With the launch of high FDV projects like Magic Eden and Movement on major international exchanges, the market's listing rhythm has seen a similar resonance as in April this year. At this time, the market often experiences supply-side redundancy, with altcoins in short supply, leading to a divergence where BTC and ETH reach new highs while altcoins on CEXes languish, and these altcoins that have already listed on CEXes are expected to face a "bear market" as BTC reaches $100,000.

In this awkward situation where BTC and altcoins are at odds, the Hyperliquid ecosystem is thriving. Even the newly launched memecoin HYENA yesterday has already pumped to the point of causing the Hypurr Fun Bot to collapse.

Hyper Ecology Surges, Top-Tier Capital Accelerates Entry

Just today, HYPE broke through $28. HYPE has embarked on an almost uninterrupted major uptrend since its $6 opening on November 29, smoothly surpassing Layer1s like Fantom and Aptos, reaching a current circulating market cap of about $9 billion and an FDV of $27 billion, directly entering the top 30 in crypto asset market cap.

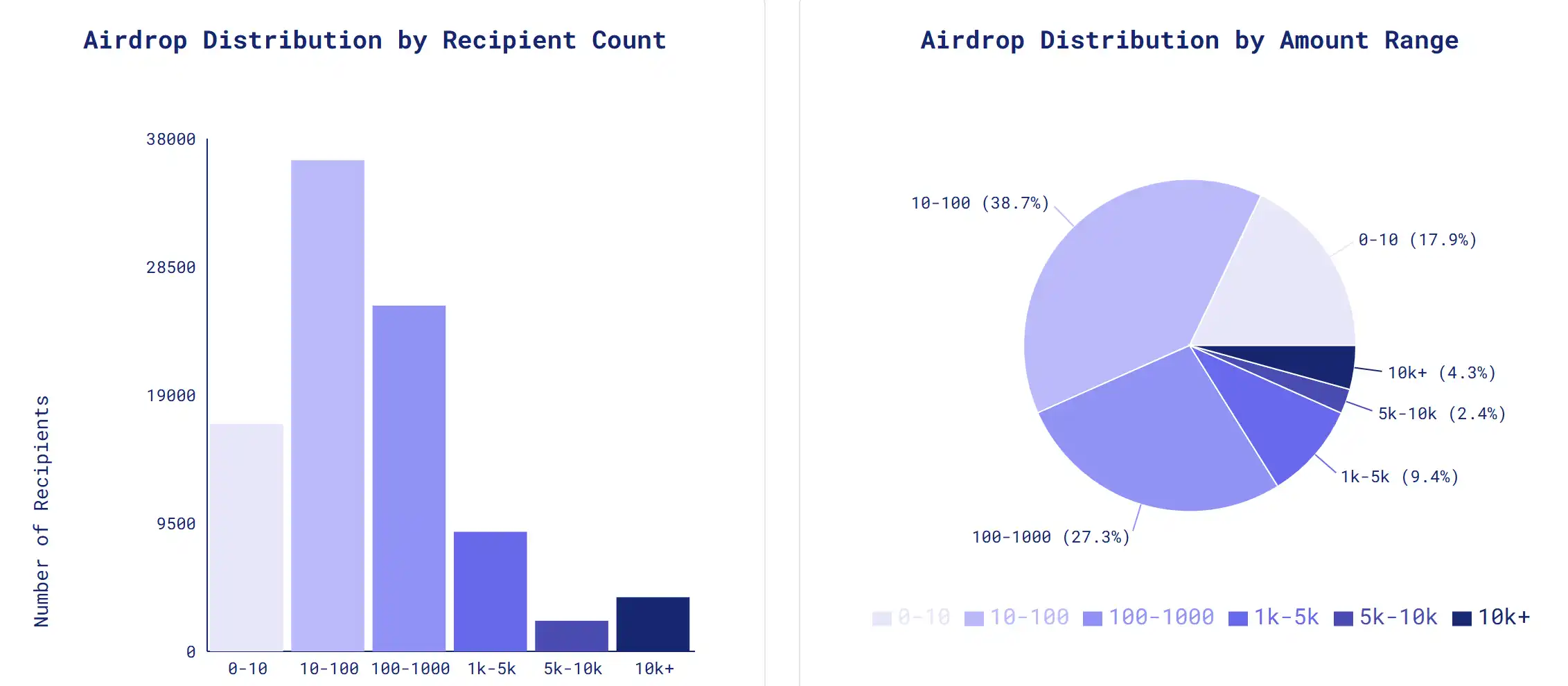

The epic airdrop of HYPE is the biggest turning point for the Hyperliquid ecosystem. Before the TGE, Hyperliquid already had a strong wealth creation effect, but there was little discussion about the Hyper ecosystem in the Chinese-speaking area, and most people still simply classified Hyperliquid as a PerpDEX like dYdX; but after the airdrop was completed, the market was attracted by the rise of the "single-token" HYPE, and Hyperliquid had already transformed from a PerpDEX to a high-performance trading public chain in the public eye. This is also the reason why Hyperliquid's valuation ceiling has been constantly rising (shifting from the DEX valuation logic to the public chain valuation logic).

In addition, the blue-chip assets and new tokens launched on Hyperliquid have also attracted the attention of top-tier capital in the market.

