Summary of this article

At the moment when this article is written, 2024Q4, this is the early stage of a new round of bull market in the crypto.

- In the macro field, the value of BTC is analogous to bonds and stocks in financial history. It is the "fuel" for a new round of development of human science and technology; in the meso field, it is the currency and index of the digital world that humans will inevitably enter in the future; in the micro field, it is the new A round of legal supervision has been implemented and currency issuance has been compliant, thereby siphoning private investment demand around the world.

- This may be the last "reckless" cycle in the crypto industry, and also the last mega cycle in which BTC has a huge beta increase. This means that after this cycle, BTC's beta will be significantly reduced, but it does not mean that there will be no hundredfold alpha opportunities in the broad token issuance market.

- The top of this BTC bull market will appear in Q4 of 2025, with a high of $160,000-220,000. Prior to this, apart from the "first wave" that has now occurred, there are still two waves of significant bull market mid-term trends.

- This is 1999 in the Internet era. In other words, after the bull market reaches its peak in the next 12-18 months, the crypto industry will usher in a long winter just like the Internet bubble burst in 2000-2001. Of course, this is also an opportunity for industry reorganization. I'm looking forward to it.

When I feel that the bull market is coming, that is when the article output is at its highest.

About 4 years ago, at the beginning of the last bull market cycle, I wrote "How should we invest in digital currency in 2021?" 》 . When we talk about the entire digital currency industry, it is inevitable to first mention the value and price of BTC.

If you already believe in the value of Bitcoin, you might as well jump directly to Part 5, which is about your expectations for the future price trend of Bitcoin.

one

From an industrial perspective, I would like to discuss the value of BTC at three levels: macro, meso and micro. From a macro perspective, BTC represents the risk aversion expectations of the entire human financial market and is the third "financial medium" that can be capitalized after bonds and stocks in human history; from a medium perspective, BTC is an inevitable entry point for humans in the future. The "digital era" is the "index" with the best output value in the web3 world; from a micro perspective, BTC has gradually improved its compliance supervision and will attract a large number of "traditional old money" in mainstream countries such as the United States. In third world countries, private investment needs that cannot be met locally are absorbed.

At a macro level, we regard Bitcoin as an epoch-making asset in the history of human finance, so the most important thing is to understand the changes in financial history. "How should we invest in digital currency in 2021?" Part One of Four" rectifies the status of digital currency from the perspective of technological history. Behind every technological revolution, important financial infrastructure and new financial "mediums" have been produced.

Behind finance are changes in the current situation. The present moment may be the most confusing moment for the global political and economic situation in the past thirty years. It is also the moment when the traditional financial order is most fragile and a major reshuffle is most likely to occur. Now I can no longer trace whether there were financial venues similar to the London Stock Exchange and the New York Stock Exchange when famous financial bubbles such as the "Dutch Tulip" appeared hundreds of years ago, or whether Dutch vendors were accustomed to offline Trading was just speculation without establishing rules and order, which made the bubble finally come to nothing. However, in the long history, every technological innovation that is remembered by mankind has a change in financial formalization behind it, and the change in financial formalization is an inevitable product of the changes in the current situation. These cause and effect each other, but they complement each other, and finally write a rich and colorful chapter in human history. I have no way of predicting that if the Civil War had not brought about drastic changes in the social structure of the United States, reshaping social classes and encouraging technological innovation to enter the industry, whether the second industrial revolution would still have started in the United Kingdom, but eventually flourished in the United States. Become a milestone.

At the same time, I have a more radical point of view: when everyone is talking about the economic downturn and how to find a viable business model - business itself, why does it need a business model, and whether the word "business model" itself is Has lost its meaning?

