Author: Avik Roy, Bitcoin Magazine; Translated by: Wuzhu, Jinse Finance

Preface

Scholars debate whether it was Mahatma Gandhi who first said, “First they ignore you, then they laugh at you, then they fight you, then you win.” What is indisputable is that Bitcoin advocates have adopted the motto as their own.

Bitcoin proponents widely predict that at some point Bitcoin will replace the U.S. dollar as the world’s primary store of value. [1] Less discussed is the fundamental question of how exactly such a transition might occur and what risks might exist along the way, particularly if fiat currency issuers choose to fight back against challenges to their monetary monopoly.

Will the U.S. government and other Western governments be willing to adapt to the emerging Bitcoin standard, or will they adopt restrictive measures to prevent the replacement of fiat currencies? If Bitcoin does surpass the U.S. dollar as the world’s most widely used medium of exchange, will the transition from the dollar to Bitcoin be as peaceful and benign as the evolution from Blockbuster Video to Netflix? Or will it be as violent and destructive as Weimar Germany and the Great Depression? Or somewhere in between?

These questions are of more than theoretical interest. If Bitcoin is to survive the potentially turbulent times ahead, the Bitcoin community will need to think carefully about how to make it resilient to future conditions, and how best to achieve the most peaceful and least disruptive economic transition to one based once again on sound money.

In particular, we must consider the vulnerability of those with incomes and wealth below the median in wealthy countries—who, at current and future Bitcoin prices, may not be able to save enough to protect themselves from the coming economic challenges. “It’s fun to be poor,” some Bitcoin supporters have retorted to their skeptics on social media. But in a real economic crisis, the poor will have no fun. The failure of fiat-based fiscal policy will do the most harm to those who rely most on government spending for their economic security. In democratic societies, populists across the political spectrum will have powerful incentives to tap into the resentment of the non-Bitcoin majority against the Bitcoin elite.

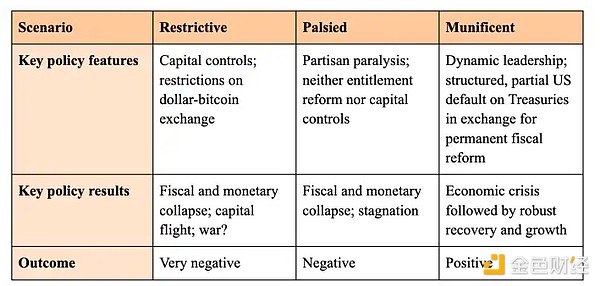

Of course, it is difficult to accurately predict how the U.S. government would respond to a hypothetical fiscal and monetary collapse in the coming decades. But potential scenarios can be broadly grouped in terms of how they would be relatively negative, neutral, or positive for society as a whole. In this article, I describe three such scenarios: a restrictive scenario, in which the U.S. attempts to actively restrict economic freedoms in order to suppress competition between the dollar and Bitcoin; a paralyzing scenario, in which partisan, ideological, and special interest conflicts paralyze the government, limiting its ability to improve the U.S. fiscal situation or prevent the rise of Bitcoin; and a generous scenario, in which the U.S. incorporates Bitcoin into its monetary system and returns to sound fiscal policy. I project these scenarios based on the high probability that the U.S. will experience a fiscal and monetary crisis in 2044.

While these scenarios could also play out in other Western countries, I’m focusing on the United States here because the U.S. dollar is the world’s reserve currency today, so the U.S. government’s response to Bitcoin is particularly important.

The coming fiscal and monetary crisis

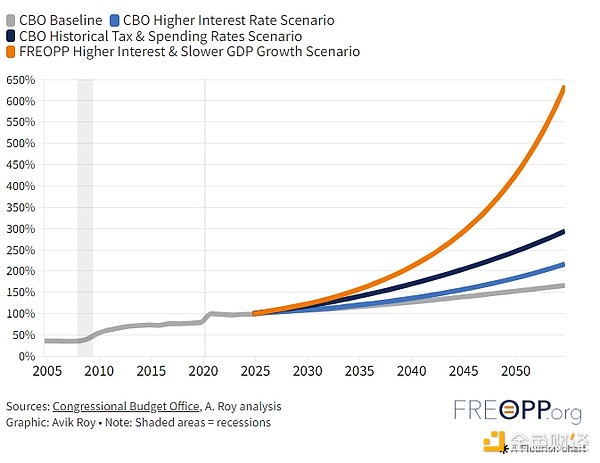

We know enough about the United States’ fiscal trajectory to conclude that a major crisis is not only possible but likely by 2044 if the federal government fails to change course. In 2024, interest on the federal debt exceeded defense spending for the first time in modern history. The Congressional Budget Office (CBO)—the official, nonpartisan fiscal scorekeeper for the nation’s legislatures—projects that federal debt held by the public will be about $84 trillion, or 139 percent of gross domestic product, by 2044. This implies an increase of $28 trillion, or 99 percent of GDP, by 2024. [2]

The CBO’s projections make some optimistic assumptions about the country’s fiscal situation in 2044. In its most recent projections at the time of this publication, the CBO assumes that the U.S. economy will continue to grow at a robust 3.6% per year forever, that the U.S. government will be able to borrow at a favorable interest rate of 3.6% through 2044, and that Congress will not pass any laws that would cause the fiscal situation to deteriorate (for example, during the COVID-19 pandemic).[3]

