The proposal by the Trump administration to establish a US Bit reserve has sparked considerable debate among financial experts, cryptocurrency enthusiasts, and policymakers.

This move aims to legalize Bit as a state-backed reserve asset, and will bring a dramatic change in the US government's stance on cryptocurrencies. Bit, which has long been viewed with skepticism, now stands at the threshold of being widely recognized as digital gold.

From speculation to national strategy... the changing status of Bit holdings

If the US fully integrates Bit, it can position itself as a leader in financial technology, while countering the rise of state-controlled digital currencies like China's Digital Yuan.

However, this policy raises important questions: Could it trigger a global 'cryptocurrency arms race'? Will it energize the creativity of the cryptocurrency ecosystem, or undermine the decentralized spirit of Bit?

According to the reserve plan proposed by US Senator Cynthia Lummis, the Treasury and Federal Reserve plan to purchase 200,000 Bit per year for 5 years, accumulating a total of 1 million BTC, or about 5% of the global supply.

Bill Chen, Chairman of Cipher Capital, told BeInCrypto that "the Bit reserve plan will elevate Bit from a speculative asset to a strategic financial product, fundamentally changing the narrative around Bit."

This change signals recognition of Bit's long-term potential, and is likely to prompt institutional investors to re-evaluate their stance on Bit. The calls for Bit reserves in Russia and Vancouver within 2 weeks suggest this could be the start of a global trend.

For Chen, this goes beyond just an investment strategy. He argues that institutional investors and cryptocurrency firms are likely to see this as a validation of Bit's long-term potential. As a result, the movement of capital towards Bit's digital gold attributes could create a wave of capital allocation to Bit.

This could also have a trickle-down effect on corporate behavior, making Bit a mainstream payment method for business transactions. Bill Hughes, Consensys' Global Head of Regulatory Affairs, believes legalizing Bit as a reserve asset could have a halo effect on corporate Bit adoption.

"If Bit is valuable enough for the federal government to hold on its balance sheet, then it's valuable enough for US corporations. We may see more corporate transactions considering Bit, especially for large-scale deals," Hughes told BeInCrypto.

Will the Bit reserve policy spark a global BTC accumulation race?

US Bit holdings could also have deep geopolitical implications, potentially triggering a global competition for cryptocurrency resources. Gi Kim, Chief Legal and Policy Officer at the Crypto Council for Innovation, views this proposal as a strategic move.

"This is clear evidence that digital assets, particularly Bit, are becoming increasingly important across the market. Just as gold, oil, and other physical assets have been considered strategic asset classes for governments for centuries, digital assets should be viewed as such for our government as well," Kim told BeInCrypto.

While the US considers a Bit reserve, emerging economies are already using cryptocurrencies to reduce their reliance on the US dollar. For example, El Salvador has actively accumulated Bit since adopting it as legal tender in 2021.

Nayib Bukele, the President of El Salvador, has claimed that the Bit adoption could save up to $400 million per year in remittance fees. While some worry this could create international tensions, Kim sees it differently.

"There should be no tension or conflict. As the US takes a leading role in developing appropriate regulatory frameworks, recognizing digital assets can empower individuals and create a more interconnected world," he added.

In the realm of power and influence, the US Bit reserve could counter China's expanding influence through its state-backed Digital Yuan. For example, the Chinese government is allowing the use of Digital Yuan payments in its Belt and Road Initiative, demonstrating China's potential to challenge the dominance of the US dollar in global trade.

"The US must act now to maintain financial leadership. By adopting Bit, the US can hedge against inflation and signal its commitment to innovation in the face of China's digital currency ambitions," Chen says.

However, other experts warn that the US Bit reserve may not fully neutralize the geopolitical influence of the Digital Yuan, as unlike the decentralized Bit, the Digital Yuan is state-backed and seamlessly integrated into China's domestic and trade networks.

Risks and Criticisms of the Bit Reserve

Despite the promises, the Bit reserve plan carries risks. Bit's price volatility raises potential issues, particularly regarding taxpayer exposure. Hughes mitigated these concerns by arguing that Bit's current scale has limited impact on the broader economy.

"For Bit to have a noticeable impact on the US economy, the use of Bit in the economy and its total market capitalization would need to increase much further. Even if the US government were to invest massive capital in Bit reserves, it would not be noticeable," Chen explains.

Another concern is that government intervention in Bit could undermine the spirit of decentralization. Hughes dismisses such concerns by emphasizing that government ownership is not the same as control.

"The purpose of the network is to allow anyone to hold and transact assets. This includes businesses and governments. The US government owning Bit would only encourage broader adoption as a store of value," he said.

Hughes points out that the US Bit reserve plan could pave the way for more crypto-friendly regulations.

"You are seeing the discussion of Bit reserves alongside a commitment by the US to fully open up to Blockchain software development. One does not necessarily lead the other, but they reinforce each other," he concluded.

Development of US Crypto Mining Infrastructure

Furthermore, if countries like China or Russia accelerate their crypto plans in response, competition could intensify in areas like mining and digital infrastructure.

