The waterfall face wash has been going on for a week.

In the early morning of December 20, the market's reaction to the Federal Reserve's "hawkish" delay in interest rate cuts the previous day expanded, and the cryptocurrency market plunged, with Bitcoin falling to as low as 96,000 USDT, and Ethereum even falling from the 3,900 USDT high in the early morning of the 19th to 3,322 USDT. The violent fluctuations caused the 24-hour contract liquidation volume on the entire network to exceed $1 billion, and Altcoins generally suffered even more severe declines.

VX: TTZS6308

The feast is over, and is it my turn to pay the bill this time? Should I sell and escape the top or be bold and buy the dips?

If you are angry with yourself for not selling out before the FOMC turned hawkish and caused the pullback, remember that you have almost no advantage in predicting the market's reaction, and see it as an opportunity to take it slow. Don't overtrade. In the long run, as long as you have patience, you'll be fine.

If BTC goes to $90,000 (which is unlikely), it will cause a large number of Altcoin liquidations, providing a very good buying opportunity.

If the Bitcoin structure falls below, it is predicted that a large amount of buying will appear again at $90,000. In pure panic, it may even fall all the way to $85,000. Altcoins will then completely collapse.

Suitable buy-in prices for ETH would be $3,000, and for SOL, $160.

Is this downturn just an interlude in the bull market, or a true turning point in market trends?

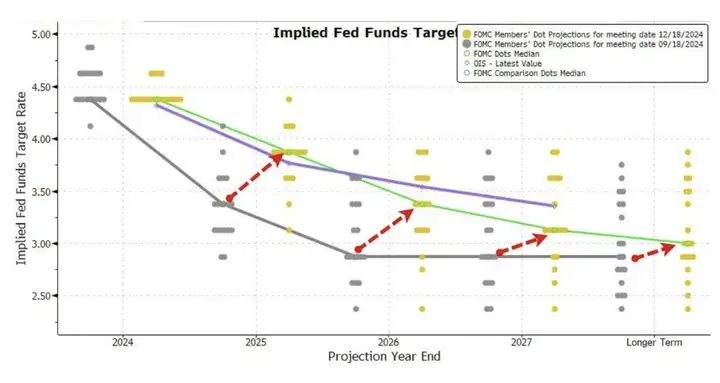

Last night, the Federal Reserve announced a 25-basis-point rate cut, and the market had originally expected this to lead to a rebound, but Powell's subsequent speech quickly changed investors' sentiment. He said that although inflation has eased, the pace of cooling has not met expectations, and the number of rate cuts in 2025 will be significantly reduced.

For risky assets like Bitcoin, higher interest rates mean increased capital costs and increased investment risks. Therefore, Bitcoin plummeted quickly, and market sentiment turned cold. In addition, Powell responded to Trump's proposal to establish a Bitcoin reserve, clearly stating that the Federal Reserve cannot hold Bitcoin and has no plans to change the existing legal framework. This further increased market uncertainty.

From a technical perspective, Bitcoin is currently showing signs of a short-term adjustment, with weakening bullish momentum and a typical top divergence. In addition, the daily chart has formed a "top pattern" structure, suggesting that it may face downward pressure in the short term. On-chain data shows that the number of active addresses has declined, and the inflow of funds to exchanges has increased, indicating that some investors have taken profits at high levels. At the same time, the hedging sentiment in the derivatives market has risen, with demand for put options reaching a three-month high.

The member Q has also been gradually reminding everyone to reduce their positions since the beginning of this week, not to enter the market, and so far it seems to be a perfect escape from the top. Now we are just waiting for the bottom signal to appear, the market to reverse, and start preparing for the next round of uptrend.

Although in the short term, the Federal Reserve's policy has caused violent market fluctuations, Bitcoin has experienced multiple fluctuations and will find new upward opportunities at a certain support level. A 20% adjustment is normal in a bull market, and such a pullback is a good buying opportunity. Therefore, although the short-term price has fallen, the long-term market support remains strong.

The current market sentiment is panicked, and the data in the options market shows that investors' concerns about the short-term downside of Bitcoin have intensified. For investors, maintaining calm is crucial. Facing market volatility, rational analysis and formulating a clear trading strategy are key. The short-term market adjustment provides investors with the opportunity to buy at low prices. For long-term bullish Bitcoin investors, this short-term volatility provides a "low-cost" opportunity.

Where are the opportunities in the future?

Although the market is currently experiencing volatility, the long-term potential of Bitcoin remains strong. With the increasing participation of more and more institutions and the gradual clarification of cryptocurrency industry regulations, the future of the market is full of opportunities.

This adjustment period may be a good time to observe and enter the market. If the Federal Reserve's rate cut expectations for 2025 continue to decrease, the market may gradually stabilize and provide more opportunities.

Although the current market is experiencing volatility due to the Federal Reserve's hawkish rhetoric, from the perspective of Bitcoin's fundamentals, this adjustment is likely just normal volatility in the bull market. For investors who are bullish on Bitcoin's long-term potential, the current market decline may be a buying opportunity worth paying attention to. Maintain patience, conduct rational analysis, and the opportunities in the future are still worth looking forward to!

When everyone is panicked and doubts that the bull run is over, that's the time to start buying. The market always goes against human nature, so avoiding noise and investing based on your own logic is the best strategy.