As Christmas approaches, the Bit market is full of expectations that a record-breaking rally will occur this year. Historically, Bitcoin (BTC) has shown a 'Santa Rally' with a bullish price movement in the week leading up to Christmas in the year of the Bit halving.

It is unclear whether the same pattern will be followed this year or if the market will chart a different course.

Will Bitcoin Repeat Its Christmas Performance?

From the beginning of this year to the present, the price of Bitcoin has increased by 137%. It recently surpassed $108,000 but has shown a downward trend recently. Despite a slight correction, some suggest that BTC could be traded at even higher prices during the Christmas week.

It is not the case that the price of Bitcoin consistently rises during the Christmas season every year. However, in a Bull market, Crypto tends to perform strongly during this period. Conversely, in a Bear market, Bitcoin prices often see a significant drop during the Christmas season.

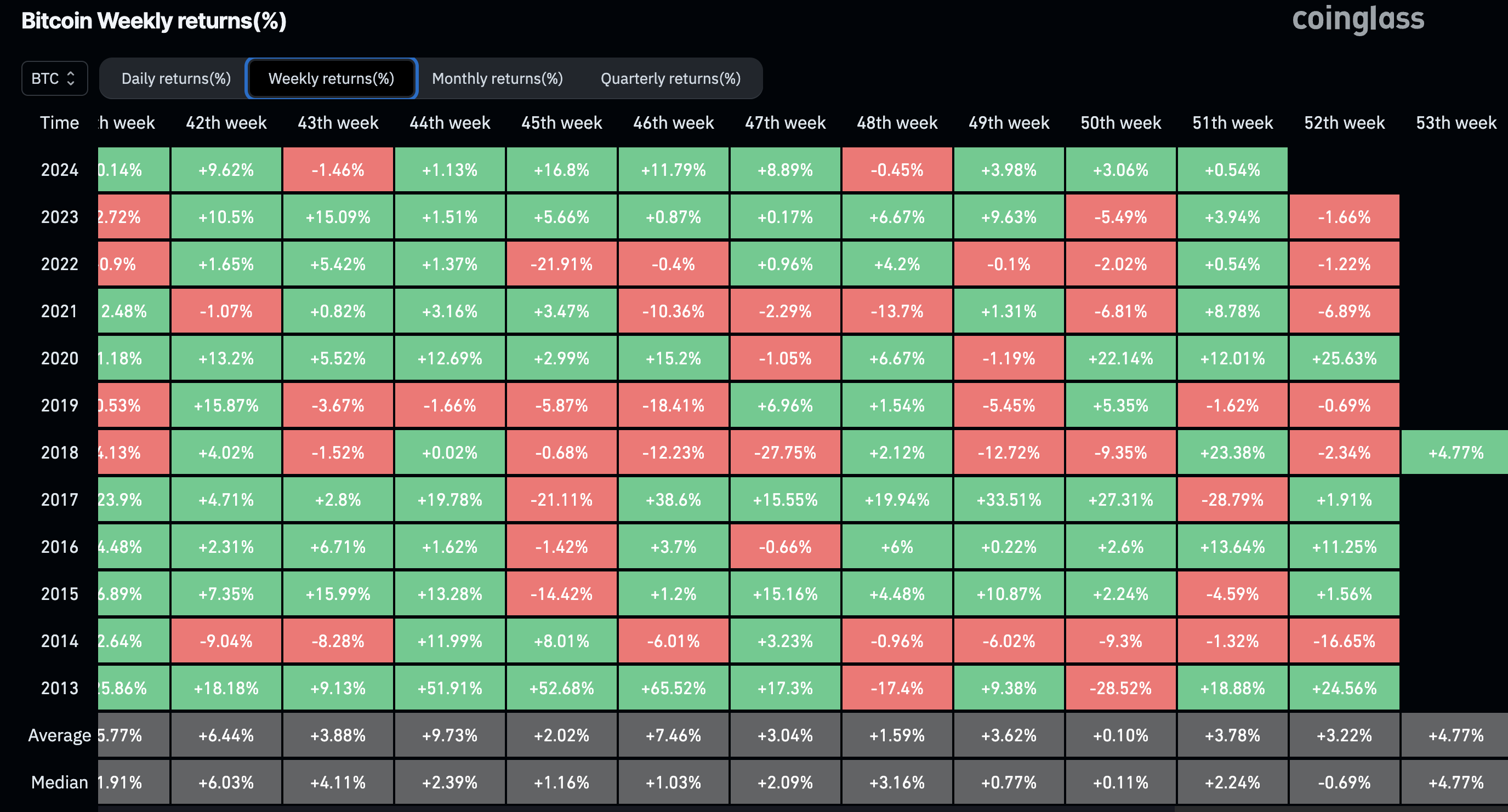

According to Coinglass data, in the 2020 Bit halving year, Bitcoin rose 25.63% during the Christmas week (week 52). Similarly, in 2016, it rose 11.25%, and in 2012, it recorded another double-digit increase.

