Author: Michael Nadeau, The DeFi Report; Translated by Wu Zhu, Jinse Finance

We have said it many times before: if you do not understand the macroeconomic trends, you do not understand cryptocurrencies. Of course, the same applies to on-chain data.

This week, we will explore how macroeconomic trends will impact the cryptocurrency market in 2025.

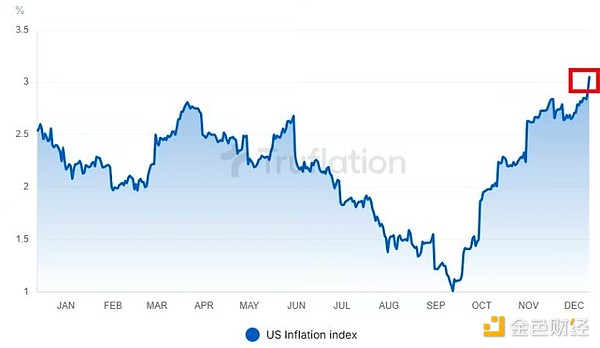

Inflation

Inflation data is rising. After bottoming at 1% in September, we have accelerated back to over 3% as calculated by Truflation.

Data: Truflation

We like Truflation's data because it uses real-time web-scraped data from various online sources. Additionally, its update frequency is more frequent than traditional government metrics like PCE.

However, the Fed's focus is on PCE. So we use PCE as a way to forecast Fed policy, and use Truflation to get a more real-time sense of the economy.

Here is personal consumption expenditure:

Data: FRED Database

It is currently at 2.3% (October data). It is also rising - this is hard to see in the chart (September was 2.1%). We will get November data on December 20th.

Outlook on Inflation

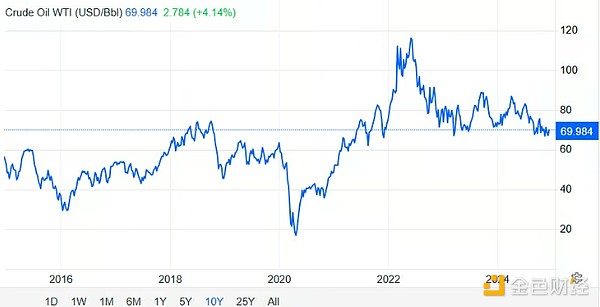

Energy costs and housing costs are the main drivers of the increase. However, oil prices are at a cyclical low.

Data: Trading Economics

The question is whether they will stay here, or potentially decline further.

Considering seasonal effects + Trump's plan to increase supply through US deregulation, it's hard to see why oil prices would spike anytime soon.

On the other hand, geopolitical conflicts, unforeseen natural disasters, or OPEC production cuts (expected US supply increase) could lead to higher oil prices.

We haven't seen these events materialize yet.

Additionally, our view is that inflation in the 21st century has been primarily driven by supply shocks + fiscal spending and stimulus checks - we don't see this as a threat today.

Therefore, we expect oil prices to fluctuate within a range, and inflation/growth to decline.

The US Dollar

Data: Trading View

Since October 1st, Bitcoin has risen 58%. Meanwhile, the US Dollar Index has risen from 100 to nearly 108. It's currently at 107.

This is a peculiar behavior. Typically, a strong US dollar is detrimental to risk assets like Bitcoin (see 2022). But we are now seeing the two strongly correlated.

So what's going on? Should we be concerned?

We believe that the US dollar is showing strength due to global markets pricing in a Trump victory. Trump's policies are business-friendly. This means they are market-friendly.

We saw the same dynamics after Trump's 2016 victory. The dollar rose. Why? We believe foreigners are digesting the "Trump bump" and are thus buying dollar-denominated assets.

Outlook on the US Dollar

We believe growth is slowing/normalizing. This is reducing inflation, albeit with a lag. Interest rates may decline.

Therefore, we expect the US dollar to trade in a range in the medium term, potentially retreating to 100.

ISM Data (Economic Cycle)

Data: MacroMicro

From an economic cycle perspective, we can see the blue line (manufacturing) appears to be bottoming. Historically, readings below 50 indicate the economy is contracting. Sustained readings below 50 indicate an economic slowdown.

This is where we are now - services (red line) are doing a bit better.

These levels often coincide with rising unemployment rates. This typically leads the Fed to adopt an accommodative monetary policy.

Again, this is what we are seeing today.

