Author: Presto Research

TechFlow by: TechFlow

Our 2024 Market Review presents a dynamic panorama of crypto markets: Memecoins dominate the top-performing list, while VC-backed tokens underperform. Meanwhile, the rise of Real World Assets (RWAs) as a key theme signals transformative trends that will shape the market in 2025.

Presto Research’s investment thesis has proven to be forward-looking, accurately predicting several of this year’s hallmark trends, including the weak performance of low circulation/high fully diluted valuation (FDV) tokens, the importance of Bitcoin strategic reserves, and the post-election bull run. These trends are still evolving and deserve our continued attention as we look forward to the next market cycle.

Our predictions for 2025 reflect a maturing industry that is poised for growth. Key themes include:

Bitcoin is gaining adoption as a store of value at the sovereign and corporate levels

The United States solidifies its position as a global crypto hub

Wider industry consolidation

We expect major smart contract platforms to continue to make progress, especially in EVM-compatible chains, Solana, and DAG-based networks, while Ethereum will rebound. Decentralized exchanges (DEX) are expected to gain a larger share of trading volume, while NFT trading volume may rebound and transform to more sustainable cultural and economic applications.

Presto Research’s key predictions for 2025 include:

Bitcoin breaks through $210,000

Total crypto market value expands to $7.5 trillion

ETH/BTC Ratio Rebounds to 0.05 as Ethereum Addresses UX Issues

Solana Soars to $1,000

Stablecoin market value reaches $300 billion

DEX trading volume exceeds 20% of centralized exchange (CEX) trading volume

A new EVM L1 public chain reaches a market value of 20 billion US dollars and a locked amount of 10 billion US dollars

A sovereign nation or S&P 500 company will include Bitcoin in its treasury reserves

Crypto Hedge Funds Outperform Crypto VCs

And more predictions!

Chapter 1: Introduction

"Sometimes nothing happens for decades; sometimes decades of change happen in a matter of weeks." It's hard to find a more perfect sentence to describe the development of the crypto industry in 2024. This year is full of major milestones in the industry: the listing of spot Bitcoin/Ethereum ETFs, the debut of IBIT options, the Republican victory brought a 180-degree turn in US crypto policy, the Bitcoin Strategic Reserve Act, the parabolic rise of MicroStrategy's stock price, the takeoff of the prediction market, the strong return of Solana and stablecoins, and the craze of Memecoins, etc., are too numerous to mention.

While most of these milestones occurred in the United States, their impact has spread across the globe, highlighting the U.S.’s thought leadership in the cryptocurrency space. Many countries continue to use the U.S. crypto policy as a benchmark; Hong Kong, for example, quickly followed suit and launched its own spot crypto ETF just months after the U.S.

Against this backdrop, Presto Research is proud to present its first annual report, From Chaos to Clarity: A Review of the Crypto Market in 2024 and a Forecast for 2025. The report reviews key trends and themes in the crypto market in 2024, while providing a forward-looking outlook for 2025.

The report is divided into two parts: the first half reviews the best and worst performing crypto assets this year and highlights the main investment theses we explored in 221 publications. The second half is a collection of predictions for 2025, with each member of the Presto Research team contributing two to four unique predictions. Given the diversity of our team members' backgrounds and areas of expertise, these unfiltered predictions provide a multi-angle view of the crypto market in 2025. We hope that these insights will provide readers with useful thoughts as they form their own opinions. I believe that every reader will find valuable content in the report.

As the crypto industry moves from chaos to clarity, we hope this report can serve as a guide and source of inspiration to help investors, builders, or curious observers navigate the opportunities and challenges ahead. Let’s dive in.

Chapter 2: 2024 Review

2.1 Best and Worst Performing Assets

In a well-functioning market, asset prices can be viewed as a synthesis of the wisdom of the crowd, reflecting narratives, themes, and trends through dynamic changes. Therefore, looking back at the best and worst performing assets in the market can provide valuable insights into past market dynamics. This is exactly what we will explore in the following analysis.

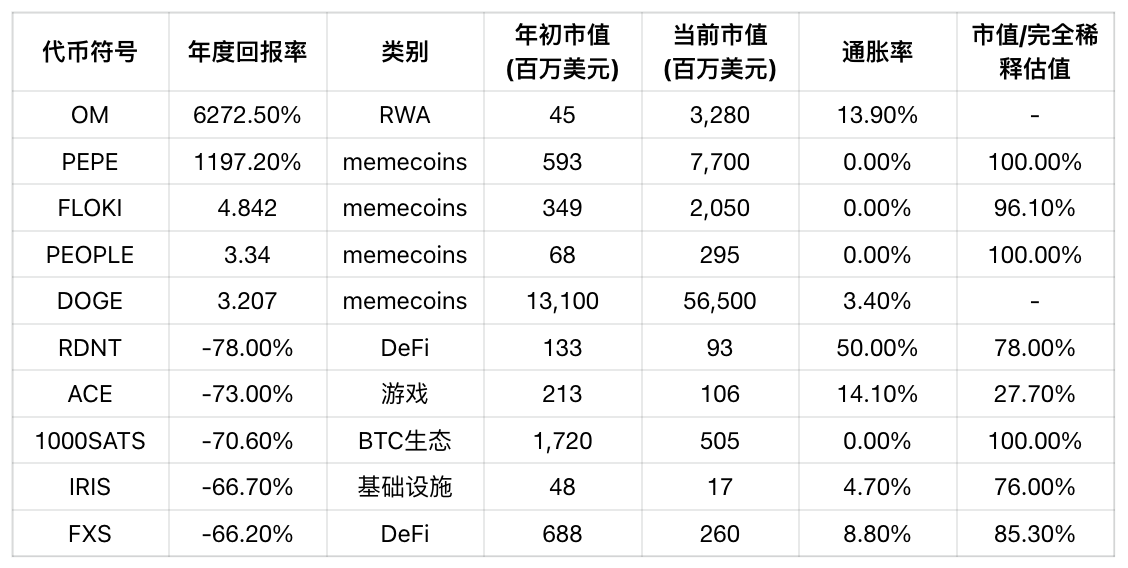

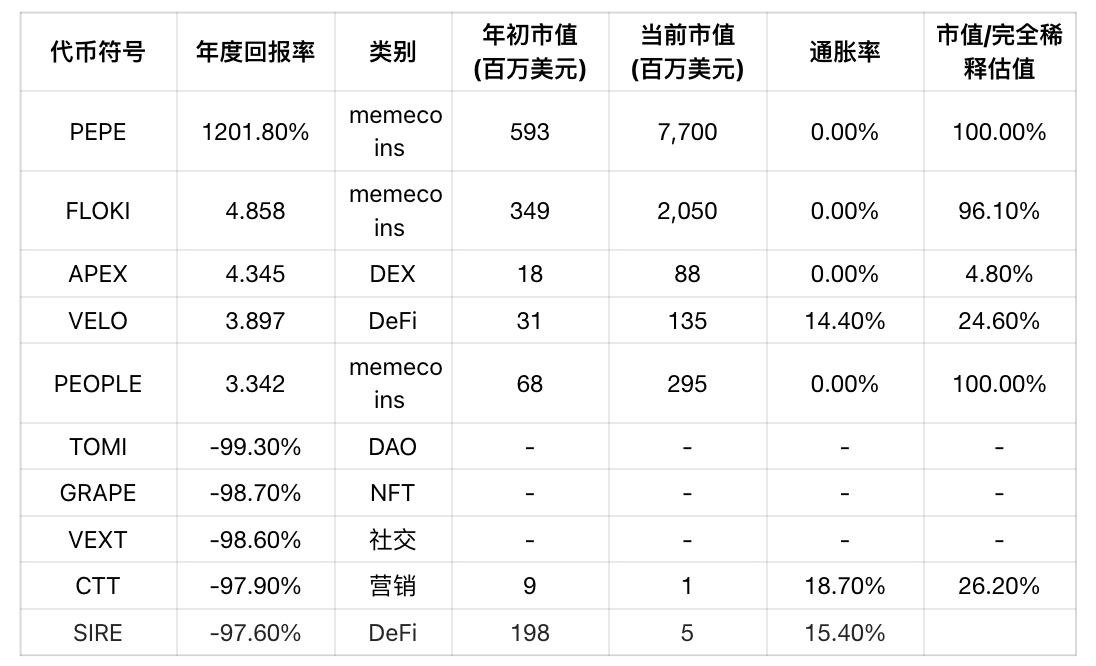

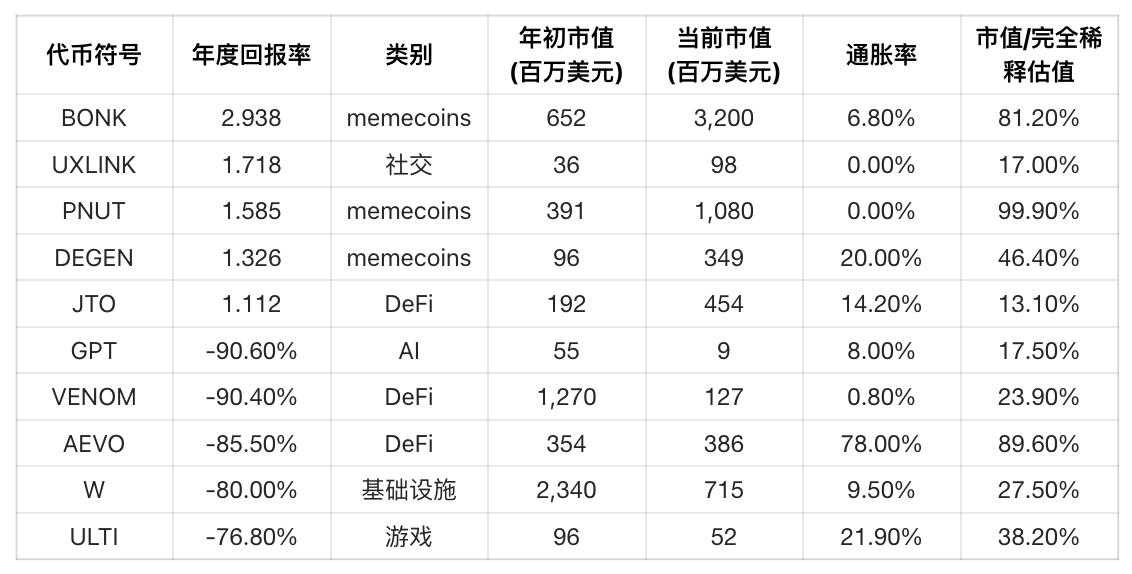

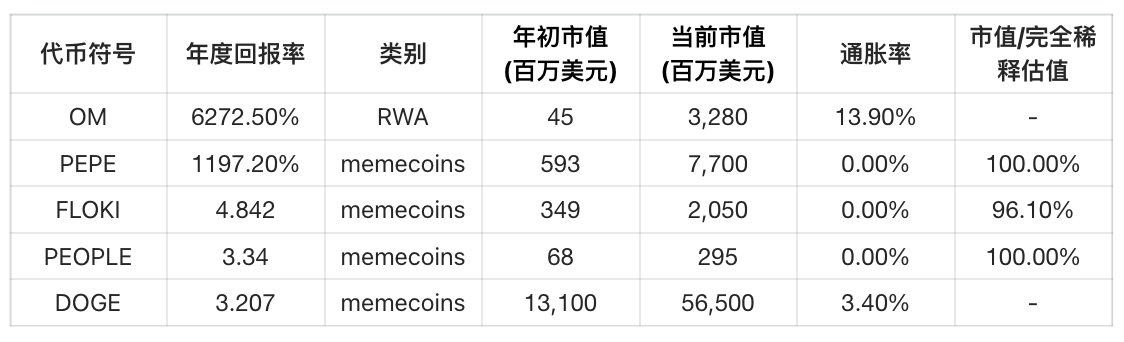

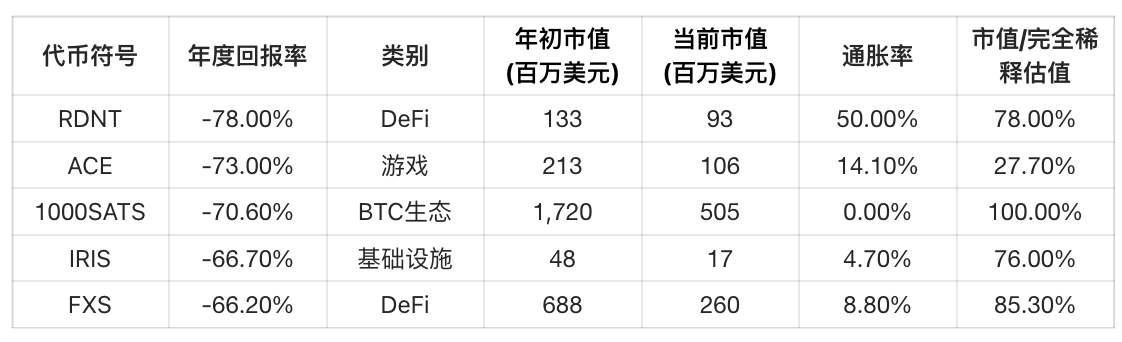

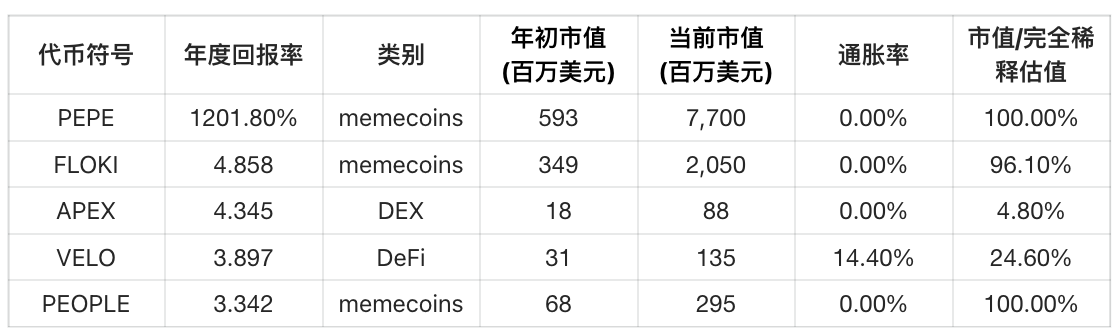

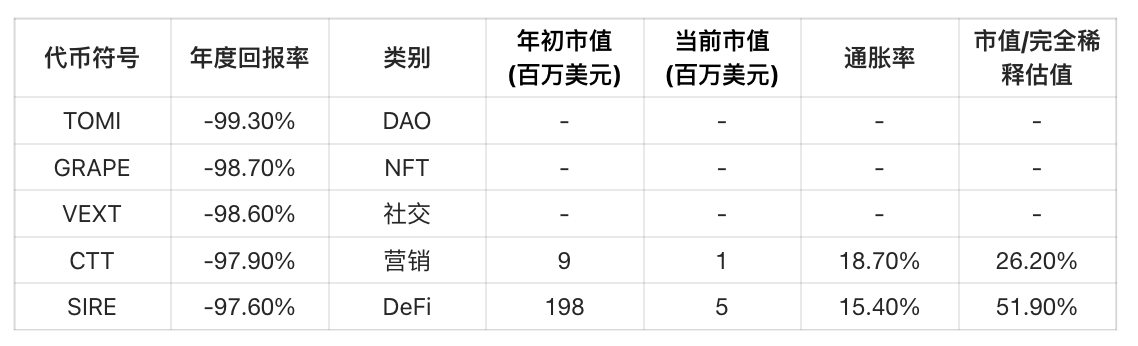

A few points about the research methodology. First, we limited the scope of our research to three major centralized exchanges (CEX): Binance, Bybit, and OKX. Second, we divided the assets into two categories: “newly listed assets” (newly listed in 2024) and “existing assets” (listed in 2023 or earlier). Finally, we screened the top five performing assets and the bottom five performing assets from each of the six subcategories, and the specific results are summarized in Figures 2 and 3.

It is important to note that this study does not cover mainstream assets with large market capitalizations such as BTC or ETH, as assets with smaller market capitalizations usually have more extreme performances. Compared to focusing on these mainstream assets, our analysis focuses more on exploring industry themes or individual projects that may be overlooked. Under this premise, we found the following three key trends: poor performance of VC coins, the craze of Memecoin, the rise of the concept of RWA (real world assets), and the rapid development of decentralized exchanges (DEX).

