Author: He Yi, Founder of Hash Global Source: substack

We believe that Web3 is not just about Bitcoin and crypto finance, it is Web3, the value internet, and the evolution and upgrade of Web2. Due to the innovation in the underlying data storage method and payment means, the arrival of Web3 will not be as clear as the upgrade from PC internet to mobile internet, but will "quietly enter the night and nourish things silently". What is this "wind"? We believe it is that user data and data assets are being massively created on the chain, because the super user experience of Web3 needs to be built around user data.

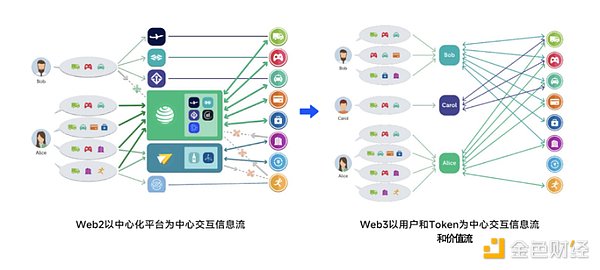

The core of Web3 is Own - ownership. For Web3 to become Web3, and not just crypto finance, it must allow users to own data assets, not just financial assets. Users owning their own data is the basis for users to get better service experience and different users to get different services. The internet has evolved from meeting needs to personalization, and then to personalized services. AI gives us the productivity of personalized services, and the large-scale value coordination of personalized services can only be supported by Web3.

Earlier, I gained a lot from listening to Professor Zeng Ming's lecture on the development stages of AI (the video public account of Zeng Ming Academy has it). The professor told me that the same framework can also be used to judge the development of Web3. Our observations and practices in recent years, the puzzles we have encountered, and the corresponding investment strategies we have formulated can be verified and form a thinking framework after having a clear understanding of the development stages, so we are no longer so anxious.

The professor also gave the definition of native applications (Killer App):

Fully utilize the unique technical advantages of new technologies;

Bring about a huge innovation in user experience;

Explore new business models;

Bring about exponential growth of massive 2C services.

Based on this standard, Yahoo, which went public in 96, is the first generation of native internet applications, while Web3 has not yet reached the native application stage. Why is it so difficult for applications other than financial native applications to emerge? The reason may be simple - we still don't have enough non-financial Web3 users. No early native internet application emerged out of nowhere, they all went through a long period of popularization, and even grassroots promotion, before becoming a killer app. Without years of promotion of internet users by AOL, there would be no Yahoo; Alibaba, Tencent, and Ctrip also went through a long process of user accumulation.

We believe that the development stage of Web3 has a duality: the vanguard of Web3 - crypto finance is moving much faster, with the number of active addresses already reaching about 600 million, which is equivalent to the number of internet users in 99, so we have already seen financial native applications like USDT, wallets, and DeFi; but the core of Web3 - the next generation of the internet, is still far from completing user popularization. Only when there are a large number of user data assets on the chain and services around these data assets, will users actively choose to use wallets to interact with the internet and use internet products, and Web3 will arrive.

Any technology needs to be integrated into the mainstream economic system, with commercial applications as the carrier. In the current stage of Web3 development, we need commercial applications in various industries, driven by their own business purposes, to grasp the core technical characteristics of Web3, massively create and issue data assets on the chain, and develop their new internet business models based on this. In this process, they will create huge commercial value and become the first generation of native Web3 applications.

All internet business development must be centered on data, whether centralized or decentralized. Web3 commercial applications focus on data-decentralized dAPPs. The data assets mentioned here refer to user identity, membership levels, movie premiere tickets, concert tickets, highlights of musicals, the first batch of crowdfunding cards of a certain singer's debut, the 5,000th like of Gui Xian teacher's photobook, the real-time distribution of "Fan Xian's smile" at a certain plot in the drama Daylight Year, and various types of check-in certificates. They will all be carried by Non-Fungible Tokens (NFTs), and the original content of the data can be stored on decentralized storage infrastructures like Greenfield.

