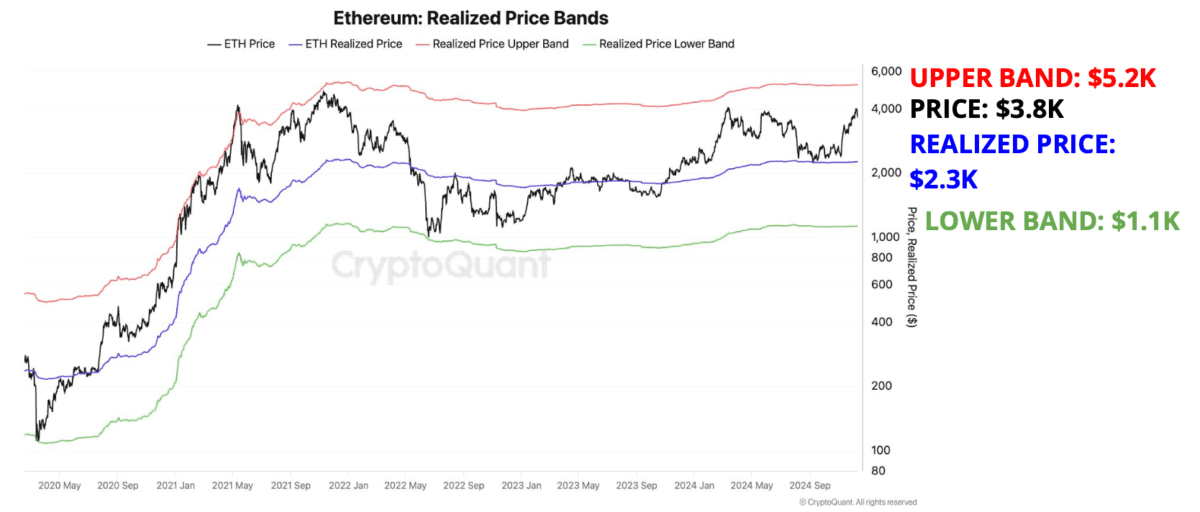

The foreign media outlet 'The Block' reported, citing the views of a CryptoQuant analyst, that if the current supply and demand dynamics remain unchanged, driven by on-chain valuation indicators and renewed investor interest in Ethereum (ETH)-related financial products, the Ethereum price could see a significant increase. The CryptoQuant analyst stated in the interview:

"Based on valuation indicators, if the current supply and demand trend continues, Ethereum could break through $5,000."

The analyst pointed out that the realized price range is one of the key indicators in their assessment. The realized price refers to the average trading price of Ethereum in historical transactions. Currently, the upper limit of the realized price range is $5,200, reflecting the price peak of Ethereum during the 2021 bull market. The analyst noted that as new buyers purchase Ethereum at higher prices, this price ceiling will continue to rise, suggesting further upside potential in the current market cycle.

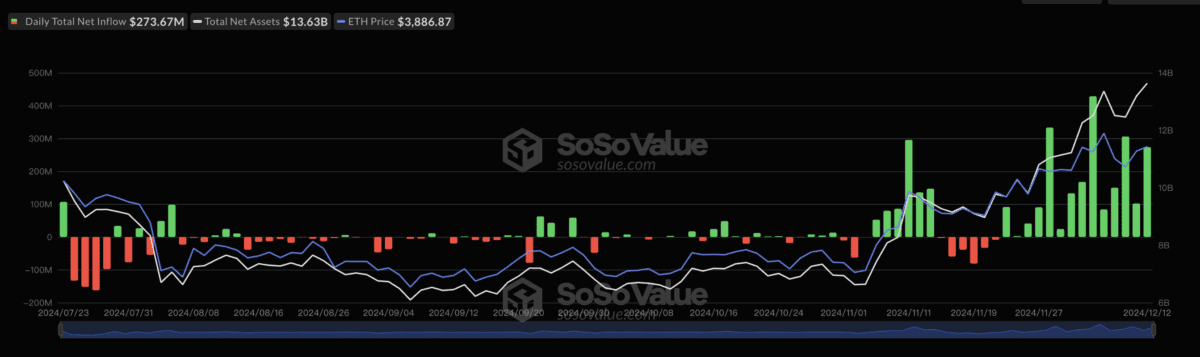

On the other hand, the recovery of investor demand is particularly evident in the strong growth of Ethereum spot ETFs in the US, especially the inflows into BlackRock's ETHA ETF and Fidelity's FETH ETF this week. According to data from the cryptocurrency data tracking platform Arkham, BlackRock and Fidelity's ETFs purchased $500 million worth of Ethereum on Tuesday and Wednesday, indicating the continued institutional interest in Ethereum as a digital asset and investment tool.

On Wednesday, the net inflow into Ethereum spot ETFs reached $102 million, marking the 13th consecutive day of net inflows. Over these 13 days, Ethereum ETFs have attracted a cumulative inflow of $1.95 billion, increasing the total net asset value to $13.18 billion, equivalent to 2.86% of Ethereum's market capitalization.