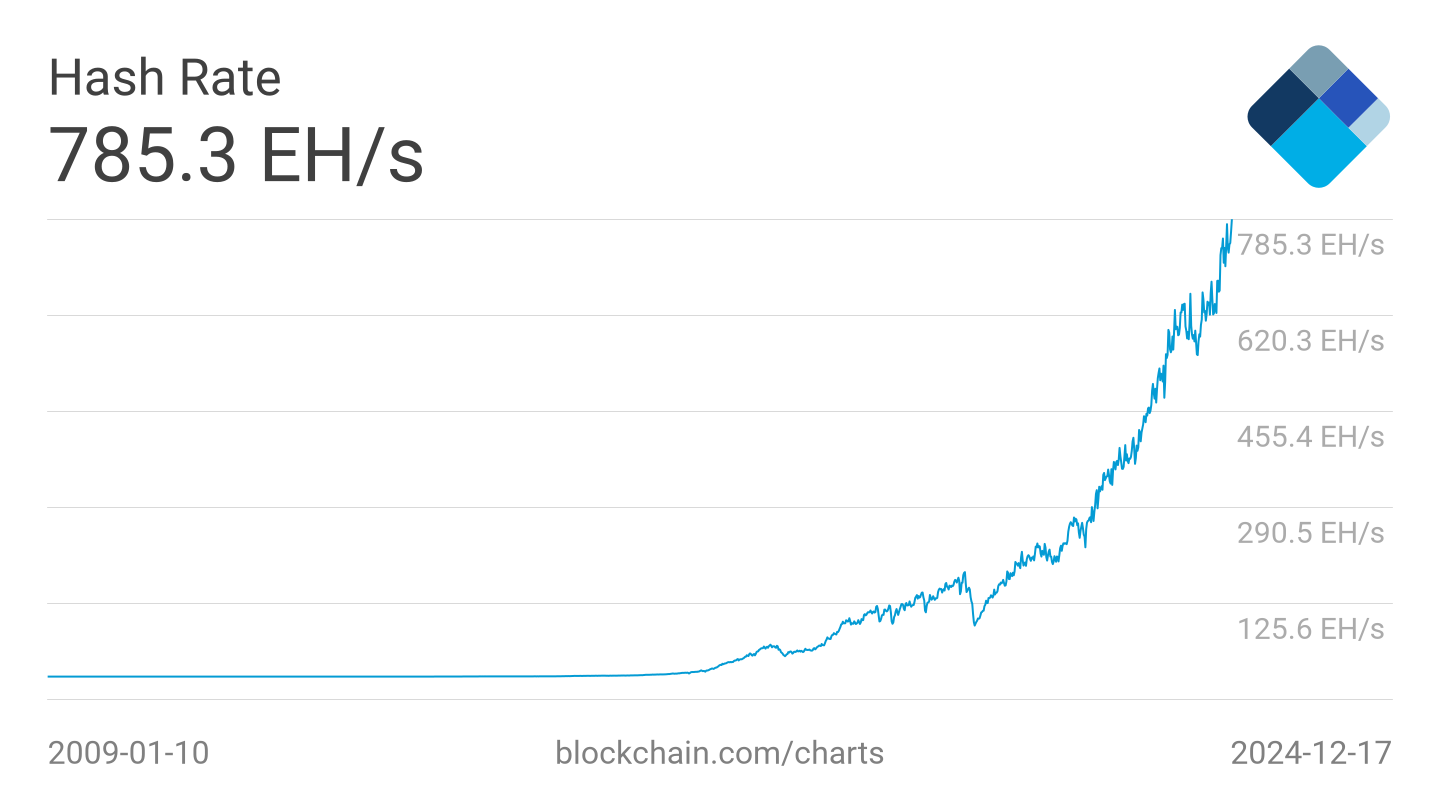

According to a recent JP Morgan report "Bit Mining: An Investor's Guide to Bit Mining and HPC", 14 publicly listed Bit miners in the US control 29% of the network's Hash Rate. Much of this Hash Rate increase has come from Bit miners based in the US, particularly public mining companies. States like Texas have emerged as leaders by leveraging abundant renewable energy for their mining operations.

As of the time of writing, Bit's Hash Rate, a measure of the computing power protecting the network, has reached an all-time high of 785.3 Exahashes per second.

The research argues that the surge in Hash Rate is not solely due to the development of the US mining industry. It is also related to significant activity in other major mining regions, particularly Russia and China. From December, Russia has banned all crypto mining in the occupied Ukraine and Siberia, citing concerns over the local power grid.

"Mining operations can accelerate the integration of renewable energy and hardware efficiency improvements to meet growing demand. Similarly, increased interest in the security and management of large institutional asset holdings will drive the evolution of storage solutions," Qian said.

However, Hughes presents a more sober view. He believes that the market's response to increasing Bit demand, rather than government action, will drive innovation.

"The increase in Hash Rate and energy efficiency improvements can mitigate concerns about the environmental footprint of Bit mining, aligning with broader public policy goals," he said.

Nevertheless, for crypto enthusiasts, the Bit reserve proposal represents the US's vision to lead digital finance and nourish the ecosystem through sound policies. The US could ride the wave of Bit adoption to reshape the future of global finance.

Whether this plan triggers a global crypto arms race or sets a precedent for responsible integration will depend on the execution of the Trump administration and international responses.