Source: Grayscale; Compiled by Tong Deng, Jinse Finance

Summary

The US election results have driven Bit to a new all-time high. Although crypto is a bipartisan issue, Grayscale research expects that the Republican's unified control of the White House and Congress should lead to legislation and regulatory oversight more favorable to industry innovation. The nominations of President-elect Trump for key cabinet positions appear to be consistent with a policy agenda supportive of crypto.

Other major crypto market developments include the launch of Bit ETP options, MicroStrategy's large Bit purchases, a surge in trading volume at South Korean crypto exchanges, AI agent innovations, and market attention on Doge.

2024 is a favorable period for crypto returns, and Grayscale Research believes the bull market is likely to continue next year.

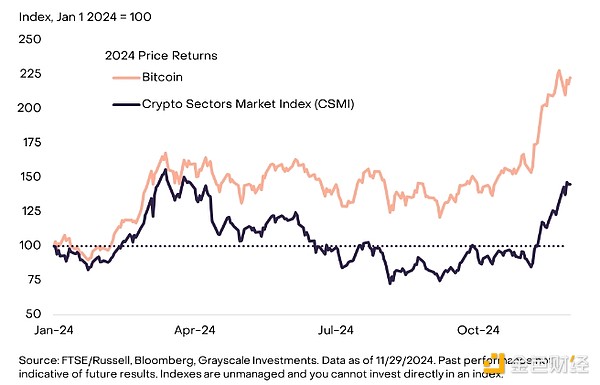

Prior to last November, Bit had already appreciated 60% by 2024, but last month's gains have brought its year-to-date return to 110%. Unlike the previous months, the favorable crypto market environment in November extended far beyond Bit: our Crypto Sector Market Index (CSMI), which measures the returns of various digital assets, rose 59% that month and is now positive for the year (Table 1).

Chart 1: Bit has appreciated 110% this year

While crypto is a global phenomenon, Grayscale research believes the recent US election results are a potential inflection point for the digital asset industry. The next President and Congress may pursue comprehensive crypto legislation and help shape institutional oversight through key appointments and confirmations. These decisions could impact many aspects of US blockchain adoption and development, including asset tokenization, stablecoin usage, and the integration of DeFi applications with traditional systems.

At the voter level, poll data shows crypto is a bipartisan issue, with Democrats having a slightly higher Bit ownership rate than Republicans. But among current and incoming Congressional members, Republicans have been more steadfast in supporting digital asset innovation, and President-elect Trump has also publicly backed the industry. Therefore, we believe the Republican control of the White House and Congress is a positive outcome for the crypto market (see our previous election report for details). Given the candidates' past statements and crypto expertise, the nominations of Scott Bessent for Treasury Secretary and Howard Lutnick for Commerce Secretary are encouraging early signs for the incoming administration. [2]

While many assets appreciated after the US election, on a risk-adjusted basis (i.e., accounting for each asset's volatility), Bit and the broader crypto market were among the best performing sectors. The overall stock market rally, driven by financials, was likely due to expectations of lower taxes and relaxed regulation in certain industries (Chart 2). Meanwhile, the renminbi depreciated, possibly due to the threat of higher US tariffs[3], while gold prices also declined, potentially reflecting reduced tail risk from the contested election outcome.

Chart 2: The crypto market outperformed traditional assets in November

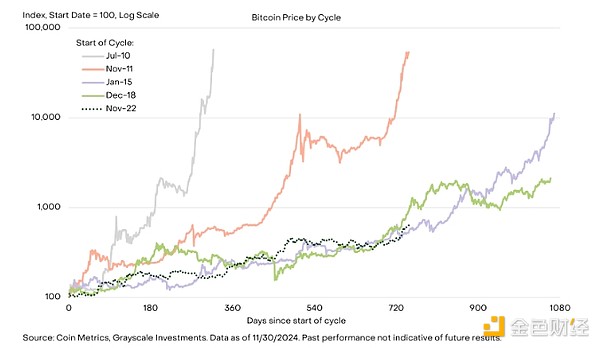

Like many physical commodities, Bit's price returns exhibit a high degree of momentum (statistical persistence), which can present the appearance of a "cycle" in prices. While each period has its specific drivers, past Bit cycles may be partly related to the four-year halving schedule. As Bit matures and is more widely adopted by traditional investors, and the supply impact of the four-year halvings diminishes, Bit's price cycles may become less pronounced. While Bit's price may always exhibit some momentum - like many physical commodities - the changes may not occur every four years.