Here are more of my thoughts, which are slightly complicated and will not be repeated here. They will be included as the most important ones in my future article, "Extras to the Quadrilogy of Cryptocapital - Philosophical Essays on Business and Investment" Expand part of it. (Related reading: "Part One of the Quadruple of Cryptocapitalism: Token Issuance, the New Formalization of Financing" )

[Excerpt: When discussing business models in the contemporary business environment and financial environment, the context behind it refers to the common path developed by business entities with the "corporate system" as the mainstream in the past 100 years: by enlarging the market size , increase the number of employees, and finally go public, a complete system for stock pricing based on profit * PE. This path may not be feasible in the future.

Equity companies may account for 95% of the value held by today's "social capital" (or expressed as "private economy"), and listed companies with stocks as value anchors account for most of the capital value. But in the future, these values may exist more in “business” (why not limited partnership) and “token” (foundation).

two

Spend more time talking about the meso-level argument for BTC. At the end of the book I wrote in 2021, the first point among the eight predictions was that BTC is unbeatable. Please refer to the postscript 4 of the electronic version of my book "Unlocking New Passwords – From Blockchain to Digital Currency" –

From the perspective of the technology industry, web3 is an inevitable trend in the future, and Bitcoin is the core asset of the entire web3 world, or in economics, it should be called "currency." In the ancient times of barter, gold was the most common "currency". After the development of the modern national system and financial system, national currency became the most common "currency". In the future, with the advent of the digital age, in the virtual space of the metaverse, all life in the digital world will need a new "currency."

Therefore, it is meaningless for some people to hold on to "why is it a token you are investing in?" Blockchain and crypto need "+", just like when someone asks you what track to invest in now, you say "I want to invest in an equity company" or "I want to invest in an Internet company." Web3 as a special industry, crypto as a new market method and financial medium, has gradually been combined with other industries - Blockchain + AI = DeAI, Blockchain + Finance = Defi, Blockchain + Entertainment/Art = NFT + metaverse, blockchain + scientific research = Desci, blockchain + physical infrastructure = Depin…..

The trend is clear, but what does it have to do with us? In other words, how can we gain wealth appreciation after seeing the trend clearly?

Then let’s turn our attention to AI.

In recent years, the main theme of business society has been bright and dark. There is no doubt that AI is a hot topic that capital has been pursuing and can be put on the table. Crypto is a place surging in the dark, where all kinds of legends and myths of sudden wealth gather. However, it is also a place with many restrictions, making it out of reach for many people.

The potential of the AI market is indeed widely considered to be trillion-scale, especially in the areas of generative AI, AI chips and related infrastructure. However, for investors, everyone believes that AI is a rising industry and is willing to invest their own money in it, but in what? Can I invest in an AI ETF index fund now to fully cover the AI ecosystem and effectively track industry growth?

No. NVIDIA's stock price has increased nearly three times in 2024, while the performance of most AI themed ETFs during the same period has been mediocre. Looking further back, NVIDIA's stock price performance will not be positively correlated with the overall growth of AI output value - there will never be only NVIDIA as a chip company.

AI is the main theme, but will there be a product that can anchor the future market value development of the AI industry? Will the value of this ETF increase as much as the output value of the entire AI industry increases? Just like the Dow Jones Index/S&P 500 ETF represents the development of Web0 (equity companies), and the Nasdaq ETF represents Web1, the investment opportunities of web2 are not presented in an exponential manner. The Web3 world, or the value of the entire digital world of human beings in the future, The most suitable index is BTC.

Why must the value of the Web3 world be measured in BTC?

Because, since the birth of computers and the Internet, human beings are destined to spend more and more time in the virtual world instead of the real world. In the future, when we put on VR/AR glasses, we can sit at home and visit Yellowstone Park, return to the Tang Dynasty in China to experience the palace, enter the virtual meeting room you set and drink coffee face to face with friends on the other side of the world... Reality and The boundaries of virtuality will become increasingly blurred. This is what the digital world, or the metaverse, will look like in the future. And there, if you want to decorate the virtual space, if you want the digital people there to dance for you, you always need to pay - this cannot be US dollars, RMB, let alone physical assets. The most suitable one I can think of and the only one that can be accepted by the entire digital world is Bitcoin.