Additionally, BTC has already recorded an 8.71% increase this December. If the historical trend continues, Crypto may see additional gains next week and could approach $120,000.

Interestingly, some analysts are confident that a similar event will occur this year as well. One of them is Mr. Crypto, a BTC and Altcoin investor.

"Bitcoin always skyrockets around Christmas in the Bit halving year. It will be no different this time." - Mr. Crypto shared on X (formerly Twitter).

Similarly, another analyst, Crypto Rover, also mentioned that the Bitcoin "Santa Rally" will occur in 2024.

On-Chain Data Supports Coin Appreciation

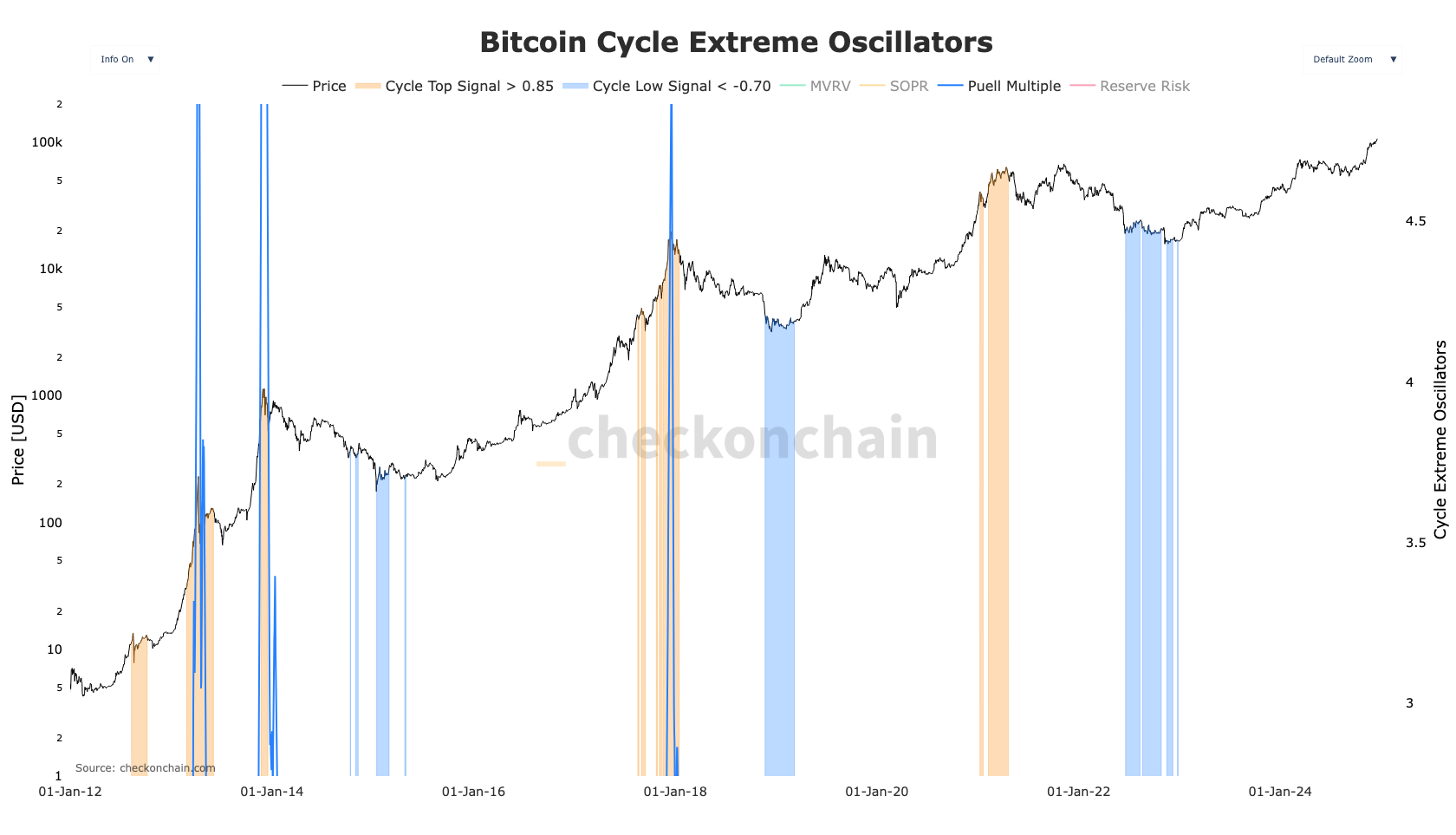

From an on-chain perspective, several extreme Bitcoin cycle metric indicators support high values. For example, looking at the Cycle Top and Cycle Bottom signals, BeInCrypto observes that BTC reaches its peak when the Cycle Top is above 0.85.

On the other hand, Crypto reaches its bottom when the Cycle Bottom is below 0.70. As shown below, Bitcoin has surpassed the bottom, but has not yet reached the peak of this cycle. If buying pressure increases during the Christmas week, Bitcoin could surpass its all-time high of $108,268.

