Author: OurNetwork

Compiled by: TechFlow

Comments from the editorial team:

NFTs had a boom in 2021, but the market quickly cooled down, sparking much controversy and reflection. Even Rolling Stone, after putting the Bored Ape image on its cover, published an article declaring that NFTs are worthless.

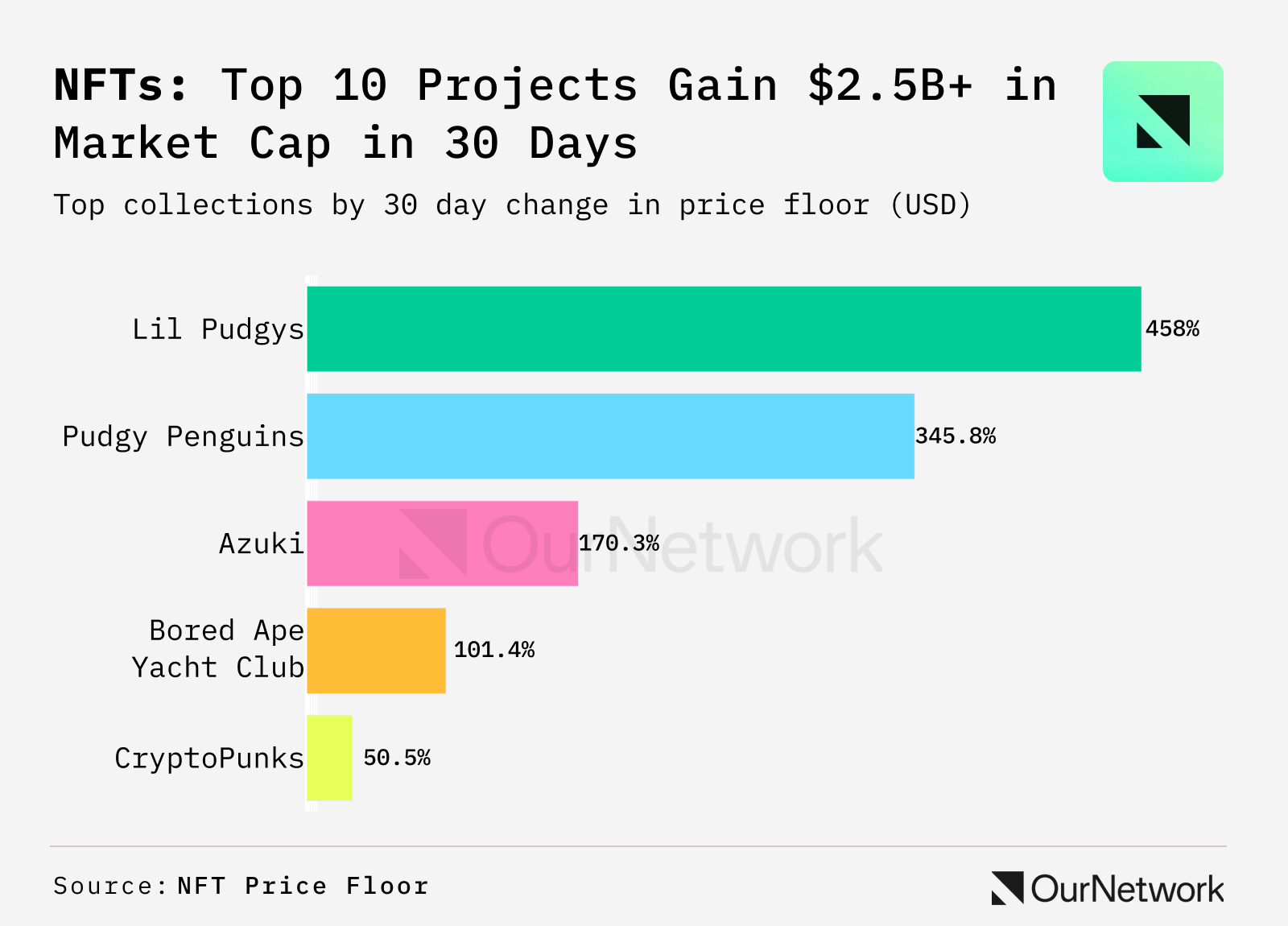

However, unexpectedly, some areas of the NFT market remain active. Data shows that as of December 16, the market capitalization of the top 10 NFT projects has grown by $2.5 billion in the past 30 days, indicating that the market is undergoing new changes.

Recently, the NFT market has been very active, especially with Pudgy Penguins and Lil Pudgys holders earning around $58,000 and $6,000 respectively from the PENGU project. Currently, the PENGU project is valued at $2.7 billion. In addition, Miladys has launched an ecosystem token, and Azukis is also widely believed to be about to launch a similar token reward mechanism.

Against the backdrop of active exploration and experimentation of ecosystem tokens, now is a good time to re-examine this area that many have abandoned. Let's dive in.

NFTs

Pudgy Penguins | Mad Lads | CryptoPunks

The expectation of airdrops for PENGU, ANIME, and Opensea tokens has driven the total NFT market value close to $11 billion

Driven by the speculative behavior around the PENGU and ANIME tokens, the NFT market has seen significant growth. Over the past 30 days, the floor price of Igloo Company's collections has seen triple-digit increases - Pudgy Penguins' price rose 345% before the PENGU airdrop. Meanwhile, Chiru Labs' Azukis also achieved a 170% increase. These growths reflect the market's expectation for token reward mechanisms, a strategy that has been proven effective in boosting user engagement in the past. Additionally, rumors about an Opensea token airdrop have further boosted market sentiment.

