XRP has surged 3.5 times in a month, which is not surprising, but what is surprising is that before the surge, XRP's market capitalization was already ranked fifth in the total market capitalization, and no one expected XRP to easily surpass Solana and USDT to become the third largest cryptocurrency by market capitalization.

In fact, the surge in XRP was not without warning, as early as November 12, WOO X Research had written that due to regulatory factors, SOL and XRP were potential beneficiaries.

In addition to the easing of regulations, Ripple has also released many positive signals:

Multiple institutions have applied for XRP ETF: On October 2, an XRP ETF application was submitted, which has now been officially submitted on the state government website, and subsequently Ripple CEO Brad Garlinghouse posted that an XRP ETF is "inevitable"

In addition to Bitwise taking the lead, Canary and 21 Shares have also submitted applications for XRP spot ETFs.

Stablecoin: In mid-November, Ripple announced the launch of the US dollar stablecoin Ripple USD (RLUSD), a stablecoin designed for enterprise payments, with the aim of strengthening Ripple's cross-border payment solutions. The New York Department of Financial Services has indicated that it will approve Ripple's issuance of the RLUSD stablecoin, and the company plans to launch the product on December 4.

Promotion in Korea: With the rise of XRP, Hashed Founder @0xryankim, a Korean VC, stated that Ripple sold XRP to Korean housewives in a Ponzi scheme-like manner in 2014, and at that time many people bought XRP, which also led to a real XRP community in Korea.

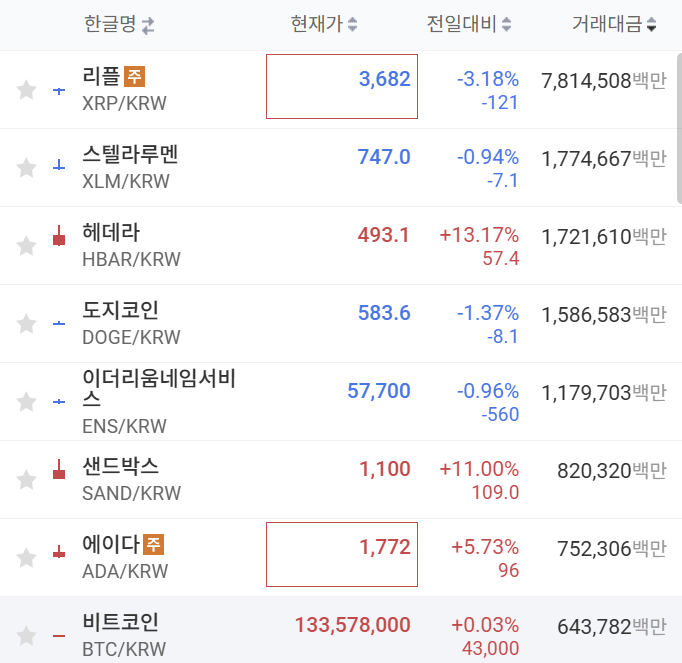

On Upbit, it can also be observed that the current trading volume of the Korean won is the largest for XRP, exceeding the trading volume of Bitcoin by 10 times.

The surge in XRP has also sparked great interest in the market for other high-value legacy coins, hoping to replicate its price performance.

XLM

XLM and XRP have a close relationship, as it was founded by Jed McCaleb and Joyce Kim in 2014. Jed McCaleb was previously involved in the creation of Ripple (XRP) and the Mt. Gox exchange.

XLM is primarily used for payments, with the goal of providing fast, inexpensive global payment solutions, especially for regions lacking banking services.

While Stellar and Ripple both focus on payments, their target markets differ:

Ripple is more focused on cross-border settlement for large financial institutions and banks.

Stellar is focused on payments and financial inclusion for individuals and small and medium-sized enterprises.

XLM and XRP are closely related, so their price trends often synchronize, and XLM can be seen as a beta of XRP.

A recent major news that has driven the price increase is the announcement on November 14 that asset management giant Franklin Templeton has invested $1.7 trillion in XLM.

Market capitalization ranking: 15

Current market capitalization: $1.635 billion

Current price: $0.544

7-day increase: +18%

ADA

Cardano was founded in 2017 by Charles Hoskinson, one of the eight co-founders of Ethereum, after he left Ethereum. The initial funding for Cardano was concentrated in the Japanese market, so it is also said that ADA has more players in Japan.

At the time, PoS was a novel concept, and 250 TPS was also representative of a high-speed public chain in 2017. However, as time has passed, Cardano's development speed has been heavily criticized. Compared to other public chains, Cardano's upgrade and ecosystem advancement speed is relatively slow, causing most developers to not choose Cardano as the first choice for project deployment, and the ecosystem is relatively thin.

This has also led to Cardano's DeFi and other blockchain applications not being able to reach the same level of maturity as Ethereum and other blockchains, limiting its ability to attract users.

However, the recent surge in ADA may be attributed to the "Trump effect", as it has both alleviated the SEC's concerns about ADA being considered a security, and more importantly, Cardano founder Charles Hoskinson is likely to become a cryptocurrency advisor to Trump.

Although currently in the speculative stage, Hoskinson's policy office is expected to open in January 2025, focusing on supporting legislative work, which also shows that Hoskinson is moving towards embracing compliance and being crypto-friendly, which has a positive incentive effect on ADA.

Market capitalization ranking: 8

Current market capitalization: $4.629 billion

Current price: $1.27

7-day increase: +34%

HBAR

Founded in 2018 and launched its mainnet in 2019, Hedera was created by Dr. Leemon Baird and Mance Harmon, and was originally touted for its low-energy, environmentally friendly operation. Hedera has already attracted many well-known Web 2 partners and clients, such as Google, IBM, Boeing, LG, Tata, etc. Recently, they have also announced a foray into the RWA market, launching an open-source toolkit for configuring, issuing and managing tokenized bonds and stocks on the Hedera network.

In the RWA application area, they have launched the DOVU carbon credit trading platform, which can tokenize credit limits and convert them into crypto assets, allowing businesses, governments and individuals to use them.

Market capitalization ranking: 19

Current market capitalization: $1.337 billion

Current price: $0.35

7-day increase: +160%