Bitcoin has recently reached an all-time high (ATH) of $99,595. This has created an optimistic sentiment that the $100,000 milestone is near. However, due to significant volatility, Bitcoin has not been able to cross this psychological barrier.

Nevertheless, Bitcoin ETFs have seen record inflows. This suggests that the move towards $100,000 is imminent, and institutional support is playing a crucial role.

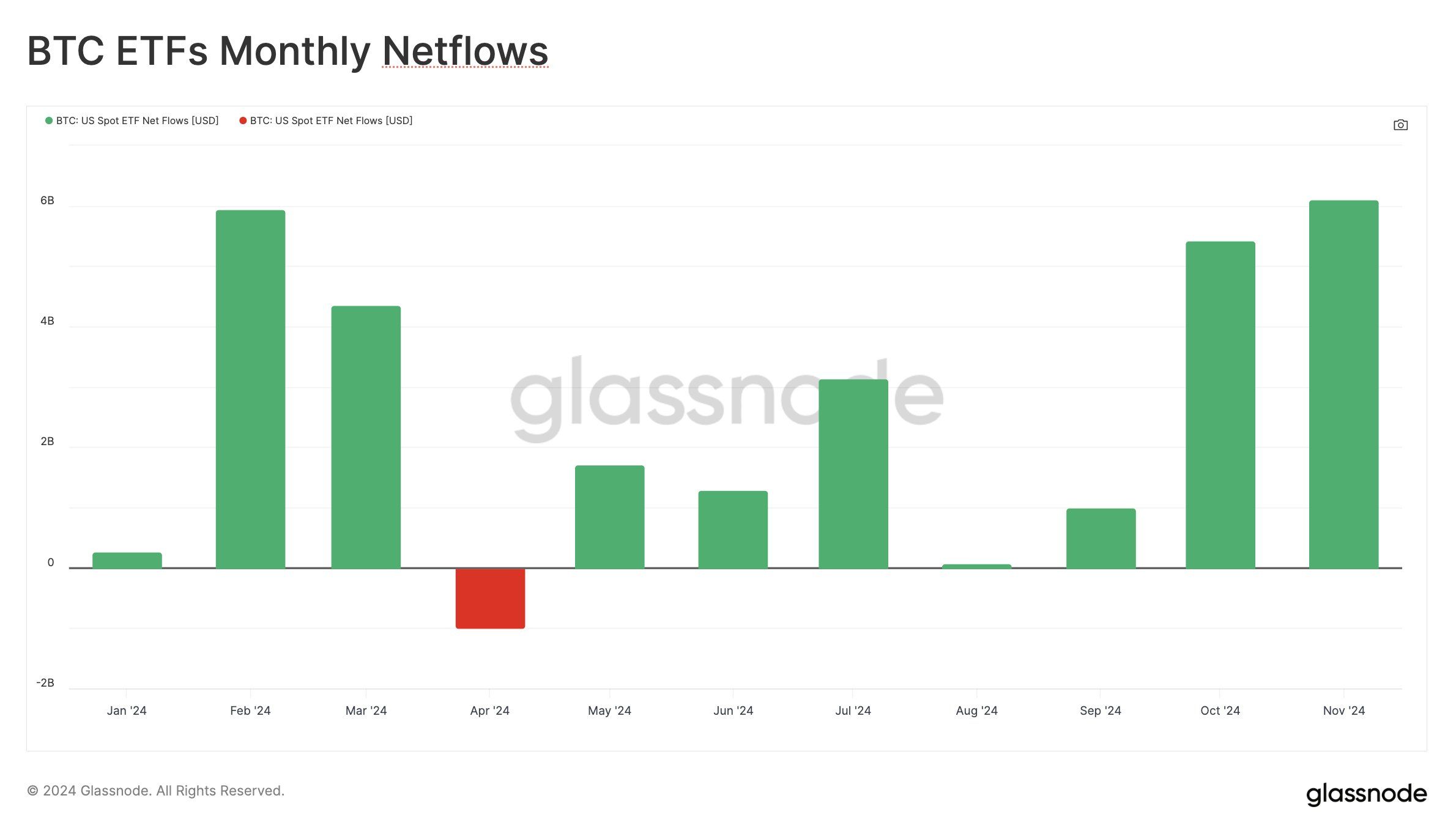

Bitcoin ETFs Lead the Uptrend with $6.1 Billion Inflows in November

In November, Bitcoin ETFs recorded $6.1 billion in inflows. This is the highest monthly inflow since the launch of the first physical Bitcoin ETF in January. This surge indicates that investors are becoming more familiar with the asset. They prefer the safety of regulated ETFs, avoiding direct Bitcoin purchases. As institutional interest increases, this trend is likely to continue in December, potentially propelling Bitcoin to new highs.

These massive inflows demonstrate that many investors are flocking to Bitcoin ETFs to gain exposure to cryptocurrencies. As more institutional capital flows into the market, Bitcoin can enhance its stability, which will boost confidence in the long-term outlook. Positive market sentiment can set the stage for another rally towards the end of the year.

Analyst Rekt Capital has set a Bitcoin price target of $100,068. The king of cryptocurrencies continues to show signs of an uptrend. The analyst mentioned that BTC has retested its downward highs and is likely to establish a bottom.

"[BTC] needs to flip the daily close back inside the rising flag to avoid another retest and instead synchronize with the bullish flag structure," Rekt Capital said.

BTC Price Prediction: Surpassing $100,000 and Beyond?

Bitcoin is currently trading at $94,940. Support is forming in this range. The critical support level for BTC is $89,800. Given the current bullish momentum, a drop to this level is unlikely. If Bitcoin can maintain this support, further price appreciation is expected in the coming weeks.

If the bullish momentum continues to strengthen, Bitcoin may be able to break through the $100,000 barrier, setting a new ATH. This level has long been considered a psychological milestone. Breaching it would be a significant achievement in Bitcoin's price history. The inflow of ETF investments can act as a catalyst to help Bitcoin cross this threshold.

However, if Bitcoin fails to break above $100,000 and starts to lose momentum, a downward correction is expected. Failure to maintain the uptrend could lead to a price pullback, bringing Bitcoin closer to the $89,800 support level. This could also invalidate the bullish outlook.