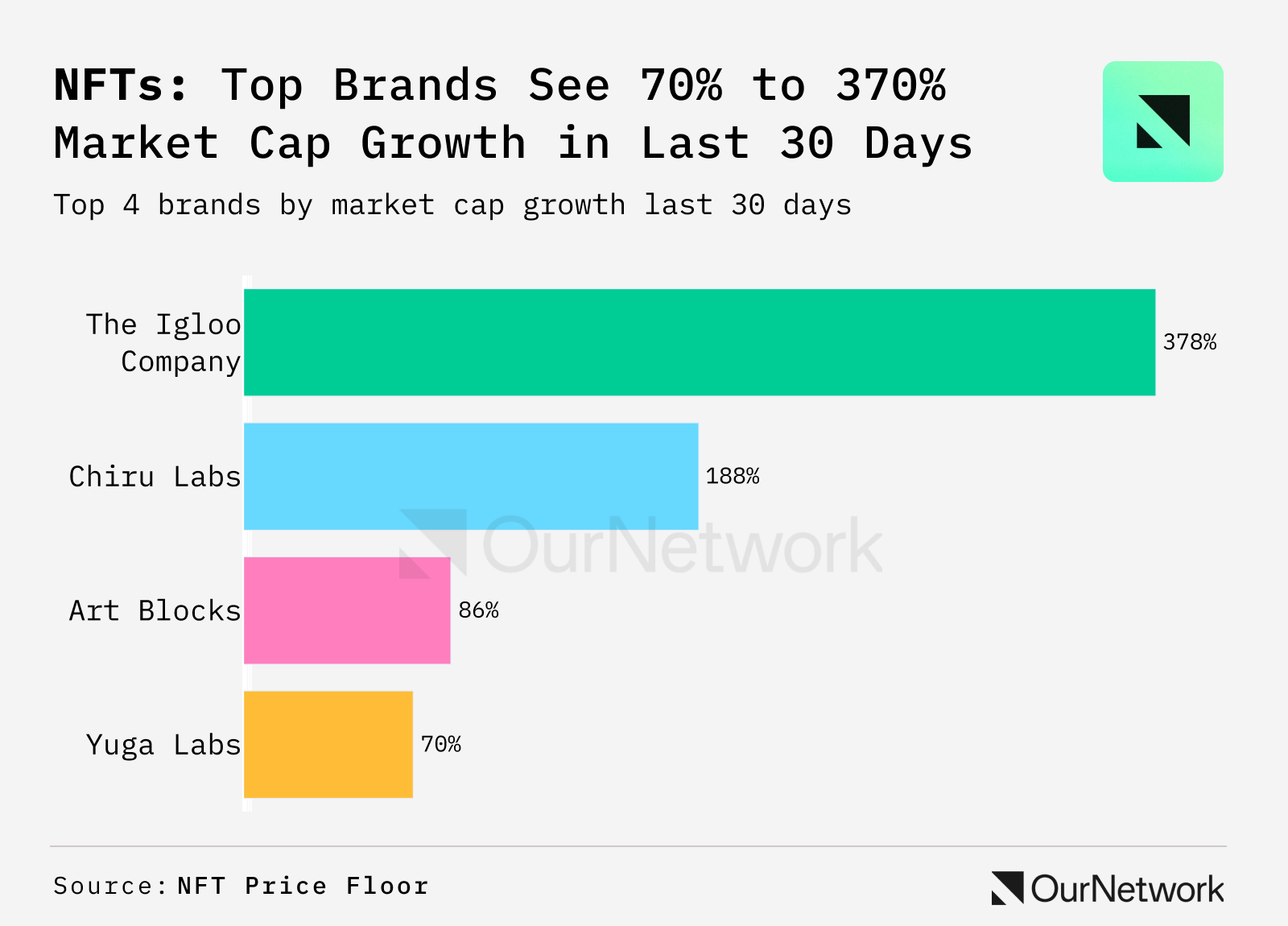

The brand rankings on NFT Price Floor show the dynamic changes in the market. Among the top four brands, Igloo Co.'s market cap has grown 377% in the past 30 days, while Chiru Labs has grown 188%. In comparison, the growth of Yuga Labs and Art Blocks has been relatively smaller, but they have also been positively impacted by the market.

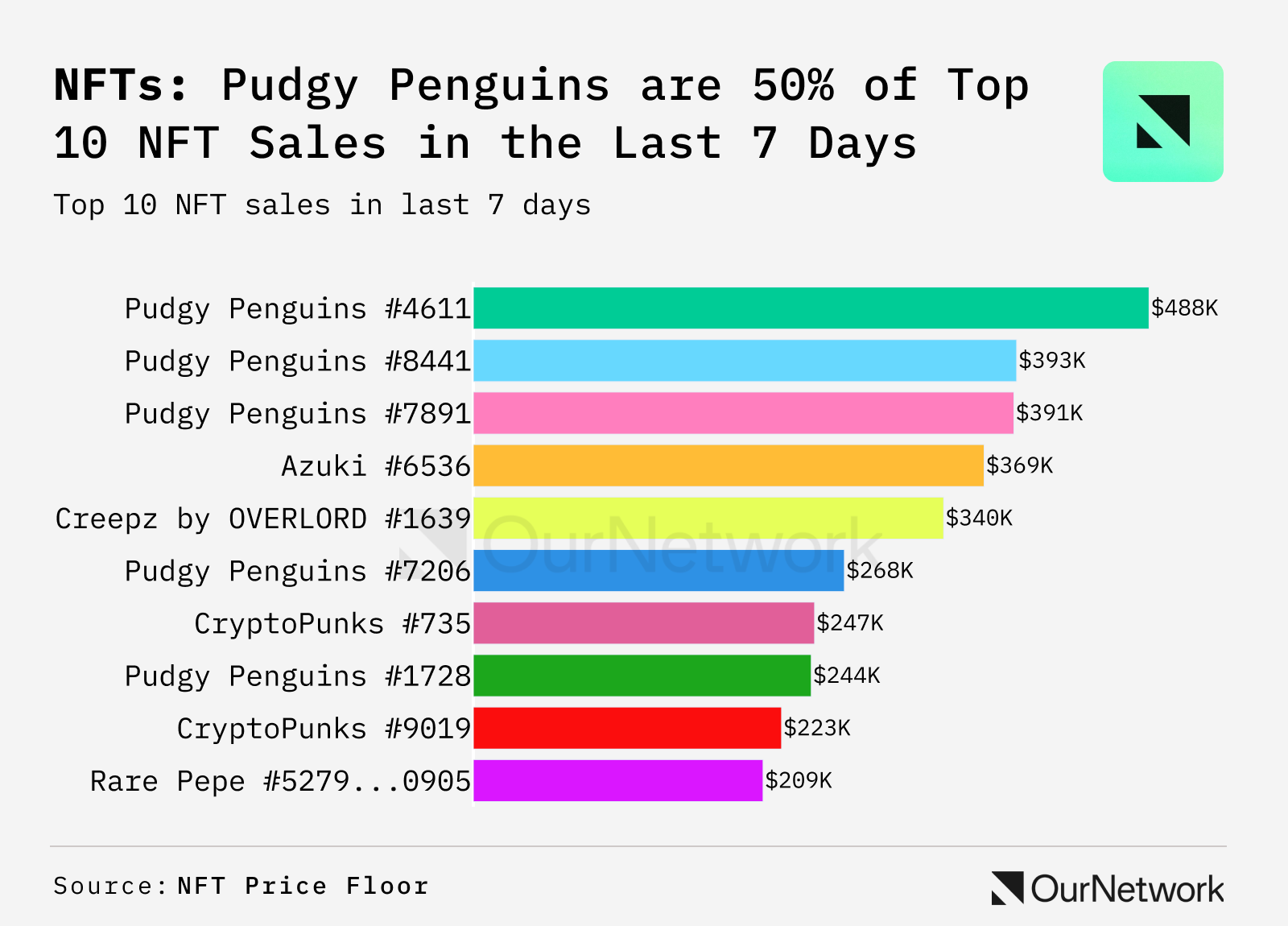

A similar trend is evident in the top trades over the past 7 days. Of the top 12 trades, 6 were Pudgy Penguins and 2 were Azukis, with prices ranging from around $500,000 to $175,000. This indicates that the market's attention and demand for Igloo Company and Chiru Labs' collections are rapidly increasing.

Trade Focus: The NFT market has also been influenced by the meme culture trend. This year, Meme NFT collections like Sproto Gremlins, Milady, and Project Aeon have performed strongly, with high-end Meme NFTs like the Pepe series still dominating. In this context, Nakamoto Cards have become the ultimate target for collectors. Notably, more and more investors are hoarding these cards, as evidenced by a recent transaction where a wallet purchased two Nakamoto Cards in just five days, indicating that the market demand for top-tier collections is heating up.

