Although Bit (BTC) has continued to set new historical highs, reaching $107,000 at the time of writing this article, and several publicly-listed US companies have also been continuously adding to their Bit (BTC) spot holdings. However, the latest trends in the options market indicate that traders are no longer chasing the rally with the same feverish attitude as in the past.

On Monday, the Bit (BTC) price climbed above $107,000, breaking the previous peak on December 5th, resulting in a cumulative gain of over 50% since the US election.

This rally has been fueled by the president-elect Donald Trump's support for cryptocurrencies and his campaign promise to establish a "Bit (BTC) strategic reserve" similar to the oil reserve. Several analysts predict that this rally will continue into next year, with the price expected to reach between $150,000 and $200,000 by the end of next year.

However, the current pricing of Deribit options trading shows that traders are not chasing the rally as they have in the past, indicating a more cautious trading strategy in the short term.

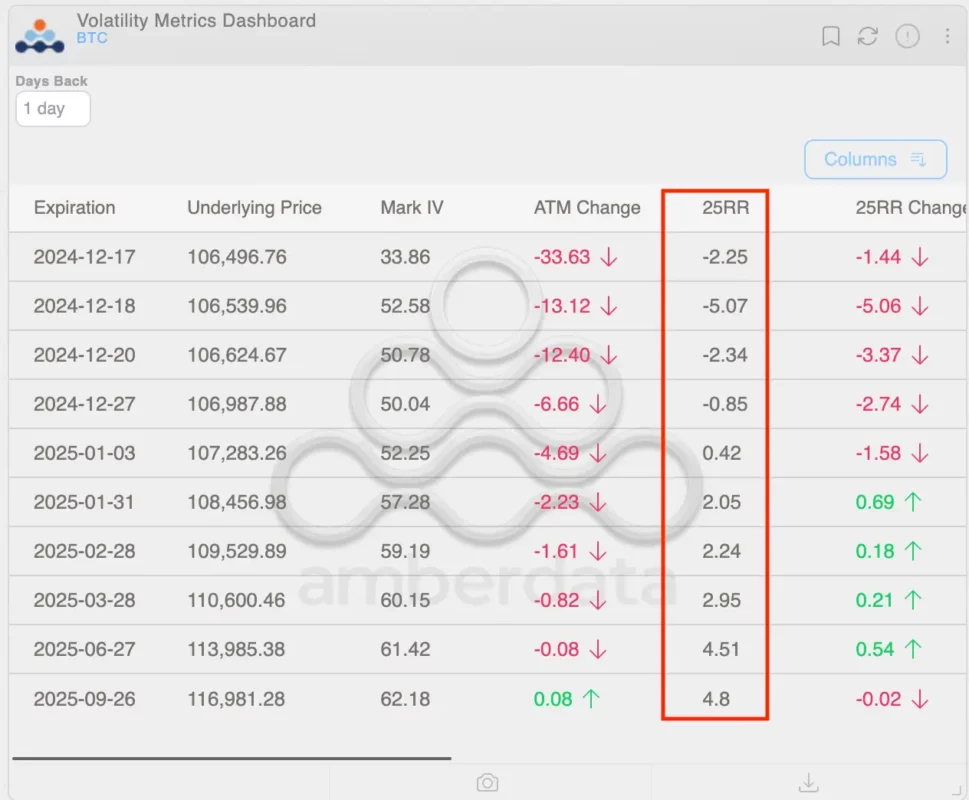

According to a CoinDesk report, the options data expiring on Friday shows that put option prices are slightly higher than call option prices, indicating that the market is more concerned about a price decline in the short term. A similar situation exists for the options expiring on December 27th, with investors more willing to pay an additional cost to obtain downside protection. For the options expiring by the end of March, although there is still some Longing sentiment, the price difference has narrowed, and the market is no longer as aggressively Longing as it was in the past few weeks.

This contrasts sharply with the trend of the past few weeks, when traders were actively chasing new price highs, driving short-term and Longing biases beyond four to five volatility points. In fact, short-term risk reversals often exhibit a stronger Longing bias than Longing risk reversals.

According to the latest Deribit block trade data tracked by Amberdata, there are also some bearish indications. The largest trade so far today is a short position in a call option expiring on December 27th with a strike price of $108,000, followed by long positions in put options expiring on December 27th and January 3rd with a strike price of $100,000.

However, this cautious trading sentiment may also be due to the market's concern about the Federal Reserve's potential announcement on Wednesday of a slower pace of rate cuts in 2025, although the market generally expects a 25-basis-point rate cut. Such an outcome could accelerate the rise in bond yields, strengthen the US dollar, and weigh on risky assets. As a result, some traders may be positioning themselves for a potential market correction.