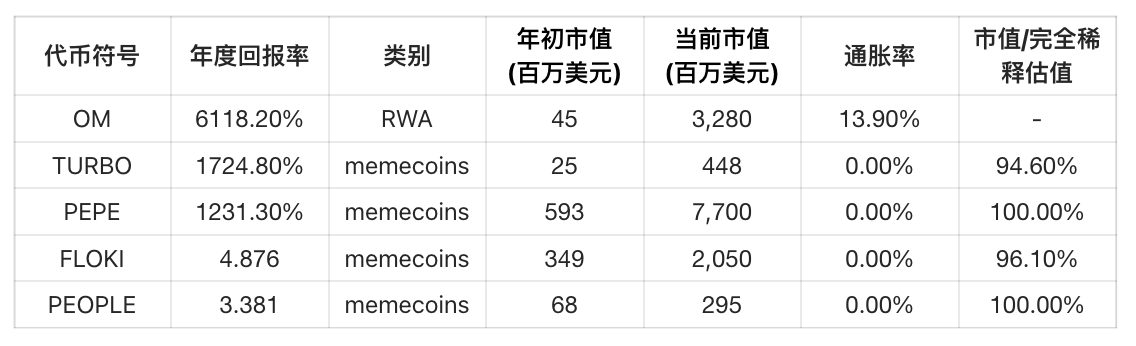

Figure 2: Top five best and worst performing new coin listings in 2024 (data as of November 29)

Binance Performance Statistics

Bybit Performance Statistics

OKX Performance Statistics

Overall performance overview

Overview of the best performing projects

Overview of the Worst Performing Projects

Meme coins performance overview

Data sources: Binance, Bybit, OKX, CoinGecko, Coinmarketcap, Token Terminal, Presto Research

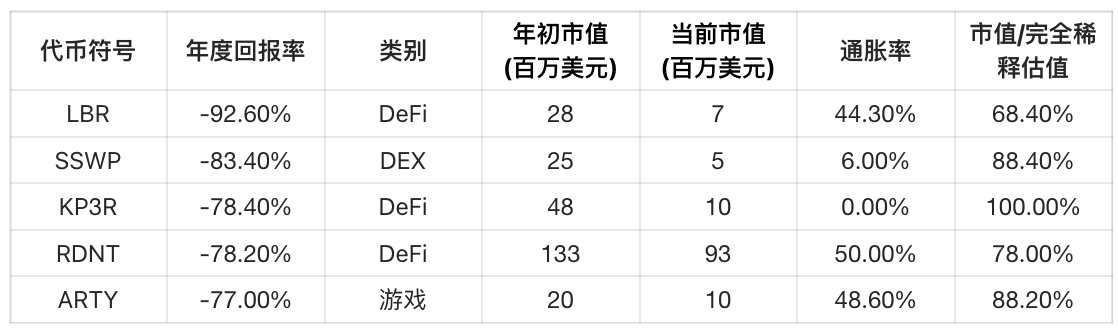

Figure 3: Top five best and worst performing legacy projects (data as of November 29)

Binance Exchange

The five best performing projects

The five worst performing projects

Bybit Exchange

The five best performing projects

The five worst performing projects

OKX Exchange Performance Analysis

The five best performing projects

The five worst performing projects

Overall performance of the best projects

Overall worst performing projects

Meme coins performance overview

2.1.1 Poor performance of "VC coins" (low circulation/high FDV)

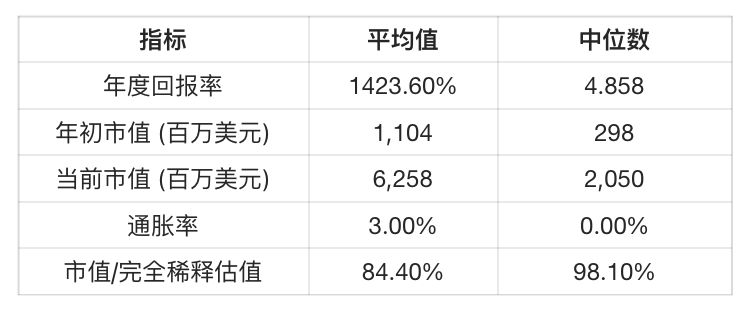

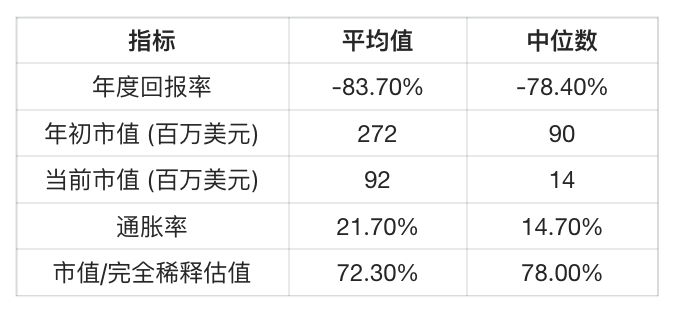

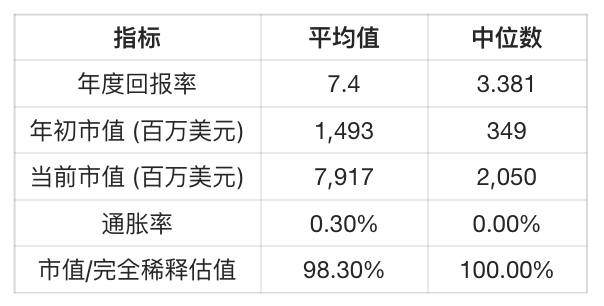

It is clear from the data table that underperforming tokens tend to have the following characteristics:

Higher inflation rates (median of 22% for new listings and 15% for existing listings)

Low turnover rate (median of 30% for new listings and 78% for existing listings)

This trend has become a unique feature of the cryptocurrency market in 2024. While the negative impact of large-scale token unlocking has always been seen as a risk, this year it has become the dominant narrative, and all market participants - exchanges, project owners, and investors - have become deeply aware of this.

We believe that this shift represents a sign of healthy market development and maturity. Simply launching a newly minted asset, no matter how glamorous it looks on the surface or how many well-known venture capital backers are behind it, no longer guarantees that retail investors will blindly follow it. This shows that the strategy of taking advantage of retail investors with information disadvantages as a centralized exchange's exit liquidity is failing. This strategy is a cheap means commonly used by second-rate venture capital, and this situation has lasted too long. We will discuss this further in the "2.2.5 Is FDV just a Meme?" section.

2.1.2 Meme craze

As retail investors increasingly believe that VC coins are "unfair" to them, many have turned to what they believe is a fairer field: Memecoins. This shift has become the main driving force behind the unprecedented boom in the Memecoin field. The prominent position of Memecoins in all six lists of top performing projects highlights their influence.

This trend can be seen as a reflection of the first point above, as Memecoins are often characterized by low inflation and/or high circulation rates - the exact opposite of the characteristics of VC coins. Regardless of whether Memecoins are truly "fair", this narrative is powerful enough to mobilize retail investors in an unprecedented way. As a result, Memecoins have firmly established themselves as a defining feature of the cryptocurrency market in 2024.

2.1.3 RWA project performance surpasses Meme

One project has completely outperformed all others in terms of price performance this year: Mantra (OM). Even the top performing Memecoin in our universe, PEPE (up 1,231%), has come nowhere near the explosive returns of OM (up 6,118%). Mantra positions itself as "a purpose-built RWA layer-1 blockchain that is able to meet real-world regulatory requirements by supporting easy on/off-chain protocols for fiat, equities, and tokenized RWAs." OM serves as the governance token for MANTRA DAO, providing users with access to a rewards program tied to key initiatives and ecosystem development.

Without going into detail about the project’s prospects, its exceptional performance highlights the market’s growing enthusiasm for the RWA theme — suggesting that retail investors believe RWA’s potential could rival or even surpass the appeal of Memecoins.

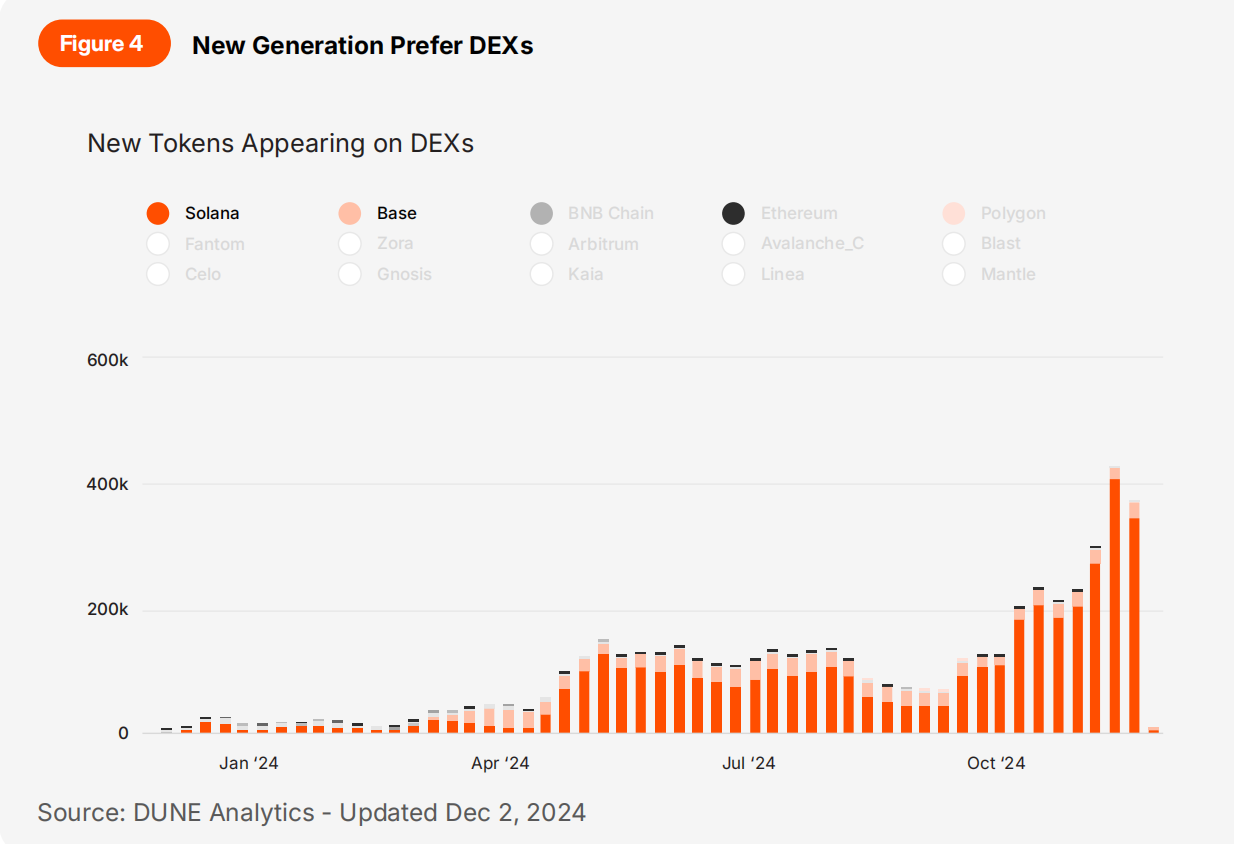

2.1.4 Early Profits Shift to Decentralized Exchanges (DEX)

Interestingly, the returns of existing projects are higher than those of newly listed projects. This seems counterintuitive, as historically new listings are often associated with the beginning of hype cycles. However, this reflects an important new trend this year: DEXs have become the preferred venue for early price discovery before projects are listed on centralized exchanges (CEXs).

Thanks to the improved functionality and user experience of DEX, many projects choose to go online on DEX first. Therefore, the steepest price increases often occur on DEX, and CEX can only capture the later stages of the increase. In the early days of the crypto market, CEX was the absolute dominant place for liquidity provision. However, with the rise of DEXs such as Hyperliquid and Raydium, and the emergence of applications such as Moonshot and Pump.fun, the market landscape has shifted. We will discuss this further in the "3.5.1 DEX Gold Rush" section.

2.2 Presto Investment Theme Review

Many of the investment themes we explored this year proved relevant throughout the year. In this section, we highlight five research articles that have particularly stood the test of time.

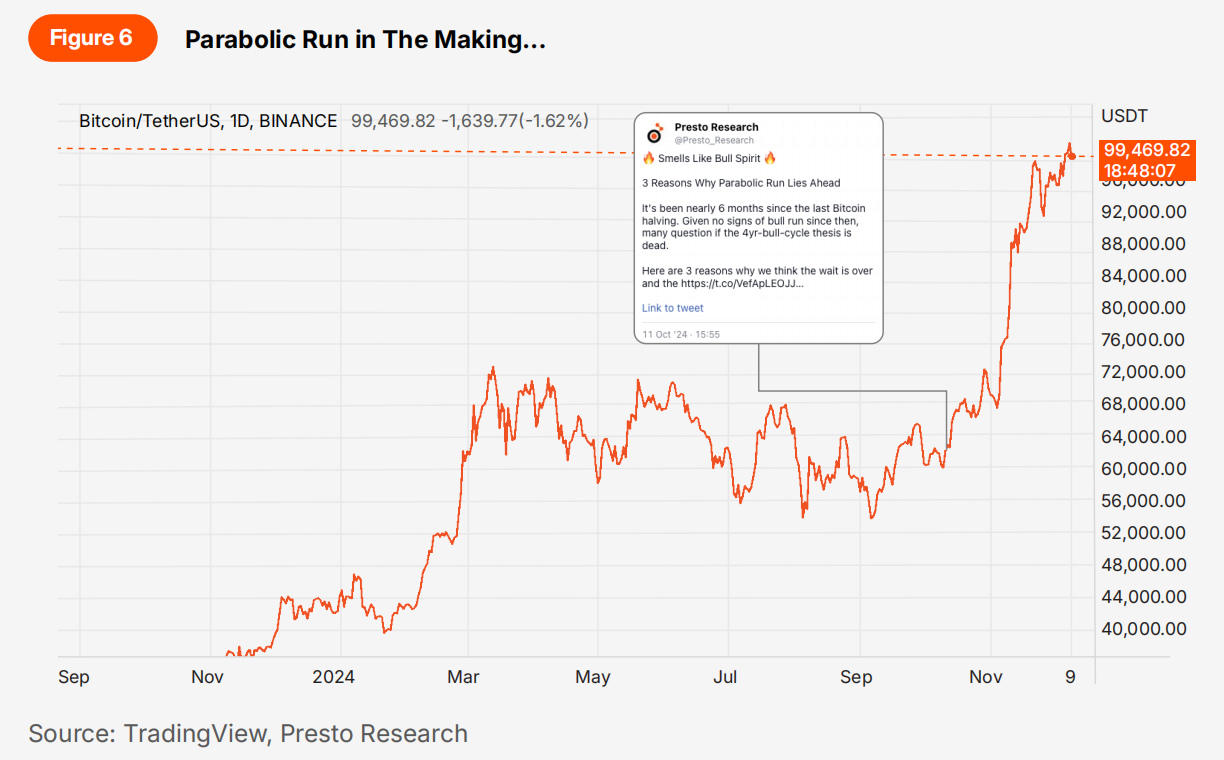

2.2.1 Three reasons why a parabolic rise is coming

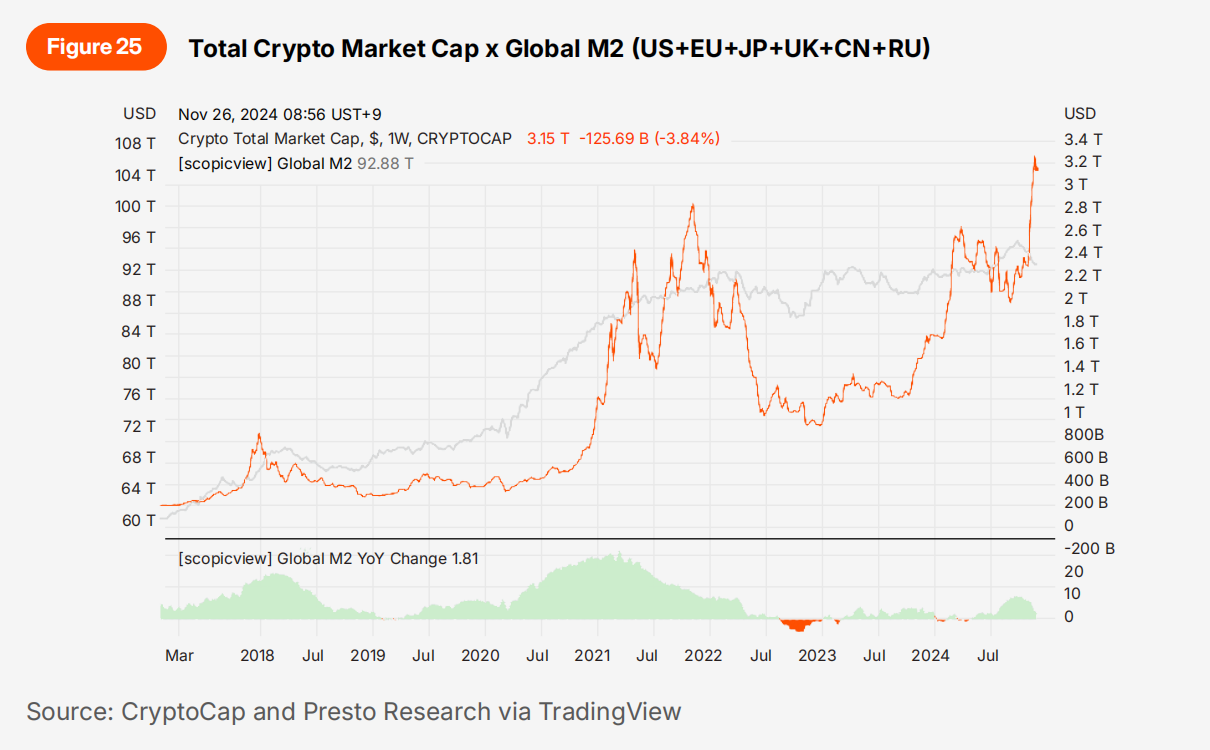

We published our bullish thesis titled "Three Reasons a Parabolic Rise is Coming" on October 11 via X (formerly Twitter), and added more data to support this thesis in our October 25 article. The bullish thesis is based on global liquidity, regulatory friendliness, and low expectations. Since then, Bitcoin has risen 67%, and the development of macro and political events is largely consistent with the assumptions in the paper.