Pudgy Penguins

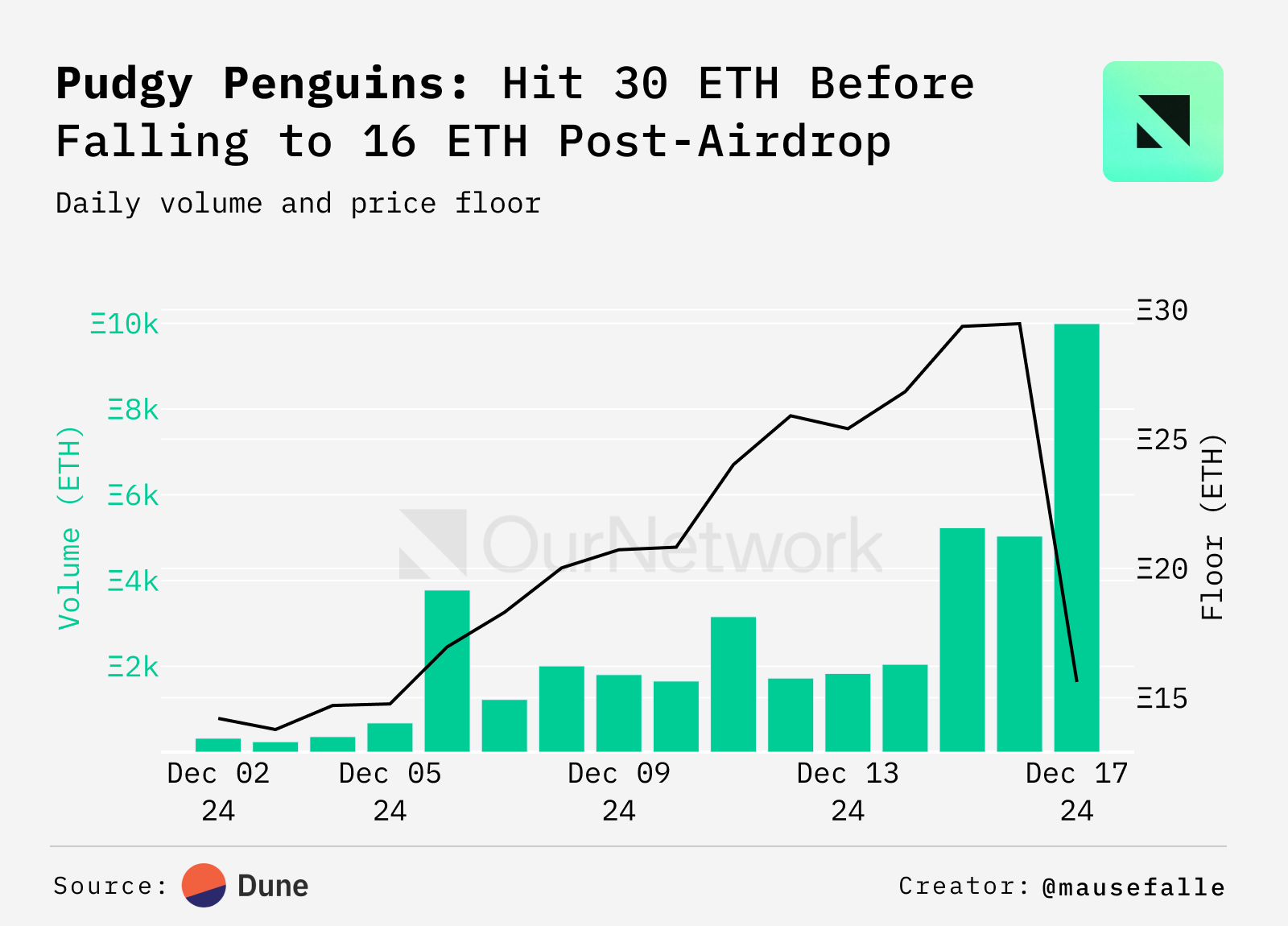

Pudgy Penguin floor price surpassed 30 ETH and then fell back to 16 ETH due to the airdrop

After the news of the PENGU token launch, the Pudgy Penguin floor price briefly surpassed 30 ETH, more than triple the floor price in early November and over half the historical high in February 2024. However, after the airdrop was completed today, the floor price fell back to 16 ETH. At the same time, trading volume increased significantly, reaching a high of 8,200 ETH today. As of December 17, each Pudgy is worth around $58,000 in PENGU tokens. Despite the airdrop having started, the number of buyers continues to grow.