The CBO understands that its projections are optimistic. In May 2024, it released an analysis of how several alternative economic scenarios would affect the debt-to-GDP ratio. The first, in which interest rates rise 5 basis points (0.05%) per year above the CBO’s benchmark, would result in a debt of $93 trillion, or 156% of GDP, in 2044. The other, in which federal tax revenues and spending as a share of GDP continue at historical levels (for example, due to a continuation of so-called temporary tax cuts and spending programs), would produce a debt of $118 trillion, or 203% of GDP, in 2044. [4]

But a combination of factors clearly shows how dire the future has become. If we use the Congressional Budget Office’s high-interest rate scenario, where interest rates increase by 5 basis points per year, and then gradually reduce GDP growth from 3.6% to 2.8% in nominal GDP in 2044, the debt in 2044 will be $156 trillion, or 288% of GDP. By 2054, the debt will be $441 trillion, or 635% of GDP (see Figure 1).

Congressional Budget Office's forecast for federal debt is very optimistic

(Debt to GDP ratio, CBO baseline and alternative scenarios, %)

Figure 1. U.S. Debt to GDP Ratio: Alternative Scenarios

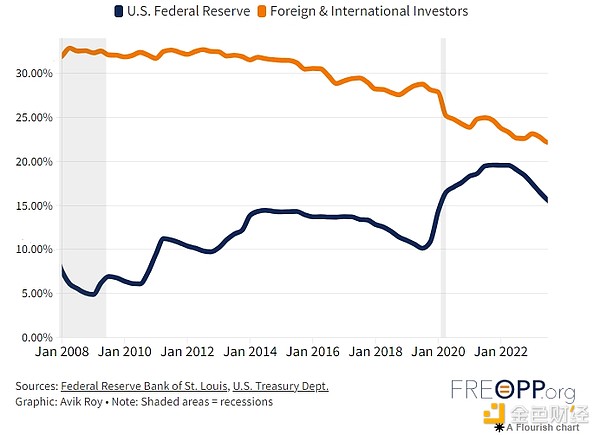

Under this scenario of rising interest rates and slowing economic growth, the U.S. government will pay $6.9 trillion in interest by 2044, nearly half of federal tax revenues. But just as we cannot assume that economic growth will remain high over the next two decades, we cannot assume that demand for U.S. government debt will remain stable. At some point, the United States will run out of money for everyone else. Credit Suisse estimates that global household wealth, defined as the value of financial and real estate assets net of debt, will be $454 trillion in 2022. [5] Not all of this wealth can be lent to the United States. In fact, the share of U.S. Treasuries held by foreign and international investors has been falling steadily since the 2008 financial crisis. [6] And while demand for Treasury bonds has fallen proportionately, the supply of Treasury bonds has been rising steadily (see Figure 2). [7]

Foreigners are reducing their lending to the U.S.

(Shareholding ratio of government bonds since 2008)

Figure 2. Ownership of U.S. Treasury Bonds

In an unregulated bond market, falling demand and rising supply should cause bond prices to fall, meaning higher interest rates. However, the Federal Reserve has intervened in the Treasury market to ensure that interest rates remain below normal levels. The Fed does this by printing new dollars out of thin air and using them to buy the Treasury bonds that the broader market refuses to buy. [8] In effect, the Fed considers monetary inflation (i.e., rapidly increasing the number of dollars in circulation) to be a more acceptable outcome than allowing interest rates to rise as the nation's creditworthiness declines.

This situation is unsustainable. Using a methodology developed by IMF researchers, economist Paul Winfree[9] estimates that “the federal government will begin to run out of fiscal space, or its ability to incur additional debt to respond to adverse events, within the next 15 years”—that is, by 2039. He further notes that “interest rates and potential (GDP) growth are the most important factors” that will influence his forecast.

For the purposes of our rehearsal, let’s assume that the United States will experience a fiscal and monetary failure in 2044, i.e., a major economic crisis characterized by rising interest rates (caused by the market’s lack of appetite to buy Treasury bonds) and high consumer price inflation (brought on by rapid monetary inflation). Over this twenty-year period, let’s also imagine that Bitcoin gradually increases in value to the point where its liquidity, measured by total market capitalization, is competitive with that of U.S. Treasuries. Competitive liquidity is important because it means that large institutions, such as governments and multinational banks, can buy Bitcoin on a large scale without unduly disturbing its price. Based on the behavior of traditional financial markets, I estimate that Bitcoin will reach a state of competitive liquidity with U.S. Treasuries when its market capitalization is roughly equal to one-fifth of the federal debt held by the public. Based on my estimate of $156 trillion in federal debt in 2044, this equates to a Bitcoin market capitalization of about $31 trillion, which translates to a price of $1.5 million per Bitcoin, or about 20 times the peak price of Bitcoin in the first half of 2024.

This is by no means an unrealistic scenario. From August 2017 to April 2021, in less than four years, Bitcoin has appreciated by a significant multiple. [11] Bitcoin has appreciated by similar multiples on numerous other occasions before. [12] If anything, my forecast for the growth of the U.S. federal debt is conservative. So let’s further imagine that by 2044, Bitcoin has become a well-known, mainstream asset. A young person who turns 18 in 2008 will celebrate his or her 54th birthday in 2044. By 2044, more than half of the U.S. population will have lived with Bitcoin throughout their adult lives. By then, a robust ecosystem of financial products, including lending, may have been built on top of the Bitcoin base layer. Finally, let’s assume that inflation has reached 50% per year in this scenario. (This figure is somewhere between the inflation rates of more than 100% in Argentina and Turkey by 2023 and the nearly 15% inflation in the United States in 1980.)