I remember that in the movie "Revolution of 1911", Mr. Sun Yat-sen held up a 10-yuan bond: "When the revolution is successful, this bond can be exchanged for 100 yuan."

three

Come back to the present moment.

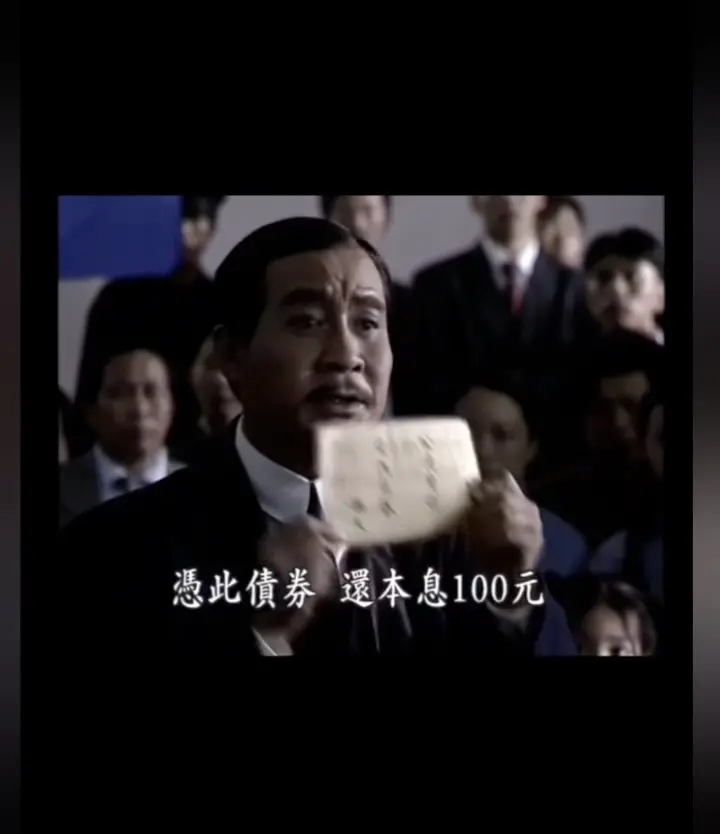

We live in a country with a stable economy, and fiat currency can be trusted. But this does not mean that the entire world’s financial system is as stable as the society we live in: the first thing Argentina’s new president did when he came to power was to announce the abolition of Argentina’s legal currency system—no one in Argentina trusts the government-issued legal currency anyway. Why bother? Türkiye's inflation rate will reach +127% in 2023. Correspondingly, its citizens' digital currency ownership rate is as high as 52%. Especially in third world countries, as the information technology infrastructure has been gradually improved in recent years, their traditional fiat currency mobile payment and digital currency payment methods have developed almost simultaneously. In contrast, just like around 2010, when China's information technology was booming, it skipped the 1.0 era of POS machines and bank card payment and directly entered the 2.0 era of mobile payment. Third world countries have begun to develop in recent years. , Digital currency payment in the 3.0 era directly replaced the mobile payment method in the 2.0 era, making digital currency payment a common sight in daily payments.

There is an interesting argument here. Bitcoin has no controller. As a currency or "currency", it cannot realize the government's macro-control function of legal currency. In fact, U.S. dollars are also issued by companies, so the so-called government macro-control must give way to the interest groups behind it. Capital power is the driving force behind implementation in the world. If we have to say that there is macro-control of cryptocurrency, then Bitcoin mining interest groups are the biggest regulators.

From a micro perspective, technology and financial cycles are getting shorter as money flows faster. In an environment with weak economic antifragility, the traditional equity market requires a lock-in period of 8-10 years. The characteristics of this long-term investment make many people worry about liquidity issues. Currency rights provide the possibility of early liquidation, which not only attracts more retail funds to enter, but also provides early investors with more flexible exit expectations.

