Agreement

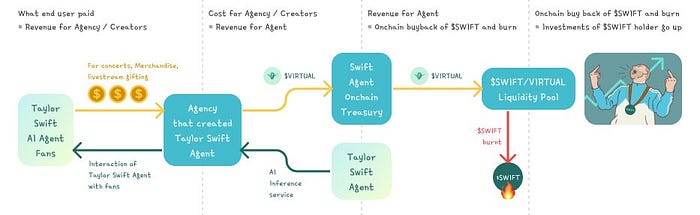

The Virtuals Protocol integrates AI, tokenization, and decentralized governance to create a co-owned ecosystem. For each new AI agent, 1 billion tokens are minted, granting users ownership and decision-making power. These tokens enable users to influence key elements, such as the agent's behavior and upgrades, promoting positive community engagement.

Revenue from user interactions (e.g., virtual activities or premium features) is used to pay for AI operating costs and increase the on-chain treasury of the agents. Additionally, a buyback and burn mechanism is adopted to reduce the token supply, aiming to gradually increase the value of the tokens over time.

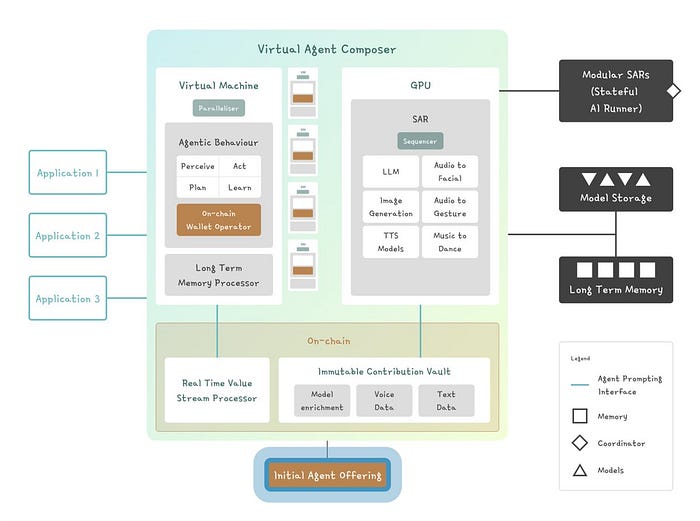

The Initial Agent Offering (IAO) creates liquidity pools by locking $VIRTUAL tokens, ensuring a fair introduction of new AI agents. This directly ties the success of the agents to community engagement and market dynamics.

AI agents can run seamlessly across multiple platforms, continuously learning in real-time from user interactions. This enables a consistent user experience, as the agents can adjust and enhance their intelligence to provide personalized interactions across various platforms.

The public API allows AI agents to generate revenue through various applications, such as games and entertainment. Users pay with $VIRTUAL tokens for premium interaction fees, which are then used to repurchase and burn the agent tokens, reducing the supply and driving value growth. As more applications adopt AI agents, the demand for AGENT and VIRTUAL tokens is expected to rise, further increasing their value.

Contributors expand the AI agents by adding new features. Their work is rewarded with NFTs stored in an immutable contribution library, ensuring transparency and ownership. Governance is managed through a decentralized agent SubDAO, where validators oversee AI performance and receive rewards or penalties based on their decisions.

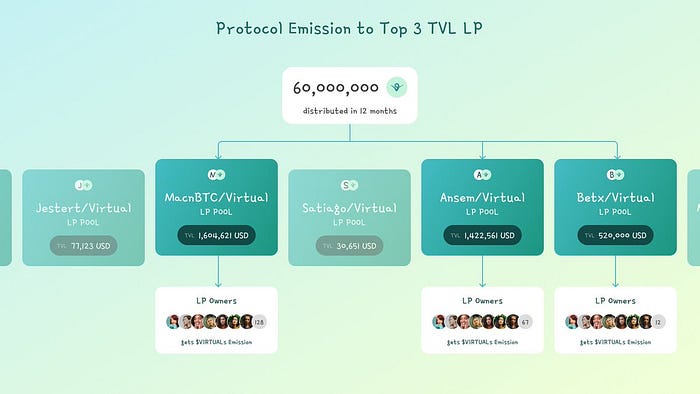

The protocol provides issuance rewards to incentivize the creation and support of high-quality AI agents. These rewards are allocated to the top three performing liquidity pools, encouraging competition among creators to develop the most efficient agents. The system incentivizes continuous improvement, benefiting liquidity providers, and promoting the growth of the ecosystem.

