen as the norm, causing many seemingly promising concepts to fail upon launch. Deeper observation reveals that many tokens are deliberately designed as short-term tools to extract maximum value from speculators, posing a persistent threat to brave investors. In the past 30 days alone, nearly two-thirds of tokens were "slaughtered" within 24 hours of launch, with over 90% of liquidity evaporating. At this early stage of such disastrous events, it is almost impossible for the tokens to recover. However, occasionally there are angry holders who try to revive the tokens through community takeovers. They may do so out of stubbornness or even revenge, creating new social media accounts and starting anew. Although the results usually match expectations (failure), if done properly, supporters may be able to secure a decent exit opportunity.

In the past 30 days alone, nearly two-thirds of tokens were "slaughtered" within 24 hours of launch, with over 90% of liquidity evaporating. At this early stage of such disastrous events, it is almost impossible for the tokens to recover. However, occasionally there are angry holders who try to revive the tokens through community takeovers. They may do so out of stubbornness or even revenge, creating new social media accounts and starting anew. Although the results usually match expectations (failure), if done properly, supporters may be able to secure a decent exit opportunity.