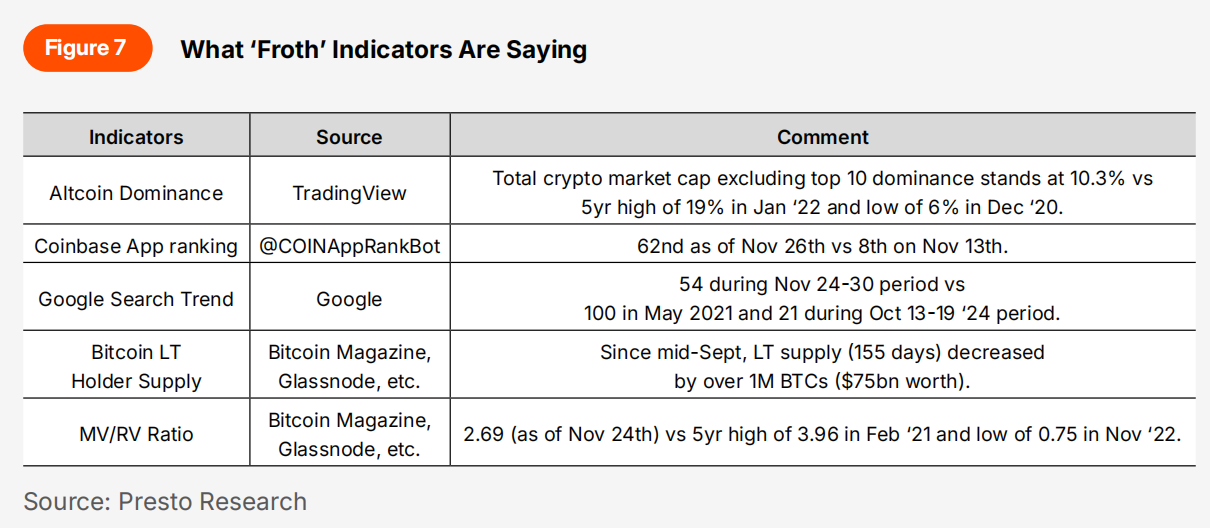

While our thesis still holds, we believe it is important to keep a close eye on the market for signs of short-term over-optimism as Bitcoin prices enter uncharted territory and market expectations continue to rise. Figure 7 summarizes useful indicators in this regard and their current status. It should be noted that this list is not exhaustive.

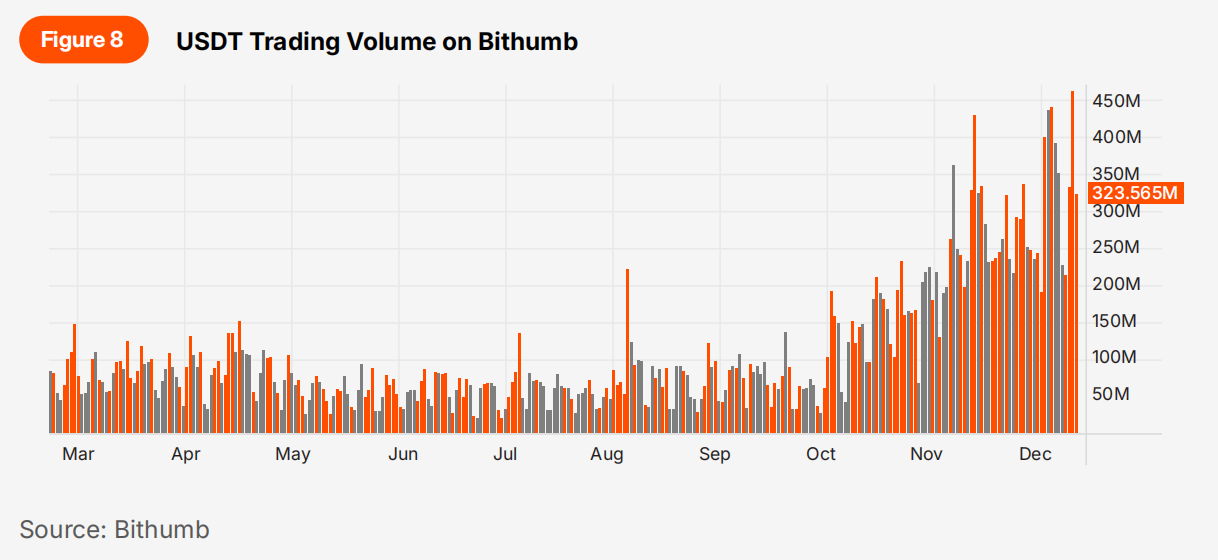

Although the "Kimchi Premium" was mentioned in the original X (Twitter) post as one of the indicators of an overheated market, we believe it is no longer as reliable as it once was. The recent widespread popularity of USD stablecoins on Korean exchanges has allowed price differences to be arbitraged more effectively. This was made clear in Min's X post .

TechFlow Note:

"Kimchi premium" refers to the phenomenon that the price of Korean cryptocurrency exchanges is at a premium to the international market.

"arbitraged away" refers to the elimination of price differences between markets through arbitrage transactions.

2.2.2. Bitcoin options market predictions for election day

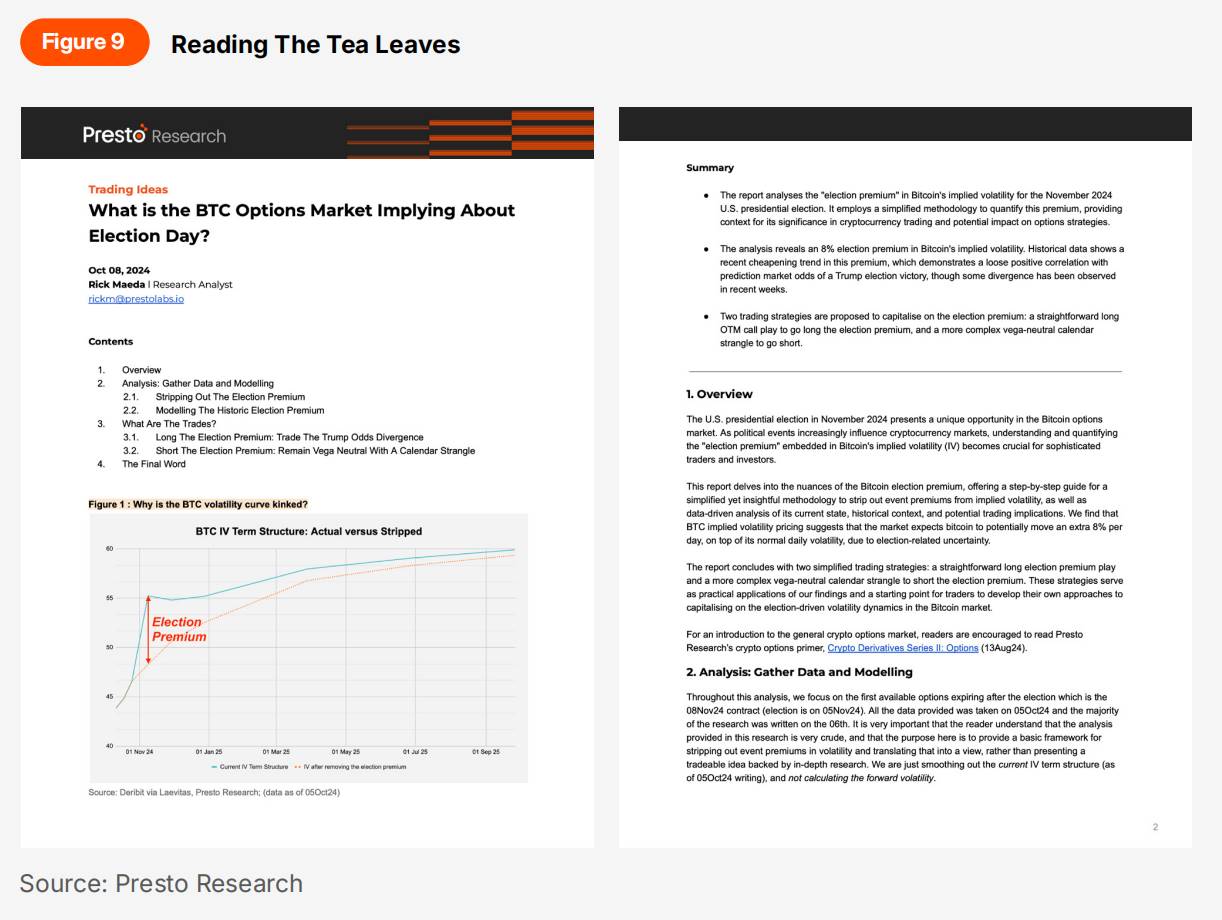

In early October, we published an analysis of Bitcoin’s election premium, finding that options markets expect an 8% increase in daily volatility during the November 2024 U.S. presidential election. However, our analysis concluded that this premium was overestimated, and therefore suggested a calendar straddle strategy: short the election premium while positioning for long volatility in March 2025 in a “vega neutral” (a hedging method to avoid volatility risk).

Post-election data confirmed our judgment. The premium calculated by actual volatility is about 4.8%, which is much lower than the 8% implied by the market in the month before the election. Our recommended trading strategy performed well: the short position of 55k/72k 08Nov24 straddle option lost 0.1653 BTC at expiration, while the long position of 65k/75k 28Mar25 straddle option had a profit of 0.4145 BTC as of December 2, with an overall net profit of 0.2492 BTC.

Recent market changes suggest that now is the time to take profits. First, one of the main reasons we were optimistic about the long-term volatility in March 2025 was the expectation of more Fed rate cuts in that quarter. However, in the post-election macro environment of the Trump administration, interest rate expectations have been significantly adjusted, and the Z4H5 federal funds rate spread has narrowed from -42.5 basis points in October to -20 basis points currently.

Second, the launch of $IBIT options on November 19 brought about structural changes that may have dampened volatility. As Joshua Lim of Arbelos has pointed out, traditional financial options markets often reduce volatility through the provision of structured products. Even the $5 billion note associated with $IBIT could account for a quarter of current Deribit open interest. Academic research supports this view - for example, Arkorful et al. (2020) showed that the launch of SSE 50ETF options in the Chinese market significantly reduced the volatility of the underlying asset, mainly due to improved information flows and increased market efficiency. This effect may be more significant in the Bitcoin market due to its global nature and mature market-making infrastructure.

2.2.3 US Strategic Bitcoin Reserve: Impact Analysis

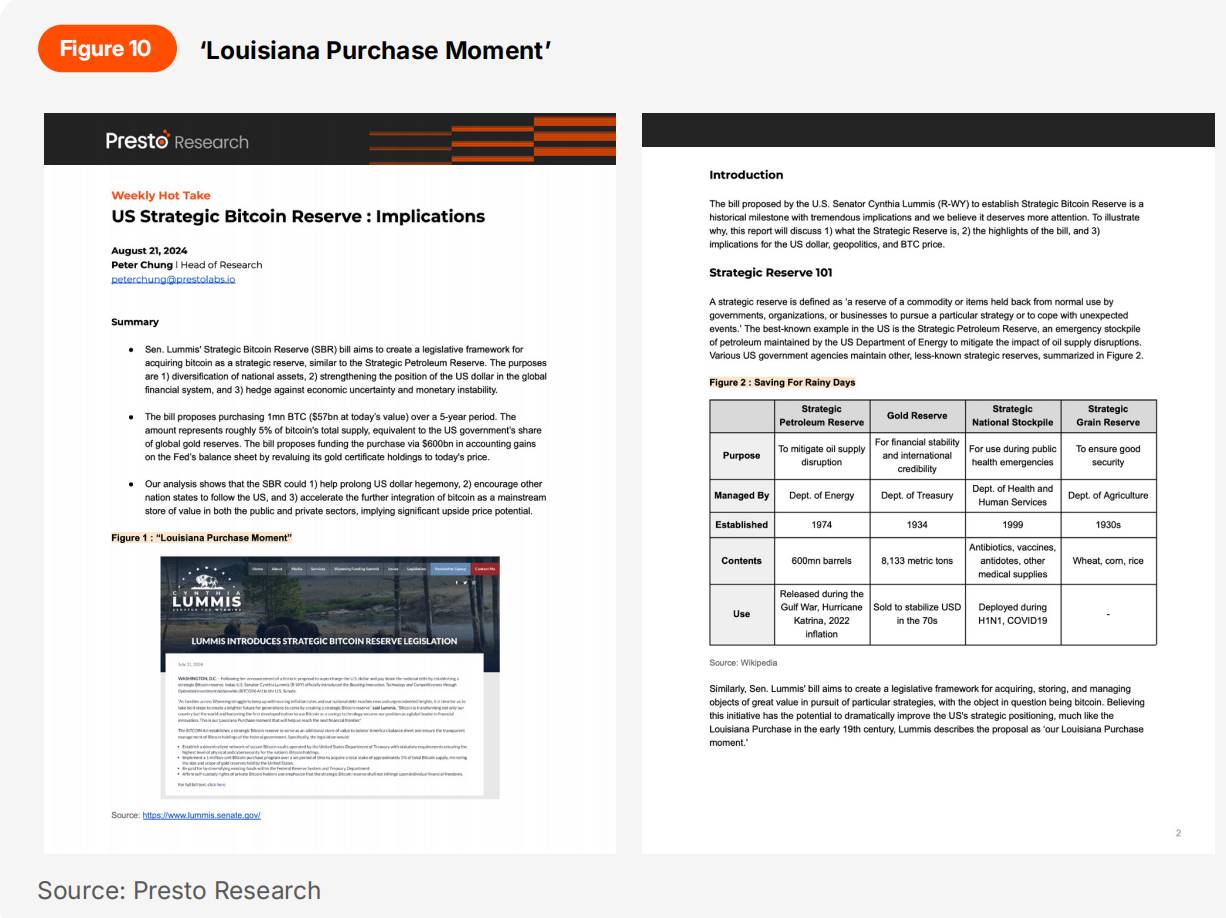

Initially, we were somewhat puzzled by the industry’s muted reaction to Senator Lummis’ Bitcoin Strategic Reserve Act (BITCOIN Act of 2024). This was after the bill was announced in Nashville. Presto Research recognized the importance of the bill and quickly released an 11-page report on it, while most crypto commentators, with the exception of a few podcast hosts, simply downplayed it.

Today, the idea of the U.S. government buying Bitcoin for geopolitical purposes, while it may sound incredible to the public outside the cryptocurrency industry, is now possible (Polymarket gives it a 26% probability). The results of the U.S. election have further accelerated this "genie out of the bottle" effect, and other national and local governments have also begun to seriously consider this idea (see "Section 3: 2025 Forecast" below for details). Reviewing the key points in the report:

With Wall Street gradually embracing the asset class and the urgency of addressing the fiscal deficit, the bill could gain more momentum in the right political environment.

Even if passage of the bill is years away, the fact that it is tabled means the discussion will begin, lawmakers will seek education, and other governments will have a benchmark to follow. This is a huge improvement from a year ago, and the market has yet to fully price in that improvement.

Now that the “right political environment” has indeed arrived, momentum is building. Just as the 2023 court ruling in Grayscale v. SEC paved the way for this year’s crypto ETF boom, Lummis’ bill and the Republican sweep set the stage for a national rush to buy Bitcoin.

