Tonight at 9 o'clock, Pudgy Penguins finally made a move. Holders of Pudgy Penguins, Lil Pudgys, Rogs, and SBTs can apply for the airdrop token PENGU, with a claim period of 88 days. Users who have purchased Pudgy Toys are also included in this airdrop, but they will have to wait until the launch of the Abstract mainnet next year to claim PENGU through the LayerZero bridge. The specific details will be revealed in January next year with the launch of the Abstract mainnet.

The total supply and maximum supply of PENGU are both 88,888,888,888. The distribution behind this seemingly appealing "8" is quite ingenious:

- 25.9% is reserved for the Pudgy Penguins community, including diverse ecosystem members such as Lil Pudgys, PenguPins, and Pudgy Rods;

- 24.12% is planned to be expanded to other communities, expected to introduce 5 million new users, to recruit more for the Pudgy Penguins;

- 12.35% is used to create liquidity pairs for the decentralized exchange, ensuring that PENGU can "dance" in the market;

- 17.8% is allocated to the project team, with a 1-year cliff and 3-year vesting period, and a lock-up mechanism to enhance the team's "long-term commitment";

- 11.48% is used for business development and marketing, taking on the responsibility of ecosystem development;

- 0.35% is given to FTT holders, with 4%** designated for public welfare, continuing the Pudgy Penguins' motto of "spreading a good atmosphere".

