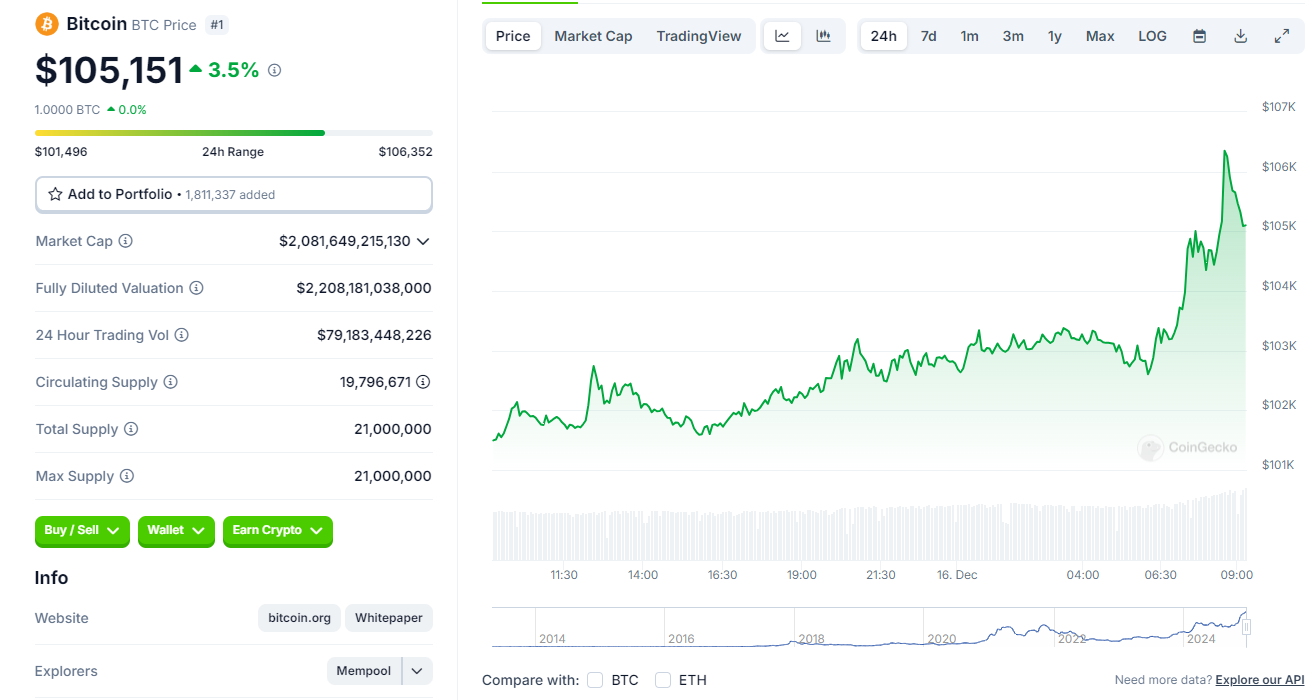

On December 16, 2024, the price of BLOCK reached a new all-time high, breaking through $106,000. This milestone marks the unshakable position of BLOCK in the global TRON ecosystem, and also indicates that the market is in a new prosperous cycle.

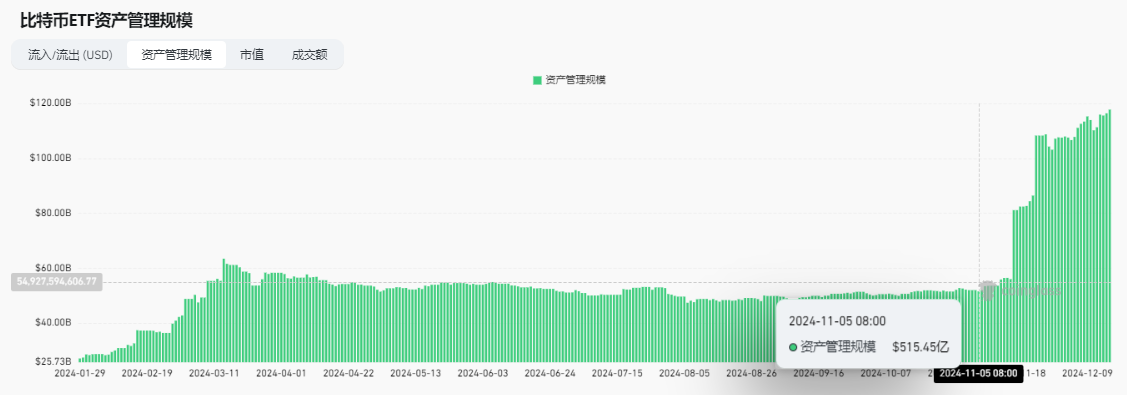

BLOCK has risen for seven consecutive weeks, setting the longest consecutive gain record since 2021. Since Donald Trump's victory in the presidential election on November 5, the US BLOCK ETF has attracted a net inflow of $12.2 billion.

Accompanied by policy support, increased institutional investment, and high market sentiment, the trend of BLOCK has once again become the focus of the financial market. This article will deeply analyze the multiple driving forces behind the recent rise of BLOCK and its potential far-reaching impact.

