Reviewing our journey from knowing to investing in Usual

First encounter with the Usual team

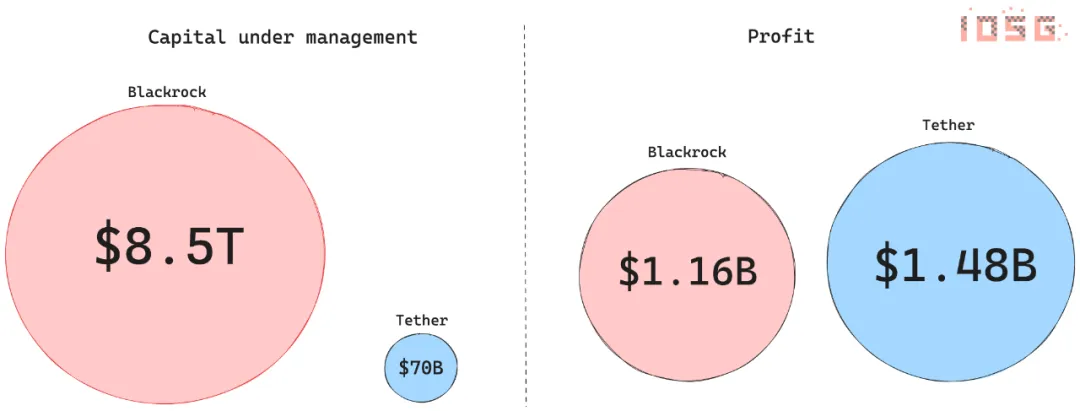

In June 2023, amidst the crypto market downturn, with Bitcoin struggling to maintain around $25,000, many investment institutions chose to either sit on the sidelines or observe during the bear market. It was during this time that we met Usual's founders, Pierre and Adli. The shocking USDC de-pegging event had just occurred, and even the safest stablecoins were found to have risks and vulnerabilities, while in contrast, TETHER was reporting record profits and was expected to surpass BlackRock this year. This contradictory phenomenon in the stablecoin market, revealing severe fragility yet containing immense potential, caught our attention.

In July, our investment team specifically visited Usual's office in Paris. At the time, they had assembled an 8-person team using their own funds and had booked a modest meeting room in a shared office space to pitch and discuss with us. We had a roughly 2-hour exchange, and later that week, we also arranged a second meeting with Usual's CTO to discuss the technical aspects. Pierre, the founder, had an interesting background - he was a former French Member of Parliament and an advisor to French President Emmanuel Macron.

Delving into Usual's product design

When Pierre shared their vision with us, we were initially struck by the depth and detail of their plans. Their strong passion and meticulous thinking were evident, which meant we had to invest more time to understand them and assess the investment potential.

During the due diligence process, we held multiple internal and external meetings and detailed written exchanges, ultimately accumulating 50-70 pages of materials. As we delved deeper, we became increasingly impressed by how they had carefully integrated every detail into their grander vision. Their responses to our questions were never vague, but always based on thorough research, demonstrating a deep understanding of future challenges.

But what truly set them apart was not just their technical prowess or attention to detail, but their genuine passion and conviction. It was clear that they lived and breathed for Usual 24/7 (quite different from the common perception of French people); their contagious enthusiasm made us believe in their vision to disrupt TETHER. We could see that these individuals were not chasing a market cycle, but rather aiming to fundamentally change the stablecoin landscape.

A difficult yet resolute investment decision

We decided to make one of IOSG's largest seed round investments to date. However, even after we committed to lead the round in August, it took nearly two months to complete the entire fundraising. IOSG typically invests in less than 15 deals per year, with around 5 of them being led by us. The lead investment process is quite challenging, and this Usual case exemplified it perfectly. After we confirmed the lead investment, we provided a comprehensive list of East and West investors, but none of them gave any commitment within a month - everyone wanted to continue observing, uncertain whether the fundraising would succeed. At the most difficult time, our colleague Momir even personally attended an investment committee meeting of a potential investor to help explain Usual's entire stablecoin and DeFi mechanism design, answering the committee's questions. Fortunately, that investor ended up participating. This deal made us experience an unprecedented lack of consensus, as around 20 mainstream investment funds in the industry all said no, yet we persisted and continued to support the team in completing that round of financing, which was also thanks to the founders' resilience and persistence.

Ironically, even the fund that introduced Usual to us ultimately abandoned this investment round. On one occasion, a French early-stage fund pointed out that foreign parties did not recognize Pierre's outstanding background, but they themselves also gave up on this investment. Reflecting on Usual's fundraising journey, it is regrettable that among the many VC funds they approached, only 3-5 funds truly delved into the project details.