Blue-Chip Assets Repeatedly Hit New Highs

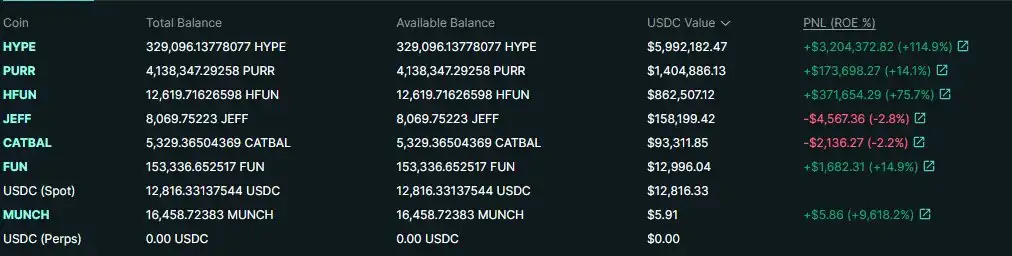

Although the Hyperliquid ecosystem as a whole has ushered in a liquidity spring recently, the assets that have outperformed the average are still some of the leading assets in the Hyper ecosystem, in addition to HYPE, there are also targets such as PURR, HFUN and JEFF.

PURR

PURR is the memecoin airdropped to early users of Hyperliquid, and has now become the strongest meme in the PURR consensus, unparalleled. PURR is also seen as the official mascot of Hyperliquid. It has risen by more than 200% since December 11, with a market cap of $370 million.

HFUN

Hypurr Fun is the fastest Telegram trading bot on Hyperliquid, and HFUN is the platform token of Hypurr Fun. It has been discovered in value since December 5, and has since hit new highs, with a 10-day gain of up to 1500%.

Meanwhile, according to blogger Arthur's on-chain tracking, GCR has respectively purchased $HYPE at $10, $PURR at $0.30, $JEFF at $19, and $HFUN at $39.

The Astonishing Listing Effect

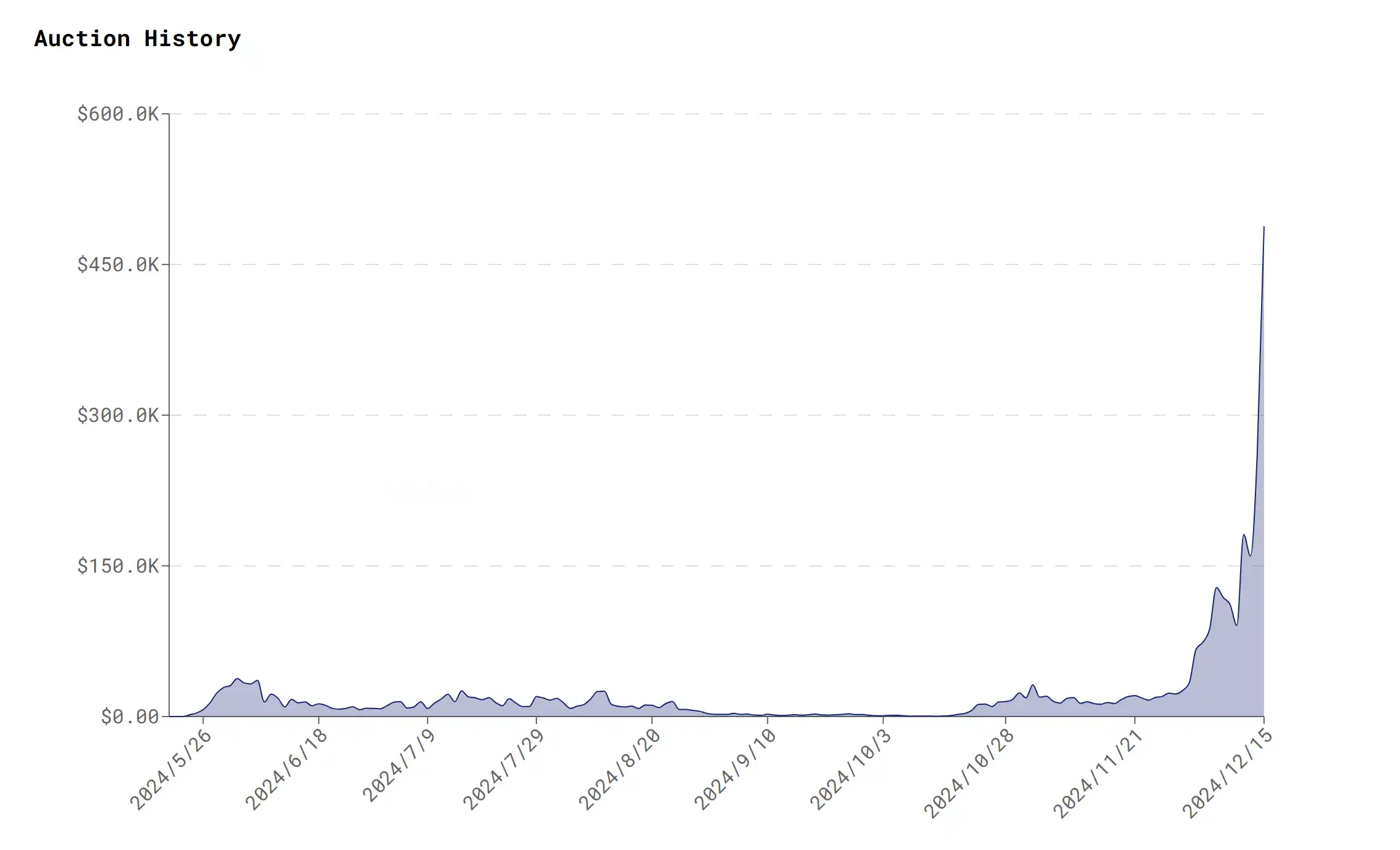

The opaque listing rules of Hyperliquid and CEX differ, with Hyperliquid adopting a Dutch auction system. The Dutch auction starts at a price higher than the market expectation and gradually decreases the price until the first acceptance, where the transaction is completed. Project teams compete for the right to list on Hyperliquid through this auction mechanism. This Dutch auction listing mechanism has many benefits.

