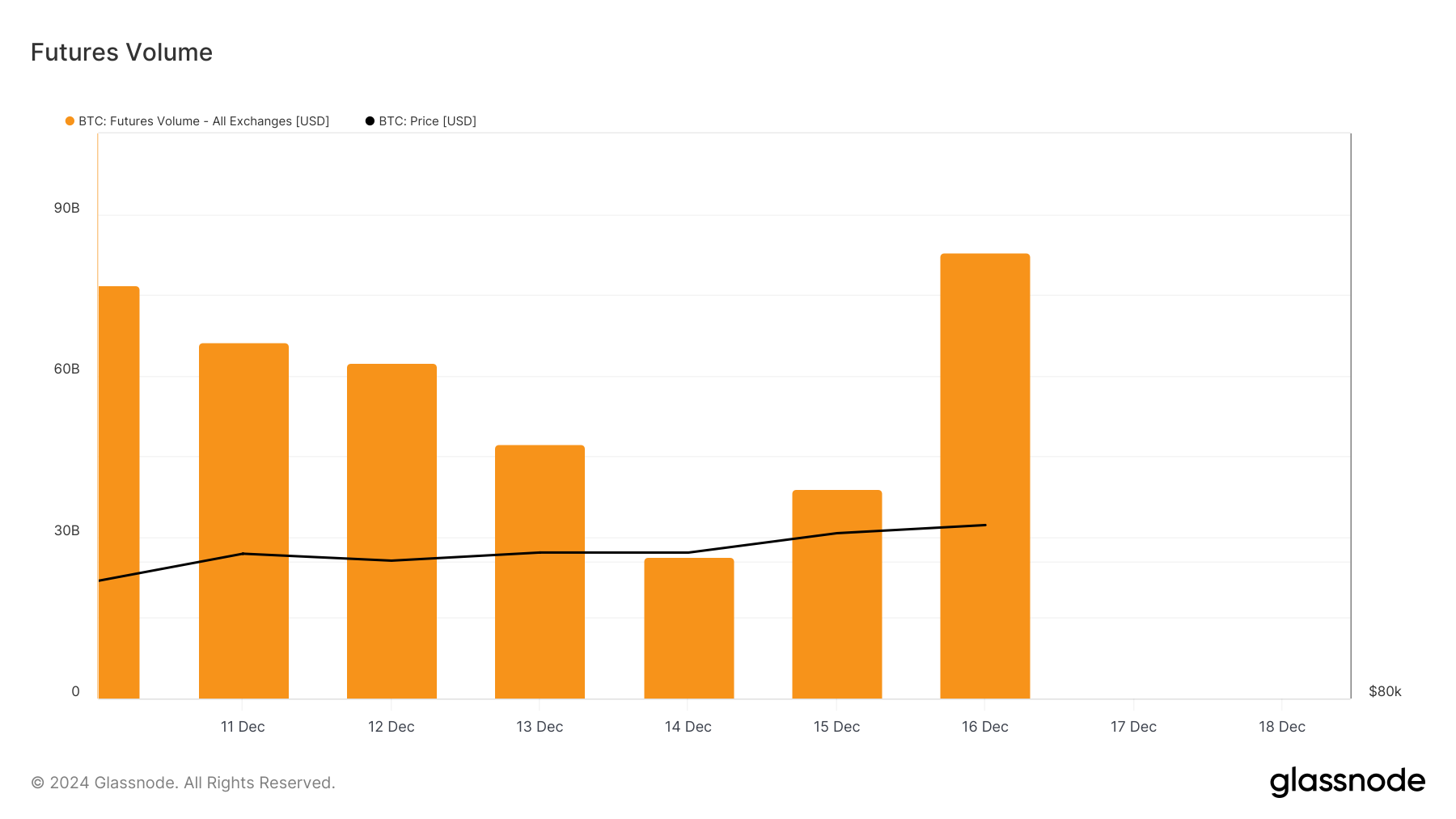

Last Monday, the trading Volume of Bitcoin (BTC) futures exceeded $90 Billion, but it has been steadily decreasing from December 10 to 14, reaching $26.39 Billion last Sunday. However, as the BTC price reached a new all-time high, the futures trading Volume also surged, reaching $82.84 Billion within 7 days.

