Author: TechFlow

It's another week dominated by the AI Agent sector, have you found the Alpha?

Top tokens like ai16z and Fartcoin have been rising, while at the bottom you can even see hundreds of self-proclaimed AI Agent tokens appearing on the monitoring list at the same time.

With so many, how do you choose?

If you are not a professional P-trader, opening sniper, or a networking master in the crypto industry, apart from envying others' win rate, energy management and information density, and becoming a buyer after FOMO, how can you judge whether a project has a future?

From the perspective of an ordinary investor, you may not have a reliable judgment handle.

In the process of selecting content materials and observing the market, the editor who has been losing money for years also has a similar sense of powerlessness - unable to see through, unable to get in, unable to recover the principal, and unable to find the complete ins and outs.

Every moment of the market is vague and chaotic, but every now and then there seems to be a clear pulse.

Obviously, an ordinary editor trying to take the pulse of the entire market will be laughed at; the following thoughts are just for sharing, and the folk remedies have at least cured the editor's own loss-making disease to a certain extent.

Differentiation of AI Agent tracks: applications to the left, platforms to the right

First, from the overall market perspective, the AI Agent track has certainly been a hot track in the recent one or two weeks. Especially yesterday, when OKX launched the GOAT spot, it also boosted the enthusiasm of the entire AI Agent track.

But apart from the unsustainable across-the-board rise, the projects that have been emerging in the AI Agent track recently have gradually shown a sense of differentiation:

Differentiation 1: It is a dedicated AI Agent application, solving a certain type of specific problem, or having a certain type of specific identity/style

Representative projects: AIXBT, Truth Terminal

Differentiation 2: It is not a dedicated AI Agent application, but it gives you a shovel to create more new applications

Representative projects: Virtuals, ai16z (Eliza framework), Empyreal SDK

Roughly speaking, this is actually a kind of evolution from applications to platforms: from AI Agents being able to issue a token, to having a platform/tool that allows more AI Agents to issue tokens.

Of course, this argument is not entirely accurate. In addition to Launchpad, some tools are not for AI Agents to issue tokens, but provide an environment for AI Agents to be better used and more usable. Essentially, this type is still not a single-point application logic, but a platform and ecosystem logic:

More usable, more capable, the tokenized tokens will have more reasons for endorsement, and are also more likely to be favored by capital speculation.

In fact, this logic may just be a replay of history.

In 2017, ICOs were popular, and every project could issue tokens through ICOs, but in the end, Ethereum actually became the largest ICO platform after ICOs, where various projects could deploy tokens through smart contracts.

Now the popular AI Agents, each Agent can independently issue a token, but there are also framework and platform-type projects that allow everyone to quickly create AI Agents through various low-threshold, no-code or natural language methods.

History never repeats itself, but it rhymes. The core of asset creation has never changed.

Attention drives, capital stirs

Note that the editor is not saying that the platform/framework-type projects in the AI Agent track are stronger than the pure AI Agent applications.

Strength is not determined by the direction of the project, but by the result of the inflow and outflow of market capital. Let's use a more brutal and straightforward proposition to explain - the chips will go to where the "story is told longer".

What does it mean for the story to be told longer?

Of course, we've seen one-day pump-and-dumps, but more often it's a short-lived pump that only lasts 1-2 hours. This type of token can attract a lot of capital in the short term, but will also immediately bleed out as capital withdraws.

From a more easily understandable perspective, it's that the capital thinks, "Your story can't be told for long."

The projects that can tell their stories more persistently can attract more attention. And attention drives heat, while capital stirs the ups and downs.

More specifically:

Look at Meme = Look at its angle

Look at AI Agent = Look at what it claims to do

So the question becomes, which AI Agents claim to do things that you think they might be able to do for longer?