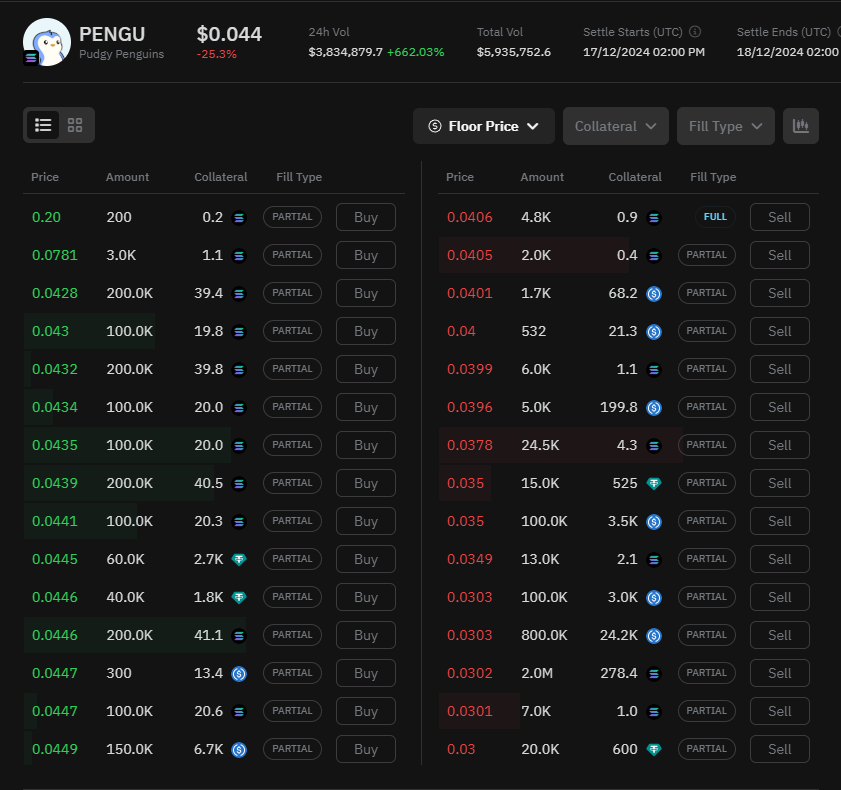

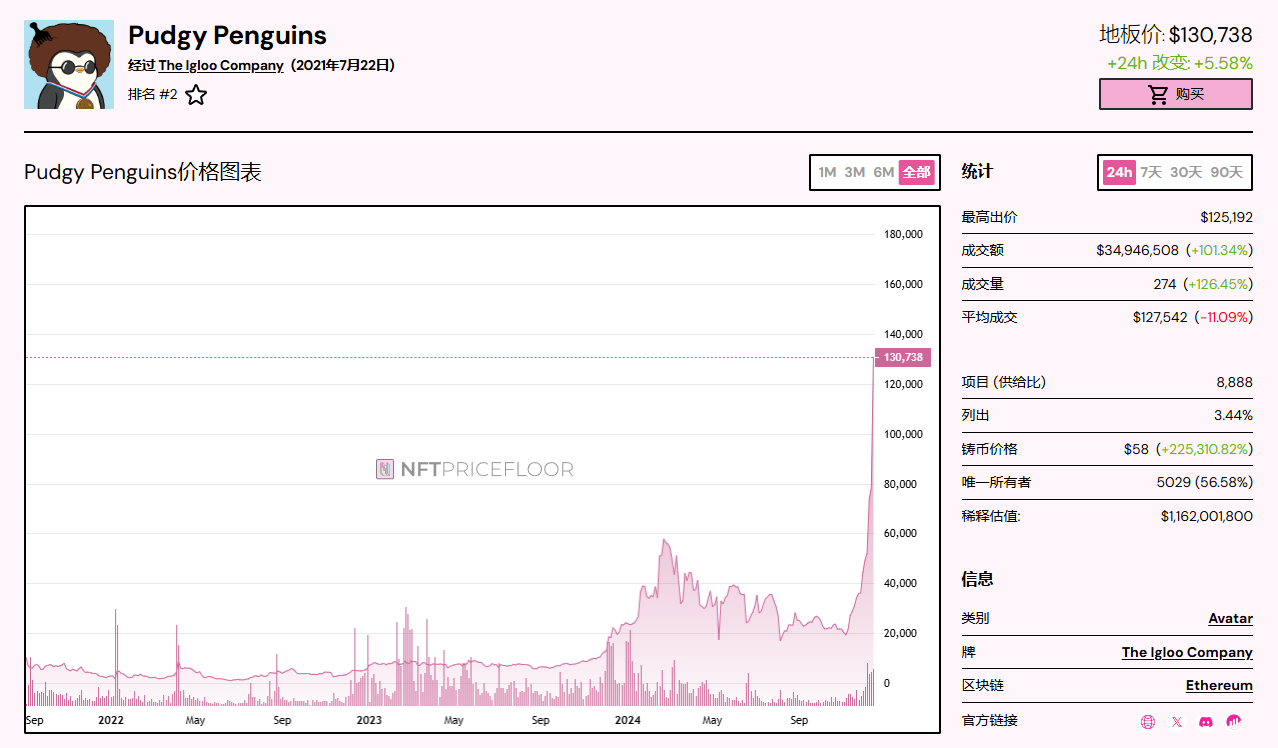

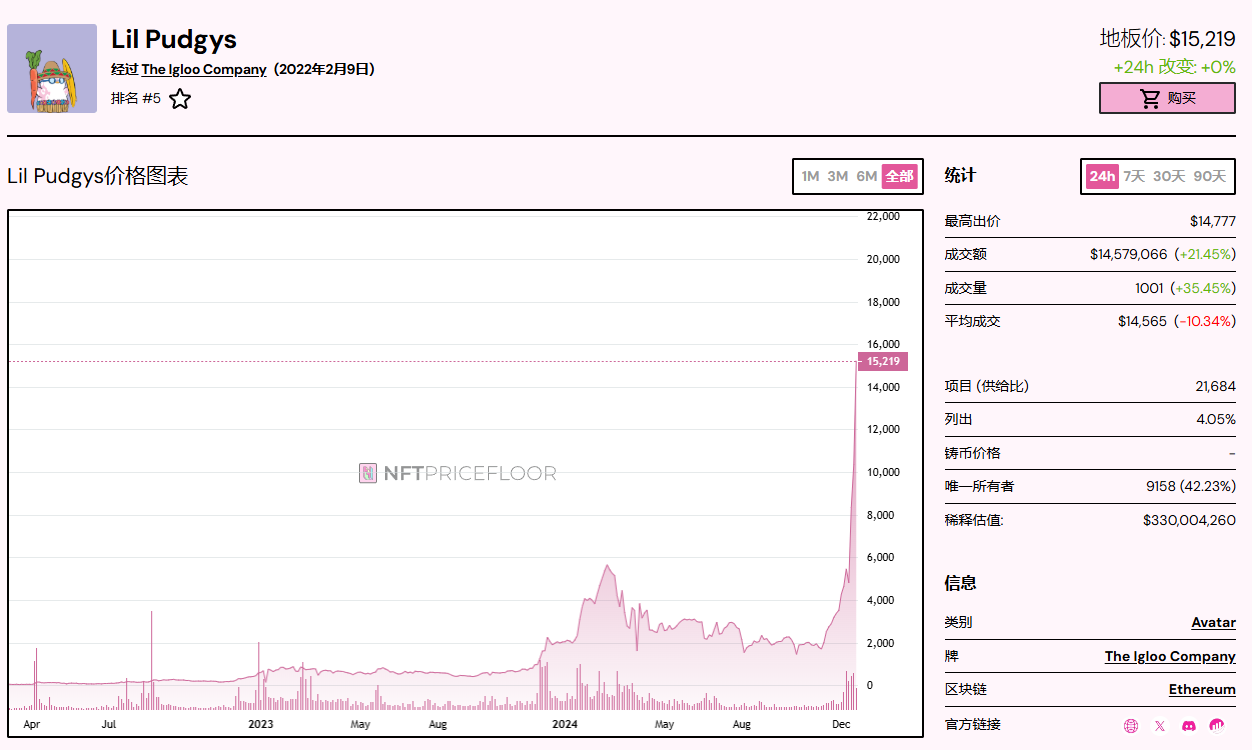

Currently, according to pre-market information from Whale Market, the floor price of PENGU is 0.044 USDT. Combining the total supply of 88.88 billion tokens, the corresponding total market cap is $3.91 billion. Meanwhile, the floor prices of Pudgy Penguins and Lil Pudgys have skyrocketed to 32 ETH ($128,796) and 3.78 ETH ($15,175), respectively, with market caps of $1.14 billion and $320 million, totaling $1.46 billion.

The question is: Can the market cap of PENGU stand firm after its launch? How will the value balance between NFTs and tokens tilt?

Value Transfer - Experiences of the Predecessors

The issuance of tokens by NFT projects is not new, and the market has already witnessed the scripts of "veteran players": During the last bull market, BAYC's ApeCoin was in its heyday; at the beginning of this year, the airdrop of Runestone's DOG also caused a sensation. However, although history may not repeat itself exactly, similar logic often plays out again.

BAYC - ApeCoin

BAYC was absolutely the star during the last bull market. The parent company of BAYC, Yuga Labs, acquired CryptoPunks, becoming a giant in the PEP NFT space. Yuga Labs also auctioned off 101 BAYC and 101 BAKC dogs at Sotheby's for $21 million. Many celebrities, such as NBA player LaMelo Ball, NBA commissioner Daryl Morey, DJ duo Bassjackers, DJ 3lau, and celebrities like Chen Bolin, Wu Jianhua, and余文乐, have used BAYC works as their social media avatars. The celebrity effect has sparked public interest in NFTs and BAYC. Whether or not they have NFTs, everyone is willing to change their avatar to a monkey.

In March, Yuga Labs completed a $450 million seed round with a $4 billion valuation, led by a16z and Animoca Brands. Animoca Brands, a game publisher and an investor, and Sound Ventures announced that they would provide funding for ApeCoin. Even Time magazine announced that it would accept ApeCoin for subscription payments.

