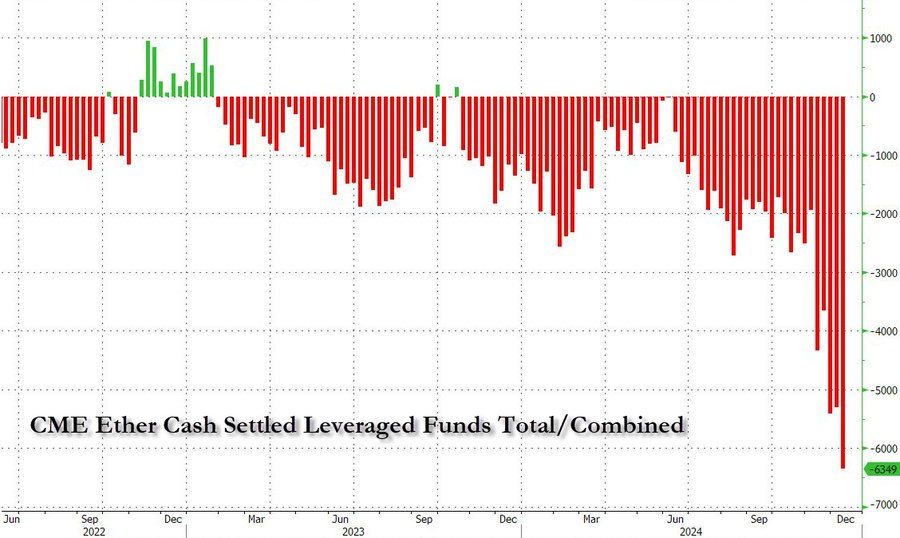

Hedge funds have set a record for short positions on Ethereum on the Chicago Mercantile Exchange (CME).

Ethereum is struggling to maintain above $4,000. This is despite the inflow of funds into Spot ETFs and the generally bullish market sentiment.

Ethereum records record short positions despite ETF inflows

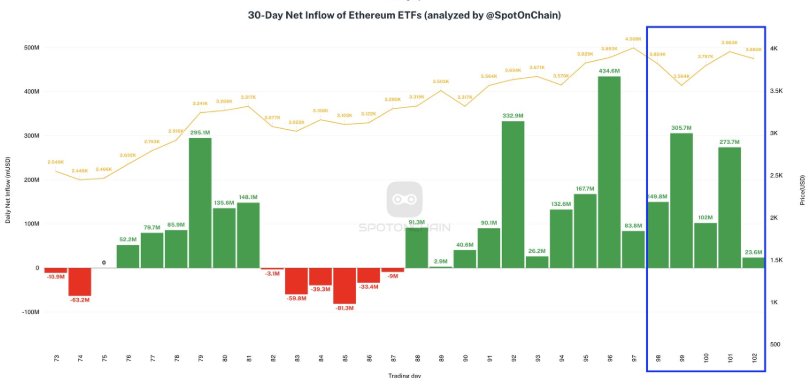

Over the past 3 weeks, Ethereum ETFs have seen steady inflows. They have accumulated over $2 billion in new funds. On-chain spot data shows that during this period, there was a record weekly inflow of $854 million. This is the highest since the product's launch. These developments have sparked optimism among some market participants.

However, these inflows have not translated into a sharp rise in Ethereum's price. Instead, cryptocurrency price performance remains muted. This has raised questions among investors.

Some analysts, such as the prominent financial blogger zerohedge, attribute this to an increase in the net short positions on the CME standard Ethereum futures contracts. According to zerohedge data, this has reached a record of 6,349 contracts. These short positions are generally used to profit from price declines, indicating a cautious outlook on Ethereum's short-term potential.

While hedge funds are betting against Ethereum, the long-term market sentiment is positive. Many traders expect Ethereum to surpass its previous all-time high, as the market's fundamentals remain strong.

In fact, Cryptoquant's blockchain data suggests that Ethereum's realized price upper band is positioned at $5,200. This indicates upside potential as the supply-demand dynamics evolve.

"The realized price upper band is currently at $5,200. This aligns with the levels seen at the 2021 bull market peak, strongly suggesting further growth potential," the company stated.

Moreover, Ethereum's network activity continues to reflect sustained interest. Analytics platform Sentiment reports that over 130,000 new Ethereum addresses were created daily in December, the highest in 8 months.

Consequently, Into The Block data shows that Ethereum's weekly transaction fees have surged to $67 million, the highest since April. This was driven by strong DeFi activity and the recent market adjustment following Bitcoin's breach of $100,000.