Author: Mercury

Compiled by: TechFlow

Market Rotation: An Opportunity for Wealth Appreciation

In any market, especially the crypto market, rotation is a rare opportunity. It allows you to transfer the profits you have made from strong assets to assets that have lagged in performance, thereby achieving compounded growth in wealth.

However, the key to success lies in understanding the concept of "relative strength". You can only have the capital to rotate when you have made enough profits in the strong assets. This is the core of this article:

When the market is in a highly prosperous stage, many tokens will perform well (like now), and the choice of rotation in such a situation may seem dazzling.

But this is actually a good thing.

Because at this time, there are more tokens worth paying attention to in the market;

And the "appeal" of these tokens will also become more prominent.

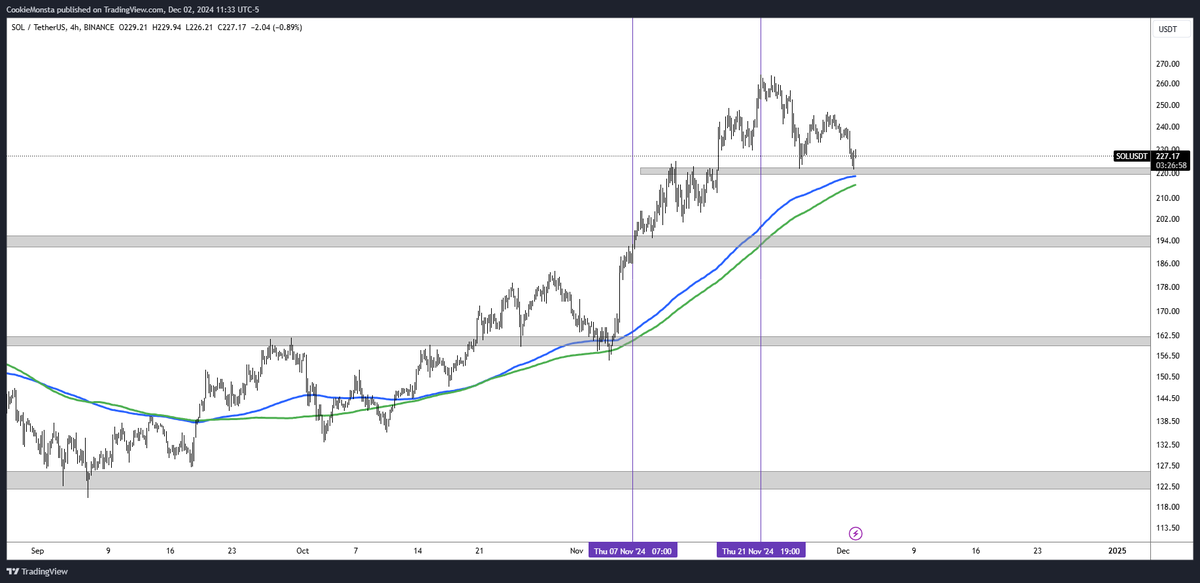

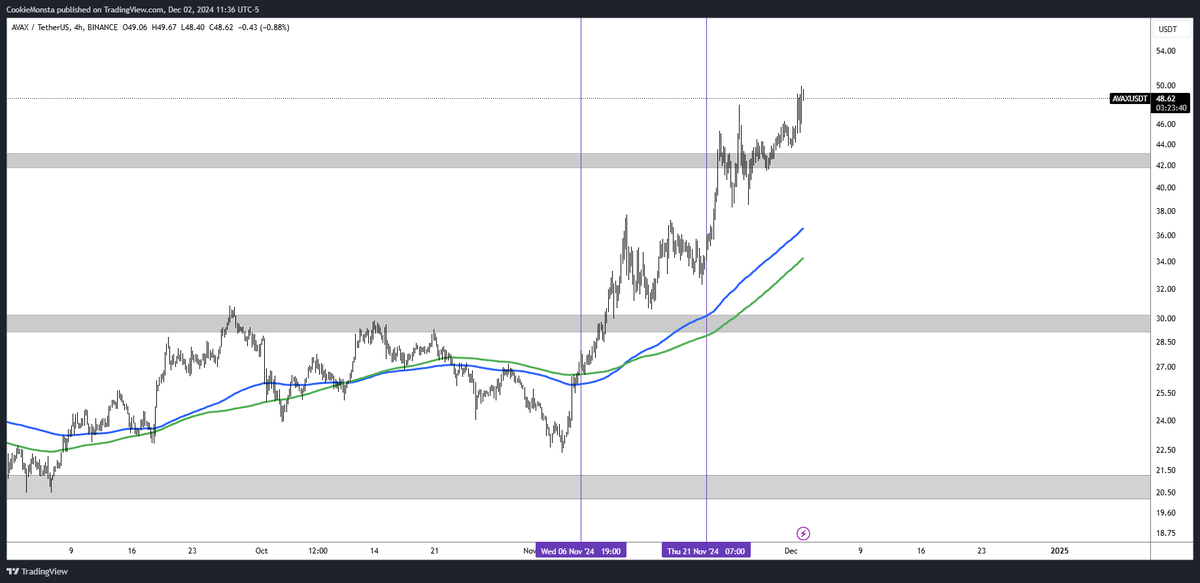

Taking $SOL and $AVAX as examples

We can observe this rotation phenomenon through the performance of $SOL and $AVAX:

When SOL broke out of a consolidation range that lasted 8 months, AVAX had not even set a new high.

After SOL broke out of the range, it slowly climbed 15%. Meanwhile, AVAX surged 45% during the same period.

Subsequently, both entered a period of consolidation after local tops. During this period, SOL led the market again, rising 30% and setting a new all-time high (ATH).

When SOL set a new high (and locally topped in an unknown situation to us), AVAX formed a higher low and then rose 45%.

Now, as AVAX sets a new high again, SOL has retraced to the trend support of the high time frame (HTF).

The "Ping-Pong Effect" of Rotation

This phenomenon is like a ping-pong ball, switching back and forth between the two assets:

One asset surges strongly, while the other stagnates;

Sometimes they rise moderately together;

Sometimes they consolidate together.

But those eye-catching large swings - the ones that make you start paying attention and get social media buzzing about a certain token - often occur when the other token is stagnating or retracing.

The Attention Economy of the Market

For those who are not deeply familiar with market dynamics or have not established a clear trading system and strategy, the market's changes may feel overwhelming.

You may encounter situations where you sell your position at the local bottom of AVAX and buy SOL, but then SOL retraces while AVAX starts to surge, or vice versa.

In trading, patience often pays off. If you can find a suitable position at the low of the high time frame (HTFs), you should try to avoid frequent rotation.

