Jessy, Jinse Finance

The day of Trump's inauguration is getting closer. He has also nominated members of the cabinet for the new administration that he favors. It is undoubtedly the case that Trump, as well as some of the cabinet members he has nominated, are crypto-friendly.

It is precisely due to the crypto-friendly policies of the Trump administration, coupled with interest rate cuts in the US, that the crypto industry has officially entered a bull market.

For example, as the WLIF project, which is highly associated with the Trump family, continues to buy tokens such as AAVE, LINK, and ENA, these tokens have seen very impressive gains.

The upcoming market trend has also become very clear. As the US regulatory framework for crypto becomes more defined, DeFi-related projects will be one of the main themes of the next bull market. The continuous investment of the Trump family's project in DeFi projects is also a manifestation of this trend.

In terms of policy, the "21st Century Financial Innovation and Technology Act" is likely to be passed. After the passage of the bill, it will clearly define when cryptocurrencies are commodities or securities. If the bill clearly defines relevant tokens as decentralized and functional, they will be treated as digital commodities and not subject to SEC regulation, and they can be exempted if they meet the centralization requirements. This will encourage DeFi projects to evolve towards greater decentralization. Moreover, the bill requires the SEC and CFTC to study the development of DeFi, assess its impact on the traditional financial market and potential regulatory strategies, which will attract more DeFi projects to "return" to the US and promote the prosperity and development of the DeFi market.

It is based on these regulatory changes in the US that DeFi has become an important narrative in this bull market.

So, what projects are Trump, his related projects, and his cabinet members buying and supporting? What does this portend for the future development of the crypto industry?

Trump:

His business involvement in crypto

WLFI:

World Liberty Financial (WLFI) is a crypto project endorsed by the Trump family, which officially launched on September 16, 2024. Trump himself claims to be the Chief Crypto Advocate of the World Liberty Financial project.

Trump's two elder sons, Donald Jr. and Eric Donald, serve as the Web 3 Ambassadors of World Liberty Financial, and his 18-year-old son Barron Trump is the DeFi Visionary of World Liberty Financial.

The whitepaper of the project states that Trump will occasionally promote the project. In return, Trump's companies will receive 75% of the project's revenue.

The project is mainly focused on building lending services, such as a credit account system based on Aave and the Ethereum blockchain, as well as a decentralized crypto trading venue. The project's governance token is WLFI.

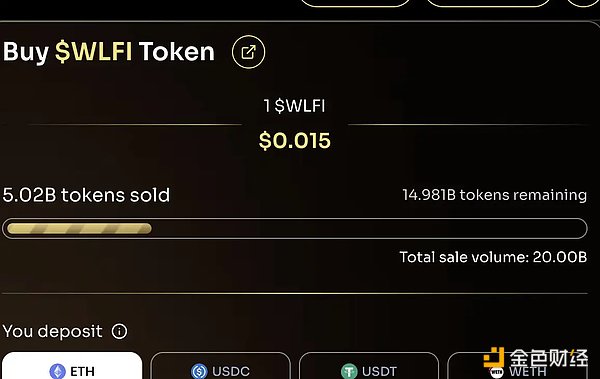

Currently, the project is still in the public sale phase, with 1/4 of the tokens already sold, raising $75 million so far.

WLFI has also been continuously purchasing tokens of other projects. Over the past period, its purchases are as follows:

ETH: Spent $30 million to purchase 8,105 ETH in the past 12 days, at an average price of $3,701.

AAVE: Bought 6,137 AAVE at an average price of $324.

LINK: Bought 78,387 LINK at an average price of $25.5.

ENA: Bought 509,955 ENA at an average price of about $0.981.

Ondo: Bought 134,216 ONDO tokens at an average price of about $1.86.

CB BTC: Purchased 103 CB BTC at a unit price of $97,181.

The tokens purchased by WLFI are mostly DeFi-related projects, which also demonstrates the ambition of the WLFI project. It itself also wants to build an on-chain lending platform, including an on-chain trading platform. The tokens it has purchased cover stablecoins, collateralized lending, RWA, oracles, and Bitcoin-wrapped projects, basically encompassing all aspects of on-chain DeFi.