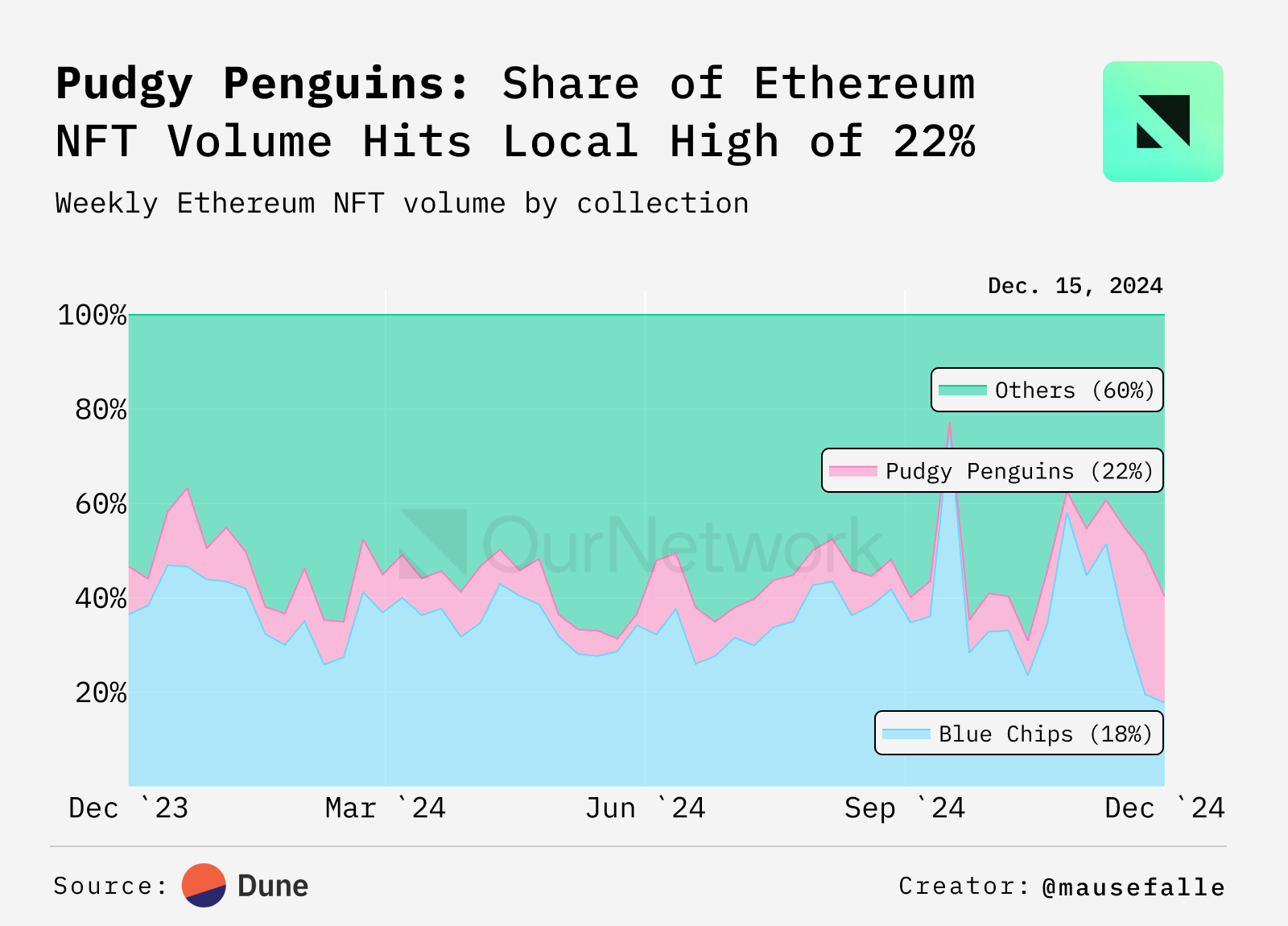

Compared to other Ethereum NFT collections, Pudgy Penguins have received significant attention recently. Since early December 2024, their trading volume has accounted for over a third of the total Ethereum NFT trading volume, more than double the share of other blue-chip NFT collections like CryptoPunks and Bored Apes. On the day of the PENGU airdrop, Pudgy Penguins' trading volume accounted for over 50% of the total Ethereum NFT volume.

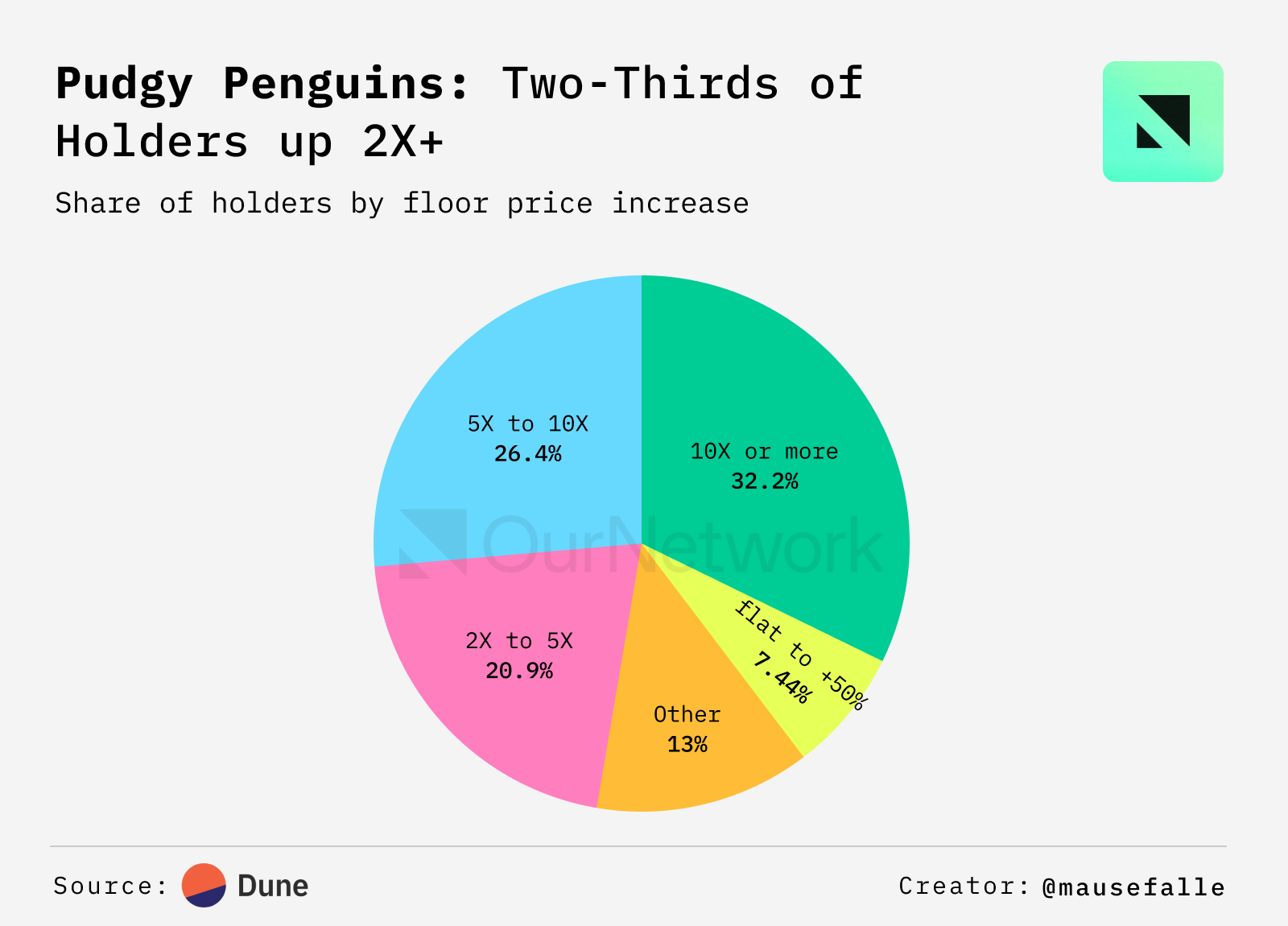

Calculated at the current floor price, two-thirds of Pudgy Penguin holders have already doubled their asset value, with half of the holders seeing gains of over 10 times. However, only 5% of holders have made sales so far, and over 19% of holders are actively increasing their positions during the floor price pullback.

Trade Focus: PENGU is the official token of Pudgy Penguins, which was officially launched on December 17, with a total supply of 88,888,888,888 tokens, and has been listed on major centralized exchanges. So far, over 20% of the tokens have been claimed. Based on the current price, each Pudgy's airdrop is worth around $58,000, while each Lil Pudgy's airdrop is worth around $6,000 (at the time of writing).