Simply put, the market shifting capital from one sector or token to another does not mean you need to follow suit.

In fact, few people can successfully capture all the important uptrends of SOL and transfer their capital to AVAX at the right time to maximize their gains. This kind of "perfectionism" rarely works in trading.

Rather than pursuing perfection, it is better to focus on both at the same time. From the market background, both SOL and AVAX are seen as having a favorable performance in the high time frame.

For example, SOL is breaking out of an 8-month consolidation range and is expected to continue the uptrend and enter the price discovery phase.

AVAX, on the other hand, just broke out of a 6-month downtrend a few weeks ago and has recently successfully broken through a monthly range high.

Overall, there is no absolute right or wrong between the two. Perhaps when SOL retraces to the trend support of the high time frame (see the first chart), AVAX is approaching the $55 resistance level.

Or, when SOL tests the support and continues to rise in the next few days or weeks, AVAX may retrace from its resistance level.

In this case, the profits you have made on one token can be used as working capital to look for new opportunities or add positions on the other token - this is the actual meaning of "rotation" in such scenarios.

The key is that these two have shown relative strength compared to the overall market, while most of the market is still in a downtrend or without obvious volatility.

How many tokens are currently returning to their monthly ranges or breaking out of high time frame trends? Although there are indeed dozens, we are still far from the stage where "you can make money just by buying blindly".

Therefore, rather than focusing too much on short-term minor rotations, it is better to patiently wait for the entry opportunities of the two, or use minor rotations to rebalance positions at key turning points.

Finally, it needs to be clarified that this is a very small rotation case.

When we discuss rotation, due to different time frames of each person, there may be different understandings of this concept.

Rotation can be small-scale, like the example just mentioned; it can also be large-scale, such as those tokens that have been stagnant for two years suddenly start to surge significantly, and we are just seeing the beginning.

However, whether it is large-scale rotation or small-scale rotation, the core logic is the same, only the scope and degree of impact are different.

I may write a second part about rotation in the future, but that's it for today - I'm tired.

I hope this article is helpful to you.