2.2.4 Is FDV a Meme?

When we published “Is Fully Diluted Valuation (FDV) a Joke?” on May 7, 2024, the issue of high FDV and low float was not yet widely recognized or a focal point of industry discussion. Interestingly, it was not until Binance Research published their thoughts on the topic a week later that the concept began to gain significant traction. Today, the high FDV-low float phenomenon is reshaping the cryptocurrency investment paradigm, affecting everything from valuation methods to issuance strategies.

This year has been particularly brutal for VC-backed projects. Retail investors have become increasingly aware of being used as exit liquidity for VCs and other early investors, leading to the disappearance of the "initial listing pump" phenomenon that was common a year ago. Even when listed on primary exchanges, projects such as Scroll and EigenLayer have not performed well. Investors are now more aware of the long-term impact of these practices and realize that their holdings may face continued dilution over the next three to four years.

One key observation from the report remains highly relevant today: the role of token economics in driving the rise of Memecoins. While Memecoins were active in early 2024, the hype back then pales in comparison to the current frenzy. Platforms like pump.fun, which began as launch pads for Memecoins, have evolved into general project launch hubs. We are now seeing these token economic trends expand to projects beyond Memecoins. This trend highlights that the rise of Memecoins is not just a speculative bubble - they are deeply influenced by the structure of token economics. As the report points out:

The recent rally in Memecoins can serve as a model for this topic. Unlike other cryptocurrencies in the space, which are often plagued by large unlocks — such as those with an initial circulating supply of 10% — most Memecoins are 100% unlocked at launch, thus avoiding ongoing dilution. While the rally in Memecoins cannot be attributed entirely to their token economics, it has undoubtedly played a major role in their appeal and continued attention.

In this context, the "barbell structure" trading strategy proved to be very prescient. On one end are assets like BTC and SOL that benefit from growing institutional investor interest and real-world demand. On the other end are Memecoins - which are not troubled by dilution from unlocking schedules - attracting speculative funds with their intuitive token economics. At the same time, investors of all kinds are becoming more and more aware of concepts such as FDV, market capitalization, and vesting schedules. They are increasingly wary of how token unlocking can erode value, and the concept of "successful listing on a tier-one exchange" is no longer enough to guarantee a project's success.

2.2.5 Babylon: Killing Two Birds with One Stone

We published a report on Babylon, a Bitcoin staking protocol, on September 3. While protocols that wrap Bitcoin for staking via bridging already exist, Babylon is technically unique as a "remote staking protocol." Babylon allows Bitcoin staking without wrapping BTC on other chains or handing over private keys to anyone, ensuring a self-custodial approach.

As a two-sided market, Babylon acts as a bridge to enhance the security of small-cap PoS chains by staking Bitcoin. Babylon's remote staking protocol leverages its innovative implementation of timestamp protocols, finality tools, and bond contracts to provide strong security for both the consumer chain (PoS chain) and the Bitcoin holder provider.

Babylon is currently undergoing a phased mainnet update. Phase 1 only allows Bitcoin deposits, Phase 2 initiates the Bitcoin staking protocol, and Phase 3 introduces the Bitcoin multi-staking protocol. At the time of writing, the first round of Phase 1 fundraising had just ended with an overwhelming response, with the total deposit limit of 1,000 BTC being reached in 74 minutes. In the second round of Phase 1 fundraising, no total deposit limit was set, and approximately 23,000 BTC was deposited in just ten Bitcoin blocks.

As of now, the third round of fundraising for Phase 1 is about to begin (December 10, 2024), while the actual mainnet activation and TGE launch will take place during the Phase 2 update in February 2025. BTC is undoubtedly the most dominant cryptocurrency by market capitalization among all existing assets (US$1.89 trillion as of December 2024). The key is to observe how much BTC Babylon can accumulate by early next year and how large its ecosystem will grow on this basis.

Chapter 3: 2025 Forecast

3.1 Institutionalization is moving forward at full speed (Author: Peter Chung)

The mainstreaming of cryptocurrencies is an ongoing process that will reach new heights in 2025 as top institutions fully support this trend, further accelerating its momentum. I expect this shift to manifest in the following four developments.

3.1.1 Bitcoin reaches $210,000 in 2025

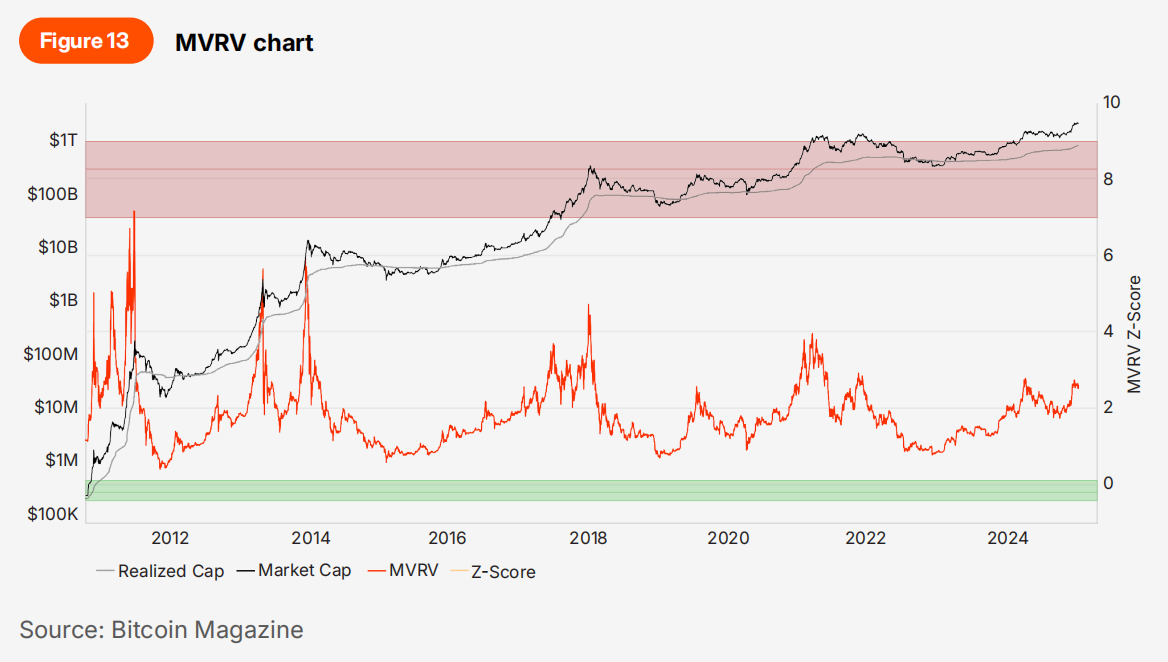

Over the years, the MVRV ratio has become one of the more reliable Bitcoin valuation tools in the digital asset industry. The MVRV ratio is calculated by dividing the market value (MV) by the realized value (RV). MV values all circulating Bitcoins equally at the current market price (i.e., market capitalization). On the other hand, RV values each circulating Bitcoin at the most recent acquisition price based on on-chain transactions. Therefore, this number represents the average acquisition price of all circulating Bitcoins.

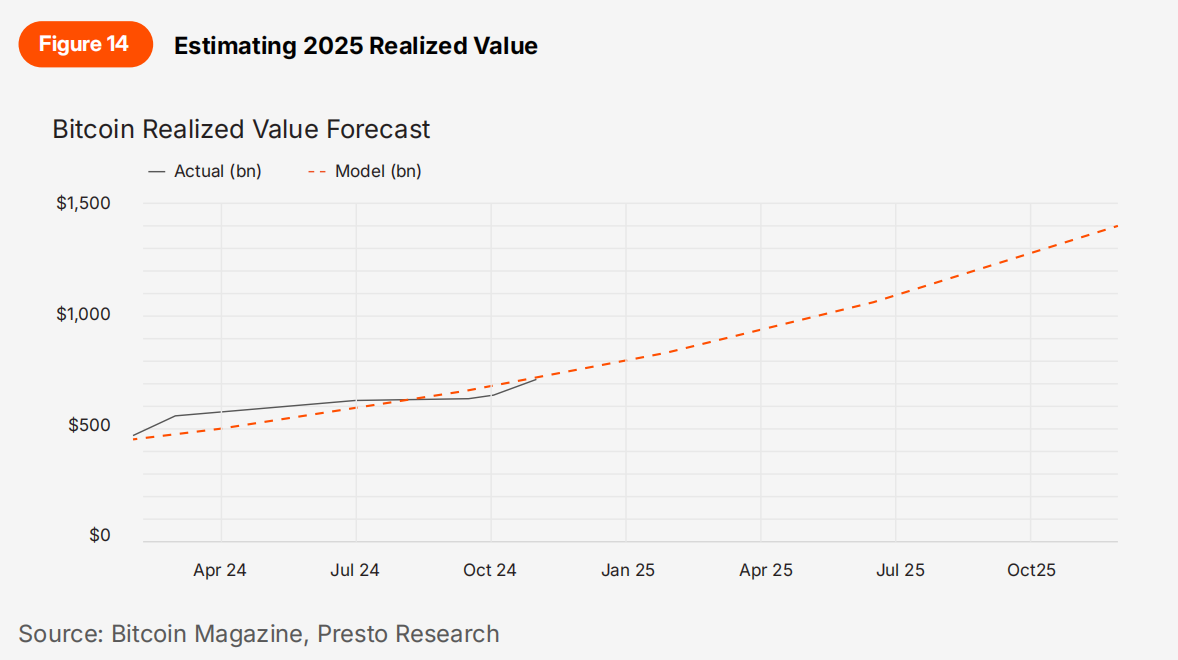

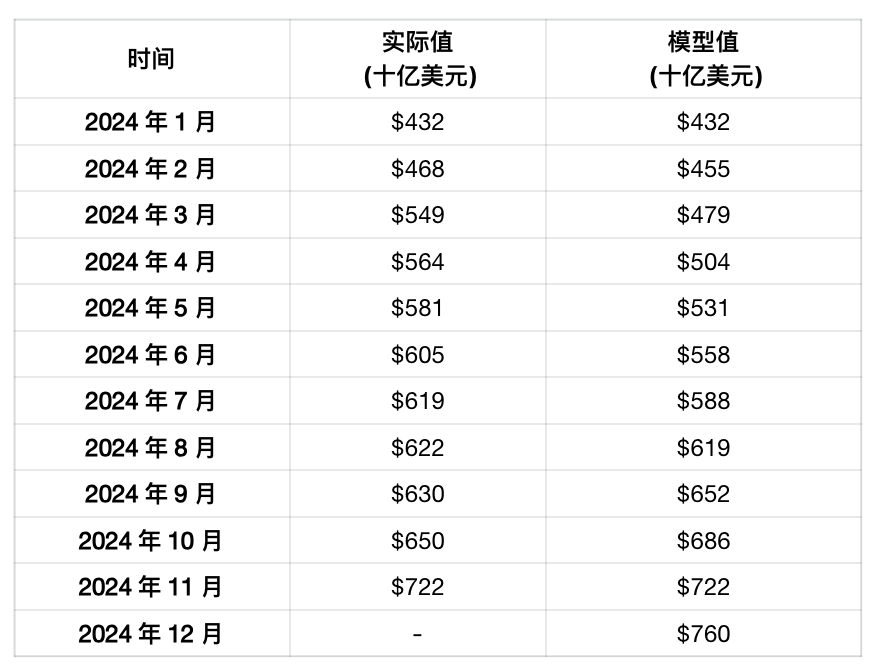

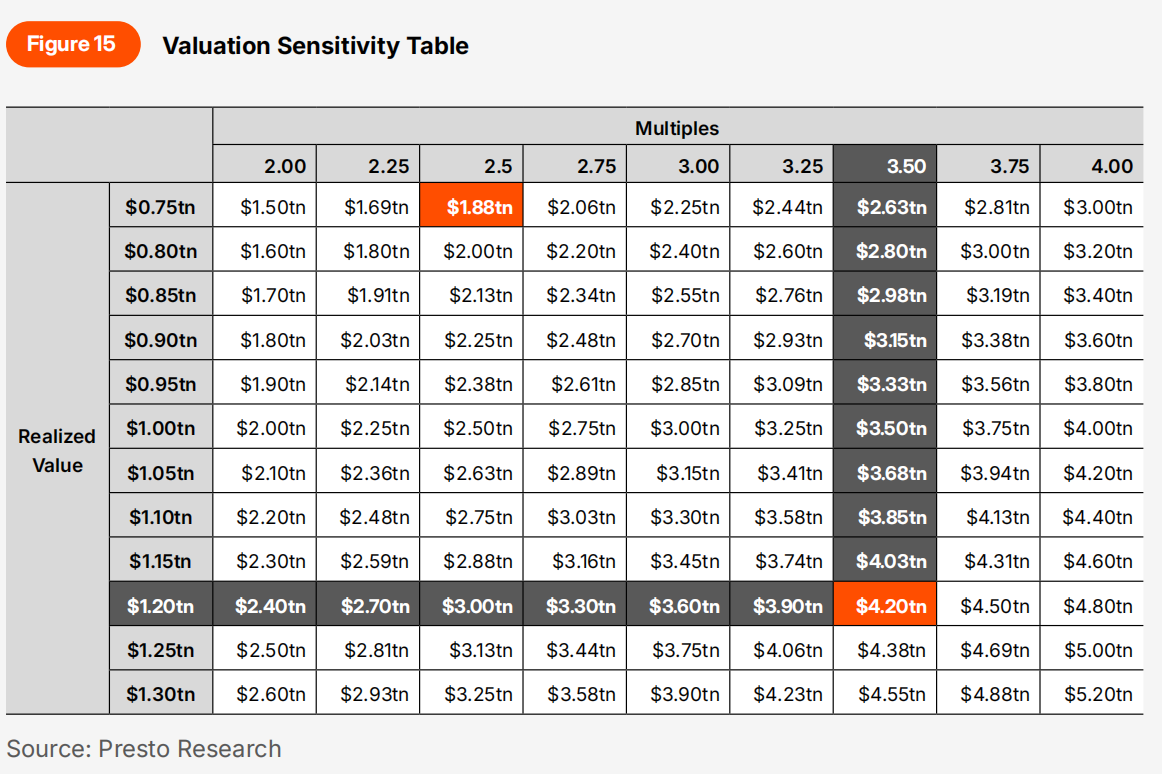

Bitcoin’s MVRV ratio has fluctuated between 0.4x and 7.7x over its history. If we exclude the early periods of extreme volatility (i.e., since 2017), the range is narrower, between 0.5x and 4.7x (Figure 13). In the past two bull runs (2017 and 2021), Bitcoin peaked at 4.7x and 4x, respectively. I take a more conservative approach and apply a 3.5x multiple to the $1.2 trillion RV projected for Q3 2025, assuming a 5.3% monthly increase from today’s $722 billion RV. This 5.3% is the monthly compound growth rate of RV between January and November of this year, reflecting the impact of spot ETFs making institutional access easier (spot ETFs acquiring more Bitcoin will cause RV to rise). This leads to my target value of the Bitcoin network in 2025 of $4.2 trillion (compared to $1.9 trillion today) or $210,000 per Bitcoin (= $4.2 trillion / 19,986,416 BTC) (Figures 14, 15).

Monthly growth rate of realized value: 5.27%

Data source: Bitcoin Magazine, Presto Research

3.1.2 Bitcoin "land grabbing movement": New sovereign states and/or S&P 500 companies will adopt Bitcoin as reserves

I predict that a sovereign nation or an S&P 500 company will announce the inclusion of Bitcoin in its reserve strategy. For sovereign nations, I define "adoption" as a government body proposing to include Bitcoin in its treasury reserves. Notably, at least one sovereign nation has made such a move in each of the past three years (Figure 16). While it is difficult to predict which nation might follow suit in 2025, President-elect Trump's recent campaign promise regarding Bitcoin reserves/storage may have prompted other nations to investigate similar strategies driven by game theory dynamics.