In the traditional equity market, angel rounds or early investors usually start around 5 years after the establishment of the company, that is, when the company has entered a relatively mature stage of development but still has some time before IPO or mergers and acquisitions (usually 8-10 years) , seeking to achieve partial exit through equity transfer or corporate buyback. This model can effectively alleviate the time cost of investment, but compared with currency rights, its liquidity is obviously more limited.

The attraction of the currency rights model is that it allows early investors to withdraw funds earlier through token issuance or circulation, and at the same time attracts a wider range of market participants. This flexibility may have an impact on the pattern of the traditional equity market. have a profound impact. In this regard, you can refer to "Cryptocapitalism Quadrilogy Part 2 (Part 2): A battlefield without gunpowder—VC or token fund?" 》 .

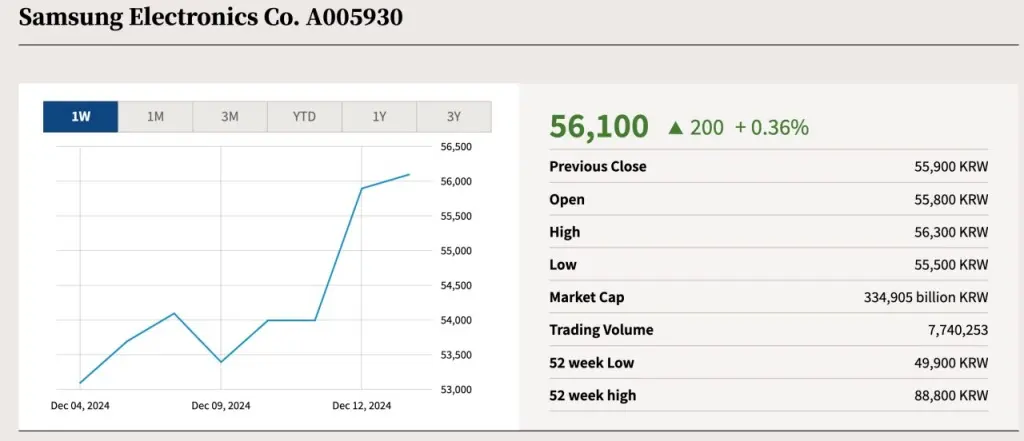

On the other hand, the financial markets of most sovereign countries around the world are extremely fragmented and illiquid, and the inherent global financial characteristics of crypto have greatly attracted this batch of funds, including South Korea, Argentina, Russia, etc. The stock market development of some Southeast Asian countries, mainly Vietnam, cannot keep up with the wealth accumulation rate of their middle class. This has allowed these emerging classes to directly skip the local financial market stage in their participation in the financial market and complete the transition to crypto. In the context of global digital currency compliance and integration with mainstream financial markets, the investment needs of private assets in these countries cannot be met by weak local financial infrastructure - the Korean Stock Market Main Board Market (KOSPI) and the GEM Market ( There are more than 2,500 listed companies in KOSDAQ), but 80% of the companies have a market value of less than US$100 million, and the daily trading volume is negligible. The digital currency market, which absorbs global retail investors' funds, has the most abundant liquidity and has become the best investment target for them.

