Over the past two years, I have been helping venture capital (VCs) firms find investment opportunities and providing financing support to startups. Starting from early 2023, I officially began building a database on venture capital and startup financing. Initially, this was just a personal management tool, as my real-time interactions with startups and VCs had already given me a good understanding of the market.

However, after reviewing over 1,000 startups in 2024, I believe I have collected meaningful data. With Notion's recent upgrades to data visualization through charts, reviewing this year and seeing what insights my database can provide is undoubtedly the best way forward!

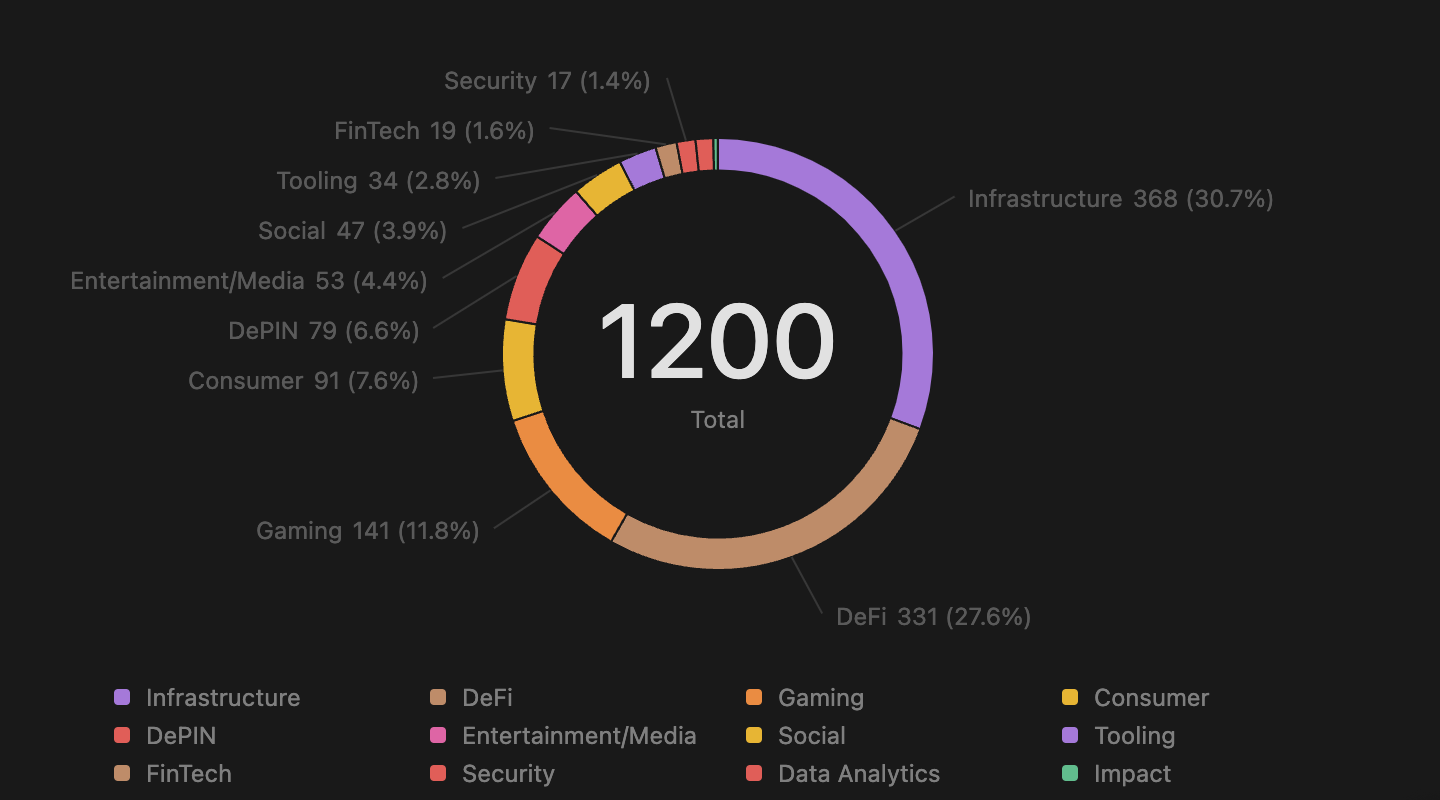

Hot Sectors

Among all the transactions reviewed, infrastructure remains the dominant category for financing, followed by DeFi. Compared to 2023, data analytics and tool startups have declined significantly, while DePIN, gaming, and consumer-facing applications have seen an increase this year.

