Bit(BTC) reached a new all-time high on December 17, but has since experienced a significant correction. Indicators such as ADX and NUPL suggest a slowdown in upward momentum and a potential shift in market sentiment.

Over the next few days, it remains to be seen whether BTC will regain its upward momentum to test $110,000, or face further correction to important support levels.

BTC's Current Trend, Potential Shift in Sentiment

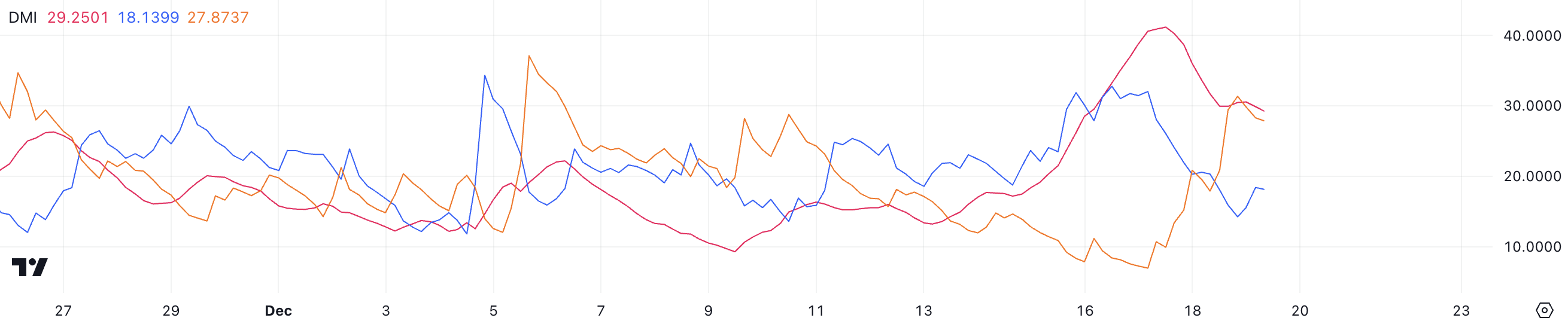

The Bit(BTC) DMI chart shows that the ADX has dropped significantly from above 40 two days before Bit(BTC) reached a new all-time high, to the current level of 29.2. This decline in ADX indicates that the trend remains relatively strong, but its intensity is weakening.

As the downtrend takes hold, the market appears to be either establishing a bottom or transitioning to the possibility of further decline.

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend, and below 20 suggesting a weak or non-trending market. Currently, BTC's D+ is at 18.1, and D- is at 27.8, indicating a dominant downtrend, and suggesting that sellers are temporarily outpacing buyers in the short term.

This imbalance can push Bit(BTC) prices lower unless buyers regain control and D+ exceeds D-.