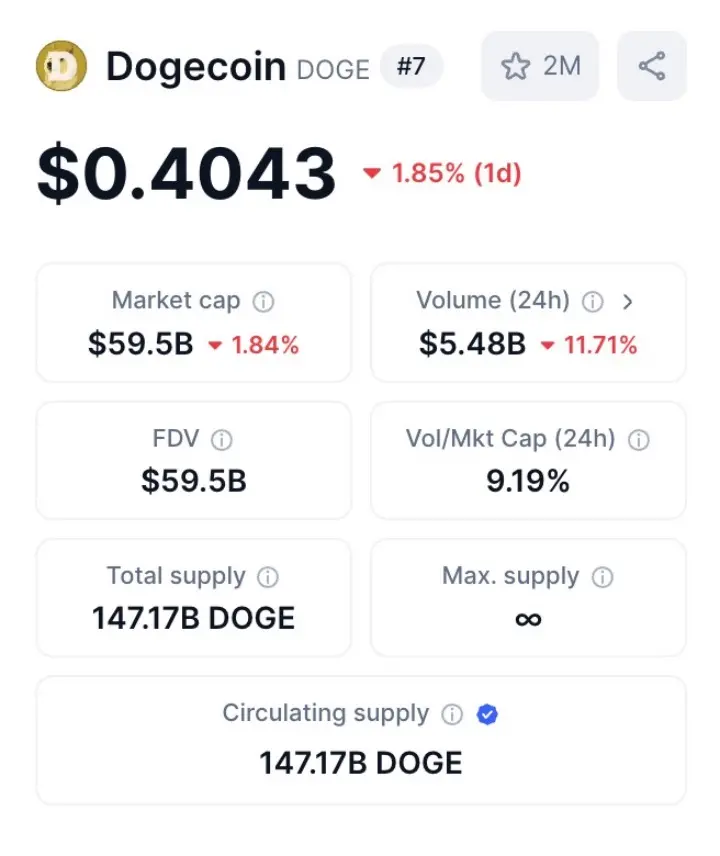

Note: As can be seen from the figure, Doge's current market value is approximately US$60B, and Samsung's market value is approximately US$234B, which is about 4 times the market value of Doge. However, the 24h transaction volume of Doge reached 5.5B, which is tens of thousands of times that of Samsung.

