Author: Bitcoin Magazine Pro; Compiled by: Bai Hua Blockchain

As Bit has now entered the six-digit range and become the norm, higher prices also seem to be a necessity. By analyzing key on-chain data, valuable insights can be provided on the basic health of the market. After understanding these indicators, investors can better predict price trends and prepare for potential market peaks or upcoming corrections.

1. Terminal Price

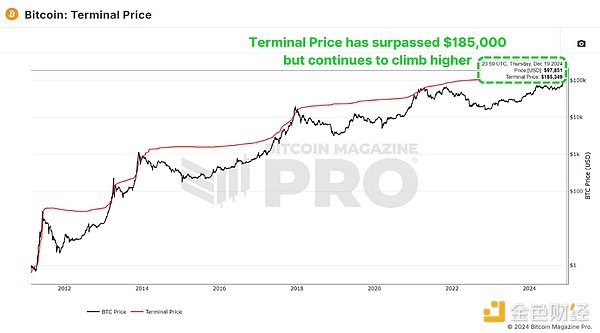

The "Terminal Price" indicator, which combines the Coin Days Destroyed (CDD) and the supply of Bit, has long been seen as an effective tool for predicting the peak of the Bit cycle. Coin Days Destroyed simply measures the activity level of Bit transactions, looking at both the length of time Bits are held and the amount of Bit involved in transactions.

Translator's note:

Terminal Price is an indicator used to predict the price peak of cryptocurrencies like Bit. It combines the supply of Bit and on-chain transaction data, such as Coin Days Destroyed (CDD), to assess market activity and investor behavior.

Coin Days Destroyed (CDD): Simply put, it looks at how long Bits have been held before being transferred, while also considering the amount transferred.

The role of Terminal Price: When the Terminal Price rises, it usually means the market is active or even overheated, and may be approaching the peak of the current bull market.

In simple terms, the Terminal Price is like a "market thermometer" that helps investors judge whether Bit is in the late stage of a bull market or about to enter a correction.

Figure 1: Bit's Terminal Price has broken through $185,000

Currently, Bit's Terminal Price has exceeded $185,000 and may continue to rise to $200,000 as the cycle develops. Given that Bit has broken through $100,000, this suggests that prices may continue to rise positively in the coming months.

2. Puell Multiple

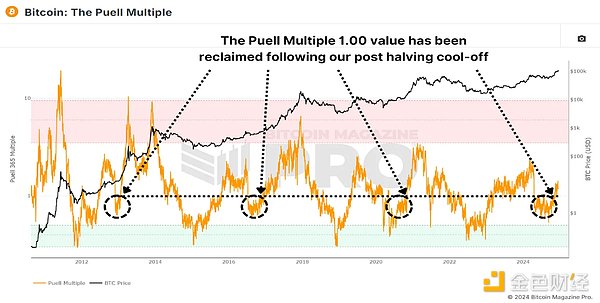

The Puell Multiple evaluates by comparing the daily miner revenue (in USD) to its 365-day moving average. After the halving event, miner revenue dropped significantly, leading the market to enter a period of consolidation.

Figure 2: The Puell Multiple has risen above 1.00

Currently, the Puell Multiple has risen back above 1, indicating that miner profitability is recovering. Historical data shows that breaking through this critical level usually signals the late stage of a bull market cycle, often accompanied by exponential price increases. This pattern has been observed in all previous bull markets.

3. MVRV Z-Score

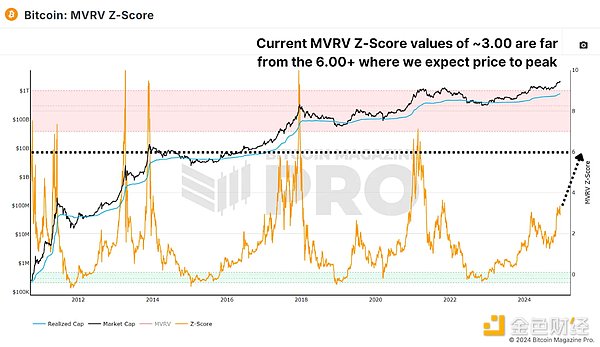

The MVRV Z-Score measures the relationship between market value and realized value (the average cost basis of Bit holders), providing key market signals. To account for asset volatility, the indicator is standardized as a Z-score, and has shown high accuracy in identifying cycle peaks and troughs.