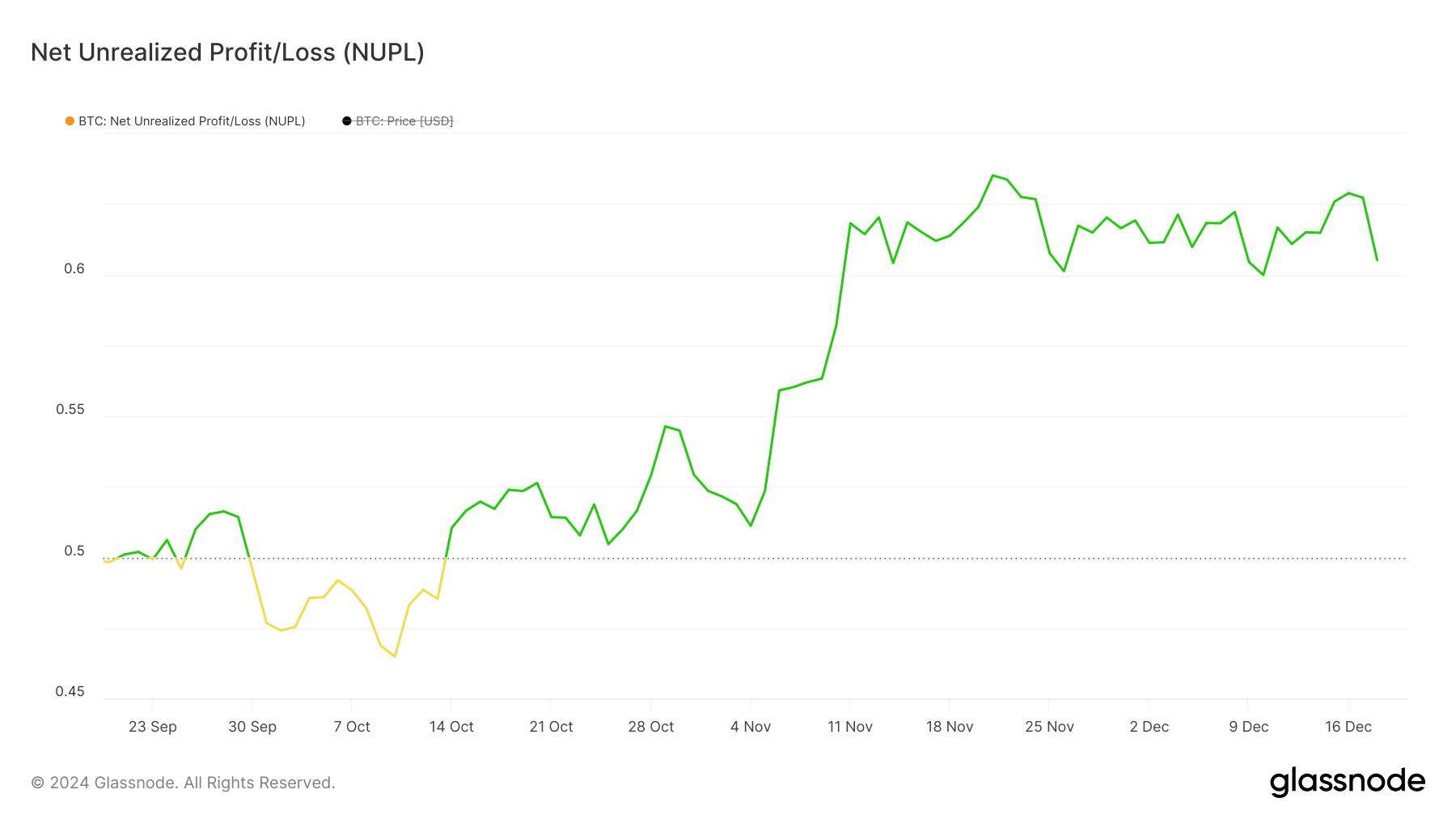

Bit(BTC) NUPL, Decreased but Still Bullish

Bit(BTC)'s NUPL is currently at 0.60, down from 0.628 when Bit(BTC) reached a new all-time high two days ago. This decline reflects a slight decrease in unrealized gains among Bit(BTC) holders, indicating some profit-taking or market cooling following the recent sharp rise.

Despite this decline, Bit(BTC) price remains firmly in the "Belief - Euphoria" zone, suggesting that while there is still confidence among investors, some caution is starting to emerge.

NUPL (Net Unrealized Profit/Loss) measures the total unrealized gains or losses of BTC holders, categorizing market sentiment into different stages.

Values above 0.5 are in the "Belief - Euphoria" zone, while levels below 0.5 indicate the "Optimism - Anxiety" stage, and above 0.7 often correspond to the "Excitement - Greed" stage associated with market peaks. Bit(BTC)'s current position at 0.60 suggests that sentiment remains bullish, but is far from extreme greed and still comfortably exceeds the anxiety level.

Bit(BTC) Price Prediction: $110,000 This Year?

If Bit(BTC) price can break through the $103,638 resistance, it could gain enough momentum to test the new all-time high of $108,000.

Successfully clearing this level would open the door for Bit(BTC) price to reach $110,000 for the first time, indicating sustained bullish momentum and strong market confidence.

However, the EMA lines and ADX currently suggest the trend may weaken, increasing the possibility of a reversal. A crossover of the short-term EMA below the long-term EMA could trigger a stronger downtrend.

In this case, Bit(BTC) price could test the $94,000 support level, and if this level is not maintained, the price could potentially correct by 11.7% from current levels, falling as low as $90,000.