We have summarized five core technical characteristics of Web3: 1) Unified ID across the network; 2) Value internet: the internet and banking network are combined into one network; 3) Everything can be tokenized: finance and data; 4) Able to establish complete "live data" across regions and platforms; 5) Able to directly reach users at both the information and value levels.

Web3 commercial applications that grasp these technical characteristics will have the following five features:

Ubiquitous data: Possess cross-platform and cross-regional data. Data can be tokenized, traded and authorized to AI models, enabling intelligent user services. The operation of on-chain data will become very important.

Giving the right thing to the right person: Content and product producers and consumers are directly connected, and differentiated experiences and pricing are possible.

Direct value connection: Embedded financial network, value can be transmitted point-to-point like information. Integrated clearing and settlement. Can be distributed automatically and in a timely manner through smart contracts.

Effective incentives: On the premise of a healthy and sustainable business model, project parties can issue Non-Fungible Tokens (NFTs) and ecosystem tokens to complete the cold start of the project and accelerate the development of the ecosystem.

New form of organization: The interests of startup teams, shareholders, industry upstream and downstream, users and fans can be unified through tokens, reshaping the organizational forms of various industries, and the corporate organizational structure is no longer the only choice.

We believe that such Web3 commercial applications are truly valuable Web3 applications that fit the current stage of development. The current Chinese internet business and content going overseas actually provide the best timing for Web3 commercial application teams. Being based in Hong Kong also has geographical advantages. Web3 is the best infrastructure for globalized businesses. The output of Web3 technology is standards, and it also embeds finance and is self-sufficient in functionality.

The growth path we envision for a Web3 commercial application aimed at the global market can be:

Use Web3 to build a globally unified and functionally complete user or fan account system.

Carry out business with NFTs and tokens as the business carrier, with NFTs as various data tags.

Fully utilize public domain traffic, use Web3 tools and various Web2/Web3 wallets to carry and build a private domain system.

Quickly establish a complete and constantly updated private domain data, and better develop the business based on data analysis and feedback.

Realize the cross-industry and same-industry flow of data on the chain, which is cheap and accurate.

Users receive personalized and intelligent services based on the data assets they hold, and obtain product experiences far exceeding Web2.

Improve product stickiness and gain good dissemination and retention, forming a self-closed loop of data growth.

The above path is particularly suitable for industries such as performance ticketing, film and television culture, entertainment creation and IP co-creation. Without a Web3 membership and fan system, the content economy and IP economy cannot be effectively developed: helping creators maximize the realization of functional value, generating a large amount of emotional value and asset value for fans, supporting the incubation and co-creation of IPs, and the value distribution throughout the entire chain, these are the areas where Web3 can best play its role. We have already started to actively invest in these fields. We also invest in the necessary Web3 business supporting facilities for the application to be carried out, including data chains, intelligent tokens, payments, stablecoins, human resources and global payroll services, etc. We hope that excellent startup teams will come to us, and you only need to manage your business logic well, and we can find technical teams to support the rest. In the current stage where technology development is ahead of application, this is the stage with the most imagination and opportunities for entrepreneurship in the business field. In discussing this path with CZ, CZ said that another key is the execution ability of the team. So we attach great importance to the background and capabilities of the team, and we are particularly hoping to cooperate with Web2 resource parties and winners to jointly promote the landing of Web3 business.

We think with the project teams: the core of all internet business is data. Whoever helps users create more data will have the moat of future business. Why are Alibaba, ByteDance, and Tencent making so much money? If ByteDance and Tencent open up user data and traffic, how can we carry out our business? Our evaluation criteria for Web3 commercial application projects are:

Have you figured out why you need to help users create on-chain data assets? How can on-chain empower the business itself?

How many data assets can be created?

How to apply and analyze the data to make the user experience more attractive (such as retention and upgrade desire)?

How to realize the value of data? How to connect with AI models? How to reduce costs and increase efficiency?