Mad Lads

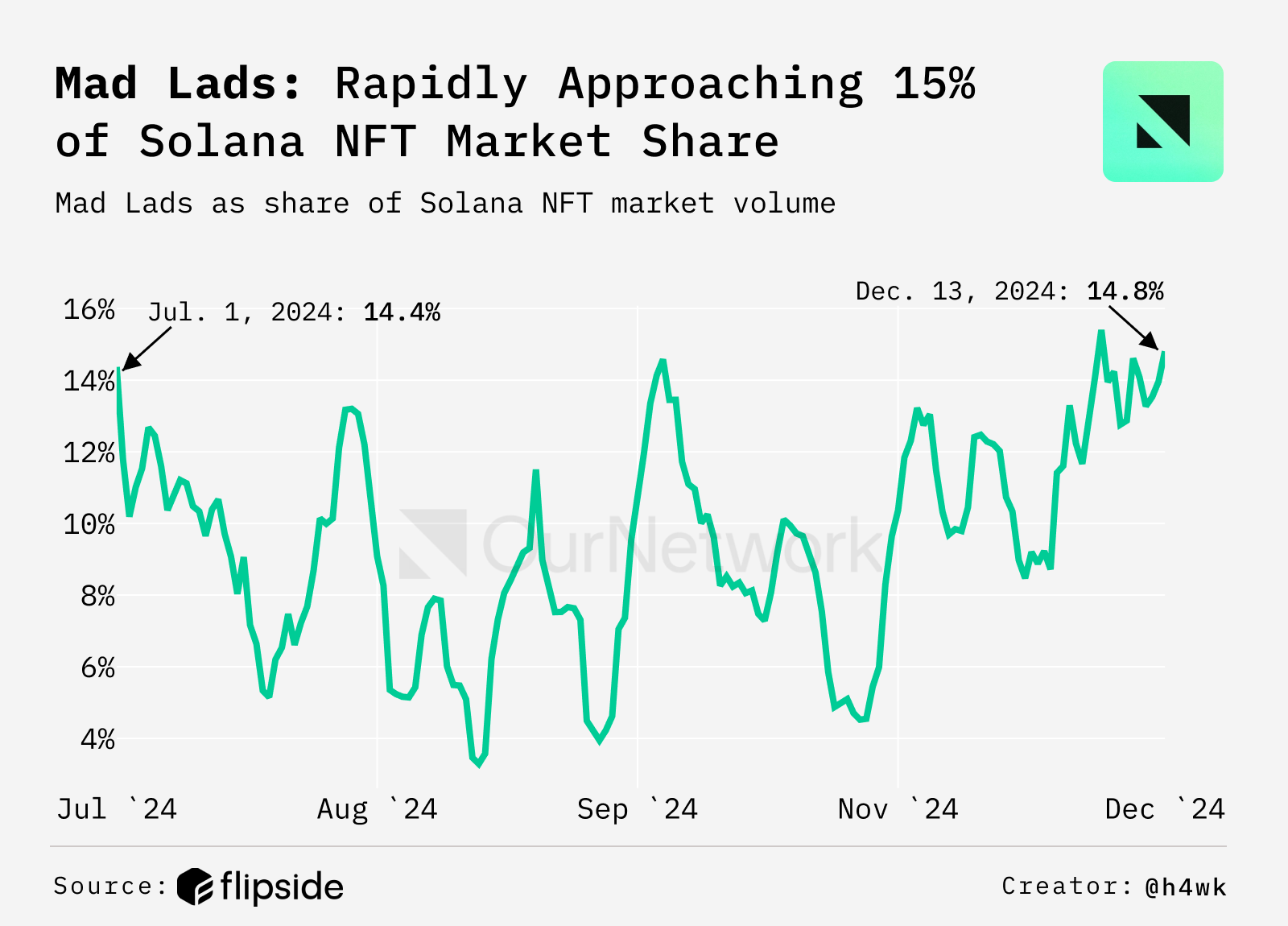

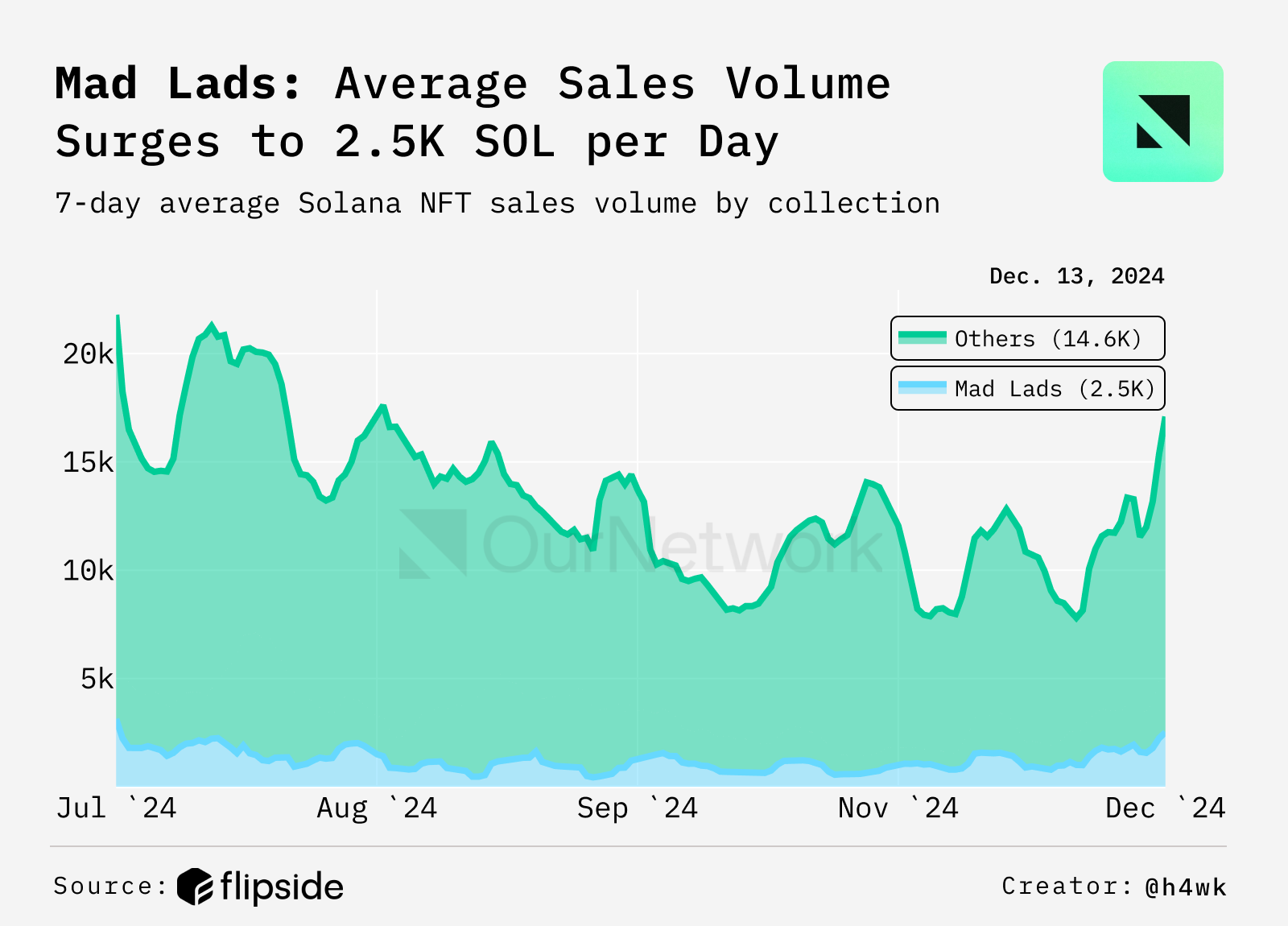

The market share of Mad Lads has increased by 10%, currently accounting for about 15% of the Solana NFT market, with a floor price of 66 SOL (about $15,000)

Over the past month, the Solana NFT market has regained attention, with Mad Lads performing particularly well. The series' market share has grown by 10%, now accounting for 15% of the Solana NFT market. The current floor price is 66 SOL, around $15,000, and Mad Lads continues to consolidate its position as a star project, reflecting the resurgence of activity and attention in the entire ecosystem.

The trading volume of Solana NFTs has surged in the past month, with a daily average of 16,000 SOL, an increase of 100% compared to the previous period. The flagship series, including Mad Lads, now account for more than 20% of the market share, indicating a renewed focus and investment enthusiasm for the Solana NFT ecosystem.