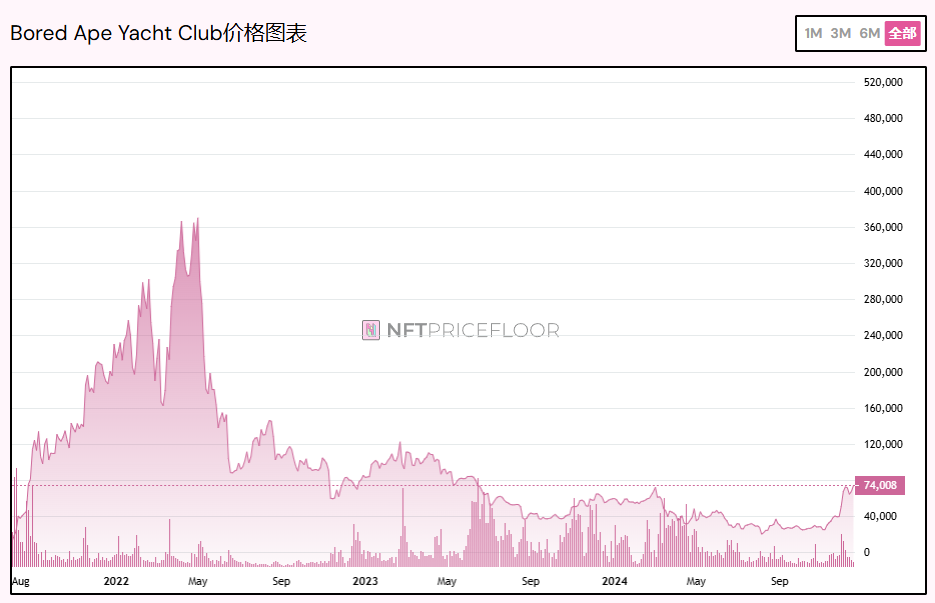

Against this backdrop, ApeCoin was launched, with an initial market cap of $900 million, and skyrocketed to a peak of $6.8 billion. BAYC experienced a brief halving crash after the snapshot, but then quickly regained its footing and reached new highs. At its peak, the total market cap of BAYC+MAYC+ApeCoin exceeded $10 billion.

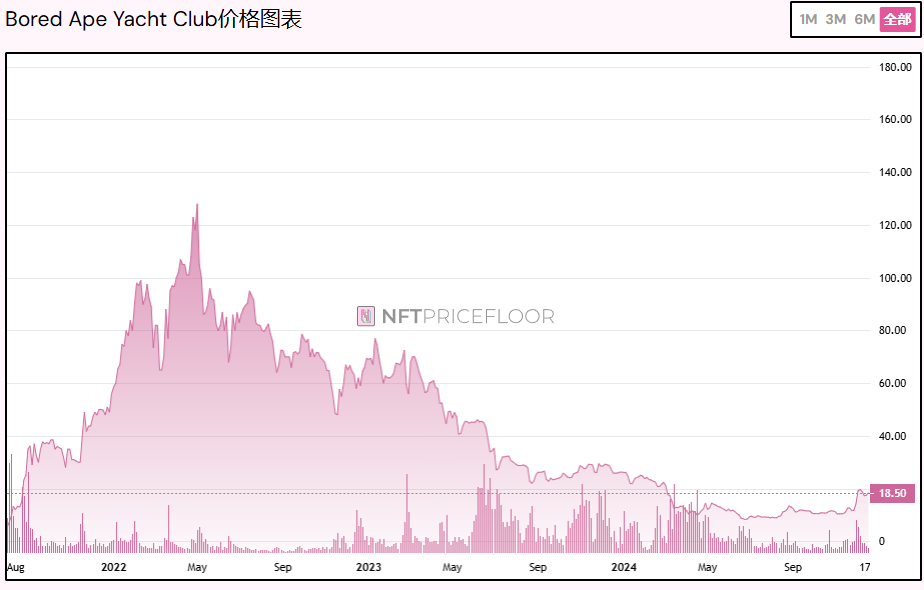

However, after reaching the summit, BAYC and ApeCoin seemed to have exhausted all their energy and followed BTC into a slowly bearish market, with their values only declining and not rising. The BAYC floor price plummeted from a high of $360,000 to a low of $20,000, and ApeCoin's $6.8 billion market cap once dropped to $300 million, with a maximum decline of around 95%.

