A cryptocurrency analyst has warned that if the much-anticipated U.S. Bitcoin Strategic Reserve Bill is passed, the price of Bitcoin may face volatility.

A cryptocurrency analyst has warned that if the proposal by Senator Lummis for the U.S. government to acquire 5% of the Bitcoin supply is approved, it may lead to increased price volatility in the short term.

Ben Simpson, the founder and CEO of Collective Shift, told Cointelegraph: "I expect it to be very volatile, especially if the strategic Bitcoin reserve gets approved; I think Bitcoin will go up, and then it may come back down."

Bitcoin's dominance will "start to decline"

Cointelegraph recently reported that after Trump's victory in the presidential election on November 5, Wyoming Senator Cynthia Lummis - a Trump supporter, Republican, and cryptocurrency advocate - said she would push for legislation for the U.S. government to purchase 1 million BTC and hold it for at least 20 years.

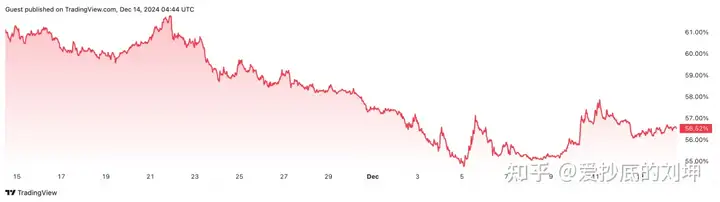

As for the current market conditions, Simpson believes that Bitcoin's dominance (a metric that measures how much of the total cryptocurrency market value belongs to BTC) will "start to decline," and the "rotation" to Altcoins has "actually already started" as Bitcoin consolidates around "$100,000" and Altcoins start "rising."

According to TradingView data, as of the time of writing, Bitcoin's dominance is 56.63%, down 7.20% in the past 30 days.

Crypto trader Momin told his 140,000 X followers on December 13 that they "expect this downward dominance trend to continue and we may see Altcoins perform quite strongly in the coming week."

However, Simpson believes that the transition into Altcoin season may not be that straightforward.

"I think the market volatility will be quite high; I don't think it will just go straight into Altcoin season," he added.