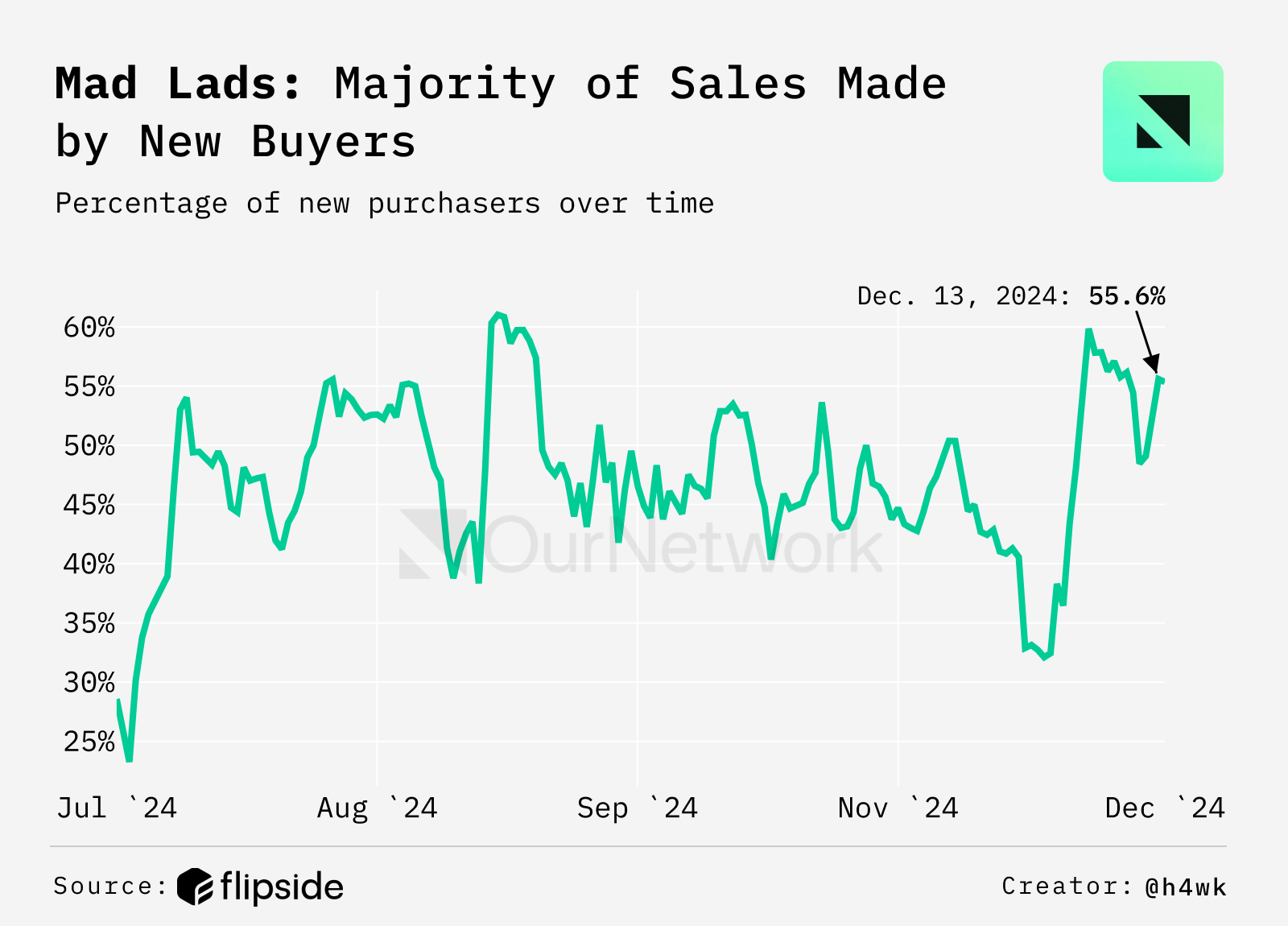

The number of new buyers for Mad Lads has increased significantly, with a 20% growth in accounts making their first purchase in the past week. These new buyers now account for more than 50% of the total daily buyers, indicating that the market's interest in the series continues to rise and is attracting more new users.

Crypto Punks

Diego Cabral | Website | Dashboard

65% Loyalty: CryptoPunks Holders Remain Steadfast for Over Two Years During the NFT Bear Market