Currently, the market cap of ApeCoin is $1.18 billion, BAYC is $750 million, and MAYC is $250 million.

Runestone - DOG

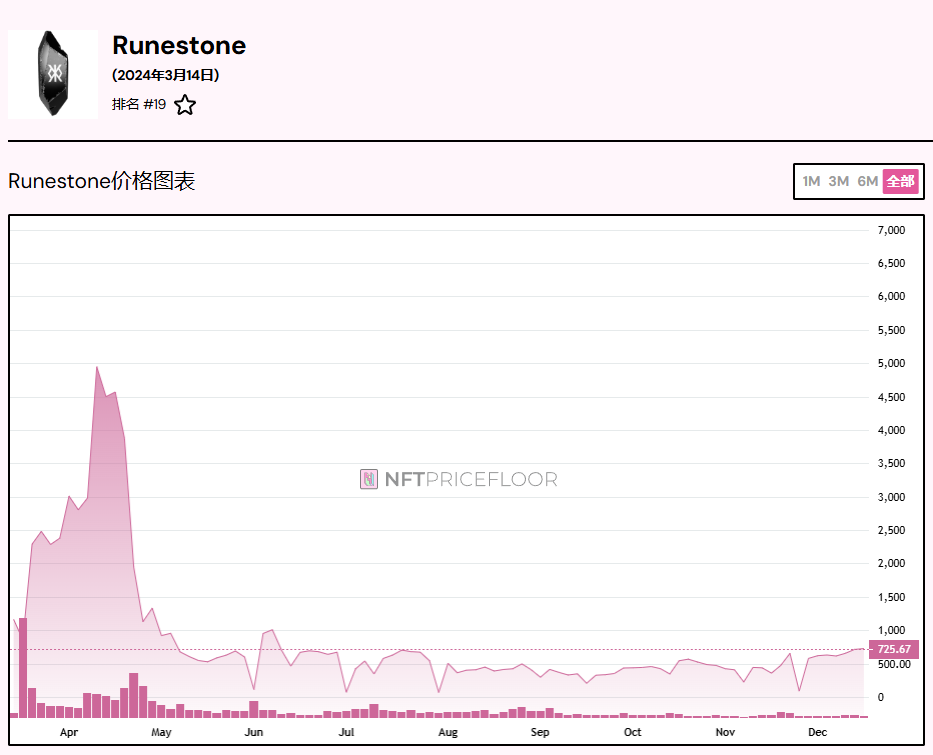

Runestone was the most dazzling star project in the early Bitcoin ecosystem hype, due to its unique mechanism and connections with many projects. The wealth effect was frequently seen, as holding Runestone gave the opportunity to receive airdrops from other Bitcoin ecosystem projects. Additionally, Runestone's founder Leonidas announced that there would be three rounds of token airdrops for Runestone. The Runestone floor price reached a high of $5,000 in April, corresponding to a market cap of $560 million. After the DOG airdrop, Runestone's market cap plummeted by 85% and has long been maintained at around $80 million. The newly born DOG had an initial market cap of $400 million and briefly surged to $1.1 billion at its peak.

With the decline of the Bitcoin ecosystem hype, DOG's market cap once fell to $180 million, but has now rebounded to $930 million.

It is not difficult to see that after the issuance of tokens by NFT projects, more than half of the value will be directly transferred to the tokens. The conversion ratio depends on two factors:

1. The social attributes of the NFT itself

2. The potential airdrop expectations of the NFT in the future

BAYC itself has top-tier social attributes in the crypto circle, and although its momentum is not as strong as before, it is still a classic. Therefore, the APE token will not completely take away the core value of BAYC. In comparison, Runestone lacks social attributes, and the cold state of the Bitcoin ecosystem also limits the actual value expectations of the airdrop. For this reason, the DOG token appears more valuable, while Runestone has almost become an abandoned child.