In 2044, under this scenario, the U.S. government would be in crisis. A rapidly depreciating dollar would cause demand for Treasury bonds to fall abruptly, with no obvious way out. If Congress adopted extreme fiscal austerity measures—such as cutting spending on welfare and entitlement programs—its members might be driven out of office. If the Fed raised interest rates enough to sustain investor demand—say, to over 30%—financial markets would collapse and the credit-fueled economy would collapse, as it did in 1929. But if the Fed allowed inflation to rise further, it would only accelerate the exit from Treasury bonds and the dollar.

How would the U.S. government respond in this scenario? How would it treat Bitcoin? Next, I consider three scenarios. First, I consider a restrictive scenario in which the U.S. attempts to use coercive measures to prevent Bitcoin from serving as a competitor to the dollar. Second, I discuss a paralysis scenario in which political divisions and economic weakness paralyze the U.S. government, preventing it from taking meaningful steps for or against Bitcoin. Finally, I consider a generous scenario in which the U.S. ultimately pegs the value of the dollar to Bitcoin, restoring the nation’s fiscal and monetary soundness. (See Figure 3.)

Figure 3. Three fiscal scenarios for the United States

1. Restrictive Scenarios

Throughout history, the most common response by governments to currency debasement has been to force their citizens to use and hold that currency rather than more sound alternatives, a phenomenon known as financial repression. Governments also commonly employ other economic restrictions, such as price controls, capital controls, and confiscatory taxation, to maintain unsound fiscal and monetary policies. [13] It is possible (even likely) that the United States will respond similarly to the coming crisis.

Price Control

In 301 AD, the Roman Emperor Diocletian issued the "dictum de Pretiis Rerum venalim" ("Regarding the Prices of Goods Sold") in an attempt to address the inflation problem caused by the 500-year-long devaluation of the Roman currency, the denarius. Diocletian's decree set price ceilings on more than 1,200 goods and services. These included wages, food, clothing, and shipping costs. Diocletian did not blame the rising prices on extravagant consumption in the Roman Empire, but on "unprincipled and dissolute men who think that greed is some kind of obligation..." who were destroying everyone's wealth.

Such behavior has persisted throughout history, right up to the modern era. In 1971, in response to the impending collapse of U.S. gold reserves, U.S. President Richard Nixon unilaterally abolished the dollar’s peg to thirty-five ounces of gold and ordered a ninety-day freeze on “all prices and wages throughout the United States.” [16] Nixon, like Diocletian and many other rulers in between, did not blame the government’s fiscal or monetary policies for addressing the country’s woes, but rather “international currency speculators” who “have been waging an all-out war against the dollar.” [17]

Even mainstream economists have shown convincingly that price controls on goods and services do not work. [18] This is because if producers are forced to sell goods and services at a loss, they will stop producing them, resulting in shortages. But price controls remain a persistent temptation for politicians because many consumers believe that price controls will protect them from inflation (at least in the short term). Since 2008, the Federal Reserve has exercised increasingly tight control over what economic historian James Grant calls “the most important price in the capital markets”—the price of money reflected by interest rates. [19] As noted above, the Fed can effectively control Treasury interest rates by acting as the primary buyer and seller of Treasury bonds in the open market. (When bond prices rise because more are being bought than sold, the interest rate implied by their prices falls, and vice versa.) In turn, the interest rates used by financial institutions and consumers are largely influenced by the interest rates on Treasury bonds, bills, and notes. Before the 2008 financial crisis, the Fed used this power only on a small portion of short-term Treasury securities. But later, under Chairman Ben Bernanke, the Fed became more aggressive in using its power to control interest rates across the economy. [20]

Capital Controls

Price controls are just one tool governments have to control currency crises. Another is capital controls, which hinder the exchange of a local currency for another currency or reserve asset.

In 1933, during the Great Depression, President Franklin Delano Roosevelt (commonly known as FDR) deployed a World War I-era regulation to prevent Americans from fleeing the dollar to buy gold. His Executive Order 6102 prohibited Americans from owning gold coins, bars, and certificates and required people to surrender their gold to the U.S. government in exchange for $20.67 per troy ounce. [21] Nine months later, Congress devalued the dollar by changing the price per troy ounce to $35.00, effectively forcing Americans to accept an immediate 41% devaluation of their savings while preventing them from escaping the devaluation by using a higher store of value. [22]

Capital controls are far from a relic of the past. Argentina has historically prohibited its citizens from converting more than $200 worth of Argentine pesos into U.S. dollars per month, ostensibly to slow the decline in the value of the peso.[23]

Mainstream economists increasingly view these modern examples of capital controls as successful. The IMF, born out of the 1944 Bretton Woods Agreement, has long voiced opposition to capital controls, largely at the behest of the United States, which benefits from the global use of the dollar. But in 2022, the IMF revised its “institutional view” on capital controls, declaring that capital controls are “an appropriate tool to manage . . . risks in a way that preserves macroeconomic and financial stability.”[25]

In my restrictive 2044 scenario, the United States uses capital controls to prevent Americans from fleeing dollars to buy Bitcoin. The federal government could accomplish this in a number of ways:

Announce a temporary but ultimately permanent suspension of dollar-to-bitcoin conversions and force conversion of all bitcoin assets held on cryptocurrency exchanges into dollars at a fixed rate. (Based on my forecast of a market price where bitcoin liquidity is competitive with treasuries, this is approximately $1.5 million per bitcoin, but there is no guarantee that the forced conversion will be at market rates.)