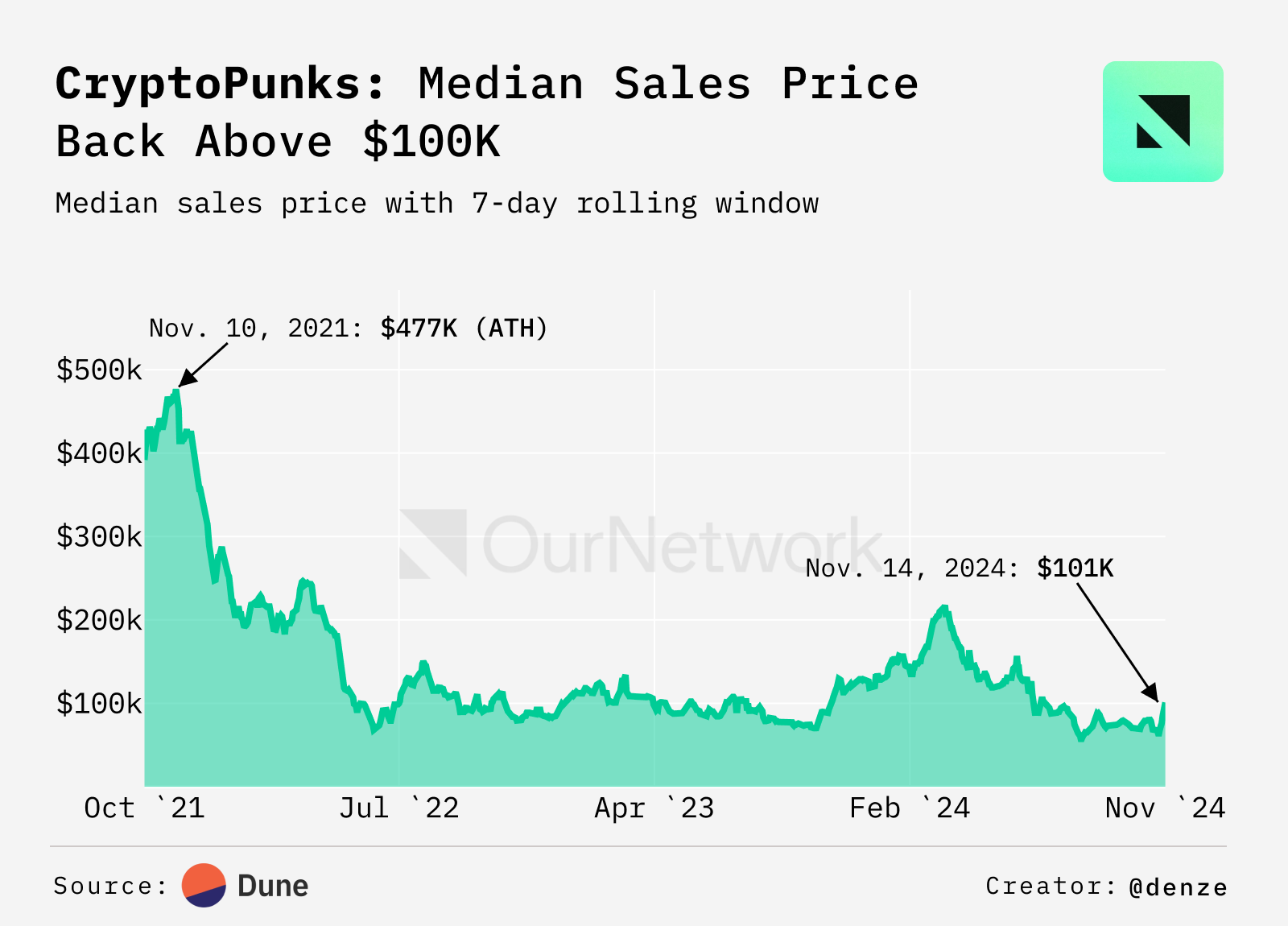

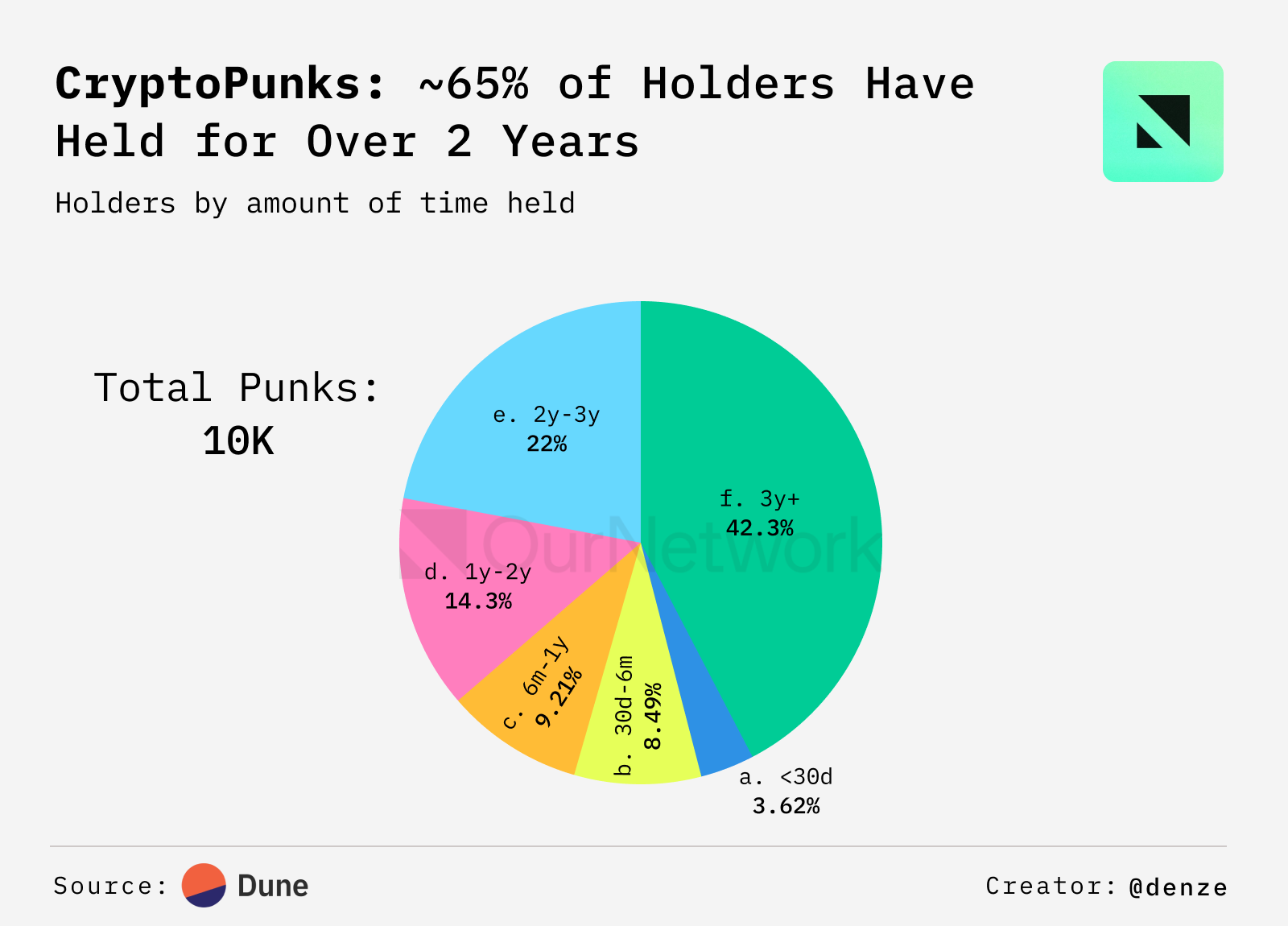

As the first iconic Non-Fungible Token (NFT) collection, CryptoPunks, based on 10,000 pixel-style characters, pioneered the PFP (Profile Picture) movement. Despite their price continuing to decline relative to ETH since 2021, CryptoPunks are still viewed as a cultural symbol and have maintained a high retention rate among collectors. Data shows that around 65% of holders have owned their NFTs for more than two years, and 59.3% of holders have never sold. This indicates that CryptoPunks holders tend to be collectors or long-term investors rather than short-term NFT speculators looking to profit from frequent trading.

