On-chain data suggests that the Bitcoin (BTC) price cycle will continue and it will last at least until April 2025.

Also Read: Hot: The number of retail investors in Bitcoin has reached a 4-year high

Bitcoin still has a lot of room for growth

As we know, the BTC price recently set a new all-time high of 6 digits on December 5th. After that, the price has retreated and is currently pushed back below the $100,000 level. This price increase has caused the unrealized profits (in simple terms, the paper profits) to surge and reach an overbought level.

So, is the price on December 5th the peak of this BTC cycle? By evaluating some on-chain Bitcoin indicators below as well as comparing with previous BTC cycle peaks, BeInCrypto realizes that this BTC price increase seems to have not stopped yet.

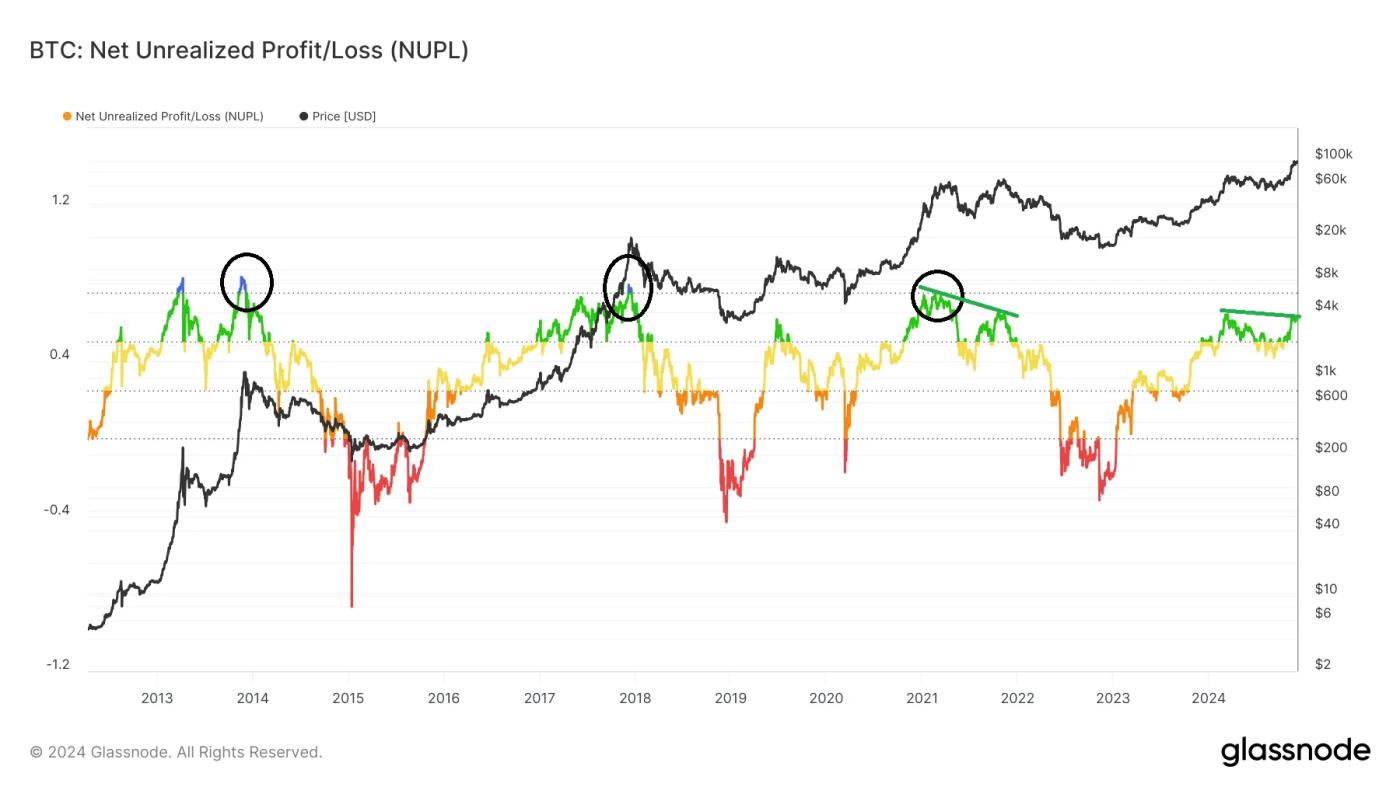

First, let's look at the on-chain indicator Net Unrealized Profit/Loss (NUPL). This indicator measures the amount of unrealized profits or losses as a percentage of market capitalization. The higher the value, the more euphoric the market is, and historically it has occurred at the peak of the Bitcoin market cycle.

