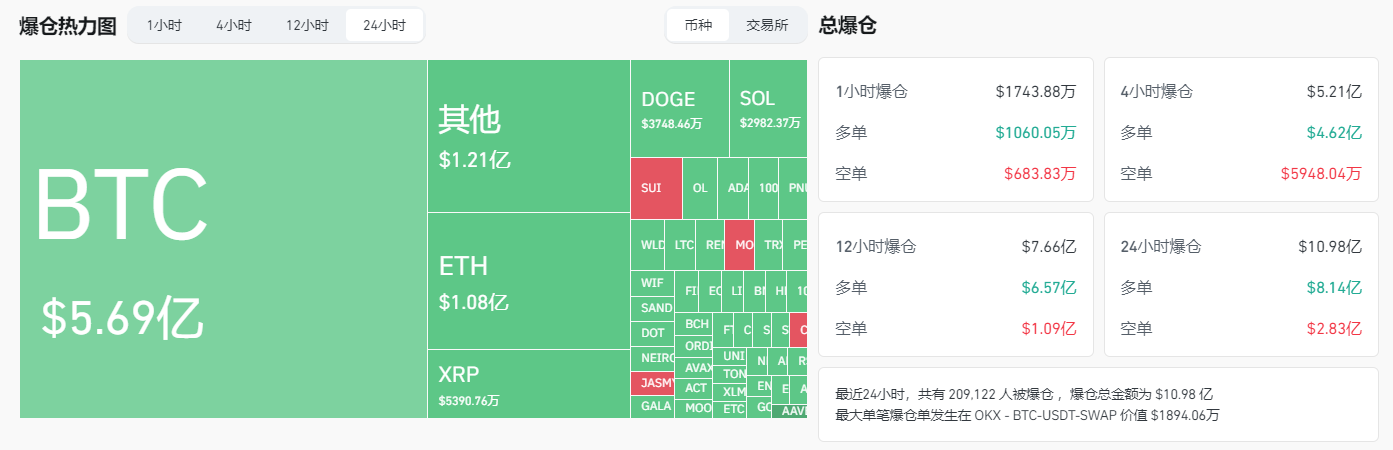

In the past 24 hours, the total liquidation amount across the network exceeded $1.087 billion, with over 210,000 people experiencing liquidation.

This liquidation amount has set a new high since the FTX incident, and the crypto market has not experienced such large-scale liquidation for a long time.

Nearly half of the liquidation amount was in Bitcoin positions, with the largest single liquidation occurring on OKX - BTC-USDT-SWAP worth $18.9406 million.

Many high-leverage contract users suffered heavy losses within a few hours due to market fluctuations. The rapid decline of Bitcoin caught many originally optimistic long investors off guard, especially those who did not set stop-loss.

Reasons behind the market correction

Regarding this significant Bitcoin pullback, several industry insiders have put forward different views.

First, many believe that this correction is essentially a healthy "adjustment" process for the market, a reasonable pullback. After breaking through $100,000, the market naturally needs to undergo certain liquidation and adjustment to release some profit-taking and prevent the risk of excessive overheating.

Some analysts had also predicted earlier that if Bitcoin's trajectory after breaking $100,000 was too rapid, it could have a negative impact on Altcoins. The market's expectations may have already been discounted, and Bitcoin's slight decline and sideways consolidation may actually be more favorable for Altcoins.

Secondly, the breaking news in Bogotá, the capital of Colombia, may also have had a certain impact on market sentiment. On December 5th, the UN Committee on Enforced Disappearances issued a report stating that about 20,000 unidentified bodies were found at Eldorado International Airport in the Colombian capital. Shortly after this shocking news was released, the price of Bitcoin began to decline, although the two seem to have no direct connection, but market sentiment is often affected by a combination of various factors.

In addition, the news about the transfer of more than 20,000 Bitcoins from Mentougou has also become a focus of market discussion. Although this news has attracted considerable attention, many industry insiders believe that the impact of Mentougou has already passed, and the transfer of more than 20,000 Bitcoins this time is merely a repayment behavior, which will not trigger a concentrated sell-off in the market. Therefore, this rumor may have been overstated in its impact on Bitcoin prices.

Market performance and short-term forecast

Anonymous cryptocurrency trader Smiley Capital stated in a X post on December 5th that the plunge that day "will truly go down in history".

Smiley Capital said: "Bitcoin fell about 10% in about 3 minutes, which is about a $200 billion drop. 180 seconds. $200 billion drop."

As of the time of writing this article, Bitcoin's market capitalization is $1.92 trillion. Just a day earlier, Bitcoin had broken through the $100,000 price level for the first time and then set a new high of $104,000.

Although Bitcoin experienced violent fluctuations in just one day, the overall trend shows that the market still exhibits strong buying power. Bitcoin's rapid rebound indicates strong capital support, which leads some analysts to believe that the market still has room for a rebound in the short term.

IG market analyst Tony Sycamore stated that while the recent pullback does not mean the end of the Bitcoin bull market, it may mean that the market will enter a consolidation phase in the next few days or weeks. In the past, Bitcoin has experienced similar consolidation phases after reaching historical highs, such as after reaching a historical high of $73,679 in March, the price fluctuated widely between $53,000 and $72,000 over the next seven months.

Market sentiment and long-term outlook

Although the market has experienced violent fluctuations, the overall capital flow situation shows that the market remains highly focused on Bitcoin's prospects. In 2024, the net inflow of funds into the US Bitcoin spot ETF has exceeded $31 billion, and the Bitcoin halving effect in April has further intensified market expectations of its supply tightening.