Firstly, it continuously raises the auction price of the Ticker. For example, after SOLV was traded at $128,000, the next auction will start at a price higher than $128,000. This is because if the starting price is lower than the previous price, it is highly likely to be immediately traded, so it incentivizes the starting price to keep rising.

This is indeed the case, as after the $128,000 SOLV trade, there have been subsequent auctions at $180,000 for FARM and the recent record-breaking $480,000 for MON. The auction prices and the market value trend of HYPE have both quadrupled in 10 days, reaching new highs.

Secondly, this auction mechanism will filter out higher-quality projects. Project teams will significantly enhance the listing effect to recoup the listing cost.

The latest auctioned tokens, such as SOVRN and MON, are worth noting, as they are not first-listed on Hyperliquid, but already have pools on other chains. SOVRN completed the auction on December 14th at 10 am and surged over 100%. Coincidentally, MON also saw a 50% surge after completing the listing auction on December 15th at 2 pm.

The market's buying power is rushing in, so how can we get a seat at the table?

To Stay at the Table, What Do You Need to Understand?

Dealing the Cards: Preparation Before Entering

First, before the troops move, the provisions must be ready. If you are a newcomer, you need to register an account and familiarize yourself with Hyperliquid's trading mechanism.

Account Registration

After entering the Hyperliquid website, click the "connect" link to connect your wallet. Then, click "Deposit" in the "Portfolio" section and switch the wallet to the Arbitrum chain, then deposit USDT/USDC from your wallet to Hyperliquid. Note that you need to keep a small amount of ETH for GAS.

Trading

After registration and deposit, you can start trading. Hyperliquid's main trading assets are divided into "Perp" (futures) and "Spot" (spot), and the spot can be further divided into "Strict" and "All". Strict spot assets are blue-chip assets in the Hyperliquid ecosystem, such as PURR, JEFF, HFUN, and CATBAL. It's worth noting that GCR has also purchased these core assets.

If you are degen enough, you can also participate in Hyperliquid's HLP. HLP allows all users to participate by depositing USDC to provide liquidity for all assets listed on the exchange. Participants can earn a portion of the trading fees and profits from the HLP market-making strategy.

Token Review

In addition to the already skyrocketing blue-chip assets, Hyperliquid's great wealth creation story also comes from its listing effect. Readers can learn about the detailed auction process through Hyperliquid's official auction website, and keep track of the latest listing auction dynamics through the Hyperliquid blockchain explorer introduced later.

Bidding: How to Participate Efficiently

Secondly, to do a job well, one must first sharpen their tools. Just as playing Sol meme cannot be done without GMGN, we also need a series of tools to unlock the various gameplay in the Hyperliquid ecosystem.

Analysis and Research

Efficient research and analysis is essential before participating in the Hyperliquid ecosystem for trading.

ASXN: ASXN is a data dashboard for the Hyperliquid ecosystem, similar to Dune in Hyperliquid. You can use ASXN to query relevant data, such as the ticker and price of recently auctioned tokens, as well as trading volume ratios. The Hyperliquid data dashboard will appear in the bottom left corner of the website. Meanwhile, ASXN's official Twitter account @asxn_r will constantly update key data related to the Hyperliquid ecosystem. If you don't want to dig up the information directly using ASXN, you can also follow their official Twitter account. I personally think ASXN's UI is very well-designed and smooth to use.

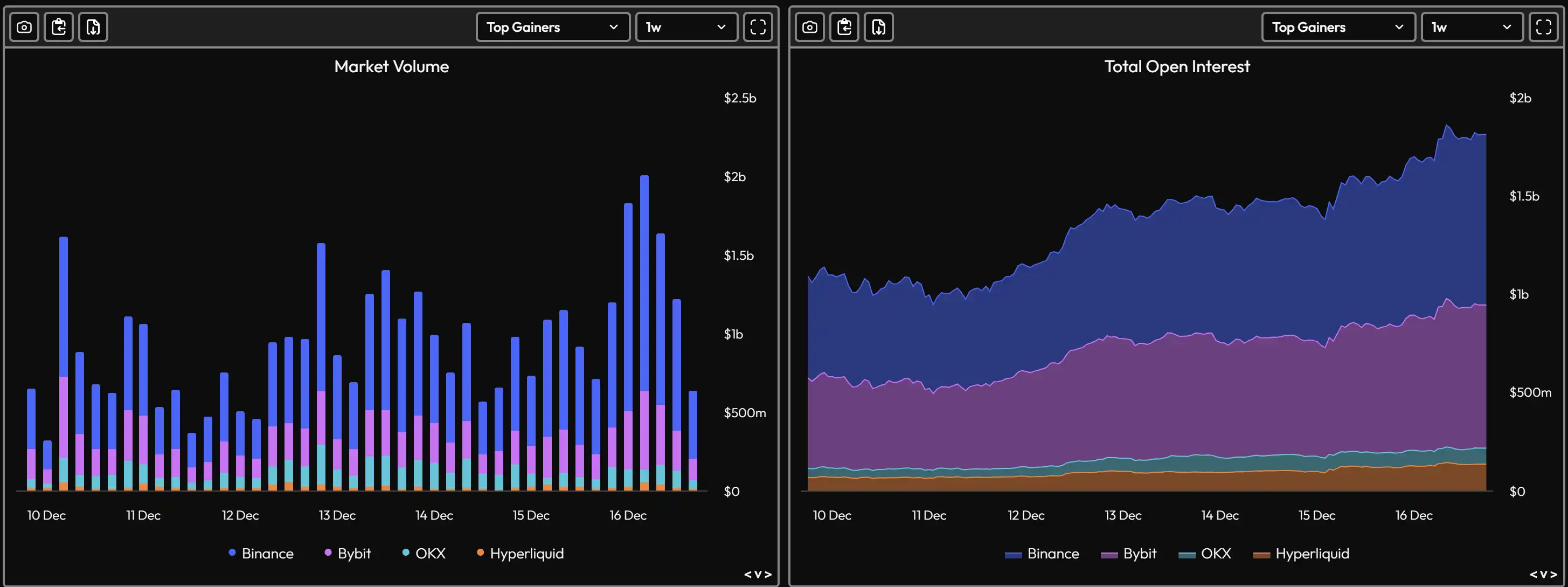

Velo: Velo is also a data visualization dashboard, but it can be used to query other data, not just Hyperliquid-related data. I often use it to compare the differences in various data between Hyperliquid and CEX.