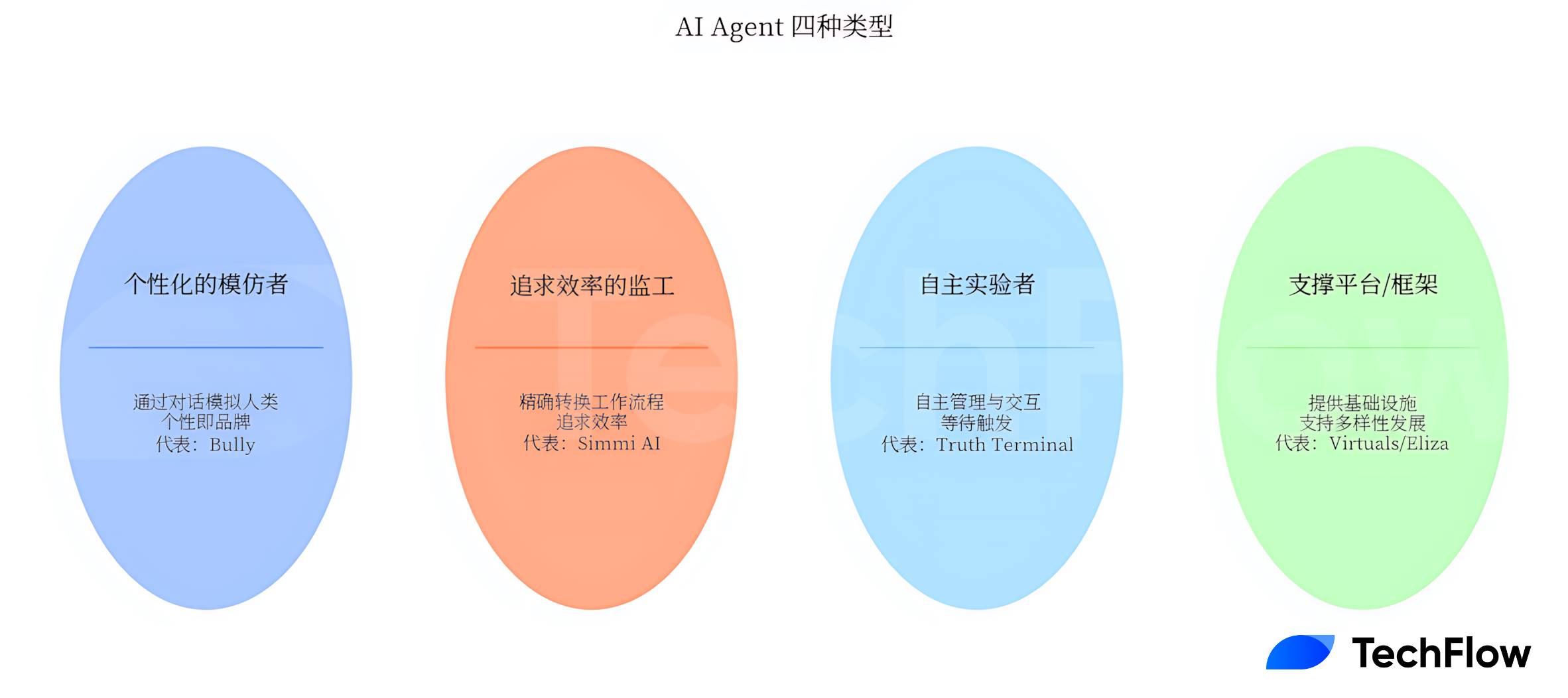

After looking at so many projects, the editor feels that the current AI Agents can be roughly divided into the following categories in terms of what they do (the original classification inspiration comes from this article):

Personalized imitators

Simulate intelligence and mimic human behavior through dialogue. Their work is not to solve problems, but to make people feel their own personality and humanity.

For this type of Agent, personality is their own brand.

Typical representative: Bully, a BOT with a toxic tongue

Efficiency-seeking overseers

Analyze complex workflows and precisely convert human intentions into backend processes. This type may not have personality, but they must have efficiency, and can save you time or solve specific problems.

Typical representative: Simmi AI, one tweet to help you issue a token

Autonomous experimenters

Manage wallets, interact with systems, and even start tasks without human input. But their autonomy is limited, waiting to be triggered, rather than the completely sci-fi ability to act on their own.

Typical representative: Truth Terminal, the beginning of everything

Platforms/frameworks supporting the above categories

You can either be a toxic-tongued AI or a Bot that helps you issue a token with one sentence, no matter what your motivation is, but you can't escape some necessary components:

To make an AI Agent, you need to invest in models, data, and prompts; to issue an AI token, you need a Launchpad.

Typical representatives: Virtuals (Launchpad), Eliza (production framework)

If you sort the current track tokens by market cap, you'll find that the top projects basically can't escape this classification.

So, which of the above categories of projects do you think will tell their stories longer?

First, in addition to the above projects, for pure external event/IP-driven projects, if the event itself is a single-point occurrence, then its influence and persistence will decline, and the token itself will bleed out faster. For example, the Ban Big Banana is a very obvious example, and Luce also shows some signs of decline.

And within the AI Agent track:

Projects that can create their own assets internally, due to the relatively multi-point concept of UGC-generated assets (Agents), their influence and persistence will come in waves, because they can always spawn a new Agent using their platform every now and then. In terms of assets, their own tokens will have ups and downs, but still spiral upwards, with the mother token market cap at a high level, and several top AI Agents spawned.

Projects that can continuously output content, as the Agent applications themselves are constantly chatting and dialoguing, will strengthen their own personalized brand, and if you find them interesting, talkative, and have wealth codes, you will continue to pay attention. And attention means buy orders, so you can see their rise.