Businesses under U.S. jurisdiction are prohibited from holding Bitcoin on their balance sheets and accepting Bitcoin as payment.

Liquidate Bitcoin by forcing Bitcoin exchange-traded funds (ETFs) to convert their holdings into U.S. dollars at a fixed exchange rate.

Requires Bitcoin custodians to sell Bitcoin to the U.S. government at a fixed exchange rate.

Those who self-custody their Bitcoins are required to sell them to the government at a fixed exchange rate.

Introduce a central bank digital currency to fully monitor all dollar transactions and ensure that none of them are used to buy Bitcoin.

It is unlikely that the U.S. government will be able to successfully execute all of these strategies. In particular, the U.S. will not be able to force everyone who self-custodies Bitcoin to hand over their private keys. But many law-abiding citizens would likely comply with such a directive. However, this would be a pyrrhic victory for the government: imposing capital controls would cause confidence in the dollar to decline further, and the cost to the U.S. government of buying all the Bitcoin in custody of U.S. citizens and residents could exceed $10 trillion, further weakening the U.S. fiscal position. Nonetheless, the government, under restrictive circumstances, would conclude that these are the least bad options.

Confiscation tax

The U.S. government could also use tax policy to restrict the use of Bitcoin, thereby limiting its adoption.

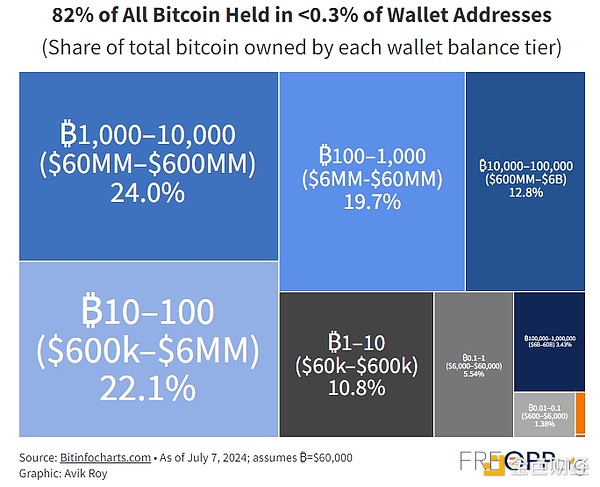

In a world where one bitcoin is worth $1.5 million, many of the wealthiest people in the United States will become early adopters of bitcoin. Technology entrepreneur Balaji Srinivasan estimates that at a price of $1 million per bitcoin, the number of bitcoin billionaires will begin to exceed the number of fiat billionaires. [26] However, this does not mean that wealth will be distributed more equally among bitcoin owners than it is among fiat currency owners today.

Less than 2% of all Bitcoin addresses contain more than 1 Bitcoin, and less than 0.3% contain more than 10 Bitcoins. The top 0.3% of addresses hold more than 82% of all Bitcoins in existence. [27] (See Figure 4.) Given that many people control multiple wallets, and even considering that some of the largest Bitcoin addresses belong to cryptocurrency exchanges, these figures likely underestimate Bitcoin wealth concentration. They fare poorly when compared to the distribution of fiat wealth in the United States; in 2019, the top 1% held just 34% of all U.S. fiat wealth. [28]

If Bitcoin ownership remains similarly distributed in 2044, those left behind by this monetary revolution—including the disenfranchised elites of the previous era—will not quietly disappear. Many will decry Bitcoin wealth inequality driven by anti-American speculators and seek policies that limit the economic power of Bitcoin owners.

Figure 4. Bitcoin ownership distribution

In 2021, Treasury Secretary Janet Yellen reportedly proposed to President Joe Biden an 80% tax on cryptocurrency capital gains, a significant increase from the current top long-term capital gains tax rate of 23.8%. [29] In 2022, President Biden, following a proposal by Massachusetts Senator Elizabeth Warren, proposed a tax on unrealized capital gains, or increases in the book value of an asset that the holder has not yet sold. [30] This would be an unprecedented move because it would require people to pay taxes on income they have not yet realized.

It has long been argued that taxing unrealized capital gains violates the U.S. Constitution because unrealized capital gains do not meet the legal definition of income, and Article I requires that non-income taxes be levied on each state in proportion to its respective population. [31] A recent Supreme Court case, Moore v. United States, gave the Court an opportunity to articulate its position on the issue; it declined to do so. [32] Therefore, it is highly likely that a future Congress, with the support of a future Supreme Court, would agree to tax unrealized capital gains, particularly cryptocurrency gains.

Furthermore, a presidential administration that does not like an existing Supreme Court's interpretation of the Constitution can simply pack the court to ensure a more favorable ruling. The Roosevelt administration threatened to do just that in the 1930s. The conservative Supreme Court at the time routinely ruled that Roosevelt's economic interventionist policies were unconstitutional. In 1937, Roosevelt responded by threatening to appoint six new Supreme Court justices to the existing nine. Although he was eventually forced to withdraw his court-packing proposal, the Supreme Court was sufficiently intimidated that it began to rapidly approve New Deal legislation.[33]

One unique aspect of U.S. tax policy is that U.S. citizens living abroad are still subject to U.S. income and capital gains taxes, as well as the taxes they paid in their country of residence. (In all other developed economies, expatriates pay tax only once, depending on where they live. For example, a French national living and working in Belgium pays the Belgian rate, not the French rate, while an American in Belgium pays both the Belgian and U.S. rates.) This creates a perverse incentive for Americans living abroad to renounce their U.S. citizenship. Several thousand Americans do so every year. However, they must first obtain approval from a U.S. embassy in a foreign country and pay taxes on any unrealized capital gains. In the restrictive context of the U.S. Treasury’s lack of revenue, it is easy to imagine the government suspending the ability of Americans to renounce their citizenship to ensure that expatriates’ income remains taxable regardless of where they live.