Figure 3: The MVRV Z-Score is still significantly lower than previous cycle peaks

Currently, Bit's MVRV Z-Score is around 3.00, not yet in the overheated red zone, indicating that the market still has room for growth. Although the trend of decreasing cycle peaks has become a trend, the Z-Score shows that the market is still some distance from reaching a state of frenzy.

4. Active Address Sentiment Index (AASI)

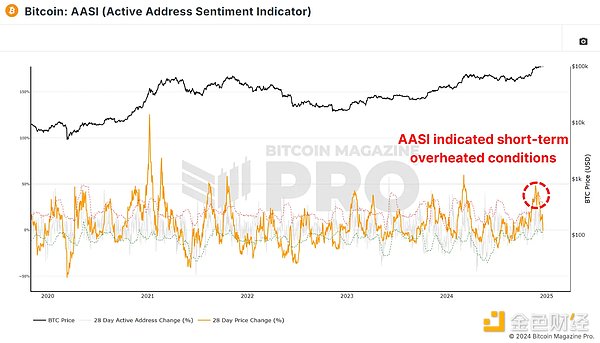

This indicator tracks the percentage change in active network addresses over a 28-day period and compares it to the corresponding price change. When price growth outpaces network activity, it suggests the market may be overbought in the short term, as positive price performance may be difficult to sustain with insufficient network utilization.

Figure 4: AASI showed signs of overheating when Bit broke through $100,000

The latest data shows that after Bit quickly rose from $50,000 to $100,000, the market experienced a slight cooling, indicating that it is currently in a healthy consolidation period. This adjustment may lay the foundation for long-term sustained growth and does not mean we should be pessimistic about the medium to long-term trend.

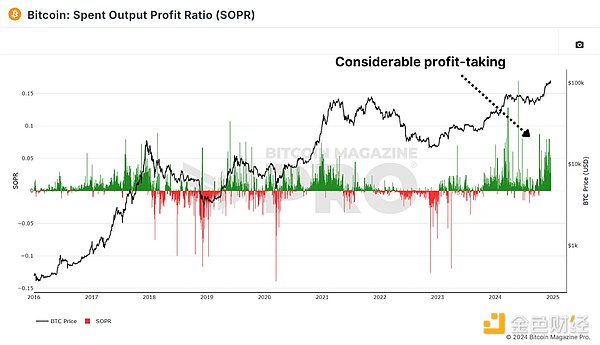

5. Spent Output Profit Ratio (SOPR)

The Spent Output Profit Ratio (SOPR) measures the profitability of Bit transactions. The latest data shows an increase in realized gains, which may indicate that we are entering the late stage of the cycle.

Figure 5: Significant SOPR clustering indicates increased profit-taking

It's worth noting that the use of Bit ETFs and derivatives is increasing. Investors may be shifting from self-custody to using ETFs for convenience and tax benefits, which could impact SOPR values.

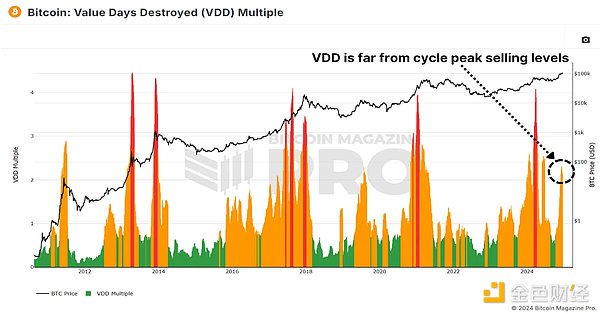

6. Value Days Destroyed (VDD)

The Value Days Destroyed (VDD) multiple adds weight to long-term large holders on top of Coin Days Destroyed (CDD). When this indicator enters the overheated red zone, it usually signals that prices have reached a major peak, as the most experienced large participants in the market start to cash out and exit.

Figure 6: VDD is at a relatively high but not yet overheated level

The current Bit VDD level shows the market is slightly overheated, but historical data suggests this range may persist for months before reaching the peak. For example, in 2017, VDD showed overbought signals nearly a year before the cycle top arrived.

7. Conclusion

In summary, these indicators suggest that Bit is gradually entering the late stage of the bull market. While some indicators show short-term cooling or mild overbought conditions, most still highlight the significant upside potential in the 2025 timeframe. The key resistance level for this cycle may be between $150,000 and $200,000, and indicators like SOPR and VDD will provide clearer signals as the peak approaches.