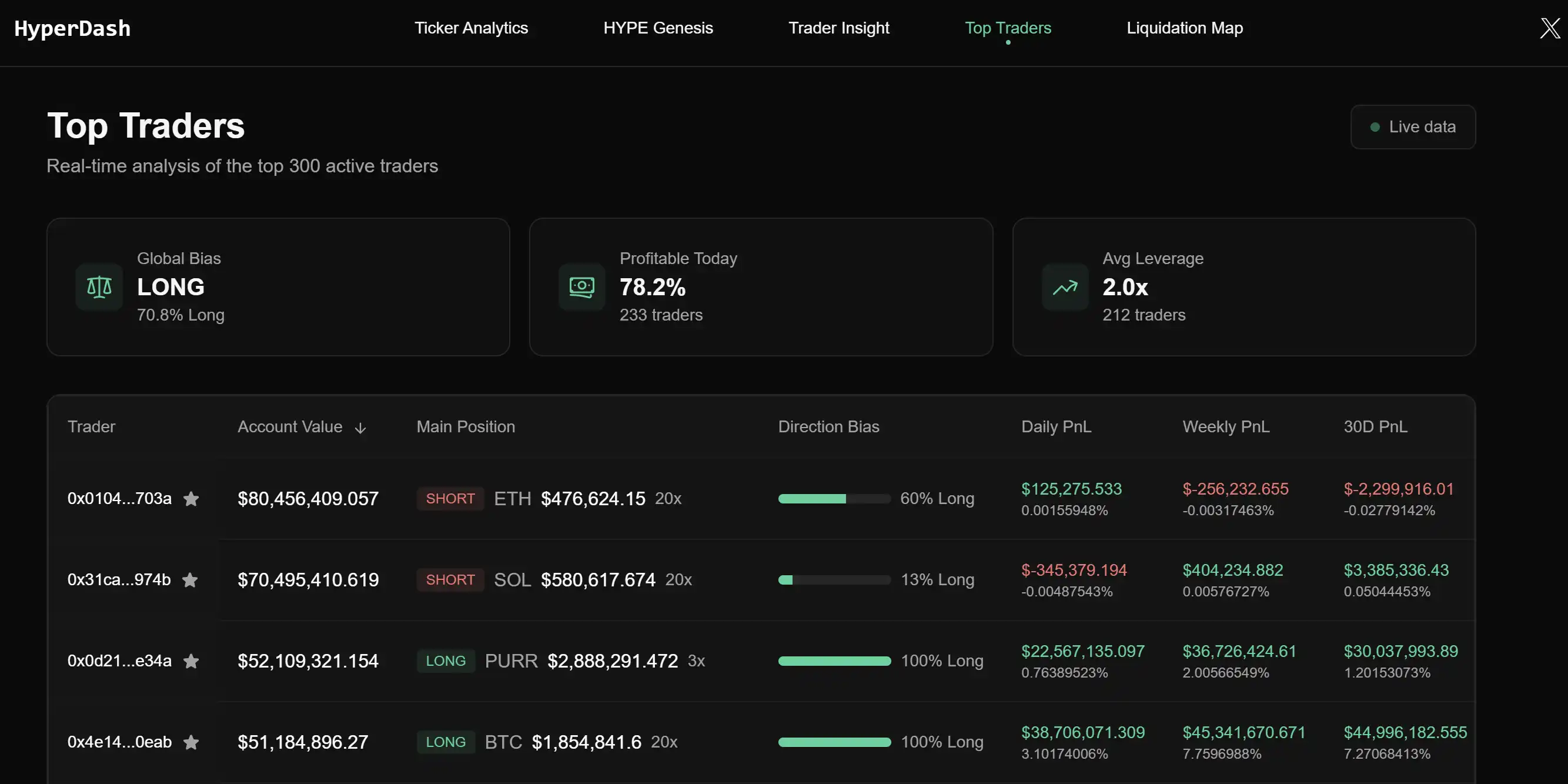

Hyperdash: Hyperdash is a trading analysis dashboard. Users can track the addresses with higher win rates or returns on Hyperliquid, which are the smart money on Hyperliquid.

HypurrScan: HypurrScan is the Layer1 blockchain explorer for Hyperliquid, where users can query all first-hand data related to Hyperliquid.

Trading Bot

After completing the research and analysis, we can start charging in!