With Trump's inauguration, as the US regulatory framework for crypto becomes more defined, DeFi will most likely enter a period of vigorous development.

2. Other crypto business layouts

Trump family companies are also actively deploying crypto businesses. For example, the Trump family owns the crypto exchange "World Liberty Finance", and their social media platform "Truth" has submitted an application to create a crypto payment service called "truthfi", and they also plan to acquire the crypto service company Bakkt. These business layouts are all closely related to cryptocurrencies.

Trump's crypto holdings:

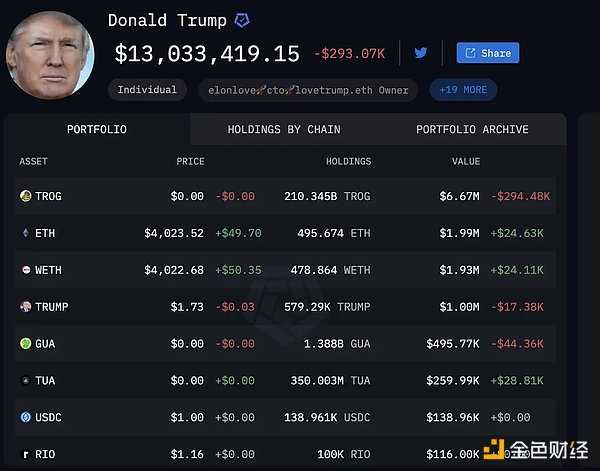

Based on the holdings in Trump's wallet, the token he holds the most is TROG, which is a Meme Coin. ETH ranks second in his investment portfolio, with over 495 ETH worth $1.99 million. In addition, he also holds over 478 WETH, worth $1.93 million.

Some of the Meme Coins in his wallet, such as Trump, are basically airdrops, while the Ethereum is from donations received during the presidential campaign, as well as commissions from the sale of his related NFTs, and also includes some revenue sharing from the sale of WLFI.

Trump's wallet also holds mainstream tokens like Matic, but the source is uncertain.

Politically, Trump wants to make the US a crypto-friendly country, starting with making Bitcoin a national reserve, and then establishing a series of policies and regulations that are conducive to the development of the crypto industry.

And Trump's cabinet members are also generally crypto-friendly, or they hold cryptocurrencies themselves.

Crypto holdings of Trump administration cabinet members

Trump's cabinet includes about 15 cabinet secretaries and some cabinet-level officials, totaling around 20 people.

Among these 20 people, there are at least six who are crypto-friendly, and several of them have publicly stated that they hold cryptocurrencies. These individuals are:

David Sachs

He was appointed by Trump as the White House's AI and Cryptocurrency Affairs Coordinator, and also serves as the Chairman of the President's Technology Advisory Council.

He has a very positive attitude towards crypto. His venture capital firm Craft Ventures has made numerous investments in the crypto space, covering infrastructure, CeFi, DeFi, NFTs and other areas, including projects like dydx and Lightning Labs.

Sachs' position as the White House's AI and Cryptocurrency Affairs Coordinator will help him lead the implementation of Trump's campaign promise to relax regulations on the crypto industry. He will serve as the direct liaison between the crypto community and the White House, as well as the intermediary between Trump, Congress, and federal agencies dealing with digital assets, to promote the formulation and implementation of relevant policies and create a more friendly policy environment for the crypto industry.

According to public information, he currently holds at least Bitcoin and Solana.

Bitcoin: Sachs started investing in Bitcoin in 2012 and has adopted a "set and forget" long-term holding strategy, viewing Bitcoin as a tool to hedge against fiat currency inflation and censorship.

Solana: In October 2021, Sachs revealed on a podcast that he holds a large amount of Solana. Even after the crypto market turmoil caused by the FTX collapse in 2022, he has not sold his Solana holdings and remains confident in its potential to surpass Ethereum.

Robert F. Kennedy Jr.