Fiscal restraint on the right

While many of the restrictive policies described above have been proposed by politicians affiliated with the Democratic Party, by 2044 Republican officials and representatives may be equally willing to exacerbate populist resentment against the Bitcoin elite. The United States has become home to a vigorous movement among American and European intellectuals to build a new ideology, widely referred to as national conservatism, in which it is acceptable to suppress individual rights in the name of the national interest. [34] For example, some national conservatives have advocated for monetary and tax policies that protect the dollar from Bitcoin, even at the expense of individual property rights. [35]

The USA PATRIOT Act was passed by an overwhelming bipartisan congressional majority just weeks after the September 11, 2001 terrorist attacks. Signed into law by Republican President George W. Bush, the bill includes numerous provisions designed to combat the financing of international terrorism and criminal activity. In particular, it strengthens anti-money laundering and know-your-customer rules, as well as reporting requirements for foreign bank account holders.[36]

The Patriot Act may help reduce the risk of terrorism against the United States, but it comes at a huge cost to economic freedom, especially for American expatriates and others who use non-U.S. bank accounts for personal or business reasons. Just as Roosevelt used World War I laws to confiscate gold held by Americans, by 2044, restrictive governments of either party will find many of the Patriot Act’s tools useful to suppress the ownership and use of Bitcoin.

The End of America’s Exorbitant Privilege

Bitcoin is designed to be remarkably resilient; its decentralized network is likely to continue to function well despite efforts by governments to restrict its use.

If we assume that half of the world’s Bitcoin is owned by Americans, and further assume that 80% of U.S. Bitcoin is held by early adopters and other large holders, then most of this 80% is likely already protected from confiscation through self-custody and offshore contingency plans. Capital controls and restrictions could cause U.S. institutional Bitcoin trading volume to collapse, but much of that volume would likely shift to decentralized exchanges or less restrictive jurisdictions outside the U.S.

The fiscal failure of the United States in 2044 would necessarily be accompanied by a weakening of the United States’ military power, since that power is based on massive deficit-funded defense spending. Thus, in 2044, the U.S. government would be less able to impose its economic will on other countries than it does today. Smaller countries such as Singapore and El Salvador could choose to welcome Bitcoin-based capital that the United States rejects. [38] Of course, the mass departure of Bitcoin-based wealth from the United States would make the United States poorer and further reduce the U.S. government’s ability to finance its spending obligations.

In addition, the U.S. restrictions on the utility of Bitcoin are not enough to convince foreign investors that U.S. Treasuries are worth holding. The main way the U.S. government makes U.S. bonds more attractive to invest in is for the Federal Reserve to significantly raise interest rates, because higher interest rates equate to higher yields on Treasury bonds. But this in turn would increase the cost of financing federal debt and accelerate the U.S. fiscal crisis.

Eventually, foreign investors could demand that the United States denominate its bonds in Bitcoin or in a Bitcoin-backed foreign currency as a precondition for further investment. This major change would end what former French Finance Minister and President Valery Giscard d’Estaing calls an exorbitant privilege for the United States: the United States’ long-standing ability to borrow in its own currency, which has allowed the country to reduce the value of its debt by paying down its debt.[39]

If U.S. bonds were denominated in Bitcoin, the U.S. would be forced to borrow money like other countries do: in a currency not made in the country. According to the Bitcoin standard, future depreciation of the dollar would increase, not decrease, the value of the U.S. debt to its creditors. U.S. creditors—holders of U.S. government bonds—would be able to demand all sorts of austerity measures, such as requiring the U.S. to eliminate its budget deficit through large tax increases and spending cuts in areas such as Medicare, Social Security, and defense.

A significant decline in the United States’ ability to finance its military would have profound geopolitical consequences. When the United States replaced Britain as the world’s leading power a century ago, the transition was relatively gentle. There is no guarantee that future transitions will proceed in the same manner. Historically, multipolar environments of great power competition have often been the source of world wars.[40]

2. Paralysis scenario

In medicine, paralysis is a form of paralysis accompanied by involuntary tremors. This term accurately describes my second scenario, where the macroeconomic shocks accompanying the rise of Bitcoin are combined in the United States with partisan polarization, bureaucratic conflict, and the weakening of American power. In this paralyzed scenario, the United States cannot take positive action on Bitcoin, but it is also unable to get its fiscal house in order.

Today, partisan polarization in the United States is at its modern height. [41] Republicans and Democrats are increasingly divided along cultural lines: Republicans are mostly rural, high school educated, and white; Democrats are mostly urban, college educated, and nonwhite. Independents, who now make up the majority of the electorate, are forced to choose between general election candidates chosen by the Republican and Democratic bases in party primaries. [42]

While we can hope that these trends reverse over time, there are reasons to believe that they will not. Among other factors, the accelerating development of software capabilities (including artificial intelligence) to manipulate behavior on a large scale (despite its promise) poses significant risks to the political sphere. The potential for deep fakes and other forms of large-scale deception could reduce trust in political parties, elections, and government institutions, while further fragmenting the American political landscape into smaller subcultural communities. The cumulative effect of this fragmentation could be an inability to reach consensus on most issues, let alone contentious issues like reducing federal welfare spending.