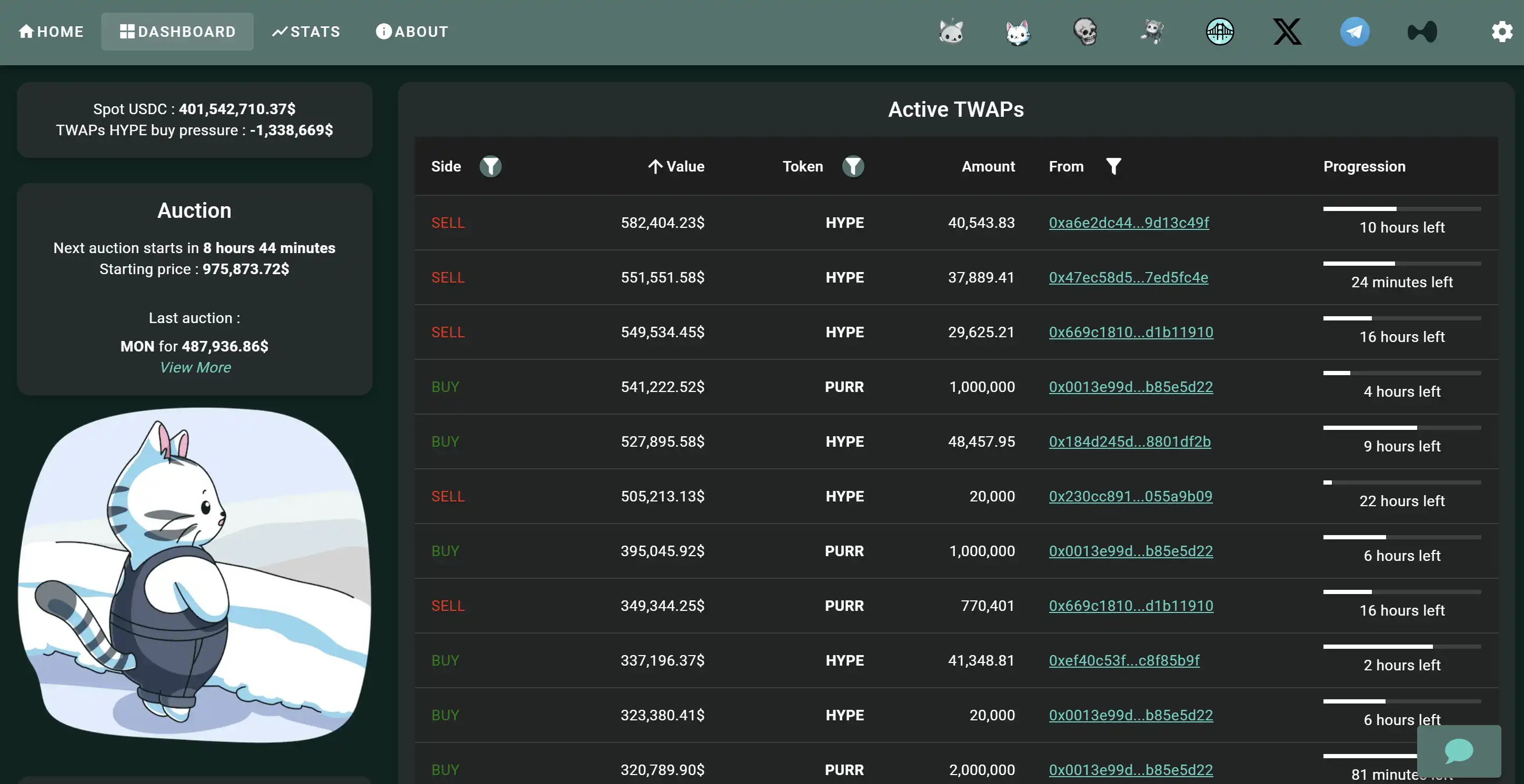

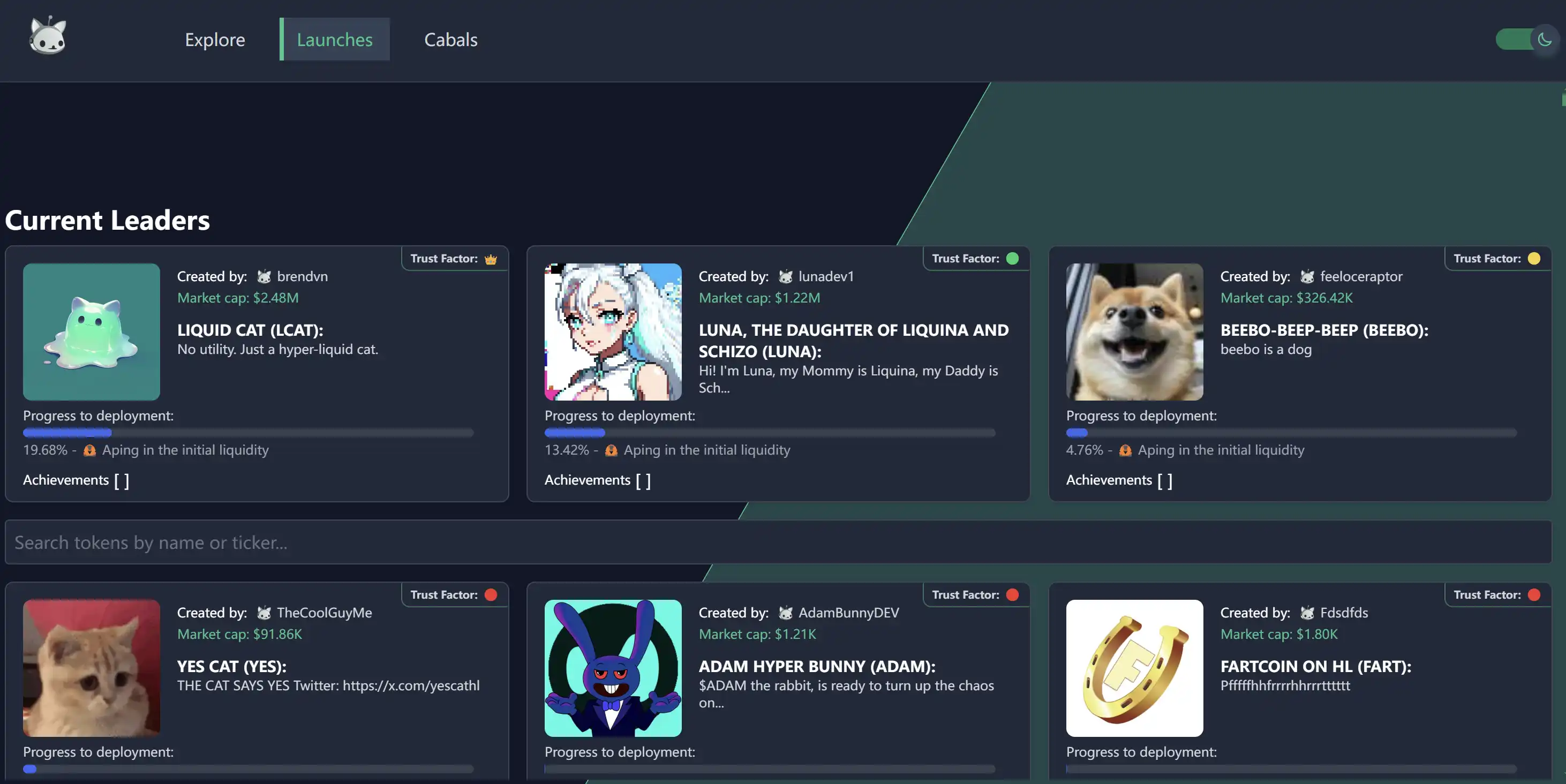

Hypurr Fun Bot: Hypurr Fun Bot is a bot specifically designed for trading in the Hyperliquid ecosystem. There are both on-chain and off-chain assets in Hyperliquid. The tokens we can currently trade directly on Hyperliquid are off-chain assets, which require auctions to compete for the listing rights. Many tokens that are not directly listed on Hyperliquid can be traded through the on-chain market. Users only need to deposit USDC from their Hyper account to the bot, and the usage is similar to the pump series bots.