To some market observers, this resurgence signifies a positive outlook for cryptocurrencies. However, Bitcoin traders seem to be taking a different path.

Increased Liquidity in the Bitcoin Derivatives Market... Not a Bullish Signal

The Bitcoin Futures trading Volume represents the value of all long and short futures contracts bought and sold over a specific period. As the Value increases, traders open long or short positions to increase their exposure to the cryptocurrency.

To clarify, longs are traders who hold contracts that predict a price increase, while shorts are traders who expect a price decline. However, a decrease in Futures trading Volume indicates that traders are reducing the number of open contracts.

According to data from glassnode, the recent BTC all-time high has awakened Bitcoin traders. After steadily declining over the past 7 days, the trading Volume has recently surged to $82.84 Billion.

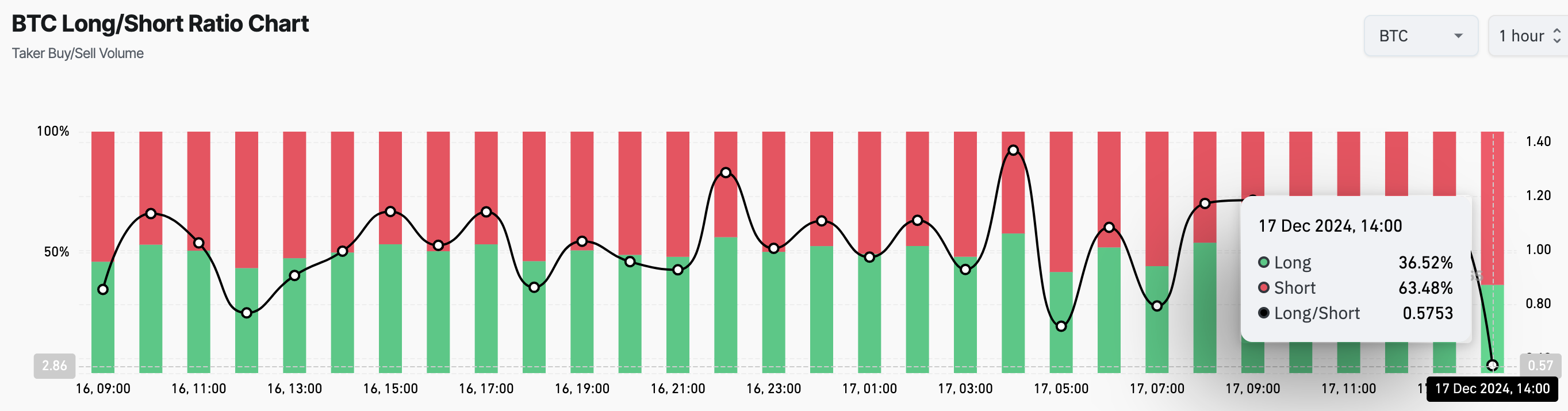

Despite the surge in trading Volume, Bitcoin traders remain skeptical that the BTC price will go below $107,000. This is reflected in the long/short ratio.

The long/short ratio is an indicator of investor sentiment. A ratio above 1 indicates that long positions outweigh shorts, while a ratio below 1 indicates that shorts are dominant.

According to data from Coinglass, the Bitcoin long/short ratio has dropped to 0.58, with short positions accounting for 63.48% of the total open interest, while long positions make up only 36.52%. This difference reinforces that most traders are positioning for a short-term correction in Bitcoin price.

BTC Price Prediction: Will it Drop Below $100,000?

The Bollinger Bands (BB), a measure of volatility on the daily chart, have positioned the Bitcoin price at $107,352. BB indicates the volatility level and whether an asset is overbought or oversold.

Generally, when the upper band of the indicator touches the price, it is considered overbought. Conversely, when the lower band touches the price, it is considered oversold. Therefore, in the former case, the Bitcoin price appears to be in an overbought state and a pullback may occur.

The Relative Strength Index (RSI) also supports this outlook, with its value exceeding 70.00, indicating that the BTC price is in an overbought state. If confirmed, the Bitcoin price could drop to $91,240. However, if buying pressure increases, the coin's value could rise to $116,000.