On-chain indicator Net Unrealized Profit/Loss (NUPL). Source: Glassnode

On-chain indicator Net Unrealized Profit/Loss (NUPL). Source: GlassnodeThe current NUPL is 0.62, lower than the euphoric level of 0.75. Furthermore, it is lower than the previous cycle highs of 0.82, 0.79, and 0.72 (black circles). Therefore, the current BTC NUPL indicates that there is still room for growth.

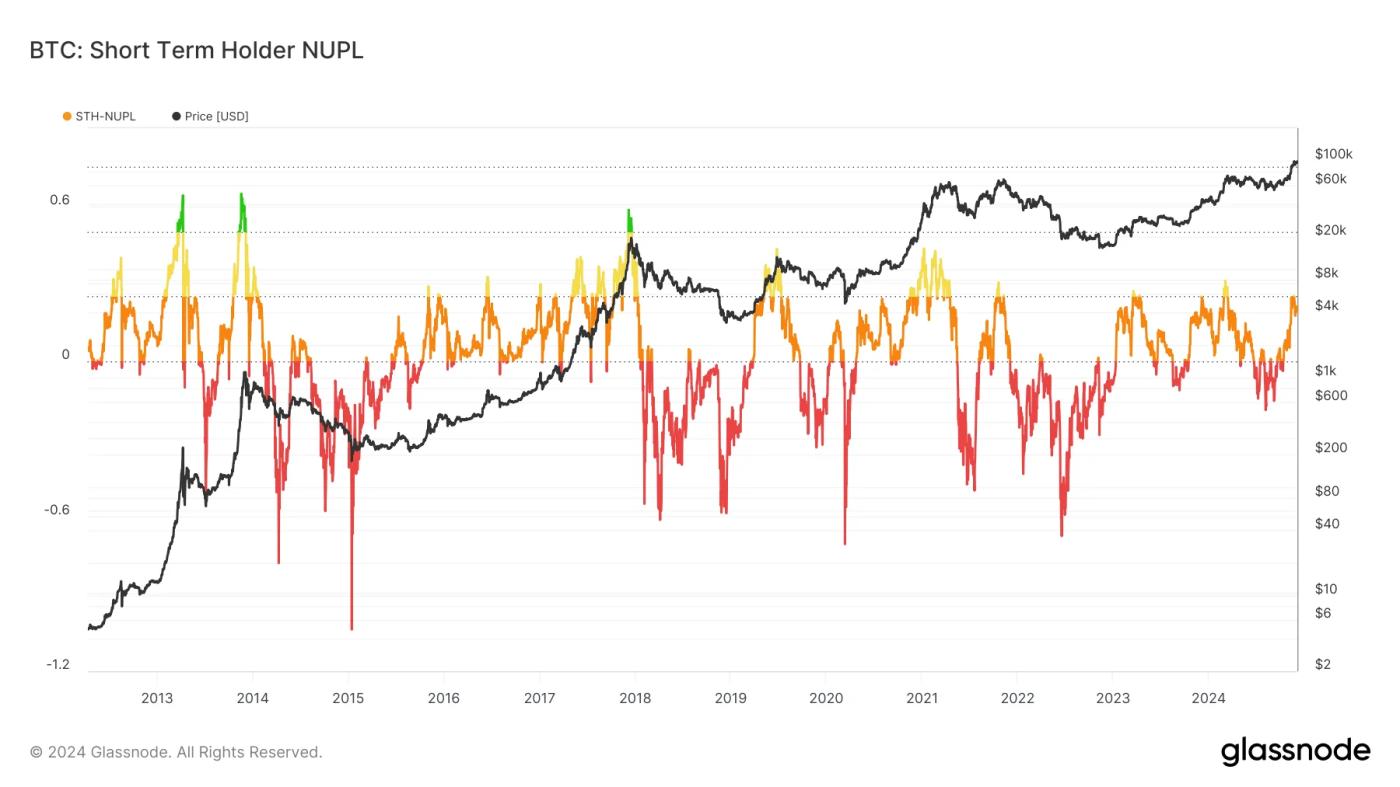

However, the decreasing divergence (green) is worrying as it led to the start of the correction in 2021. But when BeInCrypto looks at the position of short-term holders (STH), a positive signal has appeared. Currently, this indicator is still at 0.25. Each previous high had a value above 0.25, and some even reached 0.5.

BTC STH NUPL. Source: Glassnode

BTC STH NUPL. Source: GlassnodeTherefore, the combination of the two NUPLs suggests that Bitcoin can continue to rise. The short-term holder NUPL is not overbought, reducing the likelihood of a short-term decline before the trend continues.

