Table of Contents

ToggleFOMC Meeting Triggers Market Turmoil

Last night, the FOMC meeting, as expected, lowered the interest rate by one notch to a target range of 4.25% to 4.5%. This is the third rate cut of the year, with a cumulative decline of 1 percentage point, which is within market expectations. However, economists and analysts had already anticipated that the pace of rate cuts next year might slow down, but the Federal Reserve officials' hint that they expect only two rate cuts by 2025 still exceeded market expectations. Additionally, the Federal Reserve also projected that inflation may not return to the 2% target until 2027, later than the previous forecast of 2026.

This series of news has severely impacted the short-term performance of risk assets, with the Dow Jones Industrial Average plunging over 1,000 points, and the S&P 500 and Nasdaq indices falling 2.95% and 3.56% respectively. The US dollar index, on the other hand, surged 1.1% to 108.131.

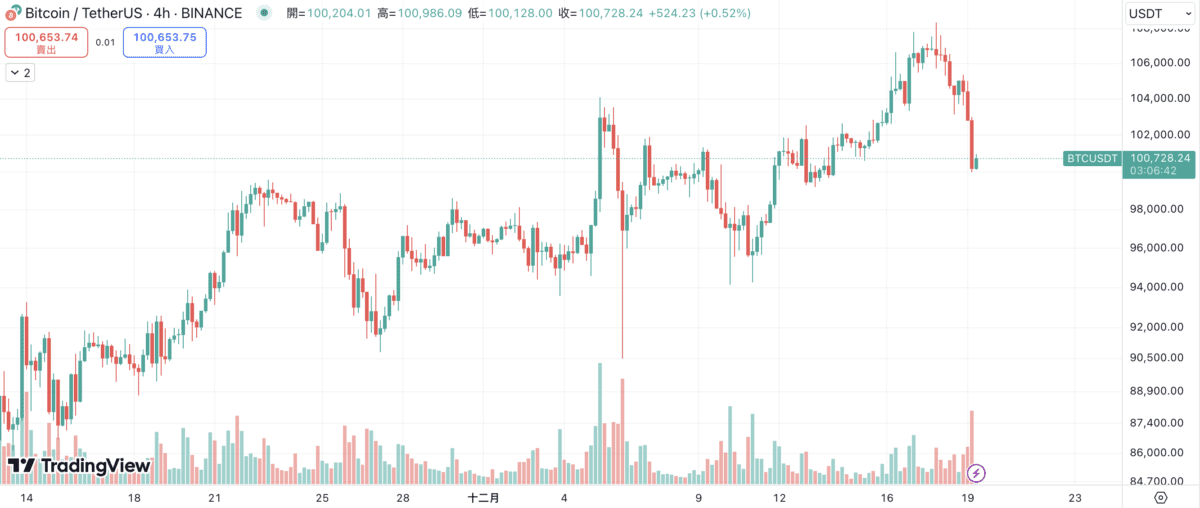

Bit Drops to 100,000 Level

The situation in the cryptocurrency market is even more dire, with Bit plummeting over 5% from yesterday morning's $106,000 level to below $101,000. Additionally, during the post-meeting press conference, the Federal Reserve Chairman Powell was also asked about the issue of Bit being held as a national strategic reserve. In response, Powell stated that the Federal Reserve has no authority to hold Bit. He further emphasized that the legal complexities of holding Bit are a matter for Congress to consider, but the Federal Reserve is not seeking to make any changes to the law. This unfavorable statement about Bit may also be one of the potential reasons for the sharp decline in Bit.

67 Million USDT in Liquidations Across the Network

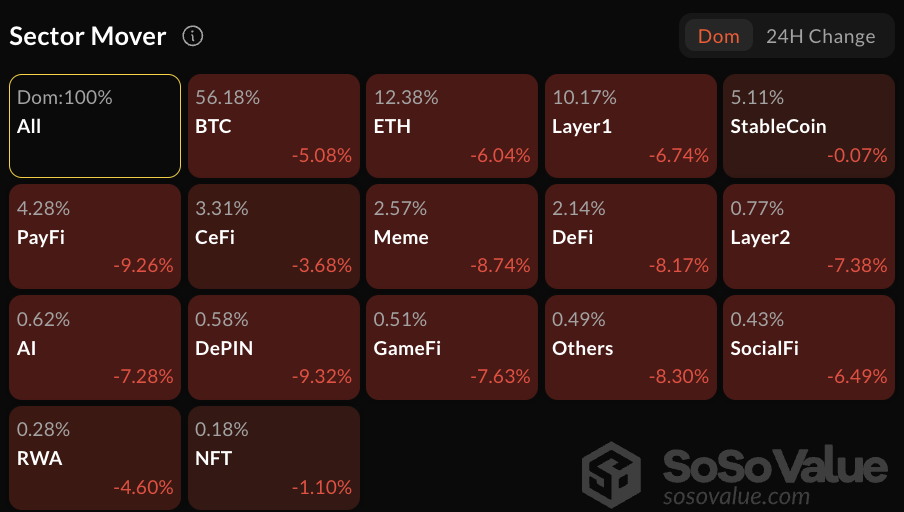

In addition to Bit, the overall market performance has been quite dismal, with data from Soso Value showing that the average decline of most concept sectors is higher than that of Bit, with the PayFi, DePIN, and meme coin sectors experiencing the largest declines.

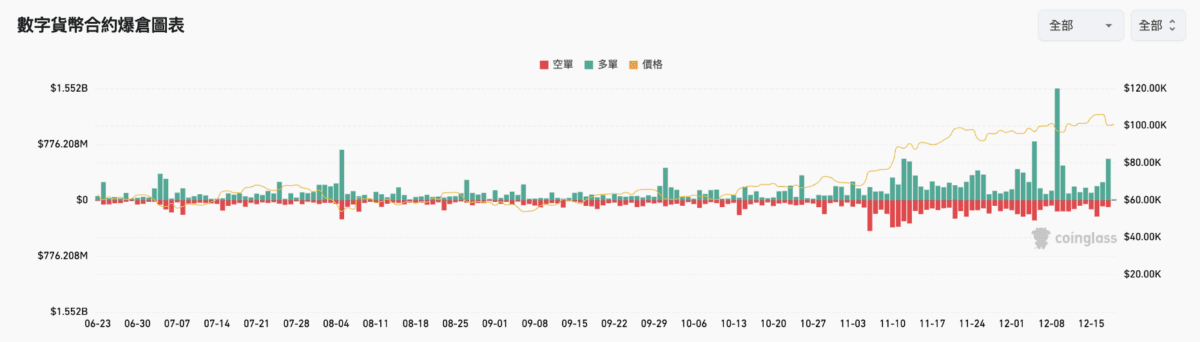

Over the past 24 hours, a total of 67 million USDT in long positions have been liquidated across the market.

(This article is reprinted with permission from GT Radar)

About GT Radar

GT Radar focuses on building long-term, stable-growth quantitative investment portfolios, with over 10 years of experience in stock and cryptocurrency quantitative trading. The trading system integrates over 150 strategies, aiming to provide high adaptability and flexibility to ensure the most robust way of profiting from the market.