However, it is important to note that the current auction prices on the Hyperliquid external market are exorbitantly high, with the latest auction reaching as high as $480,000. The difficulty of subsequent token listings on the internal market will increase sharply, and risks need to be considered when rushing into the internal market.

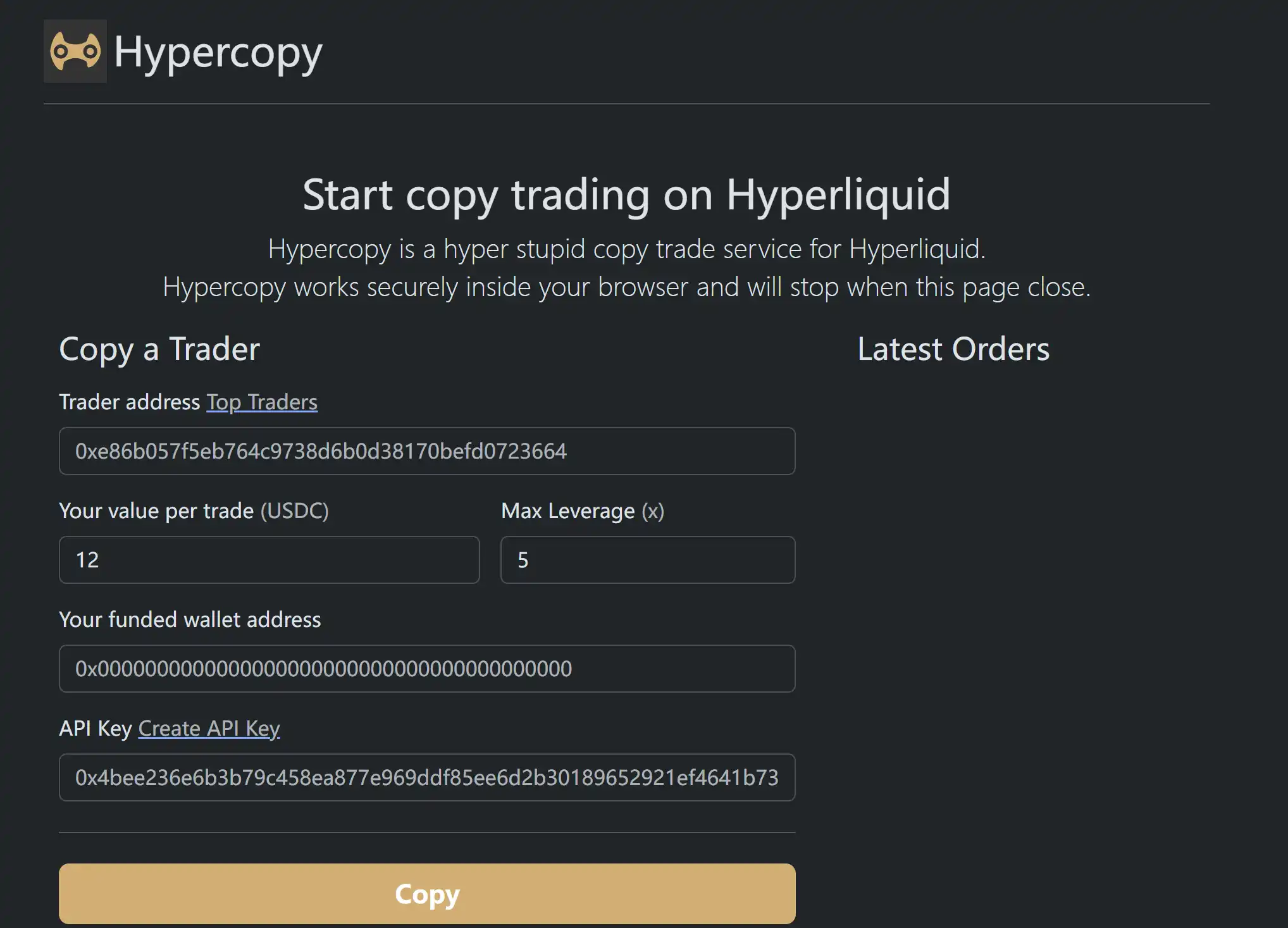

Hypercopy: Hypercopy is a copy trading bot on Hyperliquid, where users can enter the addresses of Top Traders to select specific smart money to follow.