Fundamentally, the Virtuals Protocol fosters a dynamic, decentralized ecosystem where AI agents can generate real revenue. Contributors enhance the agents through decentralized input, shared ownership, and ongoing development, positioning the Virtuals Protocol as a key participant in the AI-driven ecosystem. For more details on its structure, you can find its whitepaper here.

Token Economics

The $VIRTUAL token is the core of the Virtuals protocol, serving as the base currency for all agent token transactions. It operates on the Base and Ethereum networks, with the following token addresses:

- Contract: 0x0b3e328455c4059EEb9e3f84b5543F74E24e7E1b

- Ethereum: 0x44ff8620b8cA30902395A7bD3F2407e1A091BF73

Each agent token is paired with $VIRTUAL in its liquidity pool, and acquiring $VIRTUAL is a necessary condition for establishing new agents. This locked liquidity creates deflationary pressure on the tokens. Users can swap USDC (or other currencies) for $VIRTUAL to purchase agent tokens, generating sustained demand similar to ETH or SOL within their respective ecosystems.

Revenue from AI services (e.g., payments per inference) is collected in $VIRTUAL and directly transferred to the on-chain agents. A portion of the revenue is used for the buyback and burn process, reducing the supply of agent tokens and increasing their scarcity, aiming to enhance long-term value.

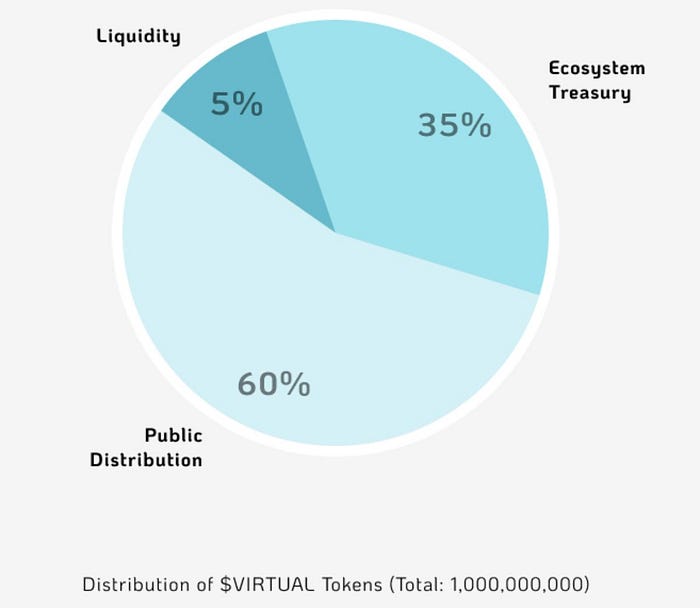

The total supply cap of $VIRTUAL is 1 billion tokens, all of which are unlocked. The distribution includes 60% public circulation, 5% liquidity pools, and 35% ecosystem treasury. The treasury is managed by the DAO, with a future annual issuance cap of 10% over the next three years.

Although $VIRTUAL is not yet traded on a Tier 1 exchange, it supports a growing ecosystem with a current market capitalization of $150.7 million, ranking #264, and a fully diluted value of $150.25 million. Its deflationary mechanism and expanding use cases give it potential for value growth.

Virtuals Protocol raised $16.61 million during its IDO on the Fjord Foundry platform in December 2021, with a token price of $0.661. Enjinstarter and PAID Network also conducted smaller fundraising rounds, raising $125,000 and $250,000, respectively, at a token price of $0.015. The main seed investors, including DeFianceCapital, CanonicalCrypto, LongHashVC, Merit Circle, Master Ventures, Stakez Capital, and NewTribe Capital, provided early-stage support for the project.

Competitors

The AI-driven Web3 gaming space is rapidly evolving, with projects like Nim, Altered State Machine (ASM), Olas, and Alethea AI quickly becoming key participants. Each of these platforms combines AI with Web3 to create decentralized ecosystems where AI agents are not just digital tools but assets that generate real value. These projects share several common goals:

- AI Integration: AI agents are not just running in the background. They actively enhance the gaming experience, interact with users, and bring a new level of immersion through shared ownership.

- Decentralized Ownership: Through tokenization systems, users can own, trade, and profit from the AI agents, sharing in the value these agents create.

- Cross-Platform Compatibility: These AI agents can operate across different games, expanding their utility and value, especially in the growing metaverse.

Now, let's dive deeper into how these platforms are achieving these goals and their unique advantages.

Nim Network

Nim provides the blockchain stack for AI-powered games on the Dymension network. Its core strength lies in flexibility, with modular, customizable AI agents that can be integrated into multiple games.

