Author:Stacy Muur

Compiled by: TechFlow

We have finally entered a bull market, but this has also exposed some weaknesses in the Web3 economic reality.

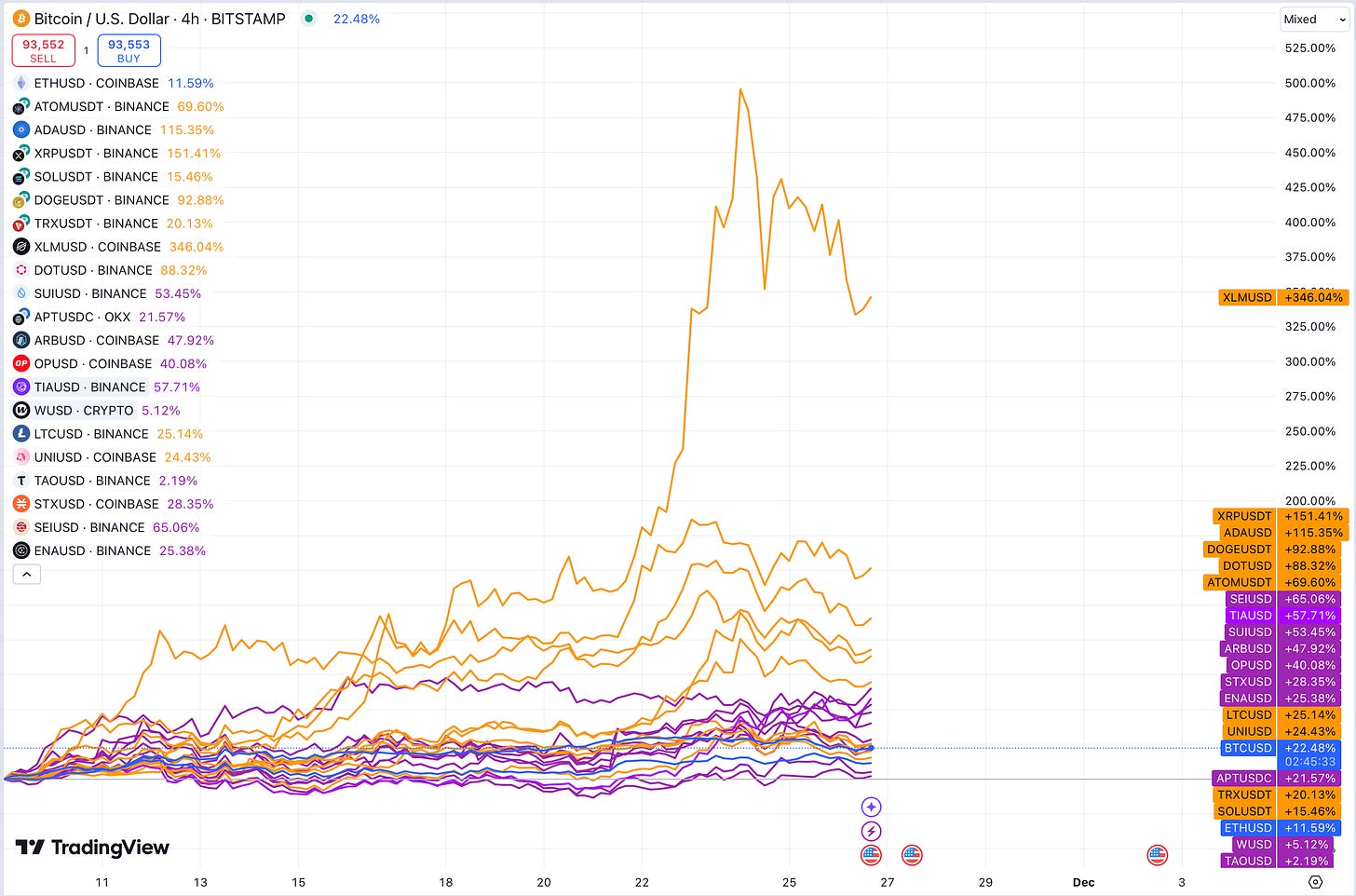

For market participants who have been constantly optimizing their portfolios over the past few years, this bull market seems a bit "stingy". Many newer Tokens have performed poorly, while established coins like XRP, $ADA, $DOT and $ATOM have achieved remarkable returns.

Background: Comparison of Old and New Coin Performance

Historically, newer Altcoins (Tokens less than two years old from the TGE, or Token Generation Event) often outperform established coins over different time periods. However, this bull market has presented a completely different trend: established projects (such as $XLM, $XRP, $ADA, $DOT and $ATOM) have become the dominant forces in the market, while new coins have performed poorly.

