Introduction

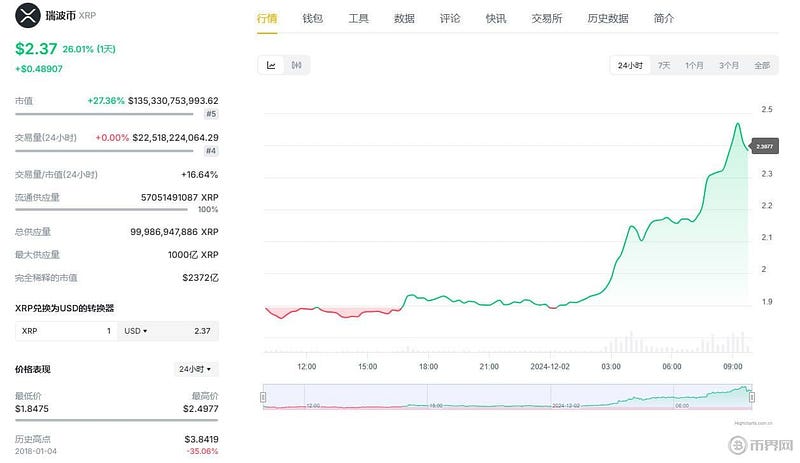

XRP (Ripple) has recently been making headlines in the market, with a continuous surge in price. It has recently surpassed the stablecoin Tether (USDT) to become the third-largest cryptocurrency by market capitalization. According to data from CoinGecko and CMC, XRP has seen a remarkable increase of over 367% in the past 30 days, and a surge of over 71% in the past week, skyrocketing from $0.51 to $2.47, a staggering 380% rise. Its market capitalization has now exceeded $141.6 billion, shocking the market.

With this rapid surge, XRP's market capitalization has now reached $141.6 billion, surpassing USDT's $134.2 billion, making it the third-largest cryptocurrency.

Change in SEC Leadership Fuels Market Optimism

The rise of XRP is not a coincidence. One of the key factors behind it is the news that the U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler will step down on January 20, 2024. This change has sparked optimism among investors, and many crypto projects that have had legal battles with the SEC, including Ripple Labs, have been attracting market attention and investor interest following Gensler's departure. Gensler's exit is seen as a signal that the SEC's policies towards the cryptocurrency industry may undergo a shift, and the market is optimistic about the potential improvement in the regulatory environment.

The ongoing lawsuit between Ripple and the SEC, which has been a focus of investor attention since 2020, has been a key factor. The SEC had accused Ripple Labs of conducting an unregistered securities sale through the issuance of XRP tokens. However, with the news of Gensler's departure, investors are hopeful that the case may see a favorable resolution, and are speculating that the Ripple-SEC lawsuit could take a positive turn. This optimism has directly contributed to the rise in XRP's price.

Ripple's Off-Chain Initiatives Empower XRP

In addition to the change in SEC leadership, Ripple's global off-chain initiatives are also a core driver behind the sustained rise of XRP. Ripple has established strategic partnerships in multiple countries and regions, and is actively promoting central bank digital currencies (CBDCs) and stablecoin projects. In 2023, Ripple acquired the Swiss digital asset custodian Metaco and the New York-based digital asset custodian Standard Custody & Trust Company, laying a solid foundation for its expansion in the digital asset space.

Notably, Ripple recently announced the launch of a new stablecoin, RLUSD, which has been approved by the New York Department of Financial Services (NYDFS) and is scheduled to be officially launched on December 4th. This move will further drive Ripple's business development in the digital currency sector and enhance the market demand for XRP.

Furthermore, Ripple is actively expanding its collaborations with global central banks and financial institutions, promoting the application of XRP in areas such as payments, settlement, and supply chain finance. For example, Ripple has partnered with the Republic of Palau to launch a central bank digital currency platform, and the Japanese financial giant SBI Group has become the first Japanese company to build a supply chain finance solution using the XRP Ledger blockchain technology.

Institutional Capital Inflow Driving XRP's Market Cap Surge

As XRP's price continues to rise, more and more institutional investors are starting to take notice and enter the market. Ripple's business model, strong technical capabilities, and deep collaborations with global financial institutions have provided a solid foundation for XRP's rally. Particularly in the context of the SEC lawsuit nearing its conclusion, investors believe that XRP has the potential to become a core asset for more financial applications, such as spot exchange-traded funds (ETFs), further driving the inflow of institutional capital.

Although XRP's current price is still about 27.6% lower than its historical high of $3.40 set in 2018, its recent gains have approached the highest levels seen in the past seven years, indicating that XRP's market potential has not yet been fully realized. As the global financial market's acceptance of digital currencies and blockchain technology continues to grow, the future performance of XRP is worth looking forward to.

Trends in Other Cryptocurrency Markets

Alongside XRP's strong performance, other top cryptocurrencies have also seen recent gains. For example, Cardano (ADA) has risen by around 10% in the past 24 hours, while Shibu Inu (SHIB) and Stellar (XLM) have increased by 8% and 13%, respectively. The upward trends of these cryptocurrencies indicate that the overall market enthusiasm for digital assets remains strong, particularly in the context of an improving regulatory environment.

Latest Price Trends of XRP, Cardano (ADA), Shibu Inu (SHIB), and Stellar (XLM)

Conclusion

The price surge of XRP is not only related to the change in SEC leadership, but also closely tied to Ripple's global strategic positioning and its deep collaborations with financial institutions. With the influx of institutional capital and increased market confidence in XRP, the cryptocurrency is poised to play a more important role in the global payment and finance sectors. The optimistic expectations of investors for XRP may also signal that this crypto asset will have a more expansive development space in the future.