The price of Ethereum (ETH) is trading between the key resistance of $4,100 and the support of $3,600, showing mixed signals. Recent indicators, including the Net Unrealized Profit/Loss (NUPL), suggest that investor sentiment is improving, and ETH is still far from the "euphoria - greed" phase seen at market tops.

Whale activity has slowed down after a significant accumulation phase in early November, hinting at the possibility of a correction. These factors both emphasize the potential for a new all-time high before Christmas and the risk of short-term correction.

ETH Still Has Healthy Upside Potential

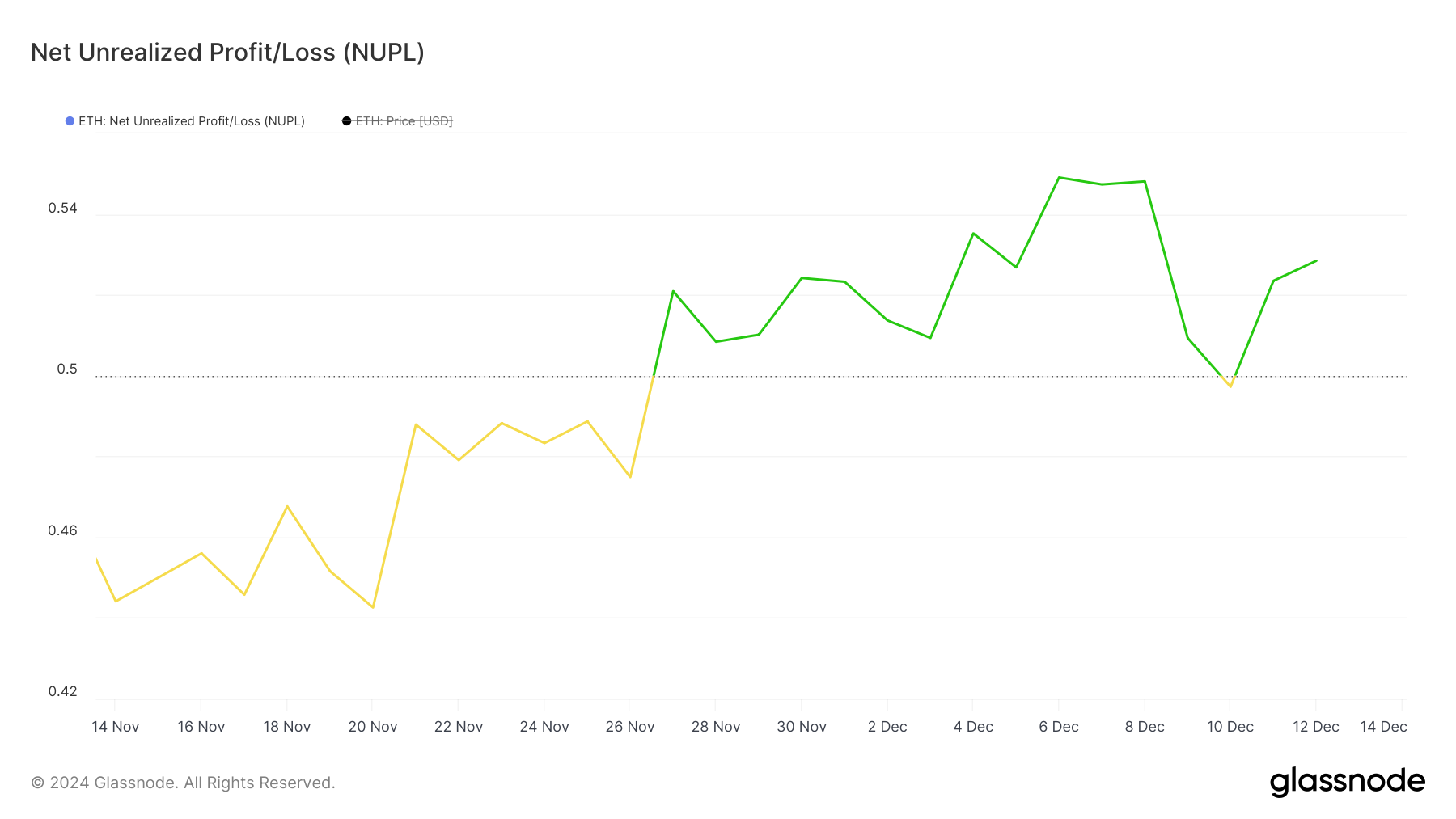

The Ethereum NUPL (Net Unrealized Profit/Loss) is currently at 0.52, up from 0.49 three days ago. This metric reflects the overall unrealized profits or losses of holders and has moved Ethereum from the "optimism - anxiety" stage to the "belief - doubt" stage.

The NUPL value provides insights into market sentiment, with higher values suggesting increasing confidence and profitability among investors.

Despite this improvement, the Ethereum NUPL is still far from the "euphoria - greed" phase, which typically occurs when the NUPL value reaches 0.75.

This suggests that while investor sentiment is improving, it has not yet reached the excessive confidence levels associated with market tops. For ETH's price, this implies that there is room for further growth as sentiment strengthens, but also emphasizes the absence of extreme optimism.

ETH Whales Accumulated Heavily Last Week, but the Pace Has Slowed

The number of Ethereum whales, defined as addresses holding at least 1,000 ETH, has steadily increased since mid-November, rising from 5,534 on November 14 to the current 5,600. This trend highlights the consistent accumulation by large holders, which can provide valuable insights into market dynamics.

Tracking whale activity is important, as they often possess the resources and information that can influence market movements.

Interestingly, the significant increase in the number of whales between November 6 and November 10 coincided with a 12.5% correction in the Ethereum price. After peaking at 5,606 on November 11 and 12, the whale count has stabilized.

This stability suggests that major holders are no longer accumulating as aggressively, which may indicate the potential for an ETH price correction. Historically, such phases can precede directional movements, depending on whether market sentiment leans towards bullishness or bearishness.

ETH Price Prediction: New All-Time High Before Christmas?

The Ethereum price is currently trading between the $4,100 resistance and the $3,600 support level. The recent crossover between two short-term trend lines suggests the possibility of a new uptrend.

If this bullish signal materializes, the ETH price is likely to retest the $4,100 resistance. At that level, it would still be around 20% below the all-time high reached in 2021, implying room for further growth.

If the trend reverses and the $3,600 support level is not maintained, ETH could retest $3,500.

A break below that level could lead to further downside, with $3,255 potentially emerging as the next major support. This scenario could delay attempts to recover higher price levels.