Under this paralysis scenario, the U.S. government would be unable to implement most of the restrictions described in the previous section in 2044. For example, paralysis could prevent Congress and the Federal Reserve from developing a central bank digital currency because of staunch opposition from activists, especially depository banking institutions, who rightly view such a currency as a mortal threat to their business models. (A retail central bank digital currency eliminates the need for individuals and businesses to keep money in banks, since they can hold accounts directly at the Federal Reserve.)[43]

Likewise, under this paralyzed scenario, Congress would be unable to impose confiscatory taxes on Bitcoin holders and the wealthy more broadly in 2044. Congress would fail to enact these policies for the same reasons that have prevented their implementation to date: concerns about the constitutionality of such taxes; opposition from powerful economic interests; and the recognition that a direct attack on Bitcoin-based capital would cause that capital to flow overseas, to the detriment of the United States.

However, this paralyzed scenario is not a libertarian utopia. In this scenario, the federal government would retain the ability to regulate centralized exchanges, ETFs, and other financial services that facilitate the exchange of dollars for bitcoin. If the majority of bitcoin held in the United States is owned through ETFs, federal regulators would retain the ability to restrict the conversion of bitcoin ETF securities into actual bitcoin, thereby severely limiting capital outflows from U.S.-controlled products.

Most importantly, however, partisan paralysis means that Congress will be unable to resolve America’s fiscal crisis. Congress will lack the votes for entitlement reform or other spending cuts. Federal spending will continue to grow rapidly through 2044, and no tax revenues will be able to keep up.

In the paralyzed scenario, Americans who hold Bitcoin will be better able to protect their savings from government intervention than in the restrictive scenario. For example, they will not have to flee the country to own Bitcoin. This suggests that a large portion of the Bitcoin community, both individuals and entrepreneurs, will remain in the United States and may become economically powerful voters. But the institutional environment in which they live and work will become dysfunctional. Policymakers who oppose Bitcoin and political donors who support Bitcoin may end up in an impasse.

As in the Restrictive Scenario, the failure of the dollar-denominated Treasury market in the Paralysis Scenario could force the United States to eventually get its fiscal house in order. In both scenarios, creditors will likely require the Treasury to issue debt securities backed by hard assets. By 2044, Bitcoin will have been proven as a superior store of value for more than three decades, and the U.S. Bitcoin community will be well-positioned to help the United States adapt to the new environment.

3. Generous Situation

The Generosity Scenario is both the least intuitive and the most optimistic scenario for the United States in 2044. In the Generosity Scenario, U.S. policymakers respond to the fiscal and monetary crises of 2044 by acting proactively to stay ahead of the curve, rather than being forced to react to forces ostensibly outside of their control.

A generous scenario envisions the United States doing something in 2044 similar to what El Salvador did in 2019 or Argentina did in 2023, when those countries elected Nayib Bukele and Javier Milei as presidents, respectively. Although Bukele and Milei are different leaders with different philosophies, they have both made clear their support for Bitcoin, with Bukele establishing Bitcoin as legal tender in El Salvador[44] and Milei pledging to replace the Argentine peso with the U.S. dollar while legalizing Bitcoin[45].[46] Milei has also used presidential powers to slash Argentina’s inflation-adjusted public spending, resulting in a primary budget surplus.[47]

Imagine that in November 2044, the United States elects a dynamic, pro-Bitcoin president who promises to adopt Bitcoin as legal tender alongside the dollar (in Bukele’s style) and work with Treasury bondholders to reduce the U.S. debt burden (in Milley’s style). One could imagine a grand fiscal bargain: Treasury bondholders accept a one-time partial default in exchange for Medicare and Social Security reforms and agree to back the dollar with Bitcoin in the future, pegged to 67 satoshis (or $1.5 million per Bitcoin). Bondholders might be happy to accept a partial default in exchange for major reforms to put the U.S. on a sustainable fiscal and monetary footing for the future.

Such reforms need not penalize the elderly and other vulnerable groups. A growing body of research suggests that fiscal solvency does not have to conflict with social welfare. For example, the Equal Opportunity Research Foundation released a health care reform plan proposed in 2020 by Representative Bruce Westerman of Arkansas and Senator Mike Braun of Indiana, called the Fair Care Act. The plan would reduce the deficit by more than $10 trillion over 30 years, making the health care system fiscally solvent while achieving universal coverage. The bill achieves this goal in two main ways: First, it means-tests health subsidies so that taxpayers only fund health care costs for the poor and middle class, not the rich. Second, it reduces the cost of health subsidies by spurring competition and innovation. In these ways, the proposal increases the financial security of low-income Americans while also increasing the fiscal sustainability of the federal government.

Similarly, the United States could reform Social Security by shifting the Social Security Trust Fund from Treasury bonds to Bitcoin (or Treasury bonds denominated in Bitcoin). [49] While this idea is less practical during the high volatility of Bitcoin’s early history, Bitcoin could become more stable against the U.S. dollar by 2044. As large financial institutions introduce traditional hedging practices to the asset, Bitcoin trading matures after ETFs, significantly reducing Bitcoin’s price volatility in U.S. dollars. Soon, Bitcoin’s price volatility could resemble that of stable assets such as gold. By collateralizing Social Security with Bitcoin, the United States could ensure that Social Security lives up to its name and provides actual financial security for American retirees during their golden years.