Figure 16: It's Been Happening Already

Data source: Presto Research

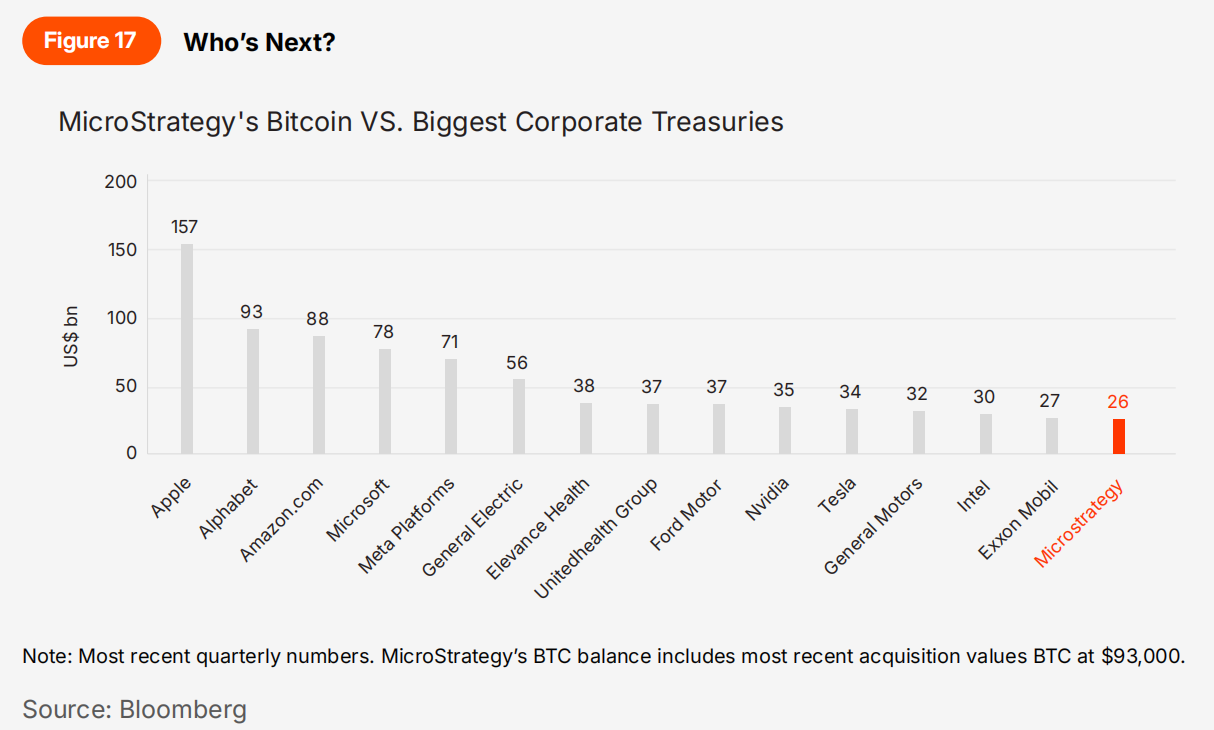

In terms of enterprise adoption, MicroStrategy's parabolic stock price rise this year has captured the attention of the corporate community like never before, prompting other companies to explore similar strategies. Traditional on-balance sheet accounting for Bitcoin holdings has been one of the main barriers to broader corporate adoption, but this barrier will be eased with the FASB's announcement of a rule change earlier this year to move from the previous lower of cost and market to fair value accounting. MicroStrategy plans to implement this change no later than the first quarter of 2025, providing greater clarity and stronger motivation for other companies to follow suit.

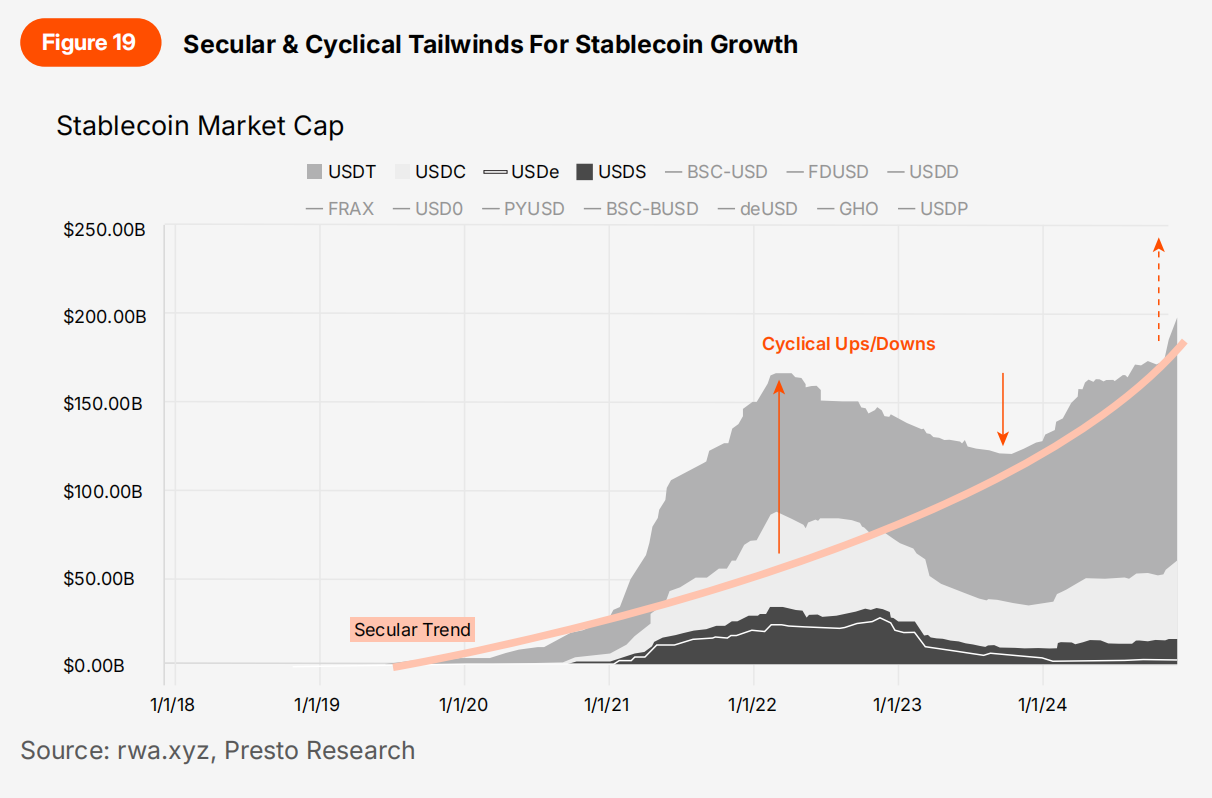

3.1.3 Stablecoins are sweeping the world: the total market value will reach 300 billion US dollars

Stablecoins may not be the most interesting topic for cryptocurrency players seeking a surge, but it is undeniable that they are the most successful killer application of blockchain. After rebounding from the local lows in November 2022, the total market value of stablecoins has now reached US$200 billion, making it the largest cryptocurrency application category.

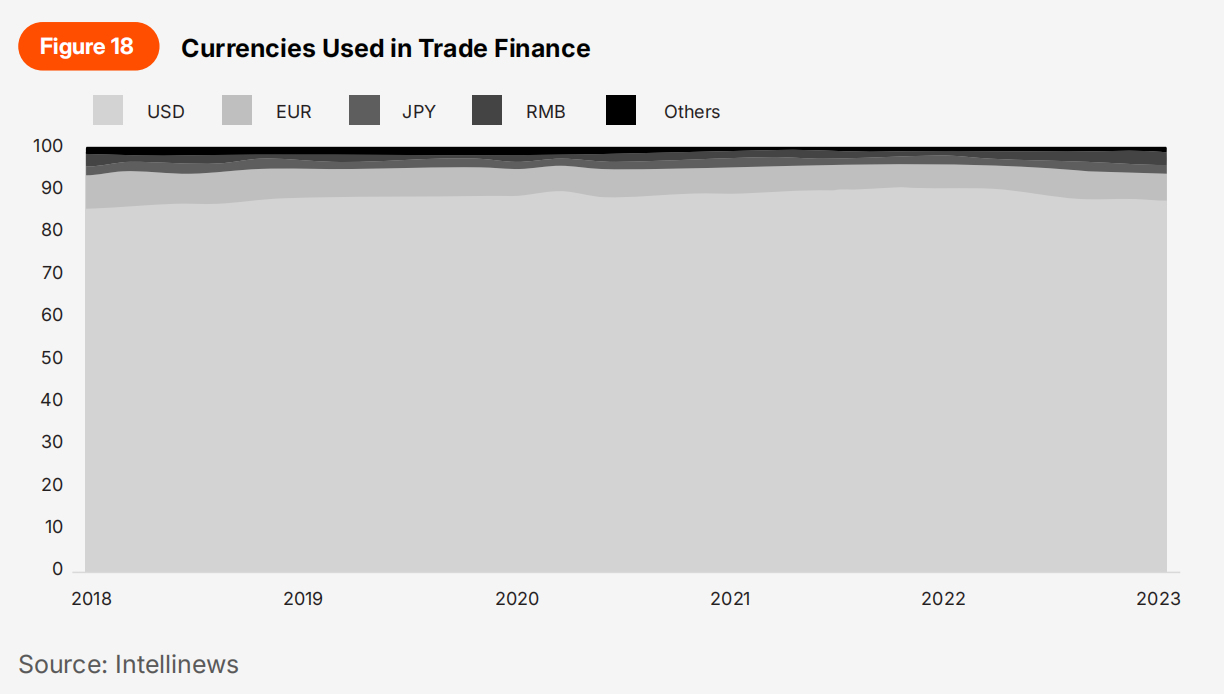

Their success offers an important but often overlooked lesson for the industry. There’s a reason why 99% of stablecoins are pegged to the U.S. dollar and non-USD stablecoins haven’t been able to take off. Tokenizing an asset doesn’t magically create demand for it; quite the contrary, the asset being tokenized must already be in universal global demand.

Few currencies other than the U.S. dollar enjoy such ubiquitous demand, as evidenced by its dominance as the preferred settlement currency (Figure 18). This is why blockchains achieve the best product-market fit with U.S. dollar stablecoins, but not with other currencies. The value proposition of blockchains as frictionless value exchange pathways is most compelling when assets frequently move across borders, which is typically where the greatest friction in transactions occurs. Most other currencies are used primarily within their issuing jurisdictions and rarely cross borders.

This has broader implications for practitioners in the real-world asset (RWA) space. Specifically, the asset being tokenized must be globally sought after. Assets that are inherently “local” — such as fiat currencies in non-major closed economies, or intellectual property that is only valued by small local communities — may only see modest 2-3x improvements. However, achieving the 10x leap required for large-scale, sustainable adoption will be much more challenging.

I forecast that stablecoin growth will continue, reaching a market cap of $300 billion in 2025, driven by both secular and cyclical tailwinds. Secular drivers include: Growing recognition of the superior functionality of a tokenized dollar as a payment solution in developed countries and a store of value in developing countries. Progress on stablecoin legislation in the U.S. Congress may also provide additional momentum. Cyclical drivers include the broader crypto bull cycle (which could increase inflows into stablecoins due to their convenience), and the yield gap between on-chain and traditional financial savings instruments. Even at $300 billion, this would only represent 1.4% of the U.S. dollar M2 supply, still implying huge upside potential.

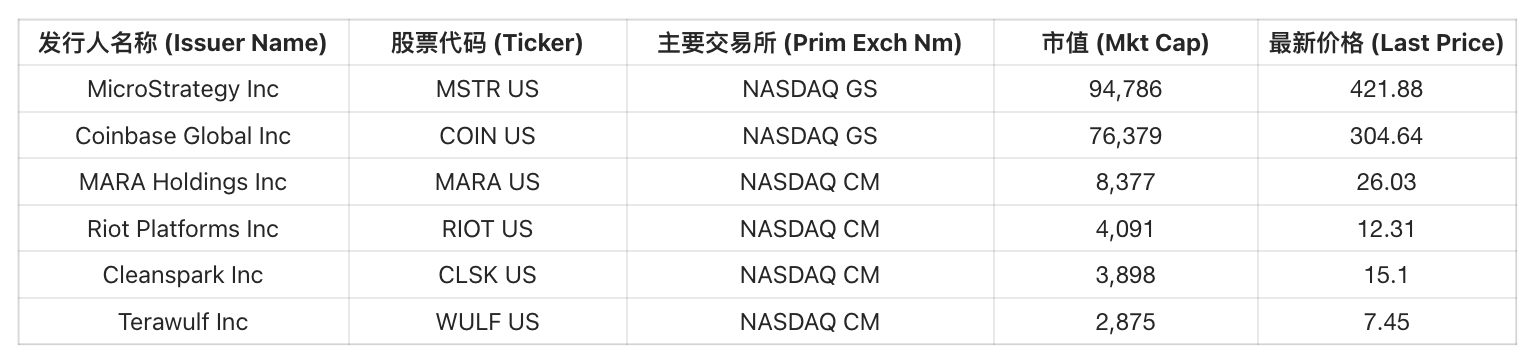

Figure 20: The expanding crypto equity club

Remark :

This table shows only US public companies with a market capitalization of more than $1 billion as of November 29.

Data source : Bloomberg

3.1.4 More Corporate Actions: Circle/Ripple/Kraken to IPO

The United States is not only a center of cryptocurrency innovation and intellectual capital, but its social values are also highly aligned with the philosophy of cryptocurrency. A crypto-friendly environment under the Trump administration could unlock opportunities that were previously unpursuable due to political risk. Traditional companies will view crypto startups as attractive assets as they seek to expand their crypto businesses, driving more M&A activity and higher valuations. We’ve already seen signs of this: even struggling companies like Bakkt have found acquirers like Trump Media.

Late-stage growth companies considering going public will not miss this window of opportunity. Well-known cryptocurrency companies such as Circle, Ripple, and Kraken have long been considered potential IPO candidates. For reference, Coinbase went public in April 2021 at the peak of the last bull market.

If any of these three companies go public, it will boost the industry in two important ways. First, it will, along with Coinbase and MicroStrategy, bring further legitimacy to the industry by increasing the market capitalization of the emerging cryptocurrency industry in the public stock market. Second, the disclosures made as public companies will provide greater transparency into their operations, providing valuable insights for the future generation of startups.

3.2 Stockization of Cryptocurrencies (Author: Min Jung)

3.2.1 The United States, the new cryptocurrency capital: Coinbase performs well in both the stock and cryptocurrency markets

Trump is known for his "Make America Great Again" (MAGA) slogan and "America First" policies, and there is no reason to think that cryptocurrencies will be an exception. If Trump intends to make the United States the capital of cryptocurrencies, his administration must ensure that the United States leads the global crypto landscape and surpasses competitors, including China. There are already rumors of plans to eliminate capital gains taxes on cryptocurrencies issued by U.S.-registered companies, indicating the government's intention to attract crypto innovation. I think this is just the beginning, and there may be more announcements to follow, further consolidating the United States' position as the global cryptocurrency center.

Such a move would fundamentally change the cryptocurrency industry. Currently, cryptocurrency is viewed as a global asset class, with little regard for the location of a project or its founders. However, this perception will change as the United States differentiates itself through favorable policies. Just as the nationality of a company matters in traditional stock markets, this could also be the case in the cryptocurrency space. In this scenario, "US crypto" would receive a clear premium, attracting top talent and projects. The United States would replicate its success in the stock market, where US-listed companies enjoy a valuation premium due to the country's legal and economic stability. This shift would redefine the global cryptocurrency landscape, placing the United States at the forefront.

The ripple effects of US dominance will extend to trading dynamics. As macro and project-level news and events will be concentrated in US trading hours, trading volume and volatility will likely increase significantly during US trading hours. In addition, US exchanges (especially Coinbase) are expected to grow significantly, and listings on their platforms will serve as a signal of global legitimacy, similar to major IPOs on Nasdaq.

At the project level, one of the most obvious beneficiaries of US dominance will be ecosystems like Coinbase’s Base. As the flagship example of US cryptocurrency innovation, Base’s success will stem from low transaction fees, a user-friendly platform, and especially US-based regulatory clarity. These advantages, combined with the influx of talent into the ecosystem, will position Base as a leading blockchain platform and solidify its position as a top L2 ecosystem with a substantial advantage not only in terms of TVL, but in all other respects.

Figure 21: Current status comparison of Base and other blockchains

Data source: DefiLlama

3.2.2 Cryptocurrency turns to fundamentals: Liquidity hedge funds will outperform

The cryptocurrency industry is moving away from speculative hype toward fundamentals-driven investing, a shift driven by the rise of standardized valuation frameworks. These frameworks are reshaping how projects are evaluated, financed, and traded, enabling a more disciplined approach to cryptocurrency investing and bringing the market closer to traditional finance principles.

For many years, cryptocurrencies lacked the same rigorous valuation standards as traditional markets, leading to their being viewed as a speculative asset class. However, as projects increasingly generate revenue through staking rewards, token buybacks, and transaction fees, they are becoming systematically valued. Investors now have tools to calculate real returns to token holders and assess the sustainability of projects. Metrics like TVL/MC and protocol revenue multiples are gaining traction, providing standardized ways to compare projects.

This shift toward fundamentals is also changing the broader investment landscape. Historically, venture capital has dominated the cryptocurrency space, thriving on early-stage projects and speculative token listings. The lack of mature metrics, limited historical data, and the tendency of crypto assets to move in tandem with Bitcoin have made it difficult for liquidity investors to differentiate between projects or implement effective strategies. However, the industry is evolving. Markets have matured enough to allow meaningful comparisons using fundamental metrics.