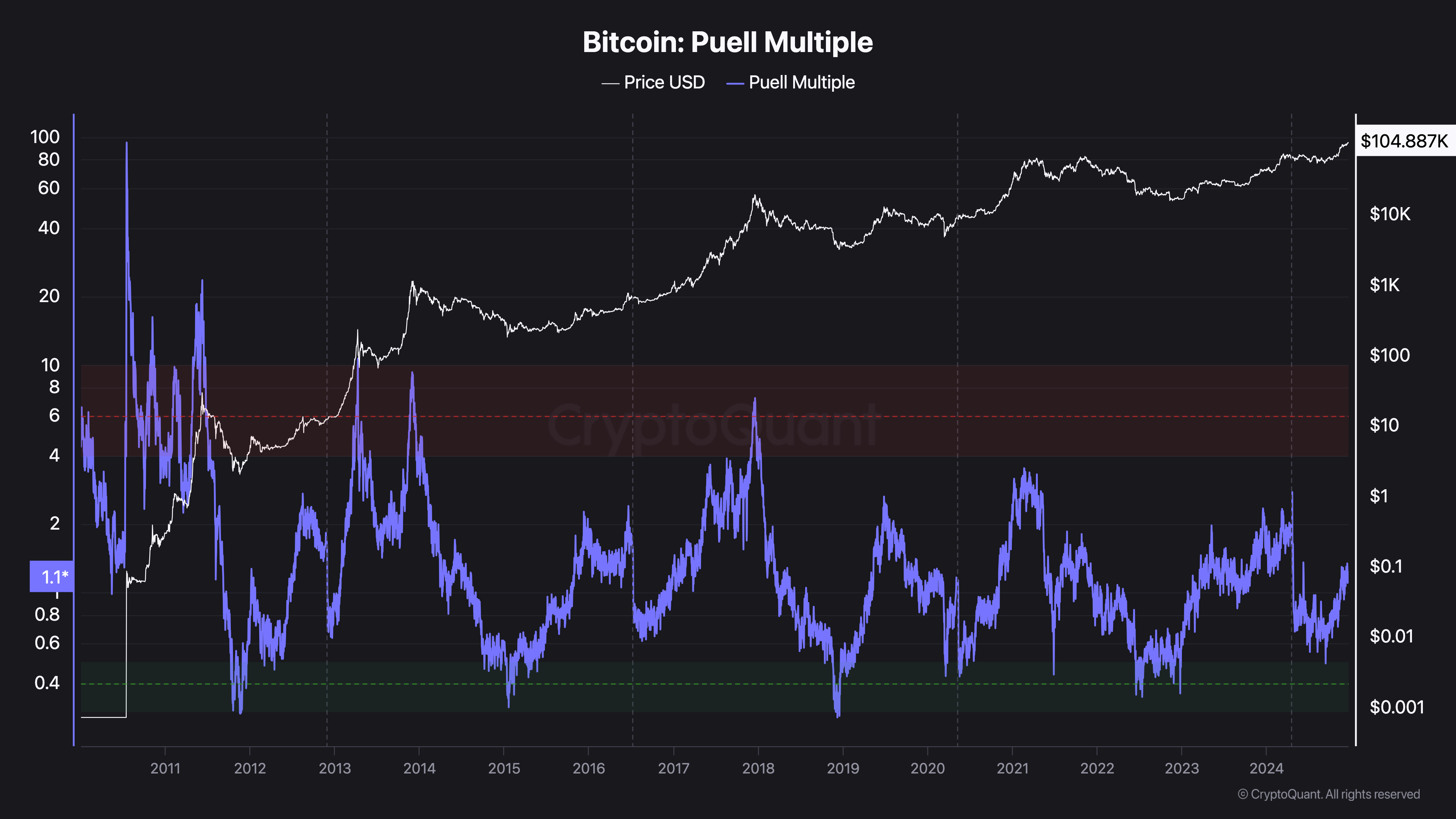

The Puell Multiple also aligns with this bias. The Puell Multiple provides a comparable perspective using Bitcoin's current price. This helps determine whether Bitcoin's price is relatively high or low compared to historical trends.

A value above 6 indicates a market top, and a value below 0.4 indicates a bottom. According to CryptoQuant, Bitcoin's Puell Multiple is 1.15. This current value suggests that BTC has surpassed the bottom but still has room to grow, as it is still far below the peak.

BTC Price Prediction, Possible $116,000?

On the daily chart, Bitcoin's price appears to be following the path it took in March when it surpassed $73,750. During that period, BTC rose 81.95% in less than 3 months. From November 5th to the time of writing, the Crypto has increased by 56.58%.

Looking at the Accumulation/Distribution (A/D) line, it can be seen that readings have increased. This rise indicates more accumulation than distribution. The Money Flow Index (MFI), which measures the level of capital flow, has also risen.

If these indicators continue the same trend, Bitcoin's price could reach over $116,000, almost $120,000, during the Christmas week. However, if BTC faces selling pressure before December 25th, this may not occur. Instead, it could drop below $100,000.