The reason for this shift in demand lies in market sentiment - as the market recovers and on-chain activity surges, we see increased interest in consumer-facing applications.

Another factor to consider is that the startup costs are relatively higher in certain sectors, not to mention the costs of building hype and a strong community before the TGE. Especially in infrastructure and DeFi, financing needs to account for technical development, liquidity/seed funding, marketing, and business expansion.

Not all startups are suitable for venture capital, as the availability of infrastructure tools now makes it easier to prototype, test, and iterate - a popular way to validate through Telegram mini-apps (more on this later).

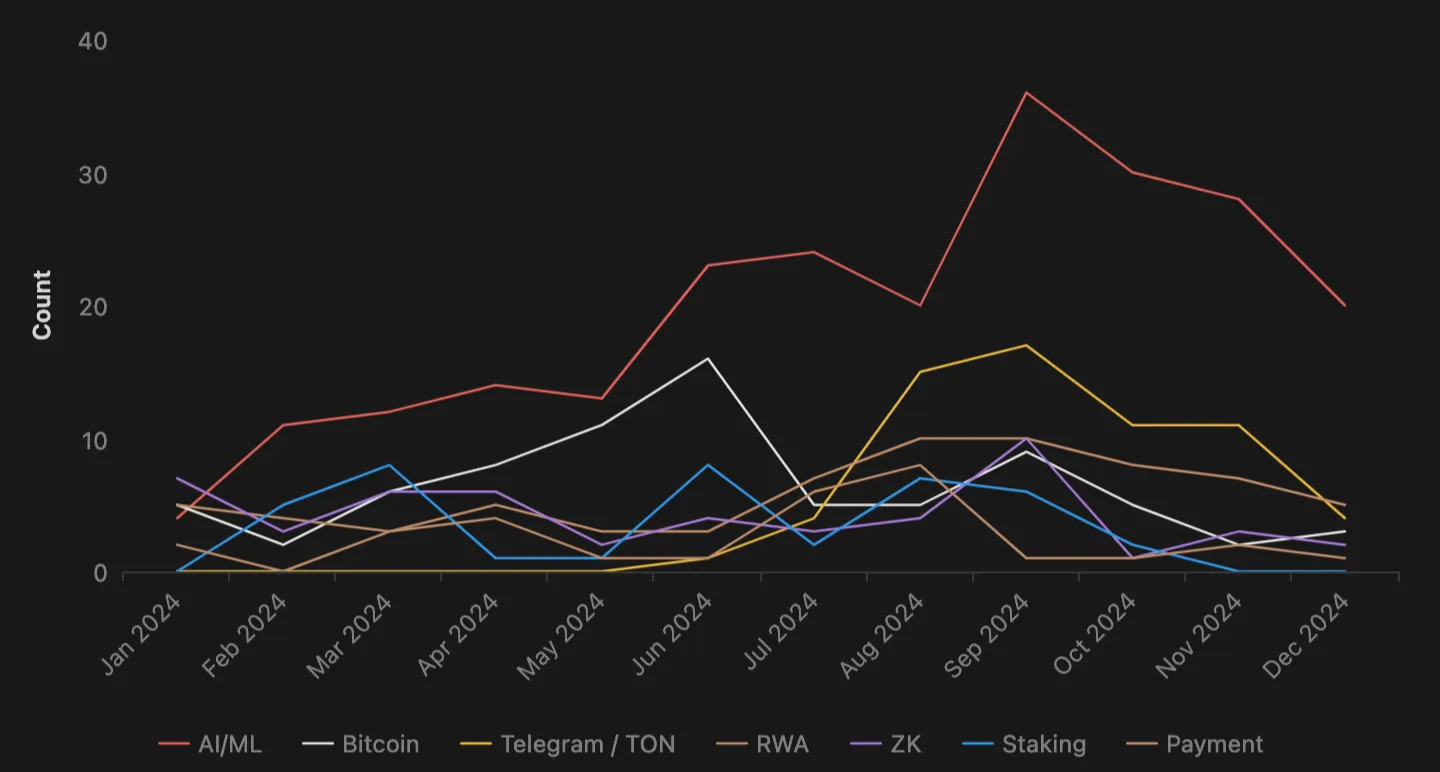

Key Subsectors

As BTC prices rose in Q1, the focus of investment remained on infrastructure, further concentrating on the Bitcoin ecosystem, particularly the increased demand for certain use cases (e.g., staking, cross-chain liquidity). This is reflected in the subsector chart, where the number of startups focused on the Bitcoin ecosystem surged in Q2 as they captured some venture capital attention.

Regarding the market, we often see a correlation between prices (i.e., BTC) and venture capital deployment, which in turn impacts the growth of startup financing and valuations (more on this later).

This increased transaction flow in specific sectors often repeats a pattern of venture capital deployment, similar to the surge in transactions built on the Telegram/TON ecosystem in Q3 2023, which was a reaction to Pantera Capital's investment announcement in May. Telegram has thus become a popular rapid-release platform, helping startups test and validate user demand while building community engagement.

Another area that continues to attract attention and excitement is the intersection of crypto and AI. Transactions in the AI/ML space have continued to increase and maintained a leading position in 2023, attracting not only venture capital interest but also the attention of crypto and non-crypto users closely following the evolving AI landscape.

Another notable phenomenon from these charts is that while the market was relatively quiet and lacked excitement from Q2 to Q3, there was a surge of transactions in September. This was primarily due to the market's anticipation of a bull run towards the end of 2024 and early 2025, with many projects trying to seize the opportunity and launch their tokens in the expected market momentum.