At the same time, the current market environment - characterized by criticism of high FDV (fully diluted valuation) and low circulating supply - has reduced the appeal of traditional venture capital. In contrast, liquid hedge funds are using these sophisticated valuation tools to execute dynamic long/short strategies that exploit real-time market inefficiencies. Their ability to systematically assess fundamentals provides a significant advantage, allowing them to navigate volatile market conditions and generate sustainable returns regardless of overall market conditions.

In 2025, I expect liquid hedge funds to outperform venture funds, using their valuation-focused strategies to ride both bullish and bearish trends. This shift will mark a turning point for the cryptocurrency market as liquid funds prove their adaptability and efficiency in navigating volatile conditions. As cryptocurrencies increasingly become the leading destination for generating excess returns, expect at least five major macro or equity long/short hedge funds to enter the space, combining their traditional expertise with the unique opportunities offered by digital assets. At the same time, expect leading investment banks to formally cover digital assets, adopting valuation metrics similar to those in the stock market. This institutional involvement will establish higher standards for asset valuation, drive greater transparency in projects, and drive further maturity in the cryptocurrency industry.

3.2.3 The rise of cryptocurrency indices: indices will rank among the top five in terms of trading volume

The cryptocurrency market is growing rapidly, and cryptocurrencies are increasingly becoming a mainstream asset class necessary for portfolio diversification and competitive returns. As ordinary investors begin to realize the importance of including cryptocurrencies in their portfolios, the demand for simplified and diversified investment options is rising. Just as stock investors have shifted from individual stock selection to gaining broader market exposure through indices such as the S&P 500, cryptocurrencies are about to undergo a similar transformation, driven by their growing role in modern investment strategies.

In traditional finance, ETFs now account for 13% of total U.S. equity assets, reflecting a growing preference for diversified exposure. Cryptocurrencies are expected to follow a similar trajectory, with index products offering a curated portfolio of assets across industries or themes.

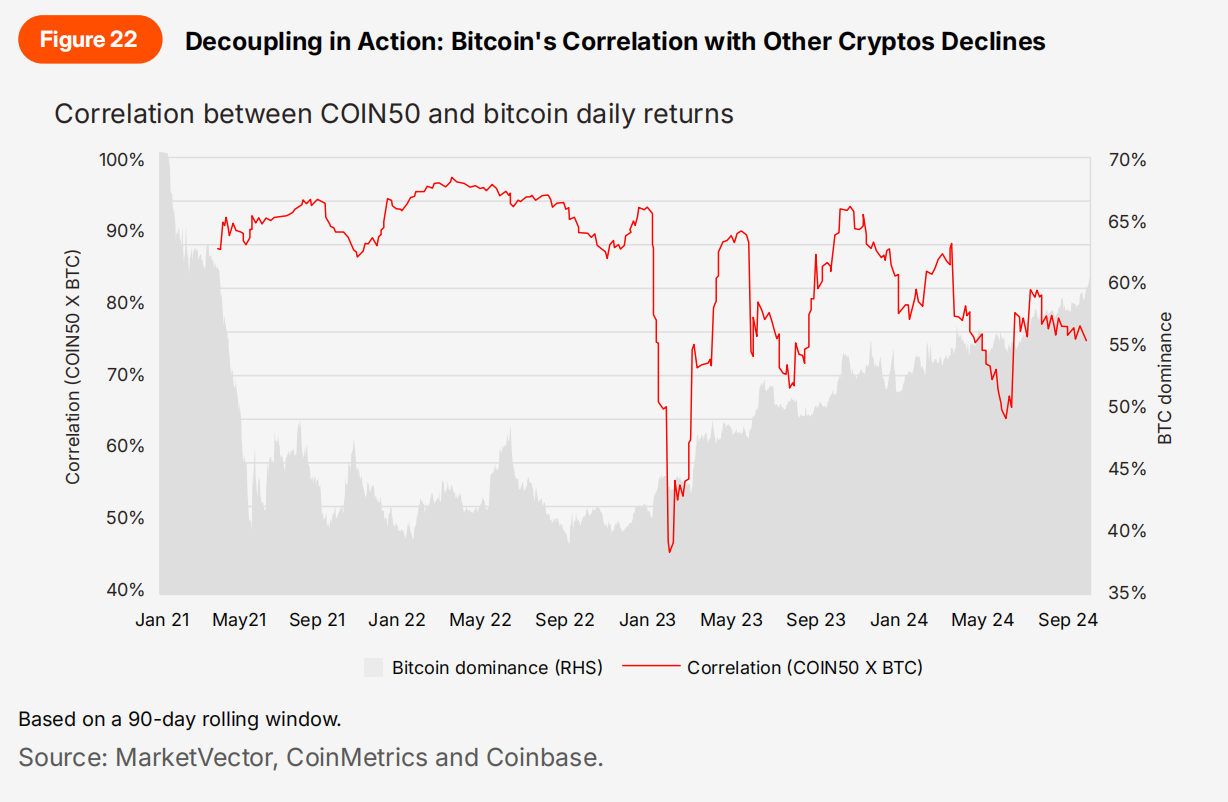

Early attempts at cryptocurrency indices, such as Binance’s Bluebird Index (tracking BNB, DOGE, and MASK), struggled to gain traction in this niche market at the time. Altcoin largely mirrored Bitcoin’s beta, making Bitcoin a logical choice to gain broad market exposure. Additionally, most investors in the space are self-proclaimed “speculators” who prefer individual tokens and believe they have the ability to outperform the market.

However, the landscape is changing. Projects are developing unique use cases and behaviors, and the performance of different sectors is driven by unique fundamentals, no longer just tracking Bitcoin's price movements. In addition, the influx of new investors - those seeking exposure to the cryptocurrency industry or taking a macro view, such as bullish on DePIN (decentralized physical infrastructure network) or high-market-cap cryptocurrencies - has increased the demand for diversified, industry-specific products.

As this evolves, expect indices to become staples on major exchanges. Cryptocurrency equivalents of $SPDR products, such as the Coinbase 50 Index (COIN50), could emerge and consistently rank in the top five in terms of trading volume. This shift will redefine how investors interact with cryptocurrencies, making them more accessible, more diverse, and aligned with traditional financial principles.

3.3 The Second Phase of the Bull Market (Author: Rick Maeda)

3.3.1 Solana will reach $1,000

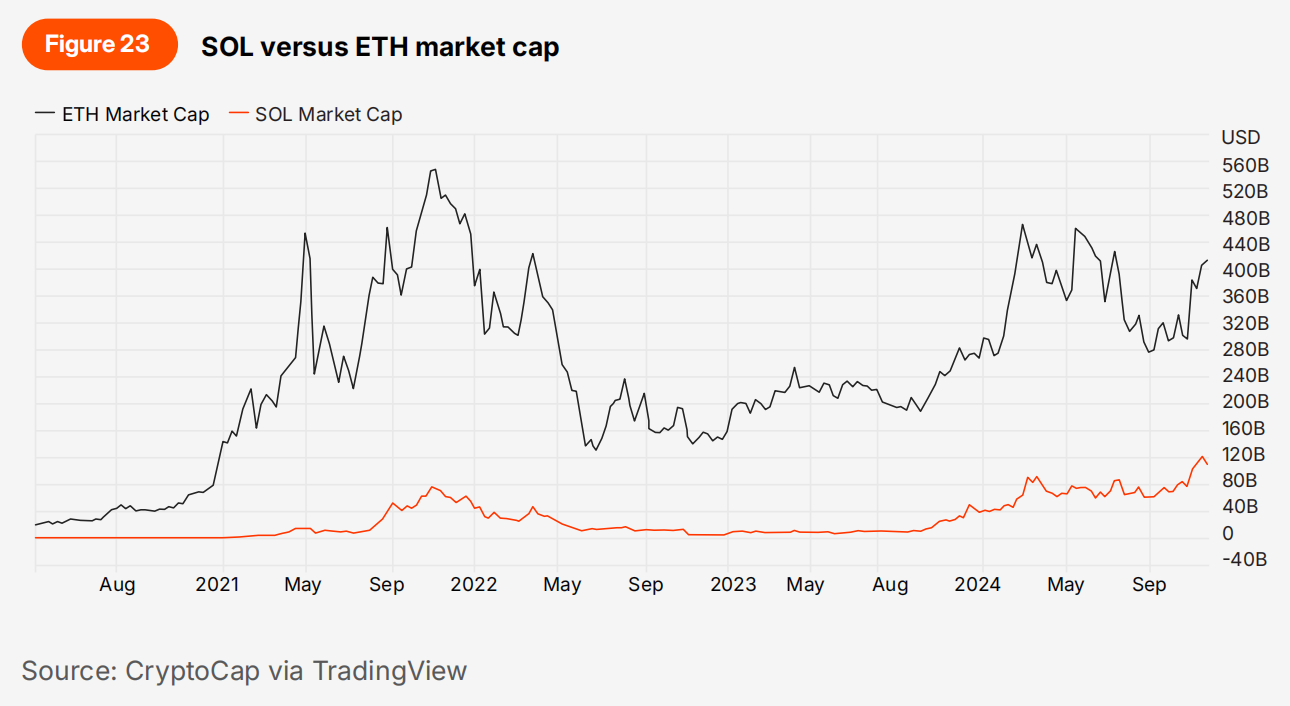

SOL’s path to $1,000 builds on the network’s transformation from a high-performance blockchain to a deeply institutionalized ecosystem. The surge in institutional adoption, coupled with projects raising $173 million in Q3 2024, reflects a maturing platform that has achieved the critical intersection of technological excellence and institutional embedding.

This momentum is amplified by unprecedented network activity, with Solana accounting for over 50% of all on-chain daily volume and activity surging 1,900% year-over-year. This explosive growth reflects a deeper truth about the network’s success — as Placeholder’s Mario Laul explores, the network’s success is not purely technical, but driven by its institutionalization through professional infrastructure and developer network effects. Solana’s differentiation stems from its unique cultural ethos that prioritizes rapid innovation over theoretical perfection — a stark contrast to Ethereum’s research-first approach.

This pragmatic approach is evident in its technical roadmap: while Anatoly advances the vision of a global state machine synchronized with 120ms block times, as Mads from Maven 11 points out, the network’s architecture is a natural fit for rollup-based expansion, laying the foundation for unprecedented scalability. The upcoming Firedancer client, which aims to achieve 1 million TPS, further demonstrates this pragmatic progress.

With only 1.93% of tokens set to enter the market in the next year, and a projected market cap of $485.93 billion at $1,000 — well within Ethereum’s historical precedent — supply and demand dynamics strongly support this price target. The combination of cultural differentiation, institutional adoption, technological evolution, and favorable token economics creates a compelling case for SOL to rise, and the potential for a spot ETF could further catalyze institutional inflows.

3.3.2 The total market value of cryptocurrency will reach 7.5 trillion US dollars

I outlined my plan for how to position in the current bull market in February 2024, a goal based on an updated version of the logic at the time - a Bitcoin price of $150,000 and a Bitcoin market cap of 40%.

2024, like 2023, is another year dominated by Bitcoin, with ETF inflows, general institutionalization of Bitcoin, and Trump’s victory allowing the original cryptocurrency to outperform many Altcoin. With Bitcoin approaching $95,000 and Bitcoin accounting for 60% (as of November 20, 2024), I expect Bitcoin to steadily break through $100,000 before Bitcoin’s share drops to 40%. I think Bitcoin will reach at least $150,000 in this cycle, so if we reverse the numbers and plug in a Bitcoin price of $150,000 and a Bitcoin share of 60%, we get a total cryptocurrency market cap of $7.49 trillion. At the previous cycle high in November 2021, the Bitcoin price was $69,000, Bitcoin accounted for 42.5%, and the total market cap was $2.9 trillion.

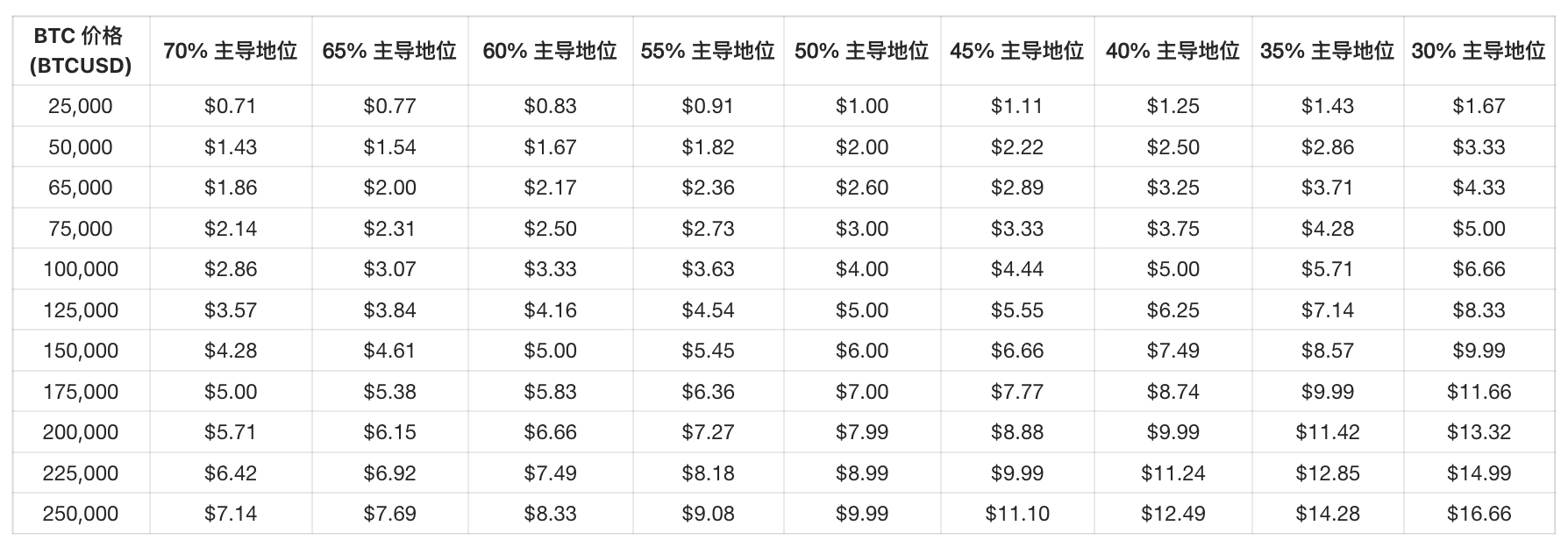

Figure 24: BTC Price x BTC Dominance

Editor’s Note:

The table shows the potential performance of Bitcoin price (BTCUSD) under different dominance levels (BTC Dominance).

Dominance refers to Bitcoin's share of the entire crypto market, ranging from 70% to 30%.

For example, when BTC price is $100,000 and dominance is 50%, its market value could reach $4.00 trillion.

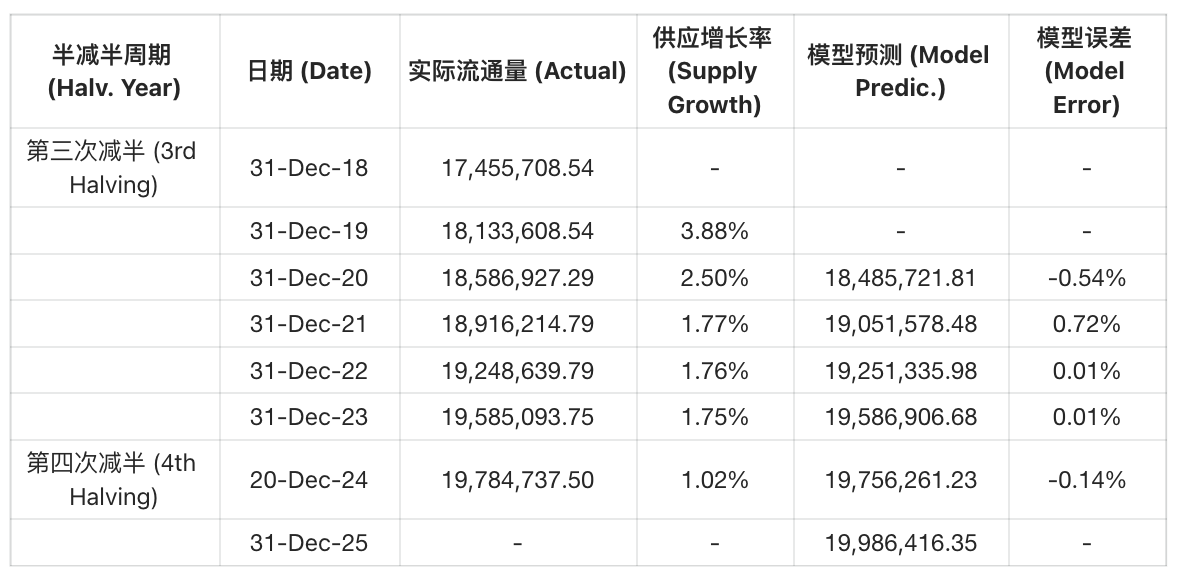

predict:

By the end of 2025, the supply of Bitcoin is expected to be 19,986,416.35 .