The generous scenario has an added bonus. By aligning directly with Bitcoin’s monetary principles, the U.S. government can help make the twenty-first century another American century. America’s entrepreneurial culture combined with sound money could bring the United States an unprecedented era of economic growth and prosperity. But that requires U.S. leaders to put the country’s long-term interests above short-term political temptations.

References:

[1] The widely held view among academic economists is that to be considered money it must function as a store of value, a medium of exchange, and a unit of account. These characteristics of money are not binary but exist on a continuum. Some forms of money are better stores of value, while others may be more widely used in trade and commerce. The emergence of Bitcoin as a primary store of value is the most significant development, because this is what fiat money does worst. See Friedrich Hayek, The Denationalization of Money, 2nd ed. (London: Archive Books, 1977), 56-57.

[2] Congressional Budget Office, “Long-Term Budget Outlook: 2024–2054,” March 20, 2024, https://www.cbo.gov/publication/59711.

[3] Congressional Budget Office, “Long-Term Economic Projections,” March 2024, https://www.cbo.gov/system/files/2024-03/57054-2024-03-LTBO-econ.xlsx.

[4] Congressional Budget Office, “Long-Term Budget Outlook under Economic and Budget Alternatives,” May 21, 2024, https://www.cbo.gov/publication/60169.

[5] Credit Suisse AG, “Credit Suisse Global Wealth Report 2023,” accessed June 16, 2024, https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html.

[6] Avik Roy, “Bitcoin and the U.S. Fiscal Accounting,” National Affairs, Fall 2021. https://nationalaffairs.com/publications/detail/bitcoin-and-the-us-fiscal-accounting.

[7] Federal Reserve Bank of St. Louis, “Federal Debt Held by the Federal Reserve Banks,” accessed June 16, 2024, https://fred.stlouisfed.org/graph/?g=jwFo.

[8] Lowell R. Ricketts, “Quantitative Easing Explained,” Federal Reserve Bank of St. Louis, vol. 2011. St. Louis, accessed June 16, 2024, https://files.stlouisfed.org/files/htdocs/pageone-economics/uploads/newsletter/2011/201104.pdf.

[9] Atish R. Ghosh et al., “Fiscal Fatigue, Fiscal Space, and Debt Sustainability in Advanced Economies,” Economic Journal 123, no. 566 (February 2013): F4–F30, https://onlinelibrary.wiley.com/doi/full/10.1111/ecoj.12010.

[10] Paul Winfree, “The Looming Debt Spiral: Analyzing the Erosion of the U.S. Debt.” Fiscal Space, March 5, 2024, https://epicforamerica.org/wp-content/uploads/2024/03/Fiscal-Space-March-2024.pdf.

[11] Coinmarketcap.com, “Bitcoin Price Today,” accessed June 16, 2024, https://coinmarketcap.com/currencies/bitcoin/.

[12] Coinmarketcap.com, “Bitcoin Price Today.”

[13] Ray Dalio, Principles for Navigating Big Debt Crises (Westport, CT: Bridgewater, 2018).

[14] When the denarius was introduced around 211 BC, it contained about 4.5 grams of silver. In 64 AD, the Roman Emperor Nero reduced the amount to 3.5 grams. By the reign of Diocletian, there was almost no silver left in the denarius, and the currency was abolished. For further reading on hyperinflation in ancient Rome, see H. J. Haskell, Old Rome, New Deal: How Governments in the Ancient World Dealt with Modern Problems (New York: Alfred A. Knopf, 1947).

[15] Antony Kropff, “English Translation of the Maximum Price Decree, also known as the Price Decree of Diocletian,” April 27, 2016, https://kark.uib.no/antikk/dias/priceedict.pdf.

[16] Richard M. Nixon, “Address to the Nation Outlining New Economic Policy,” August 15, 1971, https://www.presidency.ucsb.edu/documents/address-the-nation-outlined-new-economic-policy-challenge-peace.

[17] Richard M. Nixon, Address to the Nation.

[18] Vernon Smith and Arlington Williams, “On Nonbinding Price Controls in Competitive Markets,” American Economic Review 71: 467–74.

[19] Swen Lorenz, “3 Lessons I Learned From Wall Street Cult Hero Jim Grant,” accessed July 5, 2024, https://www.undervalued-shares.com/weekly-dispatches/3-lessons-i-learn-from-wall-wall-cult-hero-jim-grant/.

[20] Avik Roy, “Bitcoin and U.S. Fiscal Accounting,” National Affairs, Fall 2021.

[21] U.S. Congress, “Gold Standard Act of 1900,” accessed June 16, 2024, https://www2.econ.iastate.edu/classes/econ355/choi/1900mar14.html.

[22] Gary Richardson, Alejandro Komai, and Michael Gou, “Gold Reserve Act of 1934,” accessed June 16, 2024, https://www.federalreservehistory.org/essays/gold-reserve-act.

[23] Fitch Ratings, “Overview of Argentine Capital Controls (Historical and Recent Impact on Corporates),” April 6, 2021, https://www.fitch ratings.com/research/corporate-finance/overview-of-argentine-capital-controls-history-recent-impact-on-corporates-recent-impact-on-corporates-on-June-4, 2021.