Next, we will explore the underlying reasons for this phenomenon, its potential implications, and insights for the future.

Analyzing the Trend Change: Key Insights

New capital inflows, rather than capital rotation

The across-the-board rise of established Altcoins indicates that this trend is not driven by the rotation of capital within the crypto market. It is more likely that the market is attracting new capital, particularly from retail investors who are re-entering the market.

Retail investors return, but with different focus

The signs of retail investor return are evident, with the rise of Coinbase app rankings and increased viewership of crypto-related YouTube content. However, contrary to expectations that retail investors would pour funds into high-risk Memecoins, these funds seem to be flowing more towards projects that were already mature in the previous bull run. This may suggest that the current retail investor cohort is older, more risk-averse, or more familiar with the well-known Altcoins from the previous bull market.

Familiarity and trust as decision factors

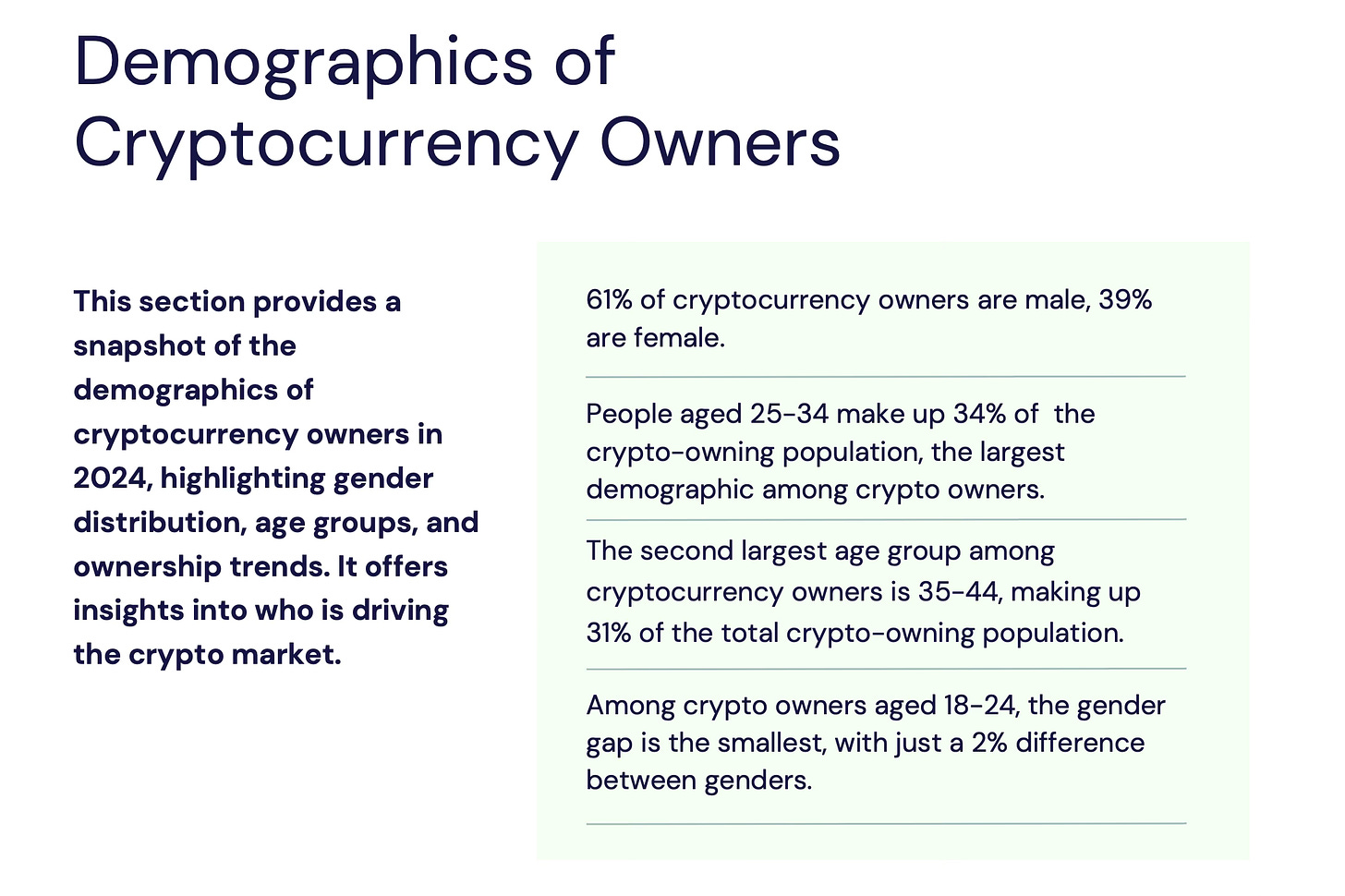

The established Altcoins that have performed exceptionally well in this bull market are essentially the star projects from the previous bull run. This suggests that the returning retail investors are likely in the 25-45 age range and have some experience in the crypto currency market. They may lack understanding of newer narratives such as DePIN (Decentralized Physical Infrastructure Networks), RWA (Real-World Assets), and AI, and therefore tend to gravitate towards the more familiar projects.

Impact of generational differences

