Bitcoin (BTC) has been trading in a narrow range over the past week and is having difficulty breaking through the $100,000 mark. The BTC price is facing resistance at $98,804 and support at $94,603.

However, the decline in important on-chain indicators suggests that the coin could see a significant upward trend in the near future.

Stablecoin influence, holder confidence... Bullish outlook for Bitcoin

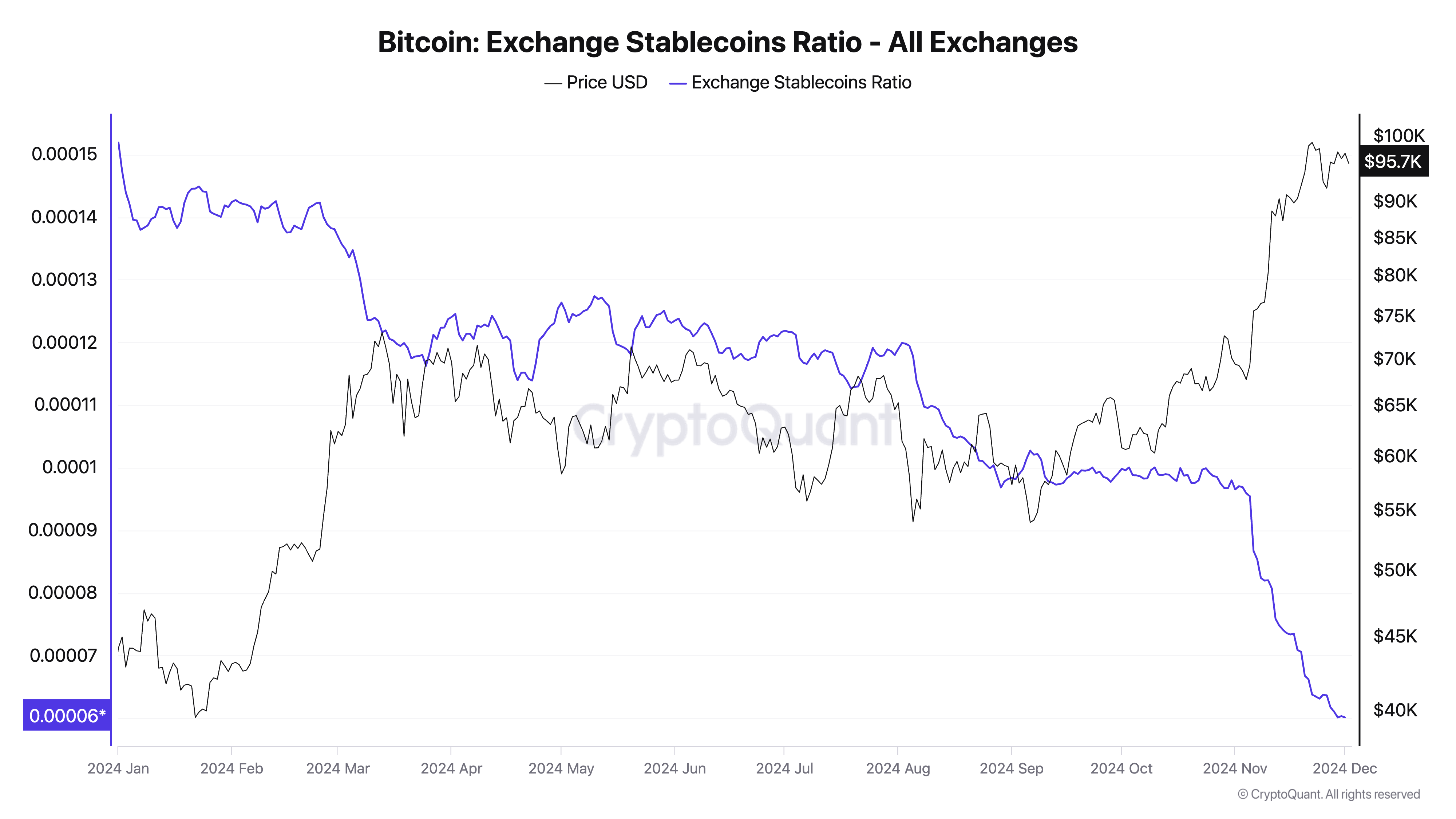

According to BTC on-chain performance evaluation by BeInCrypto, the exchange stablecoin ratio has been steadily declining. According to data from Cryptoquant, it is currently at 0.000060, the lowest level since the beginning of the year.