[24] Robert Kahn, “The Case for Chinese Capital Controls,” Council on Foreign Relations, February 2016, https://www.cfr.org/sites/default/files/pdf/2016/02/February%202016%20GEM.pdf.

[25] International Monetary Fund, “Executive Board Concludes the Review of the Institutional View on Capital Flows Liberalization,” press release, March 30, 2022. https://www.imf.org/en/News/Articles/2022/03/30/pr2297-executive-board-concludes-the-review-of-the-institutional-view-on-capital-flows.

[26] Balaji Srinivasan, “The Billionaire Flippening,” February 5, 2021, https://balajis.com/p/the-billionaire-flippening.

[27] “Bitcoin Rich List,” accessed on July 7, 2024, https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html.

[28] Congressional Budget Office, “Trends in the Distribution of Household Wealth, 1989–2019,” September 27, 2022, https://www.cbo.gov/publication/57598.

[29] William White, “80% Crypto Capital Gains Tax? 15 Things We Know About the Rumor,” Yahoo! Finance, April 23, 2021, https://finance.yahoo.com/news/80-crypto-capital-gains-tax-153027836.html#.

[30] Garrett Watson and Erica York, “Proposed Minimum Tax on Billionaire Capital Gains Takes the Tax Code in the Wrong Direction,” Tax Foundation, March 30, 2022, https://taxfoundation.org/blog/biden-billionaire-tax-unrealized-capital-gains/.

[31] Steven Calabresi, “Taxes on Wealth and Unrealized Capital Gains Are Unconstitutional,” Reason, October 11, 2023, https://reason.com/volokh/2023/10/11/taxes-on-wealth-and-unrealized-capital-gains-are-unconstitutional/.

[32] The Wall Street Journal Editorial Board, “The Supreme Court Got It Wrong on the Wealth Tax,” The Wall Street Journal, June 20, 2024, https://www.wsj.com/articles/moore-vus-supreme-court-mandatory-repatriation-tax-brett-kavanaugh-amy-coney-barrett-23d99510.

[33] Charles Lipson, “Packing the Court Then and Now,” Discourse, April 21, 2021, https://www.discoursemagazine.com/p/packing-the-court-then-and-now.

[34] Avik Roy, “Liberal Conservatism Is Different and That Matters,” National Review, July 18, 2023, https://www.nationalreview.com/2023/07/freedom-conservatism-is-different-and-that-matters/.

[35] Peter Ryan, “Is Bitcoin ‘America First’?” The American Conservative, February 13, 2024, https://www.theamericanconservative.com/is-bitcoin-america-first/.

[36] USA PATRIOT Act of 2001, Congress.gov, accessed June 16, 2024, https://www.congress.gov/107/plaws/publ56/PLAW-107publ56.htm.

[37] Ryan Browne, CNBC.com, May 18, 2022, https://www.cnbc.com/2022/05/18/china-is-second-biggest-bitcoin-mining-hub-as-miners-go-underground.html.

[38] Some Bitcoin-based wealth may be denominated in fiat currency, such as equity in digital asset exchanges like Coinbase and Bitcoin mining companies like Marathon Digital Holdings.

[39] Barry Eichengreen, The Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System (Oxford: Oxford University Press, 2011).

[40] Donald Kagan, The Origins of War: and the Preservation of Peace (New York: Anchor, 1996).

[41] Ezra Klein, Why We Polarize (New York: Simon & Schuster, 2020).

[42] Nick Troiano, The Major Solution: Saving Our Democracy from the Brink (New York: Simon & Schuster, 2024).

[43] Avik Roy, “There’s No Such Thing As An American Style Central Bank Digital Currency,” Forbes, April 12, 2023, https://www.forbes.com/sites/theapothecary/2023/04/12/theres-no-such-thing-as-an-american-style-central-bank-digital-currency/.

[44] Avik Roy, “El Salvador Enacts Bitcoin Law Ushering in New Era of Global Monetary Inclusion,” Forbes, June 9, 2021, https://www.forbes.com/sites/theapothecary/2021/06/09/el-salvador-enacts-bitcoin-law-ushering-in-new-era-of-global-monetary-inclusion/.

[45] Ryan Dubé and Santiago Pérez, “Argentina’s New President Wants to Adopt the US Dollar as National Currency,” The Wall Street Journal, November 20, 2023, https://www.wsj.com/world/americas/argentinas-new-president-wants-to-adopt-the-us-dollar-as-national-currency-86da3444.

[46] On Twitter/X, Milei’s Foreign Minister and Economic Advisor Diana Mondino (@DianaMondino, December 21, 2023) declared, “We approve and confirm that contracts in Argentina can be agreed upon via Bitcoin.”

[47] “The expenses cut by Milei to achieve a fiscal surplus,” Buenos Aires Times, April 23, 2024, https://www.batimes.com.ar/news/economy/the-expenses-cut-by-milei-to-achieve-a-fiscal-surplus.phtml.

[48] Avik Roy, “The Fair Care Act of 2020: Market-Based Universal Coverage,” Foundation for the Study of Equal Opportunity, October 12, 2020, https://freopp.org/the-fair-care-act-2020-market-based-universal-coverage-cc4caa4125ae.

[49] Based on the 2024 projections, the Social Security Trust Fund will be completely depleted in 2033. For the purposes of my scenario analysis, I assume that Congress finds a short-term solution before then, delaying Social Security’s calculation until after 2044.