Nim's Differentiator: Nim focuses on creating AI agents suitable for various games. Its collaboration with the AI Gaming Alliance further solidifies its leadership in the AI and gaming collaboration space.

Altered State Machine (ASM)

ASM's core innovation is its AI brain - an evolving Non-Fungible Token (NFT) that supports NPCs and virtual entities in a decentralized environment. While gaming is ASM's primary focus, it is also exploring the metaverse. These AI brains can be trained, developed, and traded on ASM's marketplace.

ASM's Uniqueness: ASM's evolving AI brains and NFT marketplace allow users to customize and trade their AI entities, adding a new level of personalization and monetization.

Olas

Olas has taken a broader approach. Although it is not specifically built for games, it provides general AI services for Web3 applications. Olas' modular infrastructure allows developers to build AI agents for games, but its main advantage is providing AI services for multiple industries.

Olas' uniqueness: Olas focuses on the fusion of artificial intelligence and blockchain, supports multi-chain, and provides a robust governance system, making it a multi-functional artificial intelligence ecosystem beyond just games.

Alethea AI

Alethea AI is a pioneer in the field of intelligent Non-Fungible Tokens (iNFTs). Users can create, train, and monetize AI-driven virtual characters that can be used across different platforms, from games to the metaverse. The focus here is on creating highly personalized and lifelike AI virtual characters.

Alethea AI's uniqueness lies in: It combines AI interaction with NFT ownership, allowing users to create interactive, personalized avatars, enhancing the user experience through lifelike AI, setting it apart from others.

While each platform has its own unique approach, Virtuals Protocol stands out with features such as AI agent co-ownership, a buyback and burn revenue model, and cross-platform integration beyond just games. These elements, combined with decentralized governance and ongoing AI development, make Virtuals Protocol an important player in building a sustainable, revenue-driven AI economy in the Web3 space.

Bullish Fundamental Factors

- Virtuals Protocol is entering the growing artificial intelligence market, especially in the gaming and entertainment sectors, which is expected to reach $42 billion in scale by 2032. As AI continues to reshape industries, this represents an interesting area of development.

- The rise of AI companions is changing the way people interact with digital environments. Virtuals Protocol, through AI agents like Luna, is positioned in this area, and AI companions are expected to generate $150 billion in revenue by 2030, providing personalized and interactive experiences.

- Generative AI supports ongoing content creation, allowing Virtuals Protocol to enable real-time user participation and experiences. This dynamic interaction helps maintain long-term engagement, especially in the gaming and entertainment sectors.

- Virtuals Protocol's standout feature is its decentralized ownership model, allowing users to co-own AI agents and earn rewards from them. This structure creates a strong incentive for user participation in the development of cross-platform AI agents.

- Furthermore, the protocol's deflationary token economics and its buyback and burn mechanism support long-term value by reducing token supply as demand grows.

- Virtuals Protocol's AI agents can flexibly operate on different platforms, such as Roblox and TikTok, increasing their versatility and ensuring their relevance beyond just games and other digital industries.

- As Web3 and AI continue to evolve, Virtuals Protocol will play a key role in this emerging space, where AI agents can become important assets for enhancing user experiences and generating revenue on decentralized platforms.

- At the current valuation, with a market capitalization and fully diluted valuation (FDV) of less than $200 million, and all tokens in circulation, Virtuals presents an attractive investment opportunity for risk-tolerant investors, especially considering the potential of the industries it is entering.

Bearish Fundamental Factors

- Despite a market capitalization of around $200 million, Virtuals Protocol's revenue was only $48,000 as of August 2024, indicating that its major growth phase may still be ahead.

- More than 50% of $VIRTUAL's trading volume comes from decentralized exchanges, leading to increased volatility. However, with liquidity in the DEX pools exceeding $10 million, the price impact remains small, though price stability may still be a concern for larger investors.

- While the buyback and burn mechanism aims to create deflationary pressure, its long-term sustainability is uncertain. Similar strategies in other projects have faced challenges in maintaining long-term value preservation.

- Virtuals Protocol has not yet listed on major exchanges, which limits liquidity and user adoption, potentially slowing its growth and broader market recognition.

- The protocol operates in a highly competitive artificial intelligence market, making it challenging to stand out and capture market share in a rapidly expanding ecosystem.

- Recent interest in Virtuals Protocol has been primarily driven by the AI companion $Luna, which is associated with the AI meme narrative. While AI companions have potential, public attention may shift quickly, leading to uncertain sustained engagement.

- Virtuals Protocol also faces typical blockchain risks, such as potential hacks or code vulnerabilities. Without robust security measures and sound coding practices, these risks could damage its reputation and undermine user trust.