BTC Price Prediction: The price increase will continue at least until April 2025

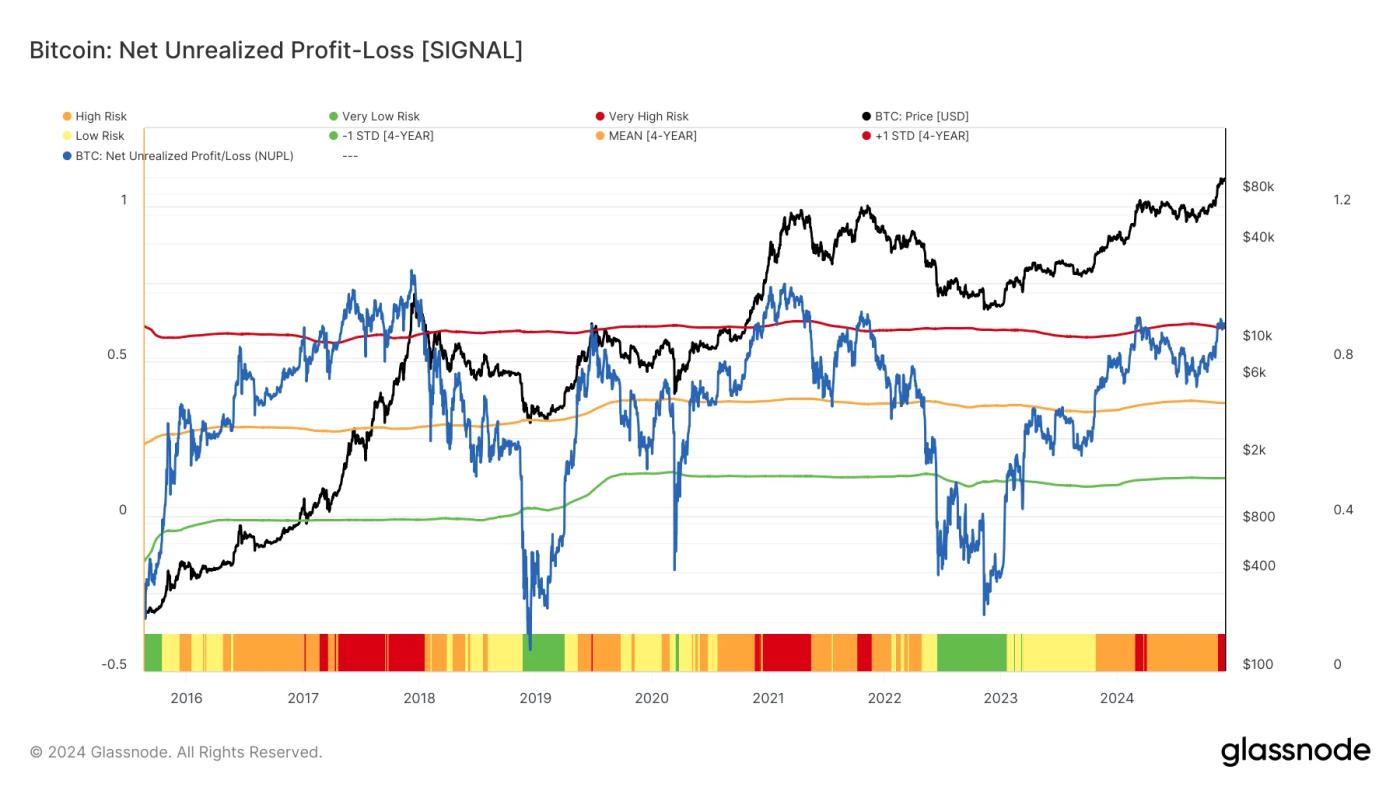

With the above analysis by BeInCrypto, we have answered the question that the BTC price will continue to rise and break the ATH on 05/12. The next question is, how long will the price continue to rise? The NUPL Signal indicator will help us answer this question.

The NUPL Signal uses the standard deviation of the 4-year medium to determine whether the market is overbought or oversold. High-risk values are those above 0.59 (red), which have historically increased the likelihood of a correction. As noted above, Bitcoin's NUPL is 0.62, so it is within the high-risk zone.

NUPL Signal. Source: Glassnode

NUPL Signal. Source: GlassnodeHowever, analysis of previous cycles shows that the correction does not start immediately after the indicator reaches this level. On the contrary, the indicator has remained above this level for 6 and 5 months respectively in the two previous BTC market cycles. And since the NUPL indicator has recently crossed above 0.59, if history repeats itself, it means that the Bitcoin price increase will continue at least until April 2025.

In your opinion, how long will this BTC growth phase last? Share and discuss this issue in the BeInCryto Telegram group.