Meanwhile, Gen Z investors (often exposed to crypto through TikTok or meme-driven content) may have less disposable capital. This could explain why, despite the return of retail investors, the Memecoin market has not been able to attract significant capital inflows.

Inflation impact

Another key factor contributing to the poor performance of new Altcoins is inflation. Relatively, the established coins have a higher proportion of circulating supply, so new capital is not diluted by the continuous issuance of Tokens.

If you are interested in these trends, the future market dynamics will be worth closely following. Will the rise of established coins change the economic landscape of Web3? How will new coins address these challenges? Let's wait and see.

In the following content, we will focus on two key factors that have had a significant impact on the market performance during this bull run: inflation and retail investor demographics.

Inflation: The Invisible Killer of Crypto Gains

The current bull market has filled the crypto market with optimism, but it has also exposed an undeniable reality: inflation is quietly eroding investors' returns. Understanding the impact of inflation on asset values is crucial for any investor seeking to profit from this bull run.

Let's illustrate this with some real examples:

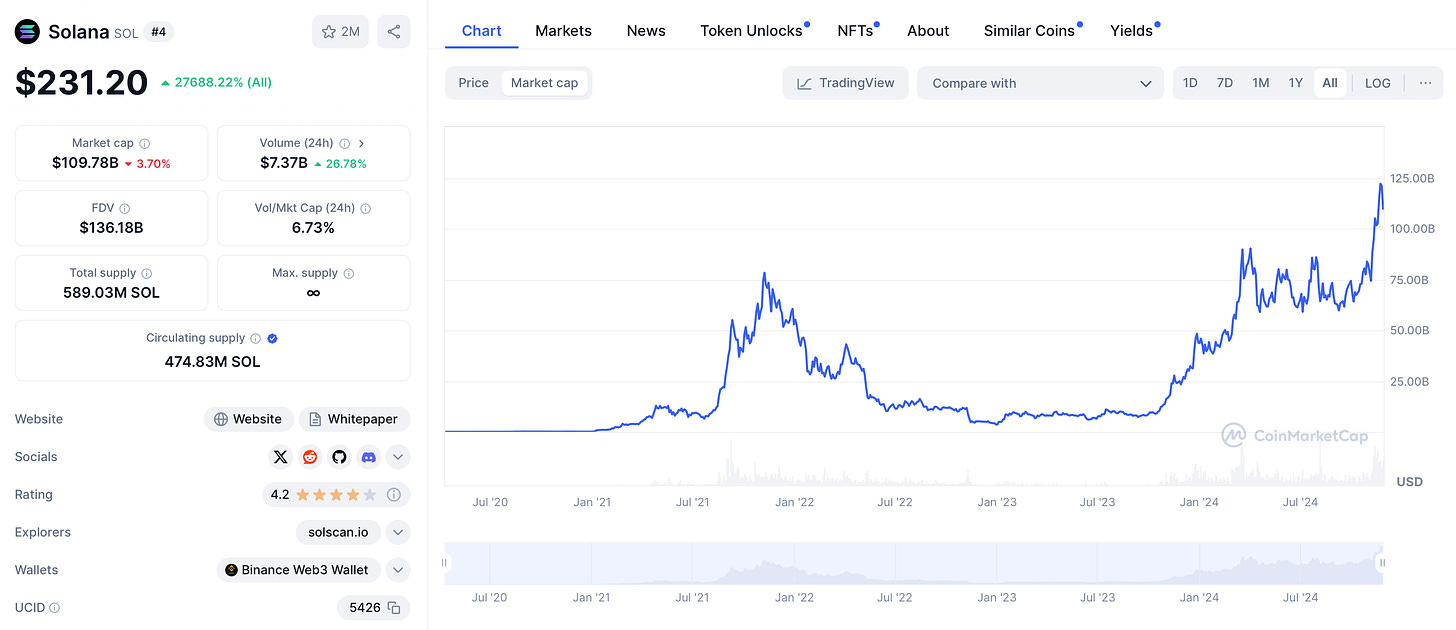

In 2021, $SOL reached a price of $258, with a market cap of $75 billion. Today, its price is still $258, but its market cap has grown to $122 billion. What's behind this change? The answer is: an increase in circulating supply. As the supply expands, the value of individual Tokens is diluted by inflation, requiring a higher market cap to maintain the same price level.

