The Federal Reserve announced a 1-notch rate cut this morning, as expected by the market. The Federal Open Market Committee (FOMC) voted 11 to 1 to lower the federal funds rate to the 4.25%-4.5% range, with Cleveland Fed President Beth Hammack casting the dissenting vote, advocating for keeping rates unchanged.

The Fed turns hawkish, stocks and cryptocurrencies plummet

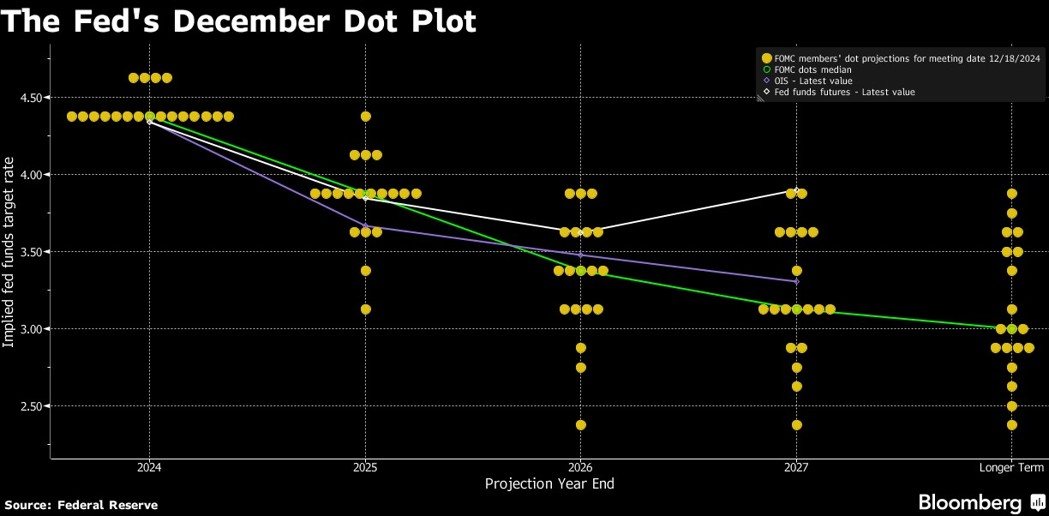

However, the Fed has reduced its forecast for the number of rate cuts next year, signaling that future rate cuts will be more cautious. The new dot plot shows that based on the median forecast, Fed officials expect the benchmark rate to reach the 4% to 4.75% range by the end of 2025, meaning there will only be two 25-basis-point rate cuts next year, fewer than the four expected at the September meeting.

In addition, Fed officials have also lowered their forecast for the number of rate cuts in 2026, with the federal funds rate expected to remain at 3.4% two years from now, higher than the 2.9% expected in September.

The Fed now expects it will take longer for inflation to return to the 2% target, and has therefore reduced its expectations for rate cuts next year. Fed Chair Powell stated in the post-meeting press conference that today's decision was indeed difficult, but the Fed believes it is the right choice, and the next stage is new, with the Fed being more cautious about further rate cuts, requiring more progress on inflation before considering further cuts.

Due to the slower pace of rate cuts than expected by the market, the US stock market plummeted on Wednesday, with the Dow Jones Industrial Average falling more than 1,100 points, the first time it has fallen for 10 consecutive trading days since 1974. The performance of the four major US stock indices is as follows:

- The Dow Jones Industrial Average fell 1,123.03 points or 2.58%, closing at 42,326.87 points.

- The S&P 500 index fell 178.45 points or 2.95%, closing at 5,872.16 points.

- The Nasdaq Composite fell 716.36 points or 3.56%, closing at 19,392.70 points.

- The Philadelphia Semiconductor Index fell 198.81 points or 3.85%, closing at 4,970.98 points.

The seven tech giants also all fell, with Tesla plunging 8.28% the most, and Nvidia falling 1.14% the least.

The cryptocurrency market also experienced a plunge, with Bitcoin falling from a high of $104,800 this morning to below $100,000, reaching a low of $98,960, and currently trading at $99,632, a 24-hour decline of 5.5%.

Powell states: The Fed is not allowed to hold Bitcoin

Powell states: The Fed is not allowed to hold Bitcoin

Additionally, the Bitcoin plunge may also be related to Powell's remarks that the Fed is not allowed to hold Bitcoin, and that the legal issues around holding Bitcoin are something Congress needs to consider, but the Fed is not currently seeking to change the law.

Former US President Trump had previously stated that he would establish a US strategic Bitcoin reserve, but did not provide details on the plan, only mentioning that the US government had seized about 200,000 Bitcoins from criminals, which could serve as an initial reserve. Republican Senator Cynthia Lummis has also introduced a bill to establish a national Bitcoin reserve, requiring the Treasury to purchase 200,000 Bitcoins per year until reaching 1 million Bitcoins.

However, Barclays analysts released a report this week analyzing that funding a strategic Bitcoin reserve would likely require Congressional approval and new US debt issuance, and therefore the bank doubts this plan will face strong opposition from the Fed.