BTC Circulating Supply

Editor’s Note:

The table records the actual and model-predicted values of Bitcoin's circulating supply from 2018 to 2025.

Each halving event significantly reduces the supply growth rate of Bitcoin, and after the fourth halving in 2024, the growth rate is expected to drop to 1.02% .

The error between the model prediction value and the actual value is getting smaller year by year, indicating that the accuracy of the prediction model is improving.

Data source:

The data comes from Glassnode and Presto Research , and the 2024 forecast is based on statistics as of November 20, 2024.

Clearly, the global macro backdrop, especially with regard to the Trump presidency, is an important factor in how long this bull market can last. We can do a simple scenario analysis of the positive ~ negative case of the outcome range:

Positive scenario, Trump focuses on pro-growth policies and deregulation, minimizing tariffs/immigration restrictions (potential outcomes: higher real rates, stronger dollar, higher stock markets, lower gold prices)

In the negative scenario, we enter a trade war situation (e.g. 60% tariffs on China, 10-20% tariffs worldwide), coupled with strong retaliation and strict immigration policies in the United States (potential results: lower interest rates due to Fed easing, stronger and then weaker dollar, stock market correction, higher gold)

Arguments can be found in favor of cryptocurrencies in both scenarios (basically, if Bitcoin can be positively correlated with risk assets in the positive case, positively correlated with gold/negatively correlated with the dollar in the negative case). But given other factors like Trump's cabinet + White House picks (and modest hope), I lean toward the positive camp and believe that this backdrop will support risk asset cryptocurrencies.

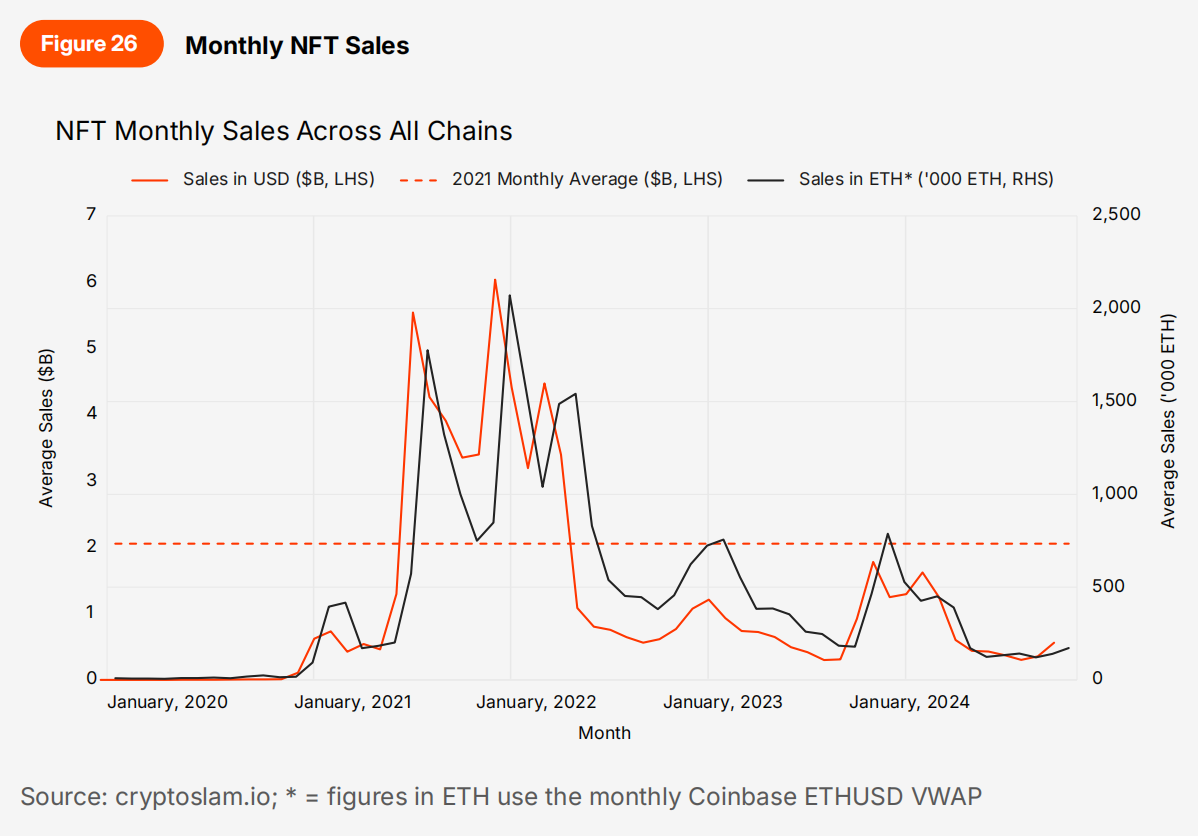

3.3.3 NFT rebound in 2025: monthly transaction volume will reach US$2 billion

As I watched Bitcoin hit new all-time highs (and watched crypto Twitter all day), something felt different this time. The usual euphoria that accompanies these milestones seemed subdued — compared to past cycles, it was clear we hadn’t yet reached that magical moment in the bull cycle when the rising tide lifts all boats. But this is why I’m optimistic about NFTs in 2025. We’re entering the mature phase of this cycle, and history shows this is when the most interesting cultural phenomena emerge.

The cultural significance of NFTs in the last cycle was profound, but often overlooked by market analysts. At their peak, NFTs represented something pure in crypto: a true community. While daily chants of “GM” and “WAGMI” on our Twitter timelines and Discord channels may seem insignificant to outsiders, they created a sense of belonging that transcended mere speculation. This is in stark contrast to today’s landscape of Memecoins, where community has become a weaponized concept, often masking predatory behavior with the appearance of a shared purpose. What’s particularly interesting is that certain NFT communities, like Pudgy Penguins and Miladys, have maintained their cultural authenticity even during the trough of the 2022 bear market—their resilience is less about rock-bottom prices and more about continued cultural relevance.

Current data supports this potential cultural renaissance, with NFT sales reaching $562 million in November 2024, up 57.8% from previous months. But beyond the numbers, what’s truly striking is how the NFT subculture continues to grow and influence the broader crypto culture. The emergence of different art movements within the NFT space—from grunge art to generative art—reflects a maturing ecosystem where cultural value is not simply tied to financial speculation. These subcultures serve as incubators for innovation, just as underground music scenes have historically spawned entirely new genres and cultural movements.

With NFTs being adopted by mainstream brands like Nike and Sony, it’s not just a matter of corporate adoption — it’s a recognition of the legitimacy of these digital subcultures. Paradoxically, however, this mainstreaming may help protect, rather than dilute, the authenticity of the NFT community. As technology becomes more accessible through layer-two solutions and multi-chain ecosystems, we’re seeing a democratization of digital culture that may foster more vibrant communities.

But maybe I’m just seeing what I want to see through my rose-tinted Solana Monkey Business glasses. For the purposes of this forecast, I expect monthly NFT trading volume to exceed $2 billion sometime in 2025 (from a monthly average of $2.056 billion in 2021), but numbers alone don’t capture the essence of what’s special about NFTs. What we’re really waiting for is the moment when crypto stops being about predatory transactions and becomes more about collective experiences — when the proportion of purely adversarial transactions decreases in favor of community building. I hope that crypto newbies will one day be able to experience the joy of anticipating NFT minting in random Discord rooms with their online friends.

Reject human nature and return to ape nature.

3.4 Focus on fundamentals (Author: Jaehyun Ha)

3.4.1 Ethereum counterattack: ETH/BTC ratio will return to 0.05

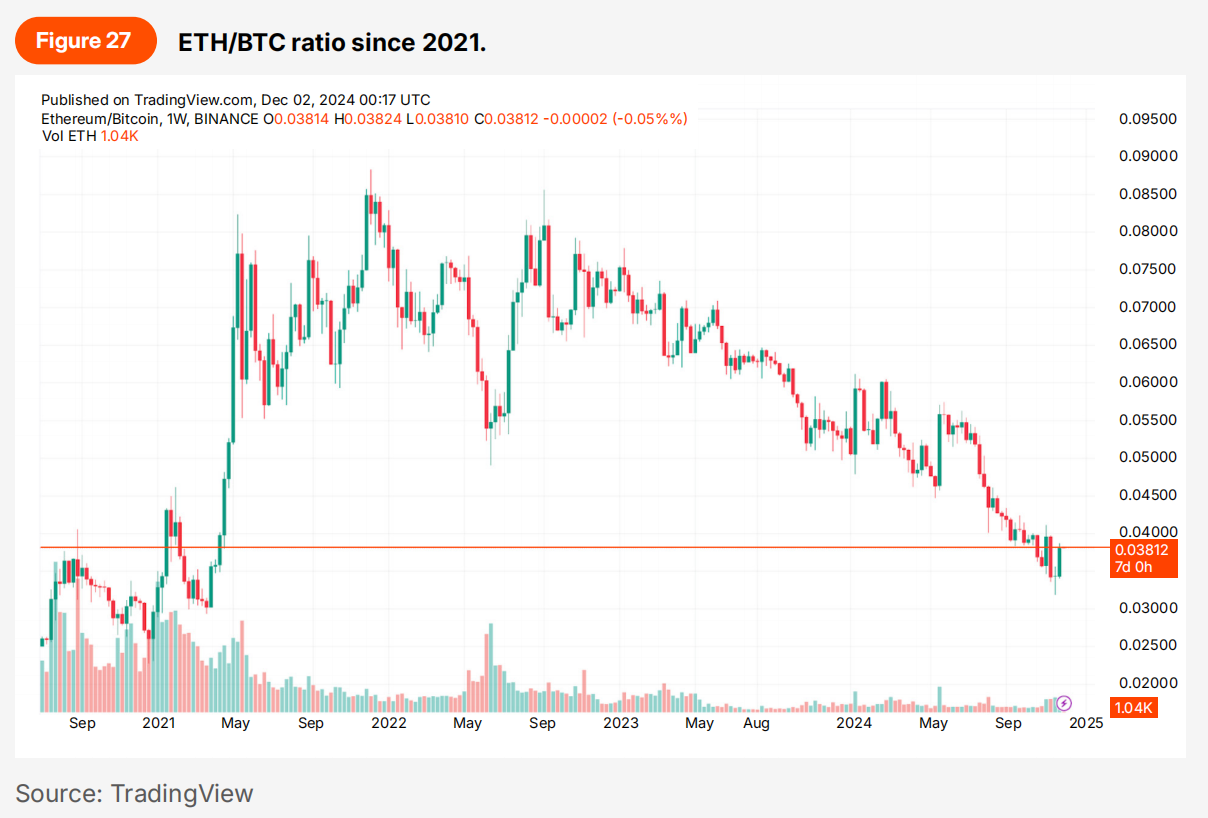

Ethereum has undoubtedly become one of the most controversial topics in the cryptocurrency industry in the second half of 2024. During this period, monolithic chains like Solana have gained significant attention for their "ease of use and speed", while Ethereum still faces challenges such as the lack of proof systems in many second-layer networks and user experience issues caused by asset fragmentation. These factors, coupled with a less cohesive narrative, have led to Ethereum's ETH/BTC ratio hitting a record low since 2021 (Figure 27).

Despite the challenges, Ethereum remains a project worth keeping a close eye on in 2025 and beyond. Major updates, such as the Pectra upgrade scheduled for early 2025, may not immediately solidify Ethereum’s position as “ultrasonic money,” but its roadmap is clearly designed to address current UX issues and drive mass adoption without compromising decentralization. Based on this focus, we expect Ethereum to potentially regain an ETH/BTC ratio of 0.05 in 2025, assuming Bitcoin reaches $120,000 and Ethereum climbs to $6,000. There are two key updates in particular to watch:

The first is the defragmentation of the Layer 2 network through ERC-7683 and EIP-7702. Over the past few years, Ethereum’s Layer 2 solutions have solved the scalability problem, but introduced fragmentation, with each Layer 2 operating as an isolated ecosystem, making cross-chain operations (such as token transfers) complicated. Here, the concept of intent standardized by ERC-7683 provides a solution, allowing users to declare desired operations without managing the complexity of a specific Layer 2, creating a unified framework for cross-chain communication. When combined with EIP-7702, which implements account abstraction by allowing externally owned accounts (EOAs) to temporarily act as smart contract wallets, these advances simplify complex transactions across chains. For example, a user can declare an intention to swap tokens on Layer 2, transfer the proceeds to another chain, and perform a governance vote - all in one seamless transaction. By combining the standardization of intent with the flexibility of account abstraction, the Ethereum ecosystem can provide a more frictionless user experience.

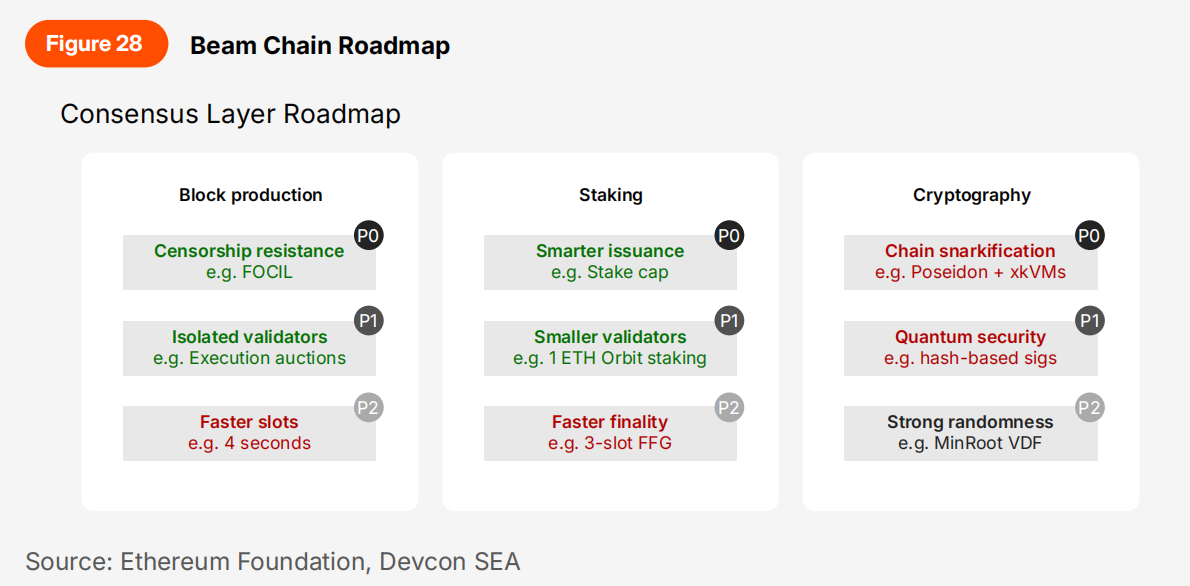

Next is the UX improvement update included in the Beam Chain roadmap. Announced by Justin Drake (Ethereum Foundation) at Devcon 7, the Beam Chain roadmap is Ethereum’s long-term plan to “clean up technical debt” by 2029. Nine major upgrades (Figure 28) are proposed in three categories (i.e., block production, staking, and cryptography) to redesign Ethereum’s consensus layer to address its current limitations and leverage the latest technical innovations, such as zero-knowledge proofs. Among them, key proposals include implementing 3-slot finalization (reducing finalization time from 15 minutes to 36 seconds), reducing slot time from 12 seconds to 4 seconds (i.e., faster block processing), and reducing the minimum staking requirement to 1 ETH (currently 32 ETH), all of which have the potential to improve Ethereum’s user experience and may attract more funds into the ecosystem.

Based on currently available information, updates related to layer 2 defragmentation are expected to be implemented in early 2025, and the Beam Chain roadmap has not yet determined the specific implementation timeline for each proposal. In particular, the core proposals of the Beam Chain roadmap involve ideas that fundamentally change key mechanisms of the Ethereum consensus layer; these updates may require extensive specification development and testing, which may take more than 1-2 years to complete. Nonetheless, these updates are expected to have a positive impact on Ethereum's price competitiveness and ecosystem in the long run. One of the most common complaints from Web3 users about Ethereum is that it is slower, less convenient, and more expensive than other blockchains. If the speed and convenience issues can be solved first, this alone could significantly enrich the ecosystem and drive a significant increase in on-chain activity (efforts are currently being made to stabilize blob fees through proposals such as EIP-7762, EIP-7691, and EIP-7623).