During the three months it took to complete the fundraising, we watched as Pierre and Adli continuously refined their vision and advanced the development progress. The resilience they displayed during this period further strengthened our conviction. Ultimately, we were fortunate to complete this round of financing with like-minded funds such as Kraken Ventures, who had also invested a significant amount of time to understand the nuances of Usual's vision.

Aligned in vision, moving forward together

After the investment, the team's execution speed even surprised us. Their attention to detail during the preparation stage translated into excellent execution in practice. They achieved milestones at a pace that exceeded our most optimistic expectations. Later, IOSG's post-investment team joined in, and we internally compiled a list of renowned KOLs from East and West. After multiple discussions and screenings, we helped the Usual team select KOLs with diverse backgrounds and unique advantages, and then introduced and recommended them one by one. Additionally, through multiple pitches to one of Asia's largest TVL communities, we helped Usual successfully enter this major Asian DeFi community, and they secured the first 200M TVL during the gray testing phase.

Reflecting on this journey, this should be encouraging for future founders. The number of "No"s you receive does not matter; you only need one "Yes" to trigger a snowball effect. Today, we are more confident than ever that our "willingness" to back Usual will be one of our most important decisions. Sometimes, that's all it takes - saying "Yes" to the right team, with the right vision, at the right time.

The arduous journey makes these important milestones all the more gratifying. We are pleased to see Usual starting to receive the recognition they deserve, while also being acutely aware that this is just the beginning of a long journey. There is still a lot of work ahead. We believe Usual has the potential to set a new gold standard for stablecoins. With a focused team, revolutionary on-chain infrastructure, and innovative token economics, Usual is poised to challenge TETHER. If successful, this "vampire attack" could bring the most significant wealth-generating effect of this bull cycle.

We would like to thank all the IOSG team members who supported the decision to invest in Usual during the bear market trough. Usual's growth has allowed the team to experience the power of growing together with the founders, and each member has become an ambassador for Usual. As a long-standing fund in the crypto industry, we are well aware of the difficulties of the investment business, but we are willing to help crypto entrepreneurs reach for the stars and succeed! We also look forward to the next founders who will come to us and become the new Usual!

You're unUSUAL!

Next, let's review some of the memos and thoughts written by our investment colleagues in 2023

Let's start with a background story and a simple question: Why has BlackRock suddenly become so interested in blockchain technology? Is BlackRock embracing the idea of cryptocurrencies? Perhaps not. Are they seeing the long-term advantages of using blockchain technology to replace traditional financial infrastructure? To some extent, yes.

But the real driving force may be the sizable business opportunities in the current blockchain space.

TETHER: The best business model in history

Last year, TETHER made headlines for surpassing BlackRock's first-quarter net income, despite BlackRock managing over 120 times more assets. How is this possible?

- Excerpt from the IOSG 2023 Usual investment memo

TETHER's core business is to accept fiat currency collateral from off-chain bank accounts and issue a digital representation of that fiat, known as USDT. This model is considered one of the most competitive business models in the financial industry for the following reasons:

100% collateral investment flexibility: TETHER can freely manage the received fiat currency.

Retaining 100% of investment returns: All profits remain within the company.

Massive operating leverage and profit margins: Operating costs remain constant regardless of scale.

- Through investing fiat currency in government bonds and other interest-bearing assets, Tether generates billions of dollars in annualized revenue from its $140 billion in assets under management. Unlike banks, they do not need to share these earnings with users, as users are primarily focused on the stablecoin itself and its utility as a widely accepted payment medium.

Another key factor is that this type of business has massive operational leverage. Whether Tether manages $10 billion, $100 billion, or $1 trillion, its operating expenses remain relatively constant. This scalability provides Tether with tremendous growth opportunities.

Scaling to Trillions: The Demand for Risk-Free Stablecoins

Despite their success, existing stablecoin providers like Tether and Circle still face several critical issues that need to be addressed. For example, the collapse of Silicon Valley Bank (SVB) has exposed some potential risks, indicating that stablecoins are not without risk. And if any risks materialize, users will be the first to bear the brunt.

Lack of Transparency

During the Silicon Valley Bank crisis, the public was unaware of whether any stablecoin providers were affected. This highlights a significant transparency problem. The lack of transparency not only undermines user trust but may also introduce regulatory risks due to information asymmetry, potentially leading to stablecoins being reclassified as securities.

Susceptibility to Bank Runs

Although Circle only held a small amount of assets at SVB, it still faced the risk of a death spiral, revealing flaws in its risk management. Due to the large deposits held in single accounts, Circle's deposits were not insured. Without intervention from the U.S. government, Circle could have faced a catastrophic bank run, as it still intended to maintain a 1:1 redemption even as the value of its collateral had depreciated.