Outlook on the Economic Cycle

We believe the slowdown in growth will lead to rising unemployment. This could ultimately manifest as downward pressure on inflation.

This leads to rate cuts. This puts downward pressure on the US dollar.

In the medium term, we believe these dynamics should be supportive of risk assets/cryptocurrencies.

Credit Markets

Data: FRED

Credit spreads continue to be at historical lows, indicating investors require low compensation for additional units of risk.

This could mean two things: 1) The market is complacent, mispricing risk. Or 2) Market participants are optimistic about the economy, with the Fed and fiscal policy being accommodative.

We believe it's the latter.

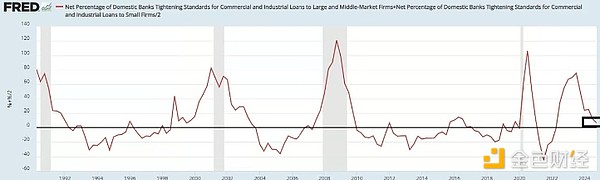

Next, let's look at the trend in bank lending.

Data: Fred Database

The proportion of banks tightening lending standards has been declining since peaking at the end of 2023. Ideally, this KPI will remain stable as the Fed cuts rates.

That said, historically we've seen a negative correlation between rate cuts and the proportion of banks tightening lending standards. Why? Rate cuts often signal an economic slowdown or recession - making it harder for banks to lend.

Outlook on Credit Markets

There are no signs of stress. At least not yet.

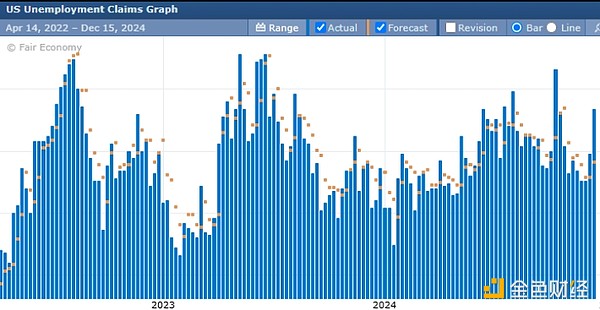

Labor Market

The unemployment rate rose to 4.2% in November (previously 4.1%). Below, we can see the recent rise in initial jobless claims.

Data: Forex Factory

We believe labor market weakness is now fully on the Fed's radar. The persistently rising initial jobless claims data tells us that it is becoming increasingly difficult for the unemployed to find jobs.

This is another sign of the slowdown/normalization in growth. That said, the stock market remains at historical highs. Corporate profits are strong. This is why the labor market has remained intact.

But I get the sense the Fed is watching this hawkishly. After all, the Sahm rule was triggered back in July.

Outlook on the Labor Market

It is softening. But not at a rapid pace. We expect the Fed will (try to) act before the data weakens significantly (since they cut 50bps in September after the July Sahm data release).

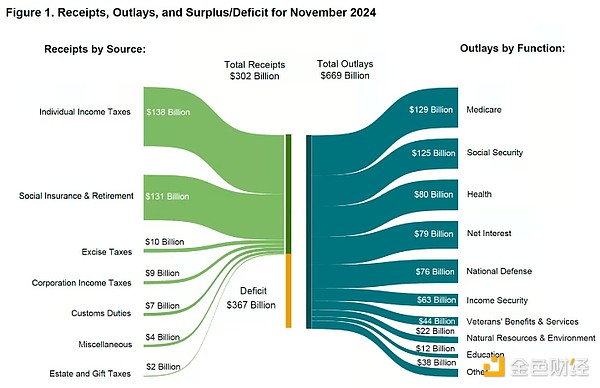

Treasury and Fiscal Spending

Data: US Treasury

The US government spent $1.83 trillion more this year than it collected in taxes. In November alone, its spending exceeded its revenue by more than double.

The $1.83 trillion that has been printed and injected into the economy/the hands of Americans has been a major driver of financial markets this year (we believe it has also been a major driver of inflation).

Here is the English translation:Now. Trump is coming. We also have a new institution called "DOGE", the Department of Government Efficiency, led by Elon Musk.

Some believe that overspending will be reduced as a result. Maybe. But which departments will be cut? Medicare/Social Security? The military? Interest?

This is equivalent to 65% of the budget - this seems untouchable.

At the same time, the Treasury must refinance over 1/3 of its debt next year. We believe they cannot do this by raising rates.