He was nominated by Trump to be the Secretary of Health and Human Services.

He believes that cryptocurrencies are a good way to hedge against inflation, and he thinks Bitcoin is the "perfect base currency". He wants the US to become the global center of cryptocurrencies, and has proposed a series of policy suggestions, such as exempting Bitcoin-to-USD conversions from capital gains tax, and using Bitcoin and other hard assets to back the US dollar. He also plans to promote budget transparency by putting the entire US budget on the blockchain, so that every American can view budget items at any time to prevent corruption and misuse of funds.

According to the disclosure, the Kennedy family trust holds between $100,000 and $2.5 million worth of BTC, and the candidate himself purchased 21 BTC during the campaign and bought 3 BTC for each of his children, demonstrating his support for cryptocurrencies through actual investment.

Wilbur Ross

Nominated by Trump to be the U.S. Secretary of Commerce, if confirmed, he will also be directly responsible for the work of the U.S. Trade Representative's Office.

He believes that BTC has values such as decentralization, and is the only asset that cannot be deprived by anyone, and he also advocates that BTC should be treated as a commodity, similar to gold and oil.

Ross is a staunch supporter of the stablecoin Tether, and his company Cantor Fitzgerald not only holds undisclosed shares in Tether, but also manages Tether's vast reserve assets, most of which are in the form of U.S. Treasuries.

On July 27, 2024, at the Bitcoin 2024 conference in Nashville, Tennessee, Ross announced the launch of a $200 million BTC lending program to provide leverage for BTC holders.

Tulsi Gabbard

Nominated by Trump as the Director of National Intelligence.

In 2019, Tulsi Gabbard signed a bill aimed at preventing the U.S. Securities and Exchange Commission from regulating cryptocurrencies, believing that the bill would protect investors, promote innovation, and bring more diverse business opportunities to her region, driving the development of the U.S. digital economy.

In 2023, Tulsi Gabbard publicly criticized the Biden administration's exploration of a central bank digital currency at the Bitcoin 2023 conference, believing that a central bank digital currency would record transaction information and increase the risk of surveillance of ordinary Americans, thereby threatening the freedom and economic autonomy of the people.

She emphasized that BTC, as a decentralized cryptocurrency, has the characteristic of being immune to manipulation by third parties, and can retain the privacy and freedom of cash transactions in the digital world, and therefore believes that cryptocurrencies such as BTC have a positive significance for social development.

According to public documents from December 2017, she held ETH and LTC worth between $1,000 and $15,000, but it is unclear whether she still holds them.

Summary

As the first U.S. president to openly support the crypto industry, Trump not only actively or passively holds crypto assets, but his business empire is also actively involved in the crypto field. From the early days of selling NFTs to the current DeFi projects and the acquisition of exchanges, Trump's participation in the crypto industry is becoming deeper and deeper.

Not only has he delved deeper into the crypto industry in the business sector, but after becoming president, the U.S. strategic BTC reserve is highly likely to become a reality, and coupled with his push for crypto legislation, relaxation of regulations, and the establishment of specialized crypto institutions and positions, it can be seen that this will coordinate the relationship between the government and the crypto industry quite well, and will also provide a legal basis and a relatively relaxed environment for the crypto industry to operate.

The cabinet members chosen by Trump are also generally crypto-friendly representatives, and while there is no public information showing that SEC Chairman Paul Atkins holds virtual currency assets, he is a staunch supporter of cryptocurrencies, and it is expected that after he takes office, he will review the many rules and court enforcement actions under Gensler's tenure, and adopt a more moderate attitude towards cryptocurrencies, seeking rule changes aimed at promoting capital formation to create a more favorable regulatory environment for the crypto industry.

Some cabinet members, although their nominated positions are not directly related to the economy, have also clearly expressed their support for crypto. As policymakers, only those who truly hold virtual currencies will formulate truly crypto-friendly policies.

Based on the holdings and the expansion of the crypto footprint of Trump and some of his cabinet members, it can be seen that the U.S. may make quite a few investments in the DeFi track.