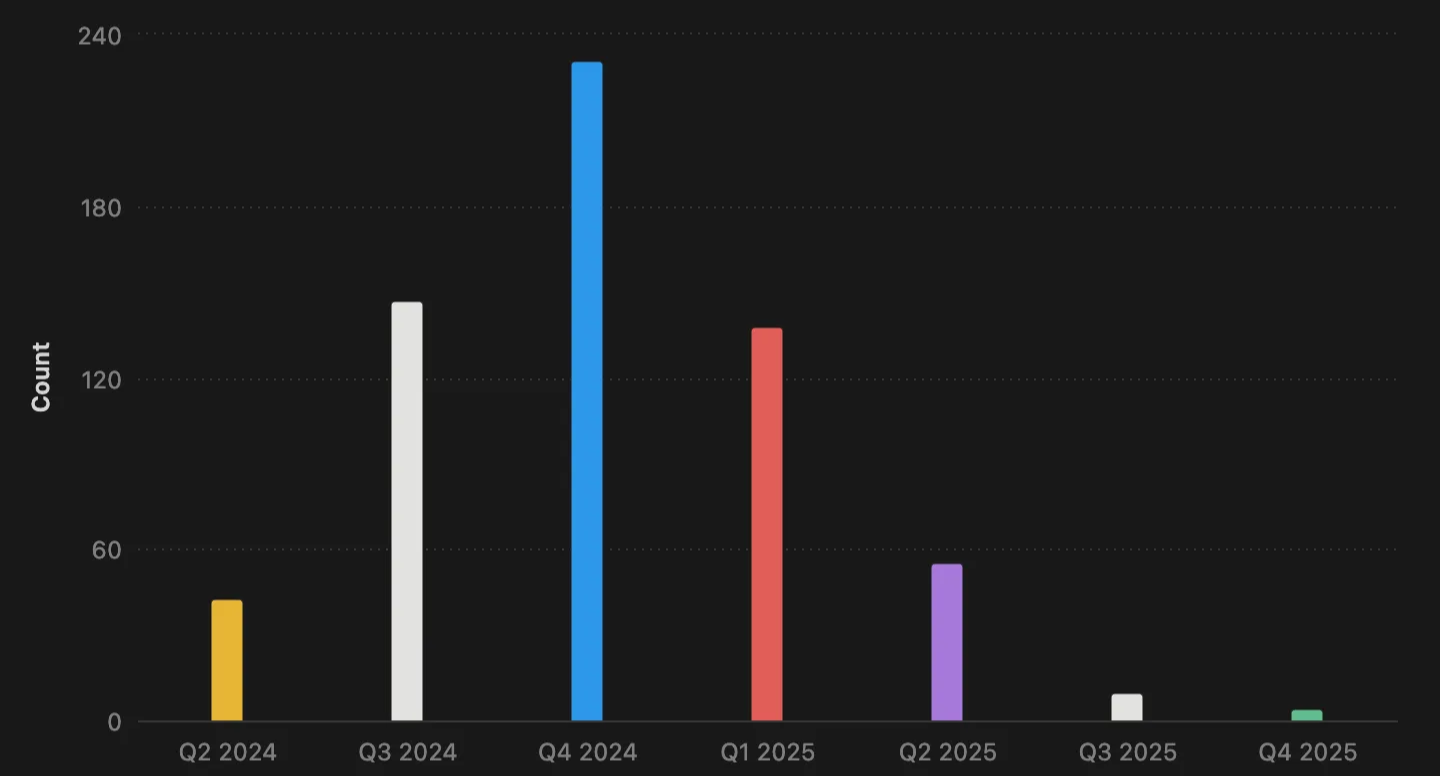

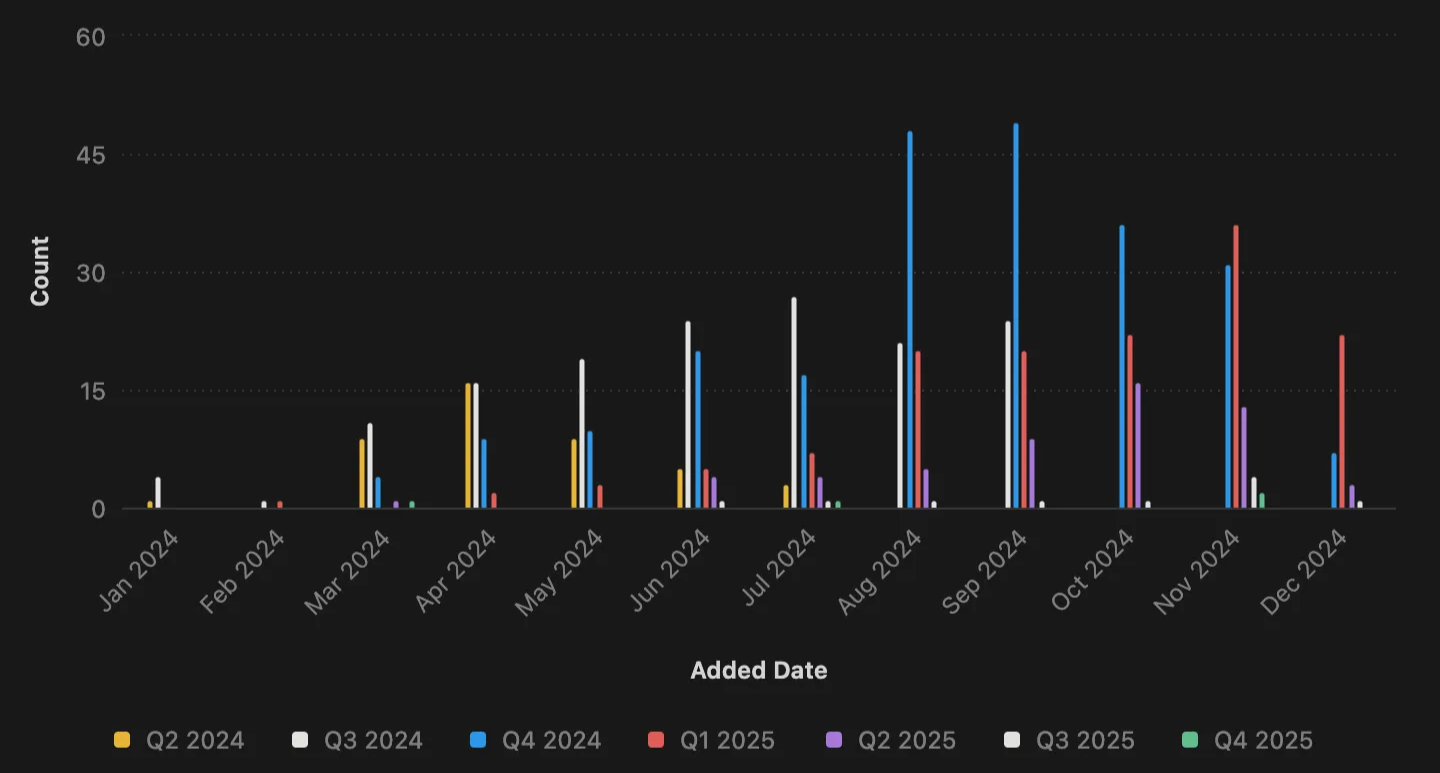

When Do Tokens Launch?

As mentioned earlier, the Q4 2024 is undoubtedly the most popular token launch quarter, followed by Q3 2024 and Q1 2025.

The cost of successfully launching a token is relatively high, requiring efforts to attract community attention and gain exposure through marketing campaigns, as well as strong partnerships, listing partners, market makers, and liquidity providers. This has led many startups to raise funds in private/pre-TGE rounds and KOL rounds to ensure sufficient capital before token launch.

If we review the timing of when startups decide to raise funds before their TGE, assuming "deal inbound" as a proxy for the start date of a round, most startups plan their fundraising rounds a quarter in advance and expect to reach their financing goals by the time of token launch.

Observing the number of open fundraising rounds in Q3 and Q4 2024, you'll notice some transactions planned their TGE in the respective quarters. This is likely because some startups were unable to complete their fundraising targets on time and ultimately had to postpone their TGE date to ensure everything was ready for launch.

Based on my experience working with Web3 startups and VCs since 2022, while there has been a slight increase in venture capital deployment in 2024, it has not fully recovered and has continued a slow recovery in 2023 and 2024. This is also reflected in the earlier observation about the relationship between deal inbound timing and planned TGE dates, where many startups struggled to raise sufficient venture capital and complete their financing, leading to TGE delays.