Nevertheless, past cycles may provide some guidance on Bit's typical statistical behavior. Bit's price appears to have reached a cyclical low in November 2022 and has since continued to appreciate for about two years. The average duration of the past four Bit price cycles is 2.2 years, with the most recent two cycles averaging close to three years. In terms of the current cycle, the cumulative returns so far seem roughly in line with the prior two bull markets (Chart 3). While macroeconomic conditions and the strength of the US dollar will ultimately drive Bit's price, history suggests the recent price appreciation is likely to persist.

Chart 3: Bit price tracking prior to the cycle

In November, the broader financial market structure around Bit continued to mature. There was $6.5 billion in net inflows into US-listed Bit exchange-traded products (ETPs), some of which may have flowed into spot/futures "basis trades". Bit ETP options also began trading last month. As of November 30th, the open interest in Bit ETP products with listed options was $7 billion, with about 70% in call options and 30% in put options. Improvements in the market structure around spot Bit ETPs may ultimately impact proxy investments like MicroStrategy stock. MicroStrategy is a publicly traded company nominally in the software business but primarily serves as a Bit investment vehicle. [4] In November, the company purchased $1.2 billion of Bit for its balance sheet and announced plans to acquire a total of $42 billion of Bit over the next three years. [5]

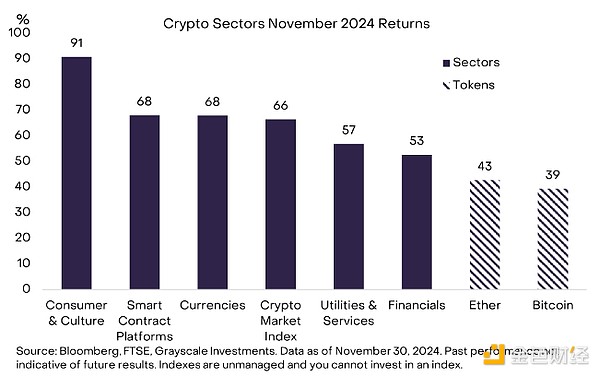

From the crypto industry perspective, the best performing sector was Consumer & Culture, largely due to the strong performance of Doge (DOGE), which surged 161% this month (Chart 4). While Doge originated as a meme coin, its blockchain is forked from Bit[6] and has faster block times and comparable transactions per second to Bit.[7]

By market cap, Doge is the largest asset in the Consumer & Culture domain. On November 12th, Trump announced plans to establish a Government Efficiency Department, with the acronym DOGE, co-led by Musk, drawing more attention to blockchain. [8] The proposed department aims to reduce government waste and drive structural reforms. While there is no direct connection between the proposed department and DOGE, the surge in attention on Musk and the DOGE meme may have stimulated demand for the token and pushed up its price.

Chart 4: The Consumer & Culture crypto sector outperformed due to meme coin demand

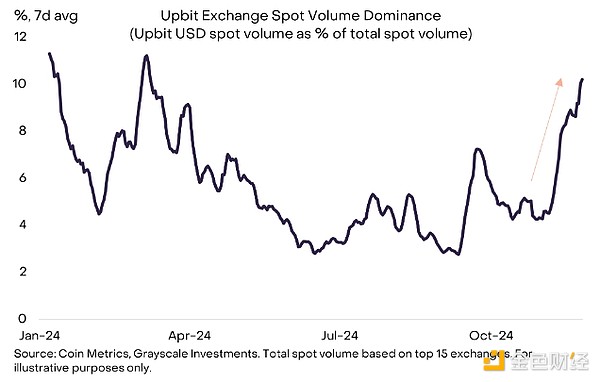

In addition to Bit and Doge, the largest market cap gainers last month were XRP and Stellar Lumens (XLM), two crypto projects initially focused on cross-border remittances but later expanded into other use cases like asset tokenization and central bank digital currency (CBDC) support. XRP has risen 281% since late October, and XLM has gained nearly 470%. The US election results may provide more regulatory clarity for crypto projects engaged in remittance applications, which could improve the fundamentals of these two projects. However, the recent returns may also be driven by specific capital flows. In particular, the sharp appreciation of XLM coincided with a surge in trading volume on the Upbit exchange centered in South Korea, potentially indicating speculative trading by Korean investors (Chart 5). Therefore, XLM's near-term outlook may depend on the sustainability of these demand sources rather than the project's fundamentals.

