The price of Polkadot (DOT) has risen more than 10% in the last 24 hours and has increased by 178.44% in the last 30 days, reflecting strong upward momentum. However, technical indicators such as RSI and CMF suggest that buying pressure is weakening, and the rally may lose steam.

The EMA lines of DOT are still in an uptrend, but if the uptrend weakens, the price may test the support level. On the other hand, if the momentum strengthens again, DOT may move towards the next resistance level, and there could be a potential breakout to the highest level since April 2022.

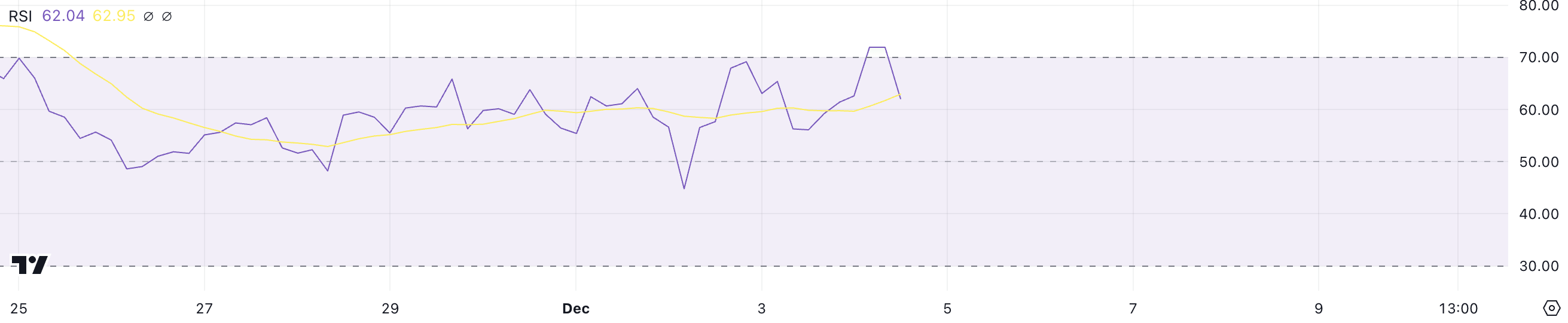

DOT RSI Exits Overbought Territory

The RSI of DOT is currently at 62, having retreated from above 70 for the first time since November 24. The recent move above 70 indicated an overbought condition and strong buying momentum, and the pullback to 62 suggests a slight slowdown.

Despite the pullback, the RSI is still in the bullish territory, suggesting continued optimism among buyers.

The RSI (Relative Strength Index) measures the speed and magnitude of price movements, with levels above 70 indicating an overbought condition and levels below 30 indicating an oversold condition. At 62, DOT's RSI reflects a healthy momentum, but it is no longer at its highest level.

If the RSI stabilizes or rises back above 70, Polkadot may resume its uptrend, but if it persistently falls below 60, the strength may weaken, leading to a price correction or a minor pullback.

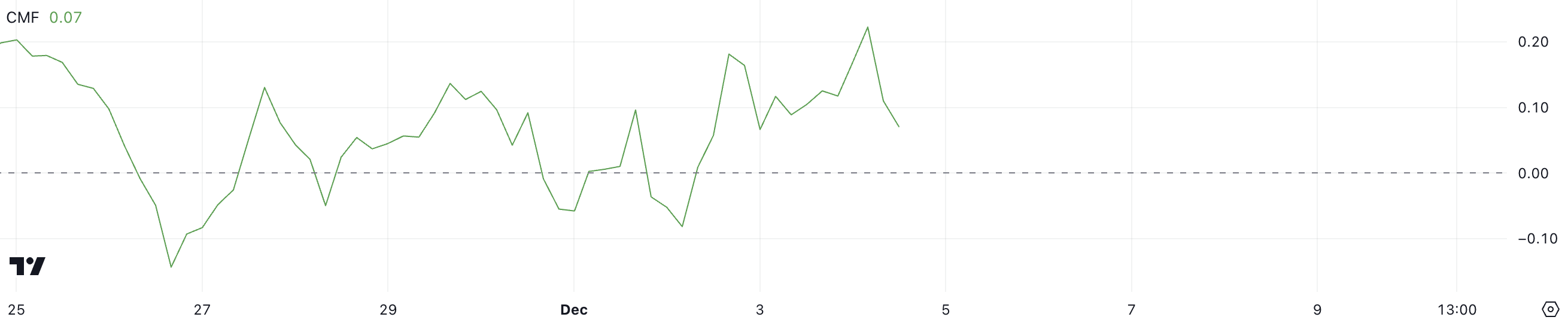

DOT CMF Remains Positive

The CMF (Chaikin Money Flow) of DOT is currently at 0.07, having declined from the recent high of 0.22 on November 23. This decline suggests that the buying pressure, while still present, has weakened from its previous strength.

The positive CMF value still indicates net capital inflows into DOT, reflecting the overall bullish sentiment, but the downward trend may suggest potential slowdown.

The CMF measures the flow of money into and out of an asset based on price and volume, with values above 0 indicating buying pressure and values below 0 indicating selling pressure. The DOT CMF is still positive at 0.07, but the decline from 0.22 may signal a decrease in the upward momentum.

If the CMF continues to decline, it could indicate an increase in selling activity, which may lead to a price correction or pullback. Conversely, if it recovers to higher levels, the upward momentum may reignite.

DOT Price Prediction: Can Polkadot Reach $12?

The EMA lines of DOT are still in an uptrend, with the short-term line above the long-term line, indicating sustained upward momentum. However, other indicators such as RSI and CMF suggest that the current uptrend may weaken.

If the buying pressure continues to weaken, the Polkadot price may test the support level of $8.4, and if that support fails, it could further decline to $7.5.

Conversely, if the uptrend regains strength, the DOT price may target the key resistance level of $11.6. A breakout above this level could see the price move towards $12, a level not seen since April 2022.