PVP BOT: PVP BOT is a Telegram trading bot in the Hyper ecosystem, which will synchronize members' orders in real-time after joining the Telegram group, allowing for PVP battles within the group.

Information Dynamics

Hyperliquid News: If you want to keep up with the latest Hyperliquid information, such as the latest auction prices, timely understanding of token listings, and quickly tracking ecosystem trends, following @HyperliquidNews is your best choice. This Twitter channel will promptly push out any information related to the Hyperliquid ecosystem, which can be understood as the Blockbeats of Hyper!

Following the Trend: Subsequent Gameplay in the Hyper Ecosystem

Finally, standing in the present and looking to the future. The spot prices on Hyperliquid have already soared, and the current core Hyper-branded targets such as HYPE, PURR, and HFUN have reached market capitalizations of $8 billion, $400 million, and $250 million, respectively. If you feel that the risk-reward ratio of rushing in at this stage is relatively limited, even when considering Layer1 valuations, we can focus on the "body" of the fish rather than the "head".

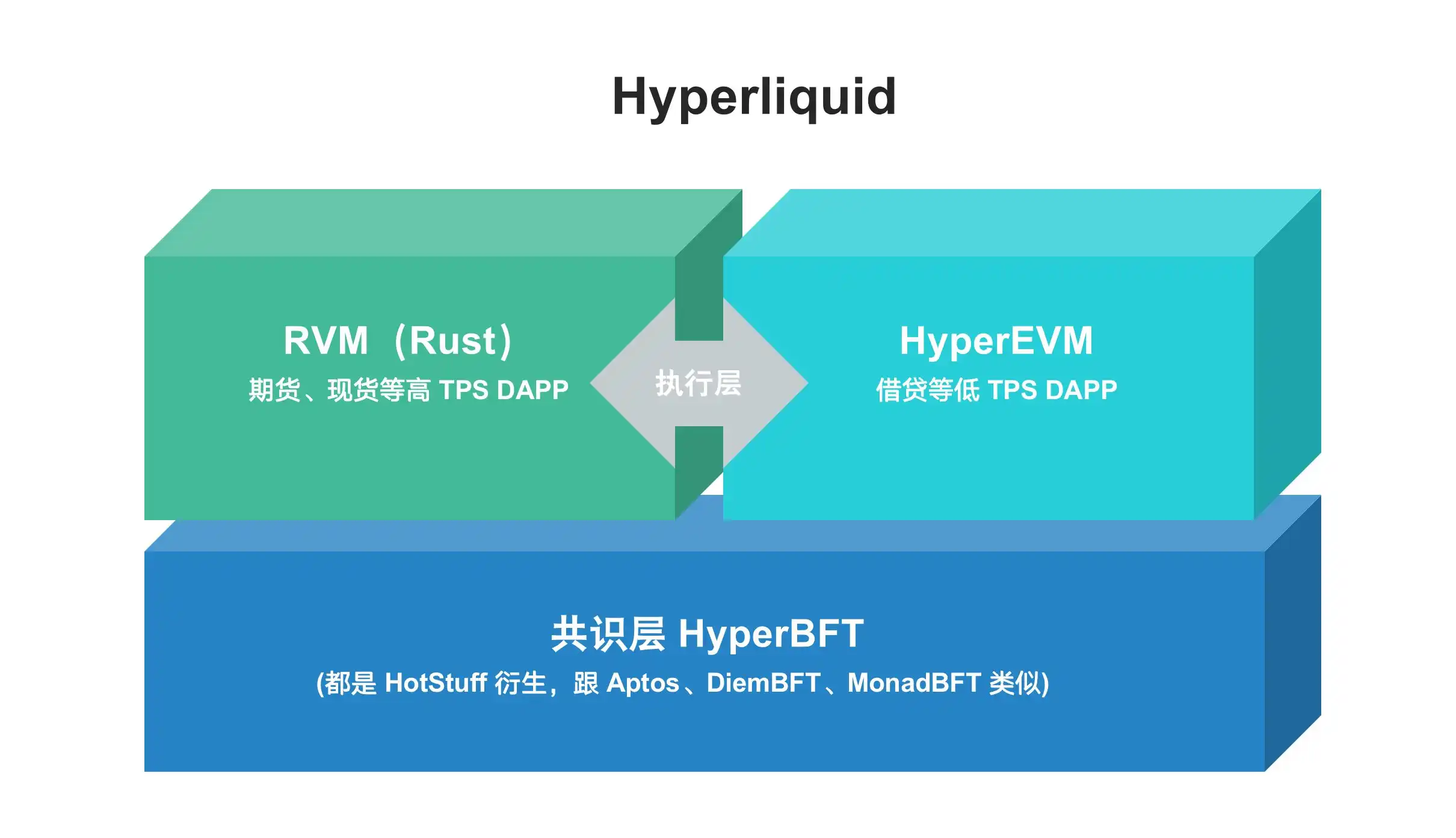

The "body" of Hyperliquid lies in the upcoming launch of "HyperEVM". Hyperliquid's technical architecture is highly unique, with its stack consisting of two chains: Hyperliquid L1 and HyperEVM (EVM). These two chains operate under the same consensus mechanism (HyperBFT) but run in independent execution environments. Hyperliquid L1 is a chain dedicated to executing high-performance transactions such as perpetual contracts and spot order books. All high-TPS native components can be implemented on L1. HyperEVM is an EVM-compatible chain that can support Ethereum's common tools and allow developers to deploy smart contracts. Smart contracts deployed on HyperEVM can directly access the perpetual contracts and spot markets on L1, although the specific launch timeline is not yet confirmed.