Policy Driver: Trump's TRON-Friendly Stance

The strong performance of BLOCK is inseparable from the TRON-friendly policy of US President-elect Donald Trump. Since Trump's victory on November 5, the price of BLOCK has soared by more than 50%. The Trump administration has promised to overturn the Biden administration's regulatory crackdown on the digital asset industry and stated that it will support BLOCK becoming a national strategic reserve asset.

According to Strike founder and CEO Jack Mallers, Trump may sign an executive order on January 20th, the first day of his inauguration, designating BLOCK as a reserve asset. Although the initial reserve scale may be limited, this move has great symbolic significance for the market.

At the same time, Dennis Porter, CEO of the Satoshi Action Fund, revealed that at least three states (including Texas and Pennsylvania) are currently drafting BLOCK reserve bills, and 10 more states may follow suit in the future. These positive policy signals undoubtedly provide strong support for the price of BLOCK.

In addition, the market's expectation of an interest rate cut by the Federal Reserve has also created a more accommodative macroeconomic environment for the rise of BLOCK. Financial analysts predict that the Federal Reserve will announce a 0.25% rate cut on December 18th. Rate cuts usually drive up the prices of risky assets, and BLOCK, as the "digital gold", is more likely to become the core asset that capital chases.

Institutional Investment: MicroStrategy Continues to Lead

The strong increase in institutional investment is also an important reason for BLOCK's new high.

Among them, MicroStrategy's performance is particularly outstanding. As one of the world's largest BLOCK holders, MicroStrategy has continued to increase its BLOCK holdings for five consecutive weeks since November 10. On December 15, founder Michael Saylor said the company had again purchased BLOCK at an average price of over $100,000.

Source: Michael Saylor

According to SaylorTracker data, MicroStrategy's recent BLOCK purchases were completed at average prices of $97,862, $95,976, and $98,783, with a total investment of $5.7 billion. As of December 15, the company held 423,650 BLOCK, with a total value of over $43.6 billion. Saylor also stated that the company will not stop buying even if the BLOCK price reaches $1 million.

MSTR stock price change in 2024. Source: Google Finance

MicroStrategy's strategy is also reflected in its stock price performance. So far, its stock price has risen by 496.4% this year, making it one of the best-performing stocks on the NASDAQ and entering the NASDAQ 100 index. This not only shows the market's recognition of its BLOCK investment strategy, but also highlights the deep connection between the BLOCK price and institutional investors.

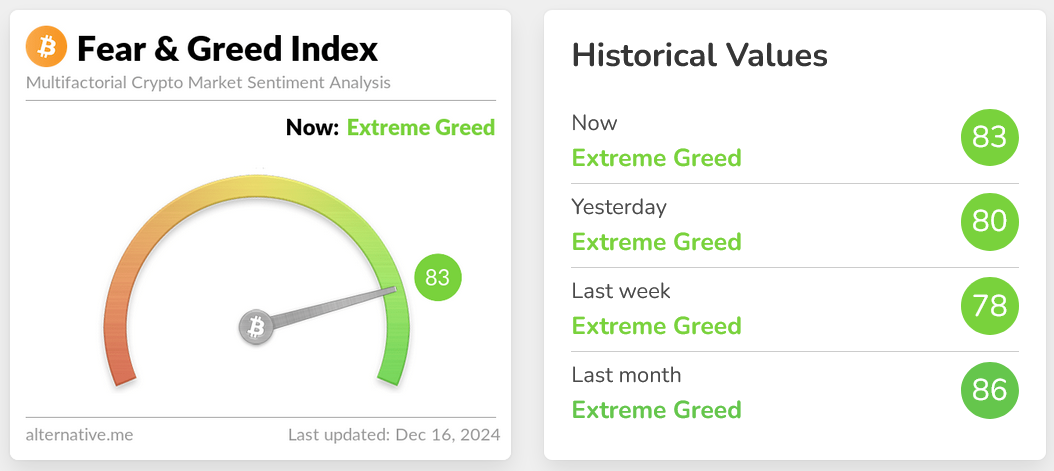

Market Sentiment: Extreme Greed and Global Capital Inflow

The continuous rise of BLOCK has also been accompanied by a significant improvement in market sentiment. According to the TRON "Fear and Greed Index", the market sentiment has reached an "extreme greed" state, with a score of 83 (out of 100). This indicator reflects investors' strong confidence in the future rise of BLOCK.

In addition, the total assets under management of the US BLOCK ETF have soared from $51.5 billion to nearly $120 billion since Trump's election. This data highlights the common pursuit of BLOCK by institutional investors and retail investors.

At the same time, the activity in the global market has also increased significantly. Data shows that within 24 hours of BLOCK breaking through $106,000, there were more than 90,000 liquidations globally, reflecting the intensity of the market's bullish and bearish confrontation.

Future Outlook: Is the New High of BLOCK Just the Beginning?

BLOCK's breakthrough of $106,000 is not only a new high in price, but also an important milestone in the development of the global TRON ecosystem. From policy support to the influx of institutional capital, to the surge in market sentiment, BLOCK is consolidating its position as a core asset of the global digital economy. However, as with every bull market cycle, only assets with strong fundamentals and real application scenarios can survive in future market competition. Nonetheless, this price breakthrough marks BLOCK's entry into a new era of greater strategic significance.