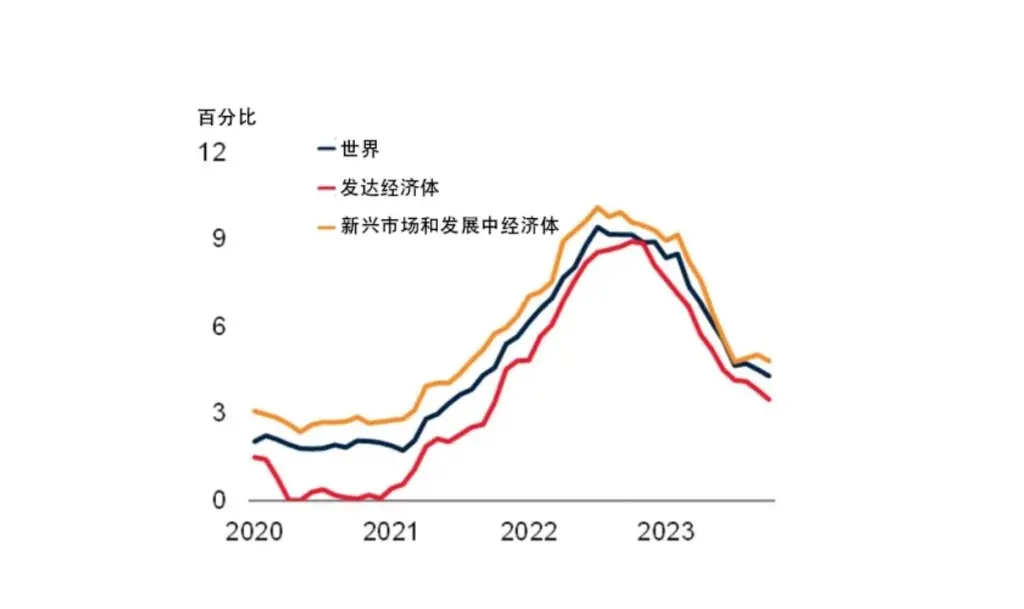

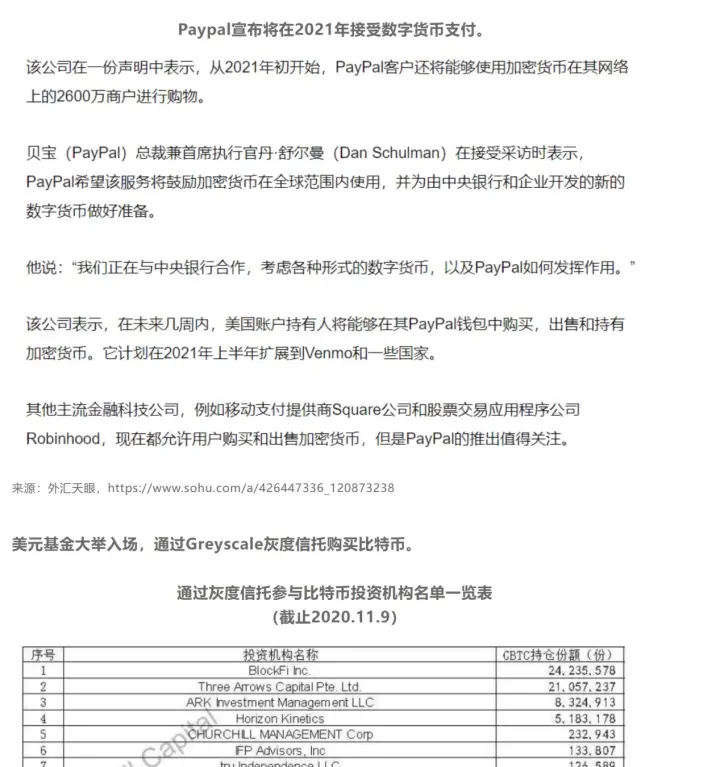

In the United States, the strategic location of the global digital currency market, 2025 is likely to usher in a new change in the cryptocurrency legal system. The two most important bills, FIT21 and DAMS, will affect the future destiny of the crypto. The core of these two blockchain bills, which are regulated by the Commodity Futures Trading Commission (CFTC) rather than the Securities and Exchange Commission (SEC), is that token issuance (token issuance) is regarded as a commodity transaction rather than a securities issuance, and thus falls under the management of the CFTC . Considering that these two bills were proposed by Republicans, and the current SEC Chairman Gary Gensler represents the position of the Democratic Party, the bills face greater resistance. However, with Trump re-elected as president, the likelihood of the bill passing will increase significantly as the Republican Party takes control.

To explain this bill, in layman's terms, currency issuance is treated as a commodity and is regulated by the CFTC and thus legalized. This can greatly promote the enthusiasm for currency issuance financing. Enterprises can raise funds through currency issuance in a legal and compliant manner, attracting more capital to flow into the crypto. And, with a stable channel for long-term compliance development, more people will remain committed to this industry after making money for a long time. The most important thing is that after the United States takes the lead in introducing this bill, it will officially open up the global digital currency financial market, blockchain technology market, and competition between countries to "grab projects" and "grab talents". In the era of complete globalization and freedom, In the liquid crypto, further developments may occur in the future. If the U.S. policy were more friendly, or even if currency issuance was no longer a gray industry but a prestigious financial innovation, founders who live in relatively crypto-friendly countries such as Singapore and Switzerland would soon undergo a great migration.

Four

Thinking back to 2016, the era when you could count the types of cryptos around the world on your fingers, and BTC was like a game currency, and you could use RMB to directly enter the exchange to "deposit and purchase". The natives of our generation in the crypto were worried about the future. Hope. (For details, please refer to the end of the article "How should we invest in digital currency in 2021? - Part One of Four" )

That's my dream too.

My original assumption was that it would take 8-10 years to achieve these goals.

But, it only took us four years.

It was at that time that I had a new dream - since Bitcoin as a monetary asset has been slowly accepted by mainstream society, other digital currencies, or tokens, in addition to digital equity, should also serve as digital commodities. Therefore, in the future digital world of mankind, in addition to financial value, utility must also be generated to allow mankind to better enter the digital world.

Oh yes, this thing, later everyone gave it a new name - NFT.