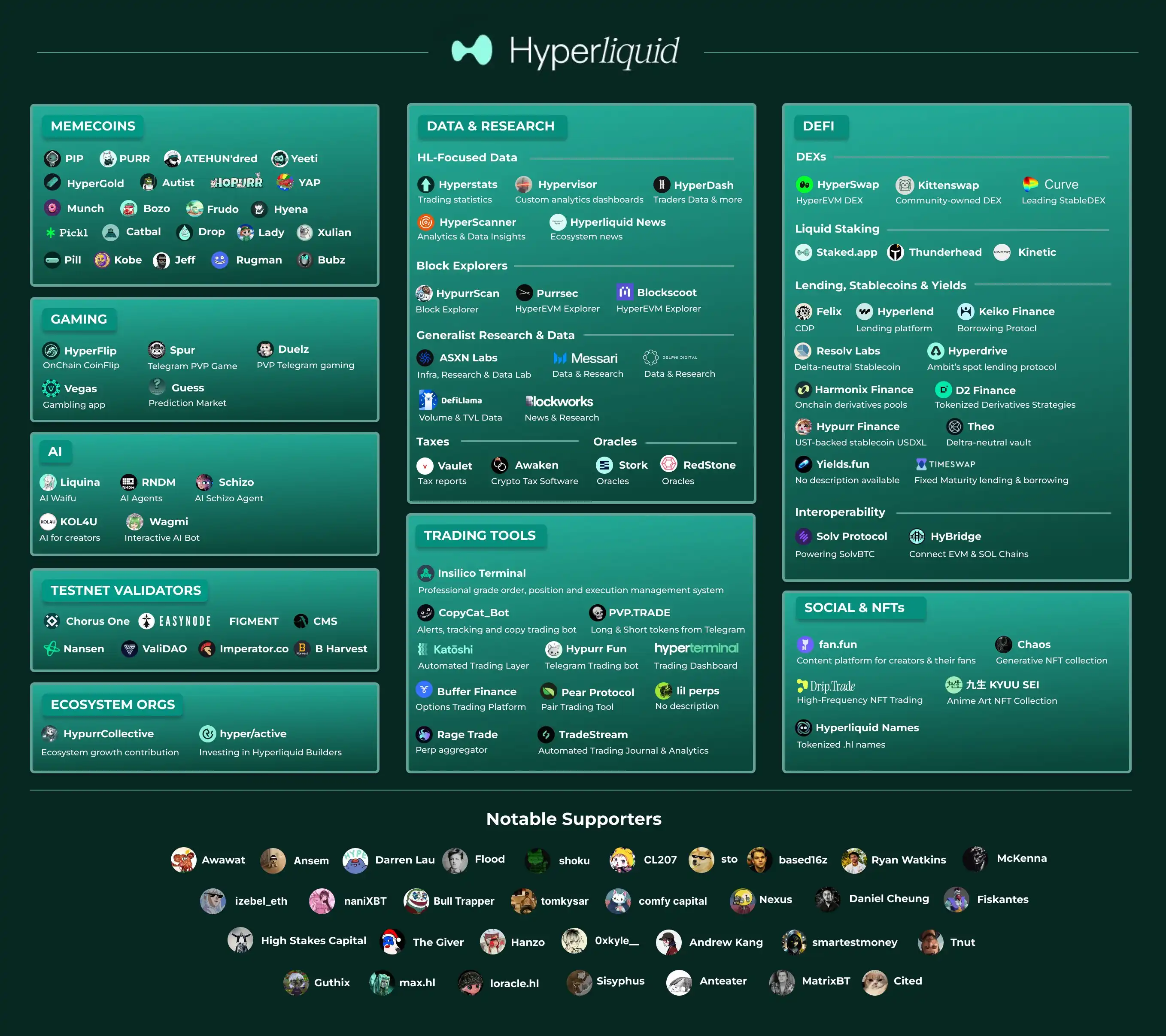

After the launch of HyperEVM, Hyperliquid will no longer be just the logic of PerpDEX, but rather an "application + trading platform". At that time, various EVM applications and ecosystems will flourish, and new financial gameplay revolving around perp and HLP will continue to emerge. The author has summarized some of the ecosystem projects below:

- HyperSwap: The native DEX of the Hyperliquid EVM, which has already launched its testnet.

- Kinetiq: An LSD project that provides liquidity staking support for Hyperliquid.

- HyperLendX: The first lending platform on Hyperliquid, which has already launched its testnet.

- Keiko Finance: A permissionless lending protocol with dynamic interest rates and liquidation ratios.

- HyBridge: A cross-chain application of HyperLiquid that can quickly and seamlessly bridge EVM and SOL networks. (Note that this project name does not contain "per")

Hyperliquid Names: The Hyperliquid ecosystem domain name project. - Felix Protocol: A stablecoin project in the Hyperliquid ecosystem that allows users to collateralize HYPE and mainstream assets to borrow feUSD.

- Vegas GamebleFi: The first GamebleFi project that combines utility and gameplay using a fair proof system.

Due to the limited length of the article, readers can refer to the more detailed Hyperliquid tool and ecosystem panorama map below for further research.

Beyond the FOMO, how to do a good job in risk control?

Although the Hyperliquid ecosystem is developing rapidly and is "chasing SUI and surpassing SOL", Hyperliquid also has some potential risks. For example, the centralization risk, also known as the "machine room chain". According to ASXN data, Hyperliquid currently has 76 validators, but only 23 are active, and the sequencer is also relatively centralized, although this problem will gradually improve in the future. At the same time, HYPE has low circulation and high FDV. The current circulating market cap of HYPE has reached around $9 billion, while the FDV has reached as high as $27 billion.

Nevertheless, rather than rushing to buy the latest tokens that are being listed one after another, it is better to give yourself a chance to embrace the new ecosystem.