Valuation Shifts

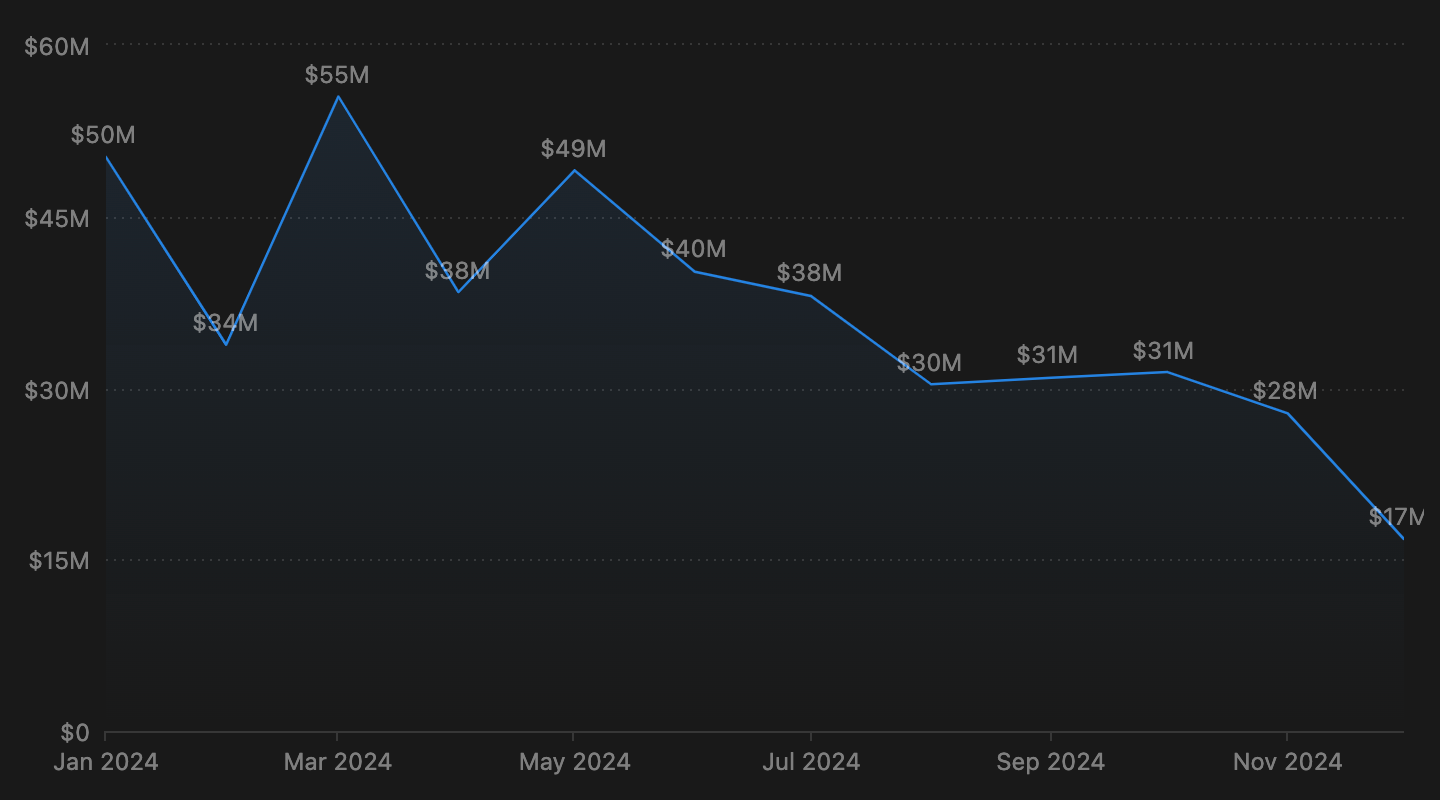

Interestingly, by analyzing the trend in monthly transaction volumes, combined with the trends in venture capital deployment and TGE patterns, as well as changes in market sentiment, I've observed a declining trend in the average valuations of financing rounds over the course of the year.

Average valuations are closely tied to the stage of the round (seed, private/pre-TGE, Series A, etc.), typically reflecting the maturity of the product/business and whether the startup has already raised funding.

In my dataset, approximately 45% of startups are in the seed round, 32% in the private/pre-TGE round, and 19% pre-seed; the remainder include OTC, Series A, and Series B.

The reasons for the decline in valuations may be twofold:

- Venture capital deployment and demand As mentioned earlier, venture capital deployment in 2024 has not increased significantly compared to 2023 (see Galaxy's report), and it is closely tied to market prices (particularly BTC volatility), naturally making it difficult for many startups to raise funds and meet their financing targets as planned.

- Retail investor and market reaction to public token launches Poor market sentiment and the historical trend of overvalued token launches have dampened retail investor enthusiasm. Many feel excluded by venture capitalists who have obtained early-stage discounts, leaving retail investors facing the pressure of buying into high-valued tokens with seemingly unattainable high-return potential. Many projects that launched tokens earlier this year have even failed to maintain their initial launch valuations, with the vast majority of tokens trading at significantly lower valuations post-launch.

In response, startups have begun to adopt lower valuations during their financing rounds to prevent excessively high prices at TGE, in order to restore retail investor confidence and ensure more sustainable market dynamics.

Conclusion

While historical data and patterns can never accurately predict the future, understanding the dynamics and interconnections between the market, venture capital, and startups is still highly valuable, as these three elements are intricately woven together in a delicate balance.

The only guarantee in this industry is that the crypto space will never cease to surprise us - it is truly a "Wild West" full of uncertainties, and we must be prepared for the unexpected.