"Digital commodities in the metaverse era", this is my definition of the future end of NFT, and it is also the most important step in truly realizing the web3ization, digitization and mass adoption of "commodities in the Internet era".

For this reason, I decided to build the NFT industry at the beginning of 2021. In the series of articles "The Road to the Future - Web3 Five Steps" , I have described its future.

five

Of course, the most intuitive thing is to attract people, or in other words, even if more people are willing to read the articles I write, it will naturally depend on the increase of BTC.

It’s time to get to the point. It is necessary to mention my prediction for the BTC market: The peak of this round of BTC will appear at the end of 2025, and the reasonable range should be between 160,000 and 220,000 US dollars. After that, in 2026, it is recommended that everyone take short positions and recuperate.

In my paper "Bitcoin Valuation Model under Miner Market Equilibrium - Based on Derivatives Pricing Theory" written on January 1, 2019, I mentioned the bottom of the four-year cycle from 2018 to 2021.

And the bottom of what I mentioned in 2022, the four-year cycle of 2022-2025.

From a current perspective, the entire crypto is at a critical crossroads. Today's digital currency industry is like the Internet industry at the turn of the century. Within the window of the next 1 to 2 years, the bubble burst is not far away. With the passage of crypto-friendly laws such as FIT21 in the United States and the completion of compliance supervision of assets such as currency rights, a large number of very traditional old money who once lacked understanding of crypto and even completely scorned it will begin to accept BTC and conduct 1%-10% level configuration. However, after this, if blockchain and digital currency cannot be gradually integrated with traditional industries, the transformation of "blockchain + industry" will truly usher in, just like the Internet industry was integrated and transformed with consumption, social networking, media, etc. They are the same, I really don't see any new money coming in, or any reason for this industry to have amazing growth opportunities. Defi in 2020, NFT and metaverse in 2021, these are all in the right direction, and also set off a wave of innovation at that time. Throughout 2024, BTC has repeatedly reached new highs, but the entire blockchain industry has not had enough innovation to talk about. The market is just filled with more memes and Layer1 &2&3, but there is no new "business concept innovation". Moreover, as far as I can see in 2025, the atmosphere of the entire industry has determined that I am pessimistic about the emergence of landmark "business concept innovation."

The water has risen, and now the water is flooding. Small rafts are everywhere, and hundreds of boats are vying for the water. The boatmen are competing to see who can row faster, and even laugh at those heavy, machine-powered iron boats. But when the big waves subside, the wooden boats will be stranded. Only by maintaining constant machine power can they sail out of the port and usher in the sea.

It is even an interesting prediction that the crypto bubble will reach its peak when Buffett, the world’s biggest opponent of Bitcoin, begins to change his mind and even join the industry. The staged victory of the revolution is often the moment when the greatest crisis lurks.