Inherent Variability

Existing stablecoins, such as Tether and Circle, are not designed to meet the future demand of trillions of dollars. They rely on human judgment, lack predictability and immutable principles, and are vulnerable to black swan risks, which could have disastrous consequences for the broader crypto industry at this scale. The stablecoins we should have should possess immutability and be built on clear, permanent service rules.

Excessive Risk-Taking

While Circle is the only stablecoin provider that was clearly impacted by the SVB collapse, this does not mean that Tether's management is more prudent; it has simply been luckier so far. Some even argue that given Tether's scale, the risks mentioned earlier are more pronounced in Tether, which is concerning. Tether has also recently begun to address some of these issues to mitigate certain black swan risks. However, a review of its balance sheet shows that they have a high degree of flexibility in managing off-chain funds, with billions of dollars invested in illiquid positions such as collateralized loans and "other investments." So, are USDT holders adequately compensated for the risks associated with these lending and investment activities?

Introducing Usual: User-Owned, Systemically Risk-Free Stablecoin

Devising an investment strategy to absorb billions of dollars in a bull market is one thing; building a stablecoin that can scale to trillions is another. Usual is addressing the latter challenge.

In recent years, it has become evident that stablecoins will gradually replace volatile cryptocurrencies as the primary payment medium on blockchains. Even if just meeting the existing $200 billion stablecoin demand, the need for exogenous assets as collateral becomes increasingly apparent. To this end, the infrastructure Usual is building has the following features:

Predictable operation based on immutable principles: Usual's design ensures the stability and reliability of its operations, reducing user uncertainty.

Maximum transparency: By enhancing transparency, Usual builds user trust and ensures relevant parties are aware of the flow of funds and asset collateralization.

Minimizing bank run risk and mitigating black swan events: Usual's mechanisms are carefully designed to avoid bank run risk and effectively address unexpected events.

Given the critical infrastructure role of stablecoins in the financial system, their design should adopt a pessimistic approach. Usual's on-chain infrastructure is carefully designed to scale seamlessly, effectively aggregate high-quality collateral, and avoid bank runs.

However, risk-averse and conservative designs often struggle to drive and achieve scale growth. Most new RWA-backed stablecoins lack the appeal for early adopters, who are unlikely to be attracted by modest 5% annualized yield rebase stablecoins. Without the momentum provided by early adopters, these projects are unlikely to reach the scale needed to attract institutional interest, thus appearing bleak in their prospects.

Risk-Averse Stablecoin x Aggressive Governance Token Design

In contrast, Usual Money adopts an innovative approach by separating its primary token - the risk-averse stablecoin - from the fully allocated governance token rewards. This model not only encourages user participation due to speculative and wealth creation opportunities, but also cultivates a strong network effect over time to ensure long-term user retention. The governance token distribution mechanism is designed to heavily reward early participants. As time passes and Usual scales and establishes network effects, the additional governance token mining will cease, effectively capping the supply of governance tokens.

Considering the scale of the opportunity: If Tether were to go public today, its valuation could exceed $50 billion (conservative estimate), based on its approximately $140 billion in productive assets under management and a conservative price-to-earnings ratio. If Tether chose to pass this value back to the community, it could potentially result in at least a 50% one-time gain for all users.

At the same time, Usual Money is not simply separating the stablecoin product from the logarithmically distributed governance tokens. For those willing to make additional commitments and maximize their returns, Usual plans to introduce a token economic model with complex game theory, which is the most innovative design since the advent of veCRV.

Exceptional Team and Vision

About the team: The product and founders are highly aligned. The team is vibrant and professional, leaving a strong, distinct impression in our conversations: they are charismatic, sharp-minded, business-oriented, and effective in articulating their vision. The co-founders complement each other's strengths, with outstanding networks in both the crypto and traditional finance domains.

- Excerpt from IOSG's 2023 Usual Investment MemoAfter engaging with hundreds of crypto teams over the past four years, we can say that Usual is among the top echelon. The Usual team is unparalleled in their energy, dedication to the project, sense of urgency from day one, and desire to prove themselves and execute on a grand vision. They possess the right combination of legal and financial expertise required to build a risk-averse stablecoin design, while also having sufficient crypto-native understanding to guide the community and complete the first stage of product scaling.

Usual has the potential to set a new gold standard for stablecoins. With a focused team, revolutionary on-chain infrastructure, and innovative token economics, Usual is poised to challenge Tether. If successful, this "vampire attack" could bring about the most significant wealth-generating effect of the current bull market.