Chart 5: Trading volume surged on the Korea-centric Upbit exchange

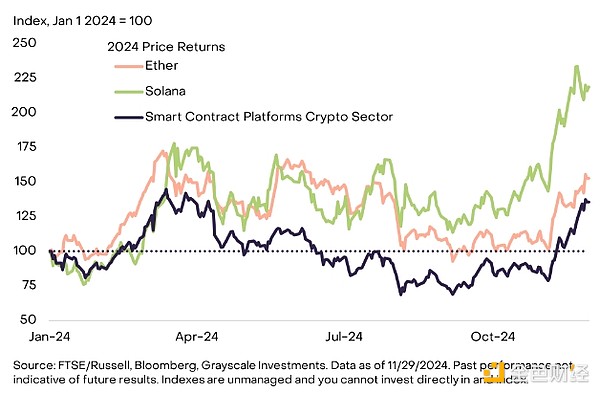

Leveraging the smart contract platform, the performance of the crypto industry Solana continues to outperform the Ethereum network's Ethereum, partly due to the widespread Meme coin trading on Solana.[9] Solana's current fees are comparable to Ethereum Layer 1, but its market capitalization is only about a quarter. [10] If Solana can continue to expand its adoption beyond Meme coins, such as in the categories of decentralized physical infrastructure (DePin) or stablecoin payments, Grayscale Research believes it may continue to experience higher fee growth and token price performance. Among the larger smart contract platform blockchains,[11] the best performers were Cardano (+216%), Polkadot (+127%), and Sui (+77%).[12]

Although Ethereum's performance this year has lagged behind Bitcoin and Solana, its performance is broadly in line with the overall performance of the smart contract platform cryptocurrency industry (Chart 6). Ethereum has certain competitive advantages that may support adoption in the coming year, including its entrenched leadership position in asset tokenization work and a broad network of application developers. Grayscale Research believes Ethereum is "playing the long game": guiding network effects by maintaining low fees on the Base and other Layer 2s. In the post-election regulatory environment, the trend of institutional adoption of digital assets may help determine whether Ethereum's scaling strategy will support its leadership in smart contract platforms over time.

Chart 6: Ethereum's performance this year has lagged Solana

Developers continue to explore innovative applications of blockchain technology, with recent market attention focused on projects related to decentralized artificial intelligence (deAI). This is a diverse category, but many projects focus on leveraging economic incentives based on blockchain infrastructure to develop AI technology components in a decentralized manner, including data collection and curation, computation, and model training and inference. In a recent report, Grayscale Research introduced the latest experiments with "AI influencers": autonomous AI agents active on social media that can make and receive payments using blockchain wallets. Another innovative market area is decentralized science (DeSci), where projects use blockchain technology to help create a transparent, accessible, and collaborative scientific research environment. In early November, a DeSci event attended by key industry figures generated more attention on the applications of this niche market.[13]

Cryptocurrency valuations rose significantly in November, with a series of market signals indicating that speculative traders' positions are currently relatively long. Without further fundamental news, the cryptocurrency market may experience more range-bound volatility in the short term.

However, looking ahead to next year, Grayscale Research believes the bull market may continue, especially if the macroeconomic backdrop remains favorable (i.e., the economy avoids recession and the Federal Reserve lowers interest rates). Investors around the world are adopting Bitcoin as a unique monetary form, providing digital scarcity and resistance to censorship. We believe as long as governments fail to control their growing debt burdens and policymakers introduce frictions to the fiat currency system through sanctions and other capital controls, the demand for these functions will continue to grow. Beyond Bitcoin, the market structure is evolving to allow investors to access crypto assets more efficiently, and the incoming Congress may bring greater regulatory clarity in the US. The market, developers continue to bring exciting new applications to market, such as those related to decentralized artificial intelligence. While 2024 is a very good year for the crypto market, we see no reason why 2025 cannot be just as good or better.

References

[1] The FTSE/Grayscale Crypto Sectors index series is weighted by the square root of the constituent market capitalizations, thereby reducing the relative weights of Bitcoin and other large-cap tokens.

[2] Sources: DL News, AP, WSJ.

[3] Source: Reuters.

[4] Source: Financial Times.

[5] Source: Financial Times.

[6] Doge is a fork of Luckycoin, which is a fork of Litecoin, which is a fork of Bitcoin.

[7] The average block time over the past year was: Doge (1.1), Bitcoin (9.9), Bitcoin Cash (10.3), and Litecoin (2.5); the average daily transactions per second over the past year were: Doge (6.2), Bitcoin (6.2), Bitcoin Cash (0.8), Litecoin (3.3). Source: Coin Metrics, Grayscale Investments. Data as of November 29, 2024. For illustrative purposes only.

[8] Source: X.com.

[9] Source: dune analytics. Note this excludes Doge, which has its own blockchain.

[10] Source: Artemis. Data as of November 30, 2024.

[11] Defined here as companies with a market capitalization over $5 billion.

[12] Source: Artemis. Data as of November 30, 2024.

[13] Source: Unchained Crypto.