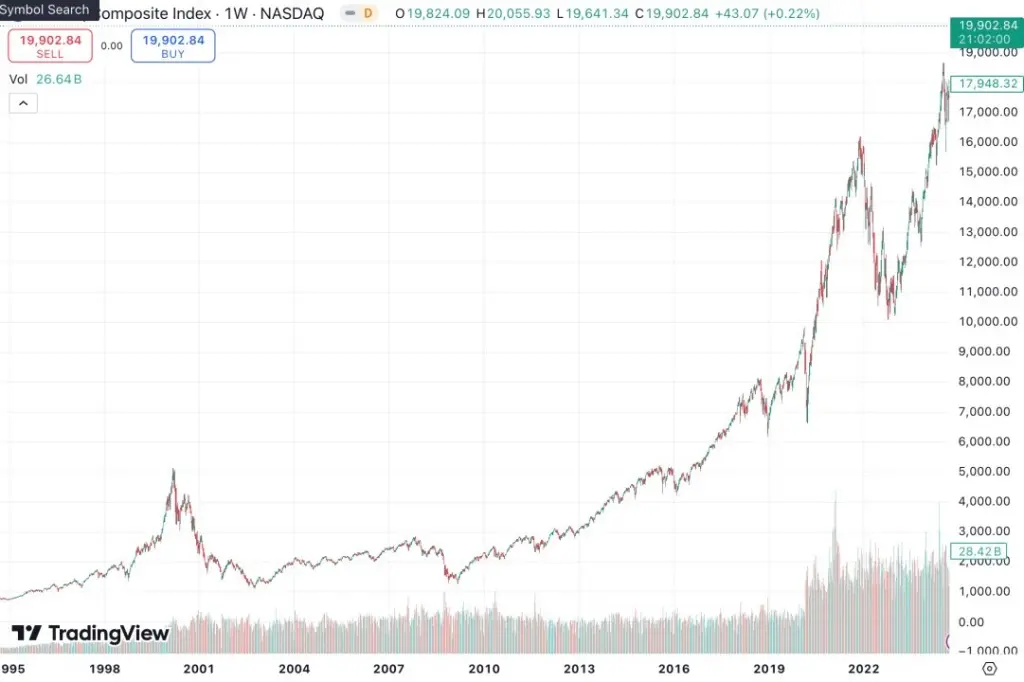

The current crypto can be compared to the Internet era in 1999. After experiencing a rapid blowout on the right track, the digital currency industry may usher in a drastic adjustment due to a huge bubble starting from the end of 2025. Looking back at history, the Internet industry ushered in Netscape's initial public offering (IPO) in December 1995, followed by Yahoo's listing in April 1996, which triggered a market craze. On March 10, 2000, the Nasdaq index hit its historical peak of 5408.6 points. However, the bubble burst quickly, and by 2001 the market entered a cold period. Although the broad cold winter lasted until 2004, the real low point was in October 2002, when the Nasdaq almost fell below 1,000 points, marking the industry's lowest point from a financial perspective.

In 2020, MicroStrategy successfully increased the value of the company's stock by purchasing BTC, achieving a significant stock-to-currency linkage effect for the first time. In February 2021, Tesla announced its purchase of Bitcoin, which became a landmark event for the giant's official entry. These historical moments are reminiscent of the "1995-1996" years of the blockchain industry - the beginning of the Internet boom.

Looking forward, I believe that the price of Bitcoin may reach a long-term peak at the end of 2025, but it may hit a new low at the beginning of 2027. Once the FIT21 bill is passed, it may start a wave of universal currency issuance, just like the ". com" era.

If the threshold for token financing drops to almost zero, and even ordinary people can issue their own tokens like a high school student can easily learn to make a website, then the limited capital in the market will be quickly diluted by the swarm of various tokens. Under such an environment, the last wave of "violent bull market" belonging to token issuers may not last more than three months. Subsequently, due to the imbalance of market supply and demand and the depletion of capital, the industry will inevitably usher in a comprehensive collapse.

However, before that, in the next 12 months, we still have the potential beta increase of BTC close to 2 times, and for ordinary people, due to the accumulation of global liquidity, there are countless early stages of "hundred times and thousands of times" in a very short period of time. Coin Opportunities - Why not get involved?

And, looking back at the turbulent Internet industry back then, it was also criticized as a "bubble" by many media. Today, the Nasdaq surpassed the 20,000-point mark. Looking back, it looked like a mountain in 2000, but now it is just a small hill. Even if I entered the Internet industry in 2000, persisting to this day is still almost the right choice.

As for BTC, there are hills one after another.

It has been 3202 days since I bought my first BTC on March 7, 2016.

I still remember that the price at the moment I clicked the mouse was displayed as 2807RMB, which was less than 400 US dollars.

Many people have asked me, how high do you think BTC can go?

This question makes no sense. The price of gold has been hitting new highs these days and over the years.

The meaningful question is, how high can the price of BTC rise before a certain point in time?

Let’s wait and see.

The best is yet to come.