Here are more similar cases:

$TAO: Although its market cap has surpassed the historical high (ATH) of $4.6 billion, its price has not set a new high.

$ENA: Its current market cap is close to the ATH ($2.12 billion vs. the current $1.84 billion), but the price has dropped from $1.49 to $0.64.

$ARB: The ATH market cap was $4.6 billion in March, but it has now declined to $3.8 billion. The price was $2.1 in March, but is now only $0.8.

$SEI: The ATH market cap was $2.8 billion, and it has recently been $2.25 billion; the ATH price was $1.03, but is now $0.53.

These are just the tip of the iceberg. In fact, many Tokens are facing similar predicaments.

Even though the "Altcoin season" seems to have arrived, inflation is quietly eroding the potential gains of many assets. As circulating supply increases, more capital investment is required to maintain or increase Token prices. For assets with higher inflation rates, investors must face a difficult struggle, even in a bull market.

How to Address the Inflation Challenge

To better protect your gains in the bull market, investors can adopt the following strategies:

Research Tokenomics: Carefully analyze a project's inflation rate and Token distribution plan before investing. Focus on those with slower supply growth or lower inflation rates.

Diversify wisely: Prioritize projects with limited total supply or clearly defined inflation caps, such as Bitcoin (BTC).

Evaluate real yield: When calculating investment returns, factor in the inflation impact and adjust your expectations accordingly.

Inflation is not just a macroeconomic term - it is the "silent killer" of gains in the crypto market. Understanding and effectively addressing the impact of inflation will be one of the keys to investors' success in the bull market.

TikTok vs. CoinMarketCap

If you are reading this article, you are likely a seasoned investor who has experienced both bull and bear markets. You may have researched various new protocols, participated in airdrops and mining, and explored many emerging investment narratives. In contrast, the average retail investors who just entered the market due to election-related news or Bitcoin prices nearing $100,000 have a completely different background and mindset.

To truly understand the behavior of these retail investors, try to recall your own experience when you first encountered cryptocurrencies. At that time, you may have had only a centralized exchange (CEX) account, filled with Token codes that were completely unfamiliar to you.

I believe the current influx of retail investors can be broadly categorized into the following three groups:

Gen Z: This generation may have purchased Memecoins (often highly volatile and entertainment-driven Tokens) due to the hype on TikTok.

Gen X: This generation may have had some prior crypto investment experience from the previous bull market.

Gen Y: In recent years, they may have been attracted to the crypto market after being exposed to stock trading platforms that have opened up to retail investors.

Recently, I have conducted an in-depth study on the investment mindset of Generation Z. Compared to other generations, they have significant differences in their risk attitudes and behavioral patterns. The following description may be more applicable to the average Generation Z investor. If you are a Generation Z reader and feel that these contents do not match your experience, then you may be one of the exceptions.

For Generation Z, taking risks and suffering losses is usually undesirable. They are more inclined to participate in low-risk activities, such as earning rewards by completing Galxe tasks, playing Hamster Kombat games, or engaging in airdrop mining. These activities require time investment rather than financial investment, making them more appealing.

However, trading is a completely different domain. When Generation Z is exposed to bull markets through TikTok, they may initially find it an exciting adventure. But as market volatility leads to losses, they are likely to quickly experience the harsh reality.

In contrast, the situation for Generation Y is different. If they develop an interest in cryptocurrencies, it is likely because they have already accumulated some trading experience in the stock market and have a clearer understanding of investment risks. Therefore, they are less likely to be attracted by high-risk Memecoins.

Generation Y is more inclined to open CoinMarketCap, review the token list, analyze market charts, and make decisions based on data. Additionally, they usually have more disposable income than Generation Z, which allows them to be more rational and prudent in their investment choices.

Conclusion

The above are my thoughts on the behavior of retail investors in the current market, and these views are generally consistent with the recent market performance. Of course, this does not mean that my analysis is 100% correct, nor does it represent the only explanation.