The exchange stablecoin ratio measures the amount of stablecoins held on exchanges in proportion to the amount of Bitcoin. A lower ratio indicates more purchasing power in the market, meaning there are more stablecoins available on exchanges to buy Bitcoin.

A decline in this ratio signals an increase in demand for Bitcoin. When more investors try to acquire Bitcoin, the price of the coin is likely to rise. This could push it back towards the psychological $100,000 mark, a level that has been difficult to break through.

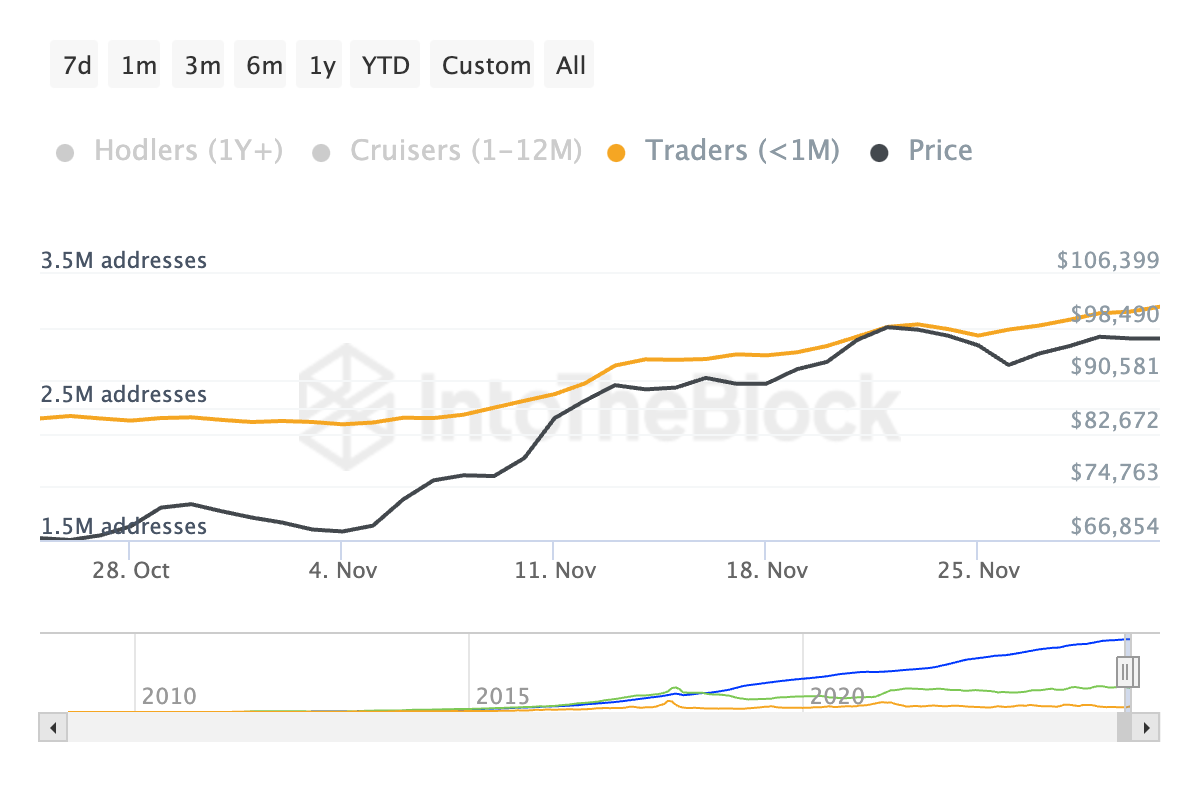

Additionally, the trend of short-term Bitcoin holders adopting a "HODL" strategy could also fuel a rally to the $100,000 mark. According to Cryptoquant, this group - generally those holding BTC for less than a month - extended their holding period by 36% during the past month.

Longer holding periods reduce selling pressure, create scarcity in the market, and signal confidence in the coin's price appreciation. This can contribute to the short-term upward momentum of Bitcoin.

BTC Price Prediction... What to Expect?

BTC is currently trading at $96,882. This is still close to the all-time high of $99,860 recorded in November, indicating that the price is still facing strong resistance to further increases. If short-term holders continue their "HODL" strategy and new demand emerges - supported by the inflow of stablecoins to exchanges - Bitcoin could break through this barrier and move towards the $100,000 milestone.

However, if selling pressure intensifies, the BTC price could consolidate within the current range or even decline further to $88,986.