Outlook on Treasury/Fiscal Spending

We believe significant fiscal spending cuts are unlikely in the near term. DOGE may cut $10 billion in spending. But it won't change the status quo in a substantive way. This will take some time.

Meanwhile, the Treasury needs to refinance 1/3 of all outstanding debt next year. We believe they will do so at lower rates.

Combining these views, we are optimistic about the prospects for risk assets/cryptocurrencies.

Fed Policy

The next FOMC meeting will be held on December 18, and the market currently expects a 97% chance of a rate cut. We believe this could also give China the green light for easing.

Why?

We believe China wants to continue its easing policy. But when the Fed doesn't cut rates, they have a hard time cutting, because the renminbi will depreciate against the dollar, making Chinese imports more expensive.

Outlook on Fed Policy

Rate hikes seem unlikely in the near term. A rate cut in December is virtually a done deal, with the market pricing in a 76% chance in January. There is no FOMC meeting in February. The next policy decision will therefore not be made until March.

We believe the labor market may show more signs of softness, and the Fed may cut rates further in the mid-to-late 2025 - a total of around 3.5% in cuts.

Will rate cuts exacerbate inflation? We don't think so - this is a non-consensus view. In fact, we believe rate hikes are causing inflation (as well as other fiscal spending) to rise.

Why?

Because interest expense is now over $1 trillion. This money is being printed and passed on to Americans holding bonds, and this money seems to be flowing into the economy. Of course, rising rates have not caused banks to stop lending (see chart above).

Therefore, we believe that as the Fed cuts rates, inflation may decline (assuming oil prices remain low and we don't see further increases in fiscal spending). Remember, we had 10 years of zero interest rates in a low inflation environment. Japan has had 0% interest rates for 30 years with relatively low inflation.

Trump Policies

The market knows what to expect from Trump's presidency:

Tax cuts. This should boost corporate profits and potentially lead to higher stock prices. It could also exacerbate income inequality and increase the deficit. More deficit = more dollars in the hands of Americans.

Tariffs/"America First". This could lead to higher domestic prices. We believe AI/automation may actually offset this to some degree.

Deregulation. This is beneficial for businesses, as it may lead to higher profits in energy, tech, and finance.

Stronger borders. This could lead to labor shortages and wage increases (inflation).

Outlook on Trump Policies

We believe Trump is generally positive for business, free markets, and asset prices. The cost is that we may see some inflationary pressures. This is where things get interesting, because if inflation returns, the Fed will seek to pause rate hikes or tighten monetary policy.

Of course, we believe Trump will try to impose his will on Jerome Powell. Ultimately, we believe Trump wants to drive economic growth over the next four years and use inflation to erode some of the debt. This means inflation must exceed the nominal interest rate, but that is not the case today.

Finally, given Trump's support for the digital asset industry (as well as the incoming SEC chair), we believe cryptocurrencies will benefit from his administration.

Not to mention the potential for favorable regulations in Congress in the coming years and the potential for Bitcoin treasury reserves.

Outlook on Trump Policies

We believe, from a market and regulatory perspective, the Trump administration will be positive for cryptocurrencies.

China

Dan Tapiero, one of my favorite macro investors, says China is currently in deflation (real rates are negative).

China's negative rates are suppressing inflationary concerns in the US. This is causing the dollar to strengthen (as we've seen today).

A US rate cut may prompt China to cut rates as well.

Ultimately, it will bring more global liquidity.

Speaking of global liquidity.

Global Liquidity

Given that 1/3 of US debt needs to be refinanced next year, we believe the Fed may have to step in as the buyer of last resort (QE).

Lower US rates will allow China and Europe to ease conditions in a coordinated manner.

We believe this will result in ample liquidity/collateral within financial markets - with cryptocurrencies/risk assets being among the biggest beneficiaries.

These dynamics are consistent with the fourth year of the crypto cycle - historically the most volatile uptrend.

Summary

Growth is slowing.

This is causing labor market turmoil (which the Fed is focused on).

This is leading to rate cuts (as we've seen today).

This allows China and Europe to ease conditions without sacrificing their currency/imports.

This provides favorable liquidity conditions for risk assets.

This is what we see ahead.

Considering fiscal spending, the incoming Trump administration, and the fourth year of the crypto cycle, you can expect an explosive bull market in 2025 (with expected volatility).

Of course, we will continue to monitor the markets and provide you with the latest insights from on-chain data and the macroeconomic perspective.

After all, if you don't understand the macroeconomic situation, you don't understand your cryptocurrencies.