Although the current Bitcoin price has pulled back, its long-term growth potential is still widely favored. Analysts generally believe that Bitcoin's market sentiment will remain active, and as the global digital asset market continues to mature, Bitcoin is likely to continue to lead the cryptocurrency market.

Resilience of the Altcoin market

Interestingly, although Bitcoin's decline has brought short-term shocks to the market, Altcoins (such as Solana, Ethereum, Dogecoin) have shown relatively strong resilience.

Recommended reading: As Bitcoin approaches $100,000, should you chase BTC or accumulate Altcoins?

MarsBit previously analyzed that in each Bitcoin crash during a bull market, it is more likely to be a positive for Altcoins.

During this Bitcoin correction, major tokens like Solana have shown a rebound trend, with Solana once rebounding to $242.

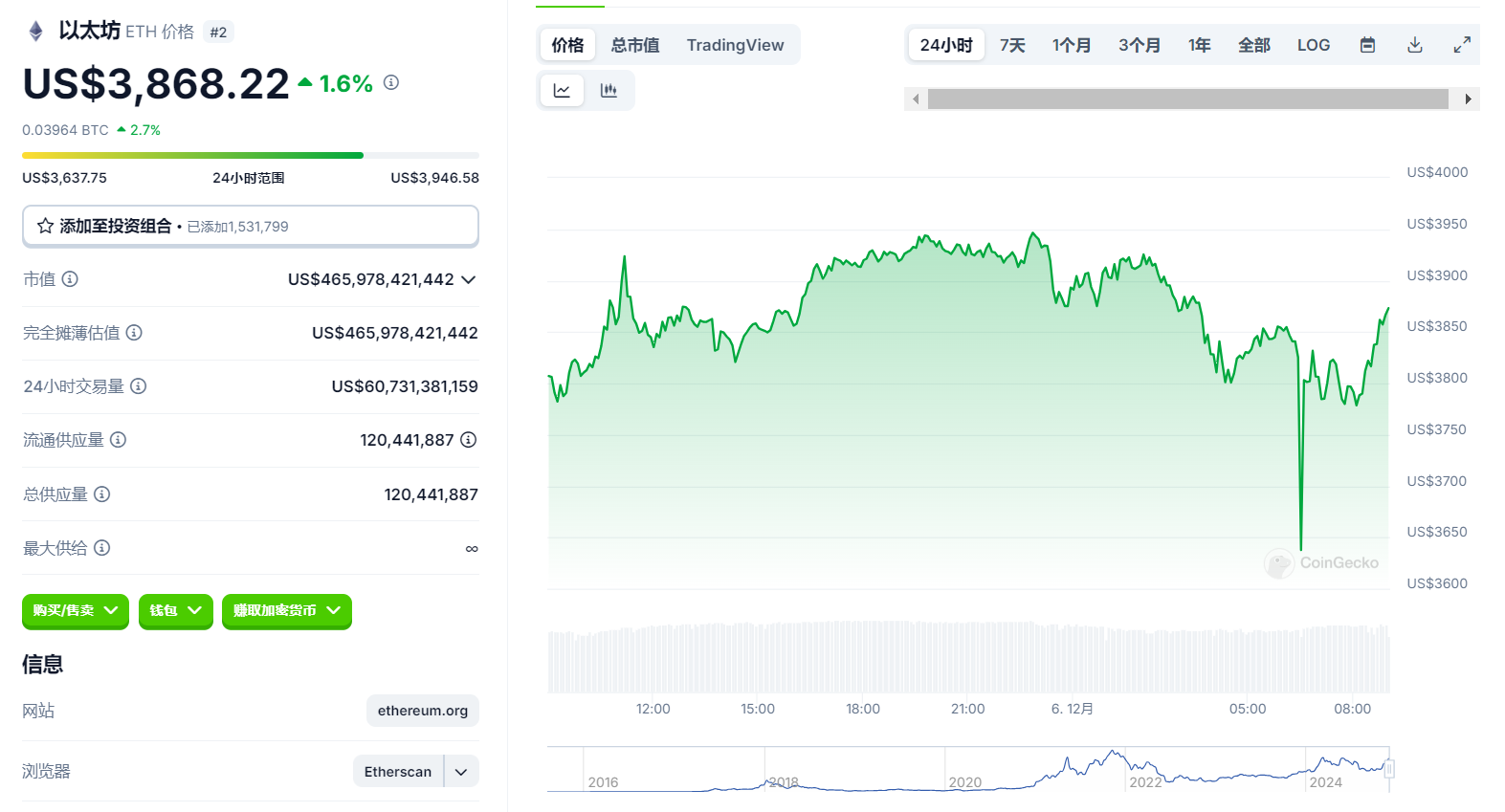

Ethereum has rebounded to $3,870.

Dogecoin has also rebounded to $0.44.

These tokens quickly rebounded after a brief decline and have stabilized along with Bitcoin, showing strong market support for other quality projects.

Bitcoin's dominance has declined from a high of 62% to 55%.

This phenomenon indicates that although market volatility is high, the overall potential of the cryptocurrency ecosystem still exists. Investors are gradually realizing that in addition to Bitcoin, other digital assets may also achieve sustainable growth in the long run, and the Altcoin season is still in full swing. Therefore, although the market sentiment is affected by fluctuations, the demand for investment in quality tokens remains strong.

Summary

Bitcoin's recent plunge has attracted widespread attention in the market, but behind the market correction, there is also a inherent need for healthy adjustment. Whether from a technical or market sentiment perspective, Bitcoin still has strong support. In the next few days, whether the market will enter a consolidation phase will be the focus of attention, but overall, Bitcoin remains the "leader" of the digital currency market and may continue to break through higher price levels in the new cycle.