Author: Li Dan, Wall Street Insider

On Thursday, December 5th, Bitcoin broke through $100,000 for the first time in its history during trading. When the Bitcoin trading price was around $27,000 in April last year, Geoffrey Kendrick, the head of emerging market foreign exchange research and cryptocurrency research at Standard Chartered Bank, accurately predicted that the currency price would reach $100,000 by the end of this year. Now that Bitcoin has broken through the $100,000 mark, Kendrick is even more optimistic about the future market, predicting that the currency price will rise to around $200,000 by the end of next year, against the backdrop of the possible increase in institutional investment in Bitcoin.

Kendrick believes that Bitcoin's surge to $100,000 this year is mainly due to the strong support of institutional investors. Throughout 2024, the investment capital flow of Bitcoin has been dominated by institutional investors. Standard Chartered expects this situation to continue in 2025, helping Bitcoin reach Standard Chartered's target level of around $200,000 by the end of 2025. Meanwhile, further absorption by US pension funds and/or sovereign wealth funds will make Standard Chartered more optimistic about the rise in currency prices.

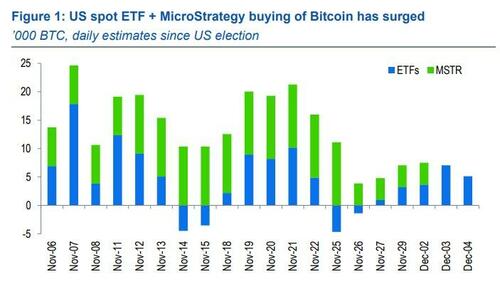

Specifically, in terms of institutional capital flows, since the beginning of this year, institutions have bought a large amount of Bitcoin through Bitcoin ETFs listed in the US and through holding MicroStrategy, a software company seen as a Bitcoin proxy, with a net purchase of 683,000 Bitcoin. Of this, 245,000 Bitcoin flowed in within a few weeks after the US election.

These capital flows have undoubtedly been the driving force behind Bitcoin's current surge and breaking through the $100,000 mark, but what will happen in the future?

Kendrick's report states that by 2025, Standard Chartered expects institutional capital flows to continue at or exceed the pace of inflows into Bitcoin in 2024. MicroStrategy is already implementing the plan it announced at the end of October, to raise $42 billion over the next three years to buy Bitcoin, so MicroStrategy's purchases in 2025 should reach or exceed the purchase scale in 2024.

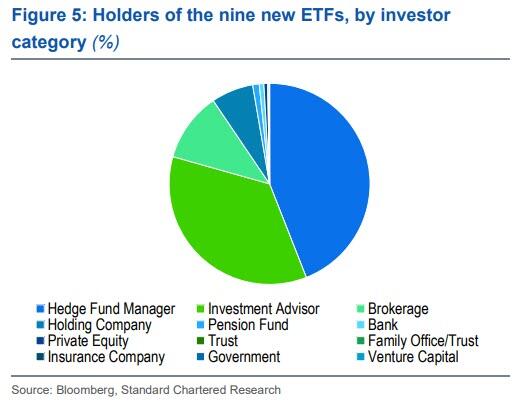

In terms of US Bitcoin ETFs, Standard Chartered has noticed from the 13F filings submitted to the US SEC that pension funds' reported holdings only account for 1% of the shares of the nine new Bitcoin ETFs.

Standard Chartered expects that with the changes in regulation after the Trump administration takes office, the traditional financial industry will be more able to participate in investing in digital assets, and by 2025, the proportion of the above-mentioned pension funds holding Bitcoin ETFs will increase. Even if a small portion of the $40 trillion in US pension funds is allocated to Bitcoin, it will significantly push up the currency price.

Against this backdrop, Standard Chartered believes that the target price of around $200,000 for Bitcoin by the end of 2025 is achievable. If US pension funds, global sovereign wealth funds (SWFs) or a possible US strategic reserve fund absorb Bitcoin more quickly, Standard Chartered will be even more optimistic about the currency's performance.

Kendrick's report mentions that Standard Chartered has previously pointed out that the US government may set up a strategic reserve fund for Bitcoin, and Standard Chartered believes the probability of this fund coming into being is low, but if it does, the impact will be significant. In addition to creating a new buyer for this small asset class, the strategic reserve fund could also provide cover for other SWFs to also purchase Bitcoin, or disclose that those funds have already purchased Bitcoin.

Kendrick's report states that in July this year, when Trump mentioned the possibility of a Bitcoin strategic reserve fund, the US government held 210,000 Bitcoin, about 1% of the total Bitcoin supply. Given the scale of global foreign exchange reserves, and the relatively small total market value of Bitcoin, Standard Chartered believes that the strategic reserve fund is an important upward driver of the currency price.

Even if foreign exchange reserve managers allocate only 1% of their funds to Bitcoin, the amount will be very large and could significantly push up the price of Bitcoin.