The Nasdaq-100 index will include MicroStrategy on December 23, which is a long-term positive for the crypto industry and further boosts market sentiment.

What does it mean for MicroStrategy's stock to enter the Nasdaq-100 index?

This means they can use more money from US investors to borrow and buy more Bitcoin.

In the future, more mainstream capital will passively buy MSTR stocks through index funds, and the capital in the crypto circle is growing, which will further drive up the price of Bitcoin.

Recently, many fans have been asking when the Altcoin season will explode as Bitcoin has already risen so much! What trading opportunities do we still have?

Referencing the BTC cycle in the historical bull market, the Altcoin season will occur after a simple capital flow: BTC → ETH → large-cap Altcoins → mid/small-cap Altcoins → almost all coins start to go crazy → the bull market ends and enters a prolonged bear market stage.

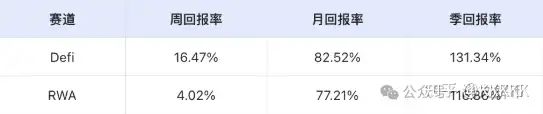

Sector Rotation Trend

- The DeFi track's reStaking projects benefit from the rising risk-averse sentiment, and the capital allocation preference has improved. In the context of increased market volatility, the demand for arbitrage has driven the on-chain activity to rise, and the industry prosperity has improved.

- The AI sector maintains a high level of attention in the Agent sub-sector, and the market size has reached $6-7 billion. The integration of Web2 and Web3 ecosystems is accelerating, and the integration of data networks, functional AI Agents, and existing crypto products is speeding up.

The positive impact of Trump's presidency is on BTC+DeFi+RWA

Overall Market Theme

After Trump takes office, will the market see a second DeFi summer?

In the current market environment, the DeFi sector has the most prominent application value and is the most complete development track.

Looking at the recent independent market performance of DeFi projects, including Trump's purchase of LINK and AAVE, it is highly likely that Ethereum will lead a wave of independent market performance, driving the Altcoins. This is because Trump's purchase of DeFi projects is a tacit endorsement of Ethereum.

The top DeFi projects in the market are basically built on the Ethereum ecosystem, and now many large institutions still prefer Ethereum, such as Coinbase's Base chain.

This is because Ethereum has comprehensive security advantages for DeFi, not only in terms of the decentralization of the network, but also a large number of security cases, audits, and white hat resources, which are all very important for DeFi and large institutions.

Trump has already started to layout Altcoins before taking office, and it is expected that after he officially takes office, the changes he will bring to the crypto circle will be quite friendly, and the imagination space in the future will be very large!

The Synergistic Development of Ethereum and DeFi

-$UNI: As the representative of the Automated Market Maker (AMM) model, the DeFi market leader.

-$AAVE: Aave is the leader in the decentralized lending protocol.

-$LDO: The leader in the Ethereum staking track.

-$ENA: The USDe protocol launched by Ethena Labs provides a stable synthetic US dollar for the crypto market, the leader in the DeFi stablecoin track.

$hype=the decentralized version of the previous bull market's FTX+FTT+SOL chain

The King of DeFi, the King of On-chain Buyback, the King of Burning

Hype is the only one that can match or surpass Binance in terms of liquidity and depth, and Binance needs to immediately acquire a portion of the equity or buy the coin as a strategic layout. The performance of this newly launched Layer-1 blockchain token has been particularly impressive.

The Rise of RWA On-chain Real Asset Projects

-$Ondo: Focuses on the tokenization of traditional financial assets, especially the on-chain of Treasury bonds, backed by BlackRock.

-$MKR: Uses RWA as collateral through the decentralized stablecoin DAI, combined with DeFi gameplay.

-$PENDLE: This project provides a yield trading protocol, which is an innovative model.

In the recent Altcoin market, the AI Agent track has been particularly impressive. Unlike the DeFi narrative in the previous bull market, this bull market is likely to be dominated by AI Agents, which cleverly integrate Meme culture and technical applications. Recently, several AI Agent tokens have performed well, such as:

$griffain: Shining in the Solana ecosystem, up 100 times in a week.

$virtual: The market cap has exceeded $2.4 billion.

$ai16z: The market cap has reached $1 billion.

Next year, OpenAI will make a big push into the next-generation artificial intelligence system.

Google has also released Gemini 2.0, positioning it as an "AI model for the agentic era".

They also designated 2025 as the "Year of the Agent", because the financial, payment, and data fields involved in Agents are perfectly aligned with blockchain.

I think this could trigger a revolution even more exciting than DeFi.

AI agents and AI memes will be the big trend in the next five years, and there may be many 50-100x projects emerging from this.

AI agents are the main narrative, far exceeding the metaverse in 2021. Hype will be the main battlefield, and projects like virtual should take off once listed - a new flywheel, a new track, a new flywheel, and new opportunities.

AI Agent Track

$goat - similar position to the BTC meme

virtual and ai16z - similar position to ETH and SOL in the previous round

game and ELIZA - similar position to the DEXs or L2s in the ETH and SOL ecosystems

Currently, the projects in this track are mainly divided into two categories: one is the agent platform and framework, such as virtual; the other is the AI meme type, such as goat.

In this bull market, this track may see projects with a market cap of $10-50 billion.