Crypto analyst Michael van de Poppe believes that the 2024 bull run for Ethereum (ETH) is still valid, even though it failed to maintain the $4,000 level. He shared his insights on X (formerly Twitter) and explained the key factors supporting his outlook.

At the time of writing, ETH is trading at $3,716. Can Ethereum recover to higher levels in the next few weeks?

The ETH rally is not over

According to Van de Poppe, ETH is in a trading range that provides investors with an opportunity to buy the coin at a discounted price. This offers a chance to accumulate at a discount. The analyst noted that the recent price decline is normal.

However, he mentioned that ETH's price is testing an important resistance area that can validate the upward movement. The chart shared by Van de Poppe shows the resistance zone is around $3,800. Therefore, if this area is breached, the Ethereum bull run can continue from the end of this month until 2025.

"ETH is actually providing a great opportunity to accumulate. This is a standard correction after testing a new resistance area. I expect it to continue running from the end of this month until next year." – Analyst post.

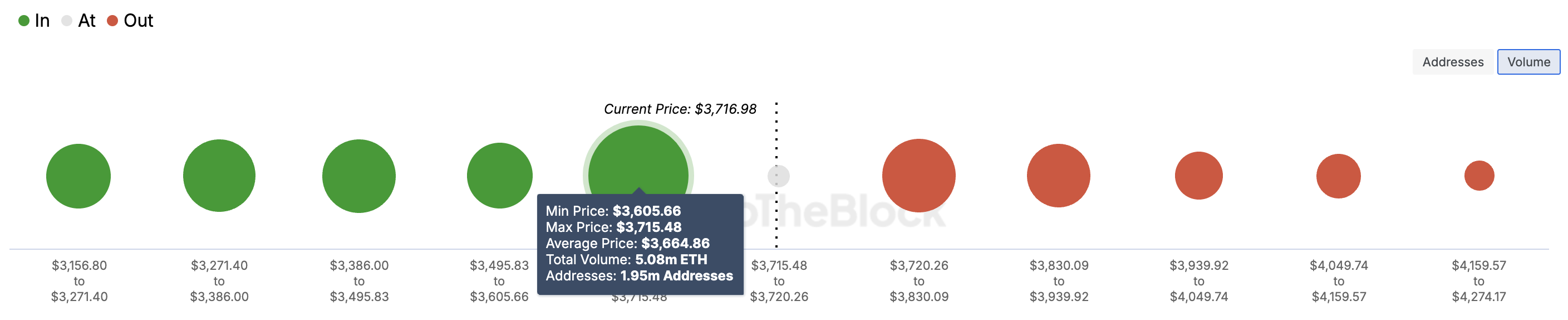

Interestingly, Van de Poppe's sentiment seems to align with the indicators shown by the In/Out of Money Around Price (IOMAP) metric. IOMAP classifies the addresses that have accumulated at lower values than the current price and the addresses that have accumulated at higher values.

Generally, the higher the trading volume in a specific price range, the stronger the resistance support. Therefore, if there is no money, high volume indicates strong resistance. However, if there is money, high volume indicates strong support.

As can be seen below, the trading volume of ETH is highest around $3,715, much higher than the range between $3,830 and $4,274. If the current situation persists, the Ethereum bull run can continue, and the price can rise to $4,500.

ETH price prediction: Reaching $4,500?

On the daily chart, Ethereum's price continues to trade above a descending triangle. This suggests that the cryptocurrency may not experience a significant correction despite the recent decline.

However, for the price to rise, the trading volume needs to increase. Additionally, the bulls need to defend the support at $3,505. Looking at the situation, the bulls seem to be able to defend this support.

If confirmed, Ethereum's price can rise to $4,096, and in a very bullish scenario, it can be pushed up to $4,500. However, if the bears manage to pull the price below $3,505, this outlook would be invalidated, potentially leading to a drop to $3,182.