3.4.2 Focus on DAG-based blockchain

Another area to watch closely in 2025 is projects based on "DAGs" (directed acyclic graphs). A DAG is a graph structure where transactions (or blocks) are vertices connected by directed edges, forming a non-cyclic data flow. Unlike traditional blockchains, which serialize transactions into a single chain, the DAG structure inherently allows multiple transactions or blocks to be processed and verified in parallel.

Projects such as IOTA pioneered the use of DAGs in distributed ledgers, highlighting their potential to overcome blockchain scalability challenges. However, performance degradation at low transaction volumes and reliance on centralized coordinators hampered widespread adoption. A few years later, Sui offered a different approach, using DAGs not as the primary ledger, but as a supporting structure for its parallel consensus mechanism. Sui's Mysticeti consensus protocol allows validators to propose and commit blocks in parallel without explicit block certification, reducing communication and computational overhead. This design avoids many of the pitfalls of earlier projects by using a pure DAG as the ledger; Sui ensures a globally consistent ledger that all nodes in the network can agree on, while retaining the scalability and performance advantages of DAGs.

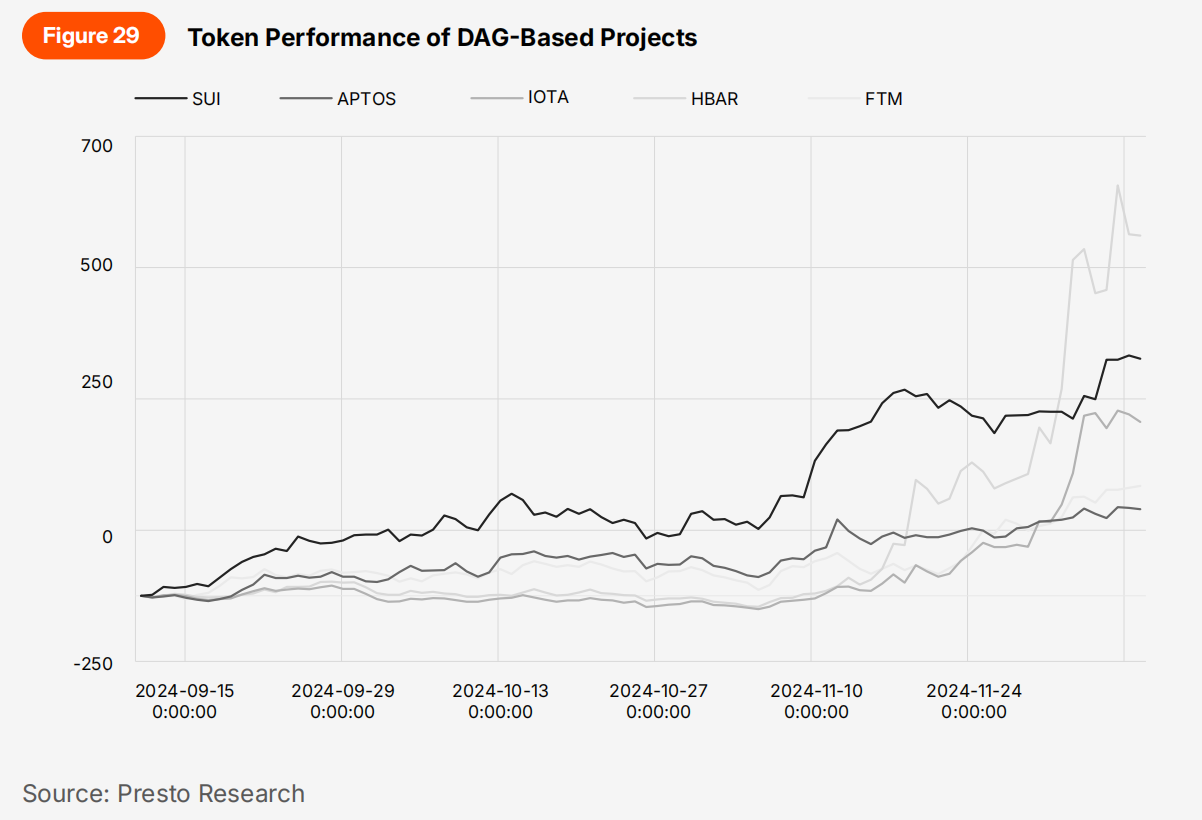

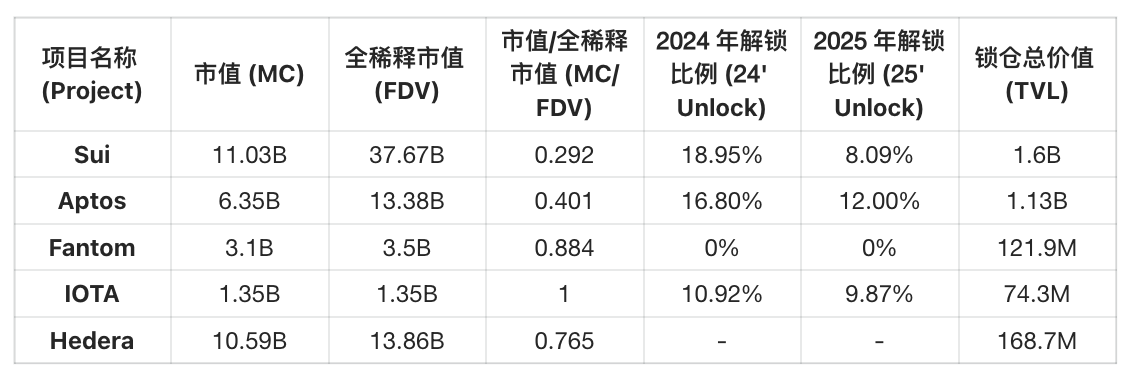

Sui has gained significant traction since Q3 2024, thanks to its technical advantages. Its price has risen by more than 300% since September 2024, and it currently ranks third among non-EVM chains in terms of TVL, reaching $1.6 billion (first place is Solana, at $8.92 billion). While concerns about Sui's high FDV/MC ratio remain, optimism remains strong. Sui's performance remains solid despite a large amount of unlocking at the end of 2024, and the outlook looks even brighter with less unlocking expected in 2025 (Figure 30). In addition to Sui's outstanding performance, another layer 1 public chain using DAG, Aptos, has also risen to fourth place among non-EVM chains, with a TVL of $1.13 billion, while other DAG-based projects such as IOTA, HBAR, and FTM have also risen by at least 100% since September 2024. DAG-based projects with improved technical robustness are proving that they are chains optimized for mass adoption, and their continued growth in 2025 is worth looking forward to. We expect the combined TVL of the 5 DAG-based projects to reach at least 50% of Solana’s in 2025 - $5-6 billion (currently $3.1 billion).

Figure 30: Key indicators of the project based on DAG

Data source: Chart information provided by Presto Research

3.5 The Hot Twenties on the Chain (Author: Biden Cho)

3.5.1 DEX Gold Rush: Spot DEX to CEX trading volume ratio exceeds 20%, perpetual DEX to CEX trading volume ratio exceeds 10%

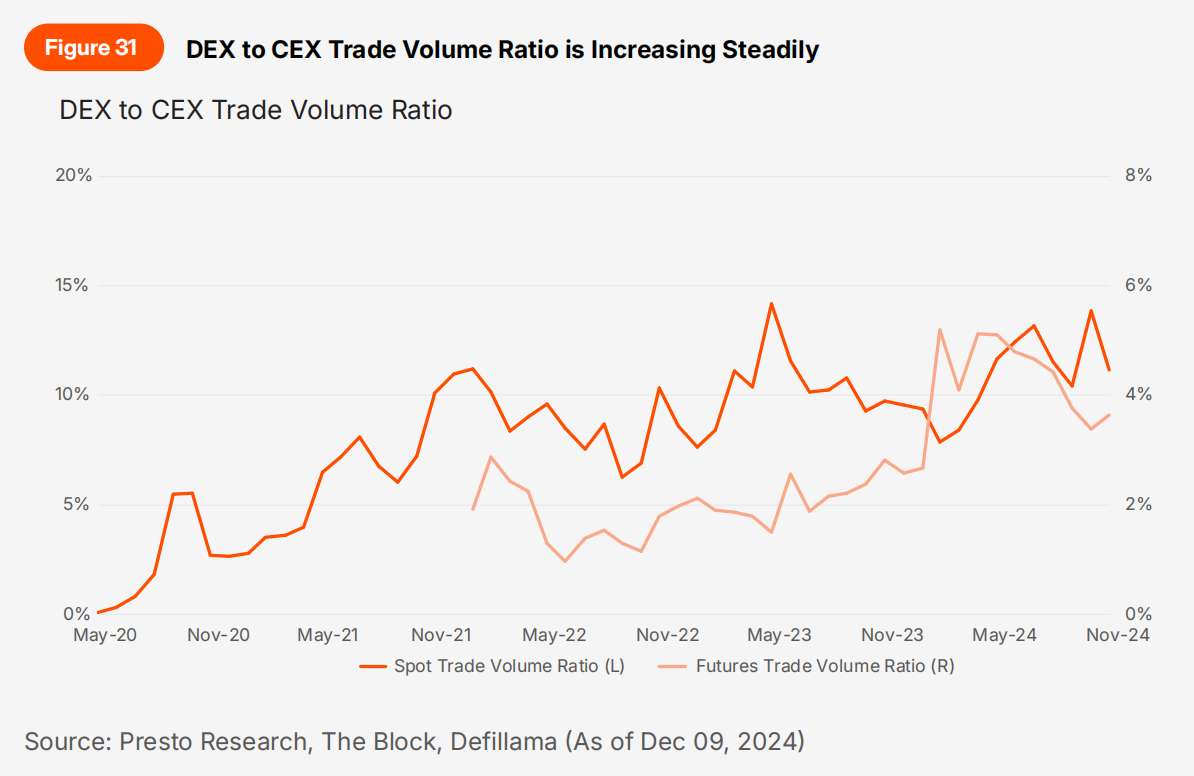

Centralized exchanges (CEXs) like Binance or Coinbase remain the primary trading platform for most investors. Figure 31 shows that the DEX to CEX volume ratio flattens when entering a bull market. This suggests that retail investors usually prefer CEXs at the beginning of a cryptocurrency bull market. Institutional investors have also become more active during this period, and they tend to use CEXs because of more abundant liquidity, easier withdrawals, and lower DeFi-related risks.

However, as the bull market progresses, the DEX to CEX volume ratio gradually increases. This is because investors seek riskier assets, leading them to turn to Altcoin, Memecoins, and eventually enter yield farming or trading on DeFi. This trend is expected to accelerate next year, pushing the spot DEX to CEX volume ratio to over 20% (currently 13.7%) and the perpetual contract DEX to CEX volume ratio to over 10% (currently 7.2%).

There are three main factors that influence this trend change.

First, under the new Trump administration, more friendly DeFi (decentralized finance) regulatory policies may be introduced, which will promote the further development of the DeFi ecosystem. Less censorship and support for token value accumulation will attract more users, further increase the demand for DeFi tokens, and thus form a virtuous circle that promotes the growth of the on-chain ecosystem.

Secondly, multi-faceted user experience (UX) improvements are a key factor, including significant improvements in wallets, trading terminals, and trading robots. After the FTX crash, traders' sensitivity to counterparty risk increased significantly, and the popularity of on-chain trading activities increased significantly. For example, Phantom Wallet has been on the top application list many times this year, showing that on-chain user experience and popularity have reached unprecedented heights.

Third, the issuance of high-value tokens on centralized exchanges (CEX) is attracting more investors to turn to on-chain transactions. As the scale of the crypto industry moves towards the trillion-dollar level, the valuation of newly issued tokens can easily reach hundreds of millions or even billions of dollars. Many investors have gradually realized that it is difficult to obtain excess returns by holding tokens on centralized exchanges, and the on-chain ecosystem is the area with the most profit potential at present.

Although there are still certain barriers to entry for self-custody and on-chain operations, the "fear of missing out" (FOMO) sentiment in this round of bull market may drive more users to flock to the on-chain economy. This "gold rush" for on-chain transactions will not only promote the overall development of the blockchain industry, but also fit in with its vision of building a trustless, open economic system.

While there are still challenges with self-custody and on-chain usage, the FOMO during this bull run could drive more users into the on-chain economy. This “gold rush” to on-chain activities could ultimately benefit the blockchain industry, in line with the goal of creating a trustless, open economy for everyone.

3.5.2 Digital gold is better than gold: the value of the Bitcoin ecosystem will reach more than 1% of the Bitcoin network

After multiple cycles, Bitcoin is increasingly being accepted by the public as digital gold and a store of value. However, despite having greater potential than physical gold, in past cycles Bitcoin has been primarily used as a "holding" asset or traded on exchanges. Only a small fraction of Bitcoin is used as collateral in DeFi, and even then, it is usually in a cross-chain form.

To unlock the full potential of Bitcoin as digital gold, numerous protocols have emerged since 2023. Native Bitcoin protocols like Ordinals and Runes enable Bitcoin to serve as a base layer for native DeFi by minting tokens and NFTs directly on its blockchain. In addition, various second-layer solutions and re-collateralized protocols have begun to generate yield on Bitcoin, using it as a security layer. This concept is not entirely new - the largest stablecoin Realcoin (now Tether, USDT) was originally issued on Bitcoin in 2014 through the Omni Layer protocol. This highlights Bitcoin's history as an innovative foundational blockchain.

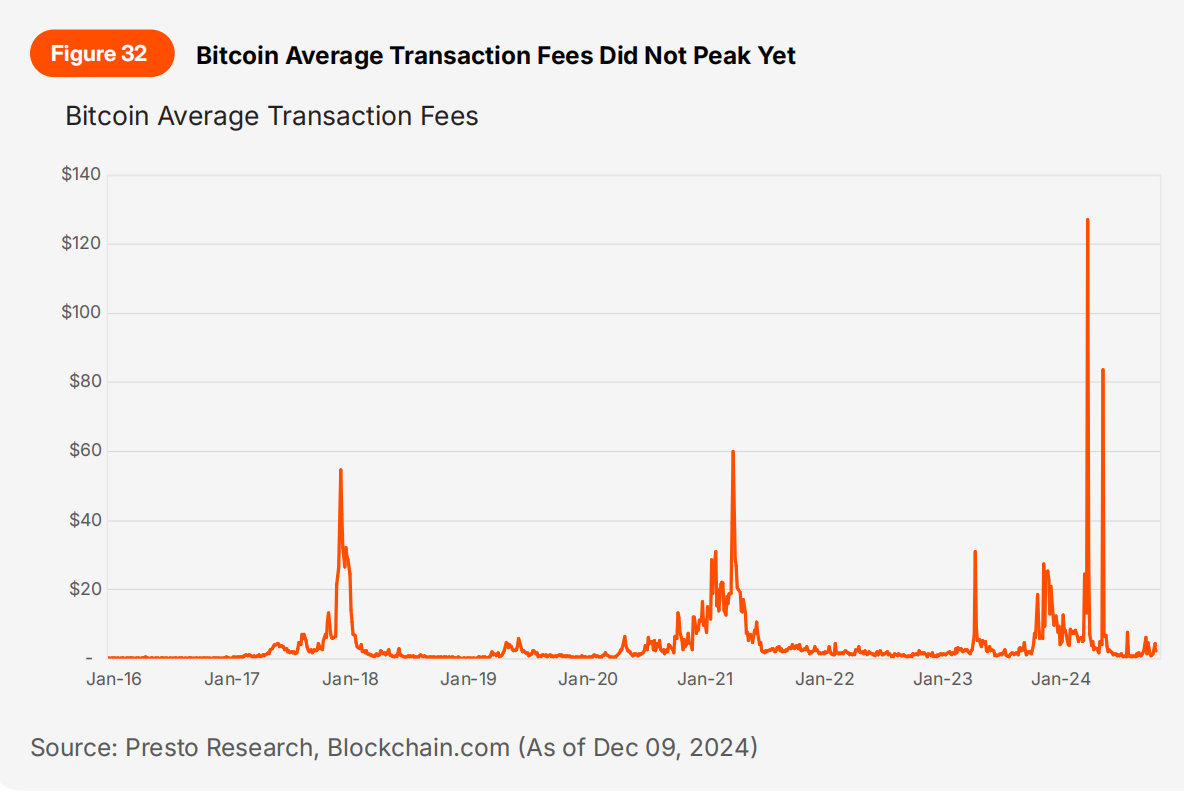

Since the launch of Ordinals in 2023, Bitcoin has achieved transaction fee levels comparable to previous bull run peaks. However, heading into the upcoming bull run, these fees have fallen to normal levels, indicating that on-chain demand for BT