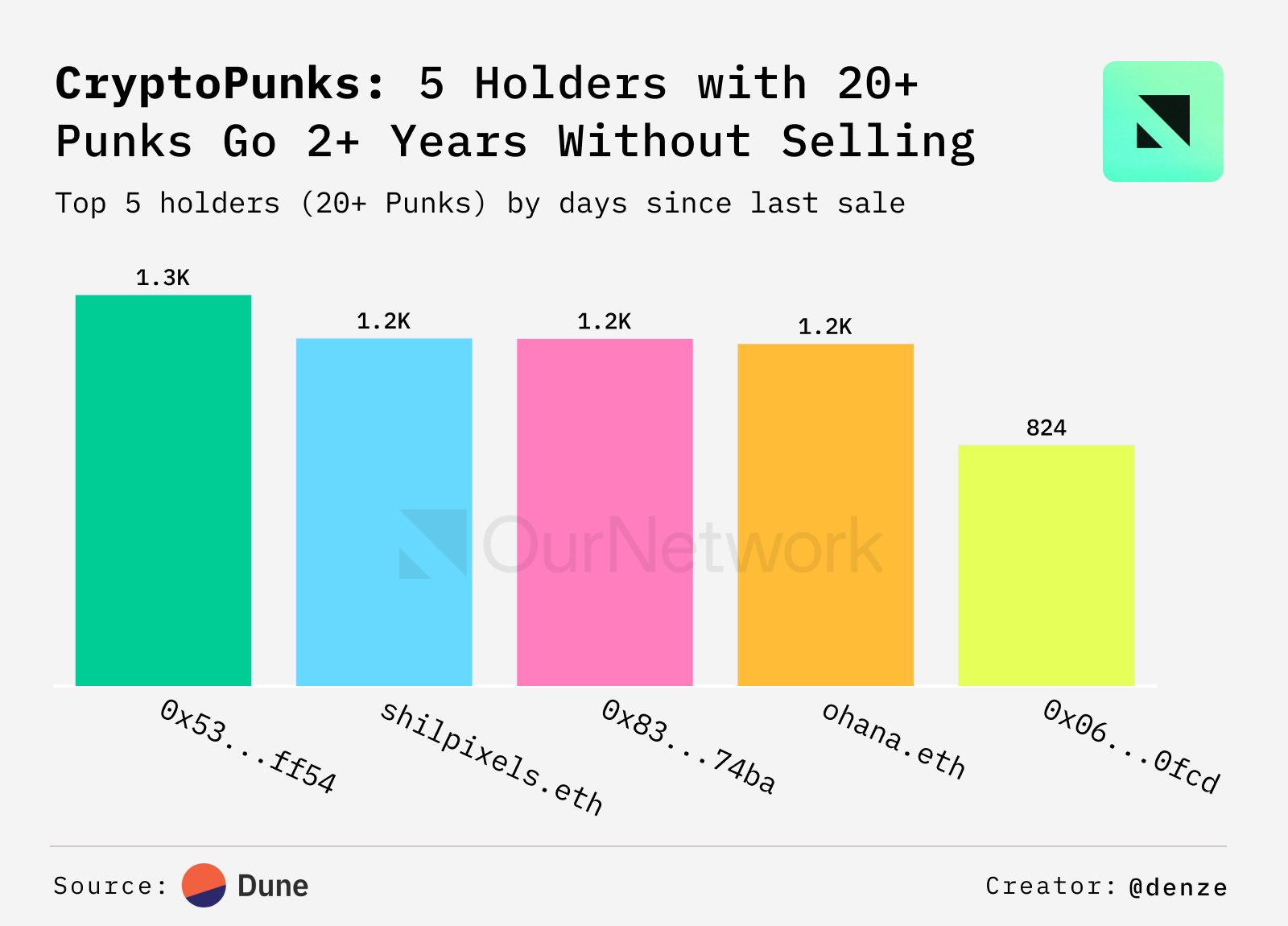

The data also shows a high level of loyalty among CryptoPunks holders. For example, 12 wallets hold more than 20 CryptoPunks for over 600 days, and 5 wallets have held them for over 1,000 days without any sales. This reflects the holders' confidence in a price rebound and their preference for long-term holding, as well as their recognition of the cultural value of CryptoPunks.

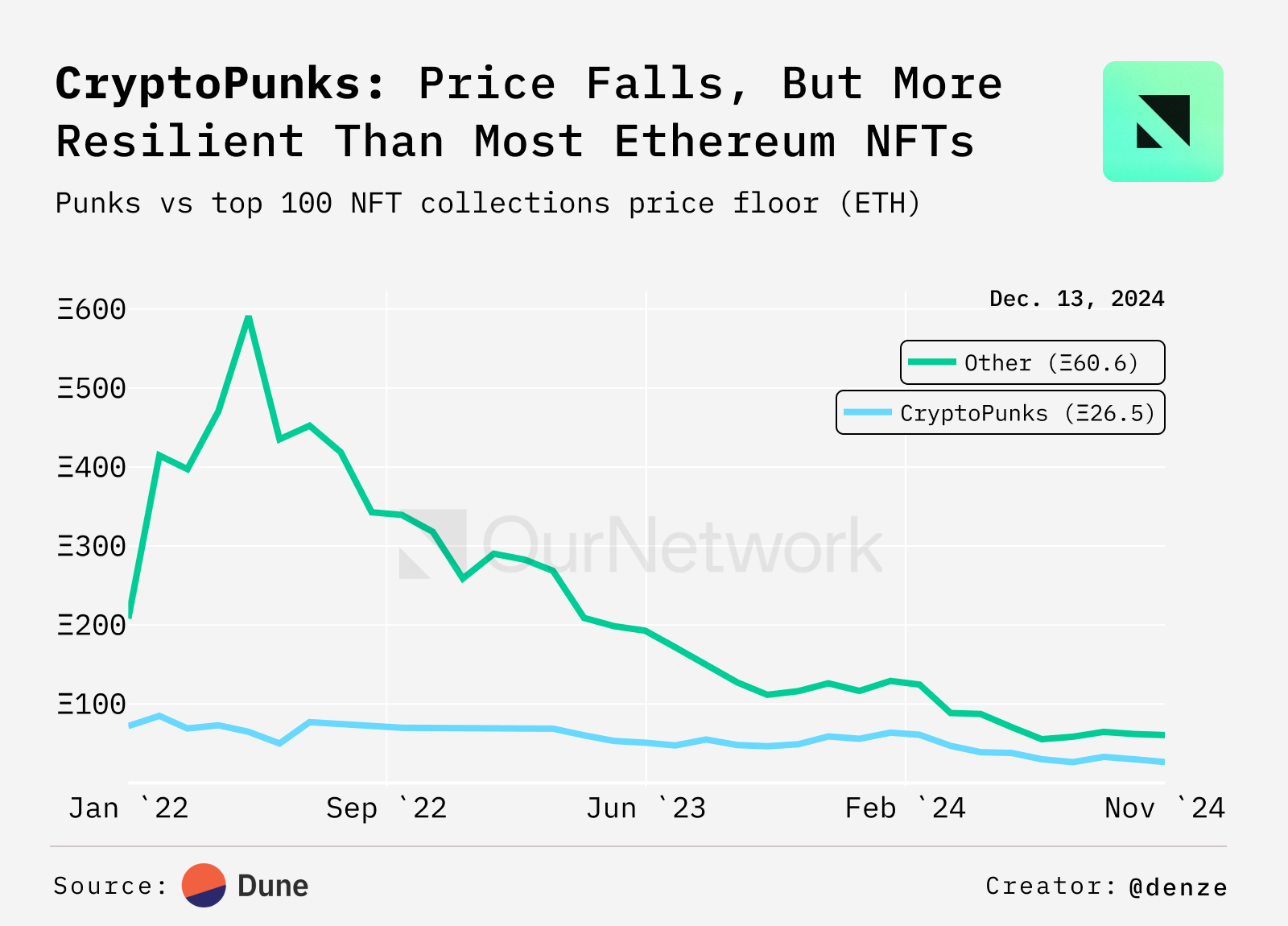

Since May 2022, the floor price of CryptoPunks has dropped from 65 ETH to 27 ETH. In comparison, the combined floor price of the top 100 Non-Fungible Token (NFT) collections on Ethereum has declined from 591 ETH to 61 ETH. CryptoPunks have shown stronger resilience against the overall decline in the NFT market, indicating that their holders are more focused on long-term value than short-term speculation compared to other major collections.

Transaction Spotlight: The largest CryptoPunks transaction in history occurred on February 12, 2022, when Punk #5822 was sold for 8,000 ETH (worth over $23 million at the time, now worth over $31 million). The second-largest transaction took place two years later, in March 2024, when Punk #7804 was sold for 4,850 ETH. While the current bull market has reignited interest in Non-Fungible Tokens (NFTs), it remains to be seen whether market demand can quickly surpass the record-breaking transaction amount of Punk #5822, which is about 65% higher than the second-largest transaction earlier this year.