However, a similar script is being played out again recently. Just last month, Animoca Brands made a strategic investment in the parent company of Pudgy Penguins, seemingly aiming to replicate the success of BAYC.

In fact, the valuation support for Igloo comes from the overall market value of Pudgy Penguins. When Igloo initially issued Pudgy Penguins, the starting price was only 0.03 ETH. Even as the Pudgy Penguins price soared, the founding team could not benefit greatly, with the only gain being the transaction fees. In this case, how to provide an exit channel for Igloo's financing capital? The answer is obvious - issuing tokens became the most direct path, and the launch of the PENGU token was thus born. For the market, the whales can control the token value at any time; for the PENGU token itself, the founding team and investment institutions need to cash out, while the NFT holders also yearn to realize their gains.

After all this, what should be done after the launch of Pudgy Penguins?

1. Sell NFTs: The earlier, the better

A wave of NFT selloffs is almost a foregone conclusion. Once the airdrop is completed, the value of Pudgy Penguins NFTs is expected to at least halve, so the earlier the sale, the higher the price. Waleswoosh, an anonymous analyst of the Azuki NFT series, posted on X platform that "I think the Pudgy Penguins floor price will stabilize around 20 ETH after the airdrop, and those who expect it to drop to 10-15 ETH are ignoring the further support from the launch of the Abstract mainnet in January 2025."

2. Potential trading opportunities with PENGU

If PENGU re-enacts the historical drama of APE and DOG, the best operation is undoubtedly to sell out when the FOMO sentiment is strongest on the day of launch, and then wait for the first natural correction of 2-5 days, and then buy the dips at the right time.

It is worth noting that, given Yuga Labs' "poor performance", the market's expectation for this round of PENGU's market performance is even higher. The combined total market value of PENGU, Pudgy Penguins, and Lil Pudgys hitting $10 billion is both a reasonable expectation and a noteworthy selling point.

If you missed the PENGU airdrop, how should you operate?

1. Buy the dips of other Non-Fungible Tokens: Find the next "undervalued" potential stock

If the PENGU airdrop goes smoothly, the market sentiment will be further stimulated, which will have a positive driving effect on other Non-Fungible Token projects with token issuance plans. Currently, the market values of Azuki and Doodles are both less than $500 million, which are obviously undervalued compared to Pudgy Penguins in the token issuance state. At this time, seizing the opportunity to layout those Non-Fungible Tokens with the highest token issuance expectations may be able to capture the next round of value explosion.

2. Continue to lurk Pudgy Penguins: Layout the next big move

In June this year, Igloo, the parent company of Pudgy Penguins, successfully acquired the on-chain creator economy platform Frame, and plans to jointly build the L2 network Abstract Chain designed for on-chain culture and community. Immediately afterwards, Igloo completed a $11 million financing a month later, with the investment lineup including well-known institutions such as Founders Fund, Distributed Capital, 1kx, EVG and Selini Capital.

Igloo plans to invest this capital into the new business Cube Labs, which will be deeply involved in the development of the Abstract network. This blockchain built on ZK technology is positioned as the world's largest on-chain cultural community, aiming to provide a low-cost, fast and secure transaction experience through the ZK technology stack and EigenDA services.

Therefore, Pudgy Penguins still have a strong expectation of public chain airdrop. Once the NFT selling frenzy after the airdrop has subsided, buying the dips of Pudgy Penguins is not only a stable choice, but also has the prospect of a new explosion in the future.

Finally

At 9 o'clock tonight, PENGU will officially go live, and in this airdrop storm, the market will find its own balance point. Whether it is choosing short-term arbitrage or long-term lurking, the only constant is: when the chess game of capital is rearranged, the next opportunity is often hidden in the "ignored corner", have fun everyone.