Bit (BTC) has once again proven the wealth-creating ability of cryptocurrencies by recently reaching $100,000. A recent report shows the growth rate of Bit (BTC) millionaires compared to stock investors.

This groundbreaking moment explored by NFTEvening and Storible reflects Bit's (BTC) wealth-creating ability compared to traditional investments like stocks.

Bit (BTC) investment more profitable than stocks

In addition to validating the trust of early adopters, Bit's (BTC) rise to $100,000 has created a large number of new millionaires and billionaires. Recent research by NFTEvening and Storible tracked over 17,000 Bit (BTC) wallets with balances exceeding $1 million on dune analytics.

Specifically, the study focused on wallets that gradually built wealth, excluding those with initial balances exceeding $1 million or $100,000. This emphasized retail investors rather than institutional ones. The findings are as follows:

- 14,211 new Bit (BTC) millionaires: Over 14,000 individuals reached millionaire status as Bit (BTC) surpassed $100,000.

- 4 new Bit (BTC) billionaires: Four lucky investors joined the billionaire ranks, highlighting Bit's (BTC) exponential financial growth potential.

To contextualize Bit's (BTC) performance, analysts compared it to equal investments in top-cap stocks during the same period. The comparison of Bit's (BTC) wealth creation speed to blue-chip stocks was striking. According to the report:

- Millionaire creation: Bit (BTC) investors generally become millionaires in 10.3 years (or 3,775 days) with a $4,000 investment, representing a 250x return on investment (ROI) since 2010. In contrast, the same investment in blue-chip stocks during this period would have grown to only $45,000, a fraction of Bit's (BTC) potential.

- Billionaire creation: Historically, a $30,500 investment in Bit (BTC) has reached billionaire status in 12.7 years (or 4,645 days), achieving a 32,787x ROI. Meanwhile, a similar investment in stocks would have reached $950,000 over the same period.

These results further emphasize the stark difference between Bit (BTC) and traditional investment vehicles. However, the research did not stop there, comparing Bit (BTC) to market leaders.

Bit (BTC) returns since 2010 dwarf Apple, Nvidia, Tesla

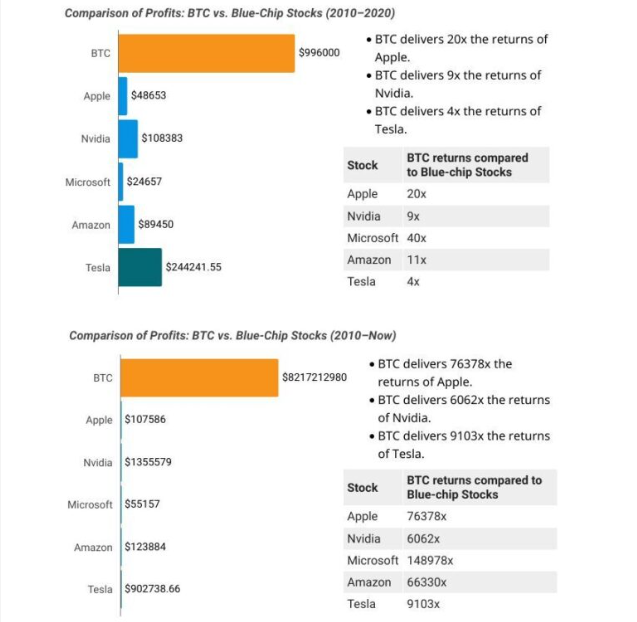

Compared to the top 10 stocks by market capitalization, Bit's (BTC) performance overwhelms even the most successful companies. Specifically:

- 2010-2020 returns: Bit (BTC) provided 20x the returns of Apple, 9x the returns of Nvidia, and 4x the returns of Tesla.

- 2010-present returns: Bit's (BTC) ROI has skyrocketed to 76,378x Apple's, 6,062x Nvidia's, and 9,103x Tesla's.

These findings align with a recent survey by ReviewExchanges that investigated U.S. investors' reactions to Bit (BTC) reaching $100,000, as reported by BeInCrypto. According to the survey, 72% of respondents view cryptocurrencies as a major future investment, citing optimism for Bit (BTC) ETFs, political changes, and increased mainstream adoption.

However, 83% of investors reported gains of less than $10,000. Simultaneously, 79% of cryptocurrency holders acknowledged missing out on significant gains in this latest bull run. This highlights the importance of timing in cryptocurrency investments, as late market entry or insufficient initial investment can result in missed potential profits.

Nevertheless, investors should not rely solely on surveys but conduct thorough research to make well-informed decisions. With growing interest and accelerated mainstream adoption, Bit (BTC) and cryptocurrencies appear poised to continue reshaping the distribution of wealth.

At the time of writing, Bit (BTC) was trading at $102,496, a slight decline of nearly 2% since the start of the Thursday session, as the cryptocurrency market is being shaken by the recent interest rate decision by the Federal Reserve.