In the past month, AI Agent has sparked a new wave of enthusiasm in the crypto industry.

In less than a month, the total market capitalization of AI Agent projects has reached over $10 billion. Among them, Virtuals once reached a market capitalization of $3 billion, and projects like ai16z and Fartcoin once reached $1 billion. According to incomplete statistics by , there are at least 14 cryptocurrencies related to AI Agent with a market capitalization of over $100 million.

Many Web3 practitioners believe that AI Agent may be one of the biggest narratives in this cycle, just like DeFi, Non-Fungible Token (NFT), and metaverse in the previous cycles. So, when a brand-new crypto narrative emerges in the early stage, how can we find the leading crypto projects of AI Agent through a set of good methodologies?

The author tries to list ten methods for the readers.

One: On-Chain Revenue Method

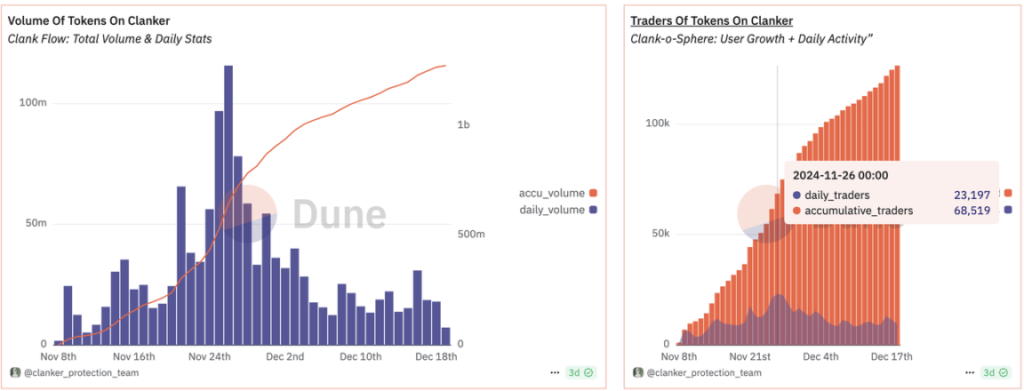

This method is more suitable for judging platform-type AI Agents, such as Clanker, vvaifu.fun, and Virtuals. If the daily on-chain revenue and on-chain transaction volume have fluctuations, such as consecutive high-speed growth, it may indicate that this AI Agent is likely to have good development. Conversely, it may mean that the development has stagnated.

For example, Clanker, as a star project in the Base ecosystem's AI Agent, can be seen from the on-chain data that after November 26, the number of issued tokens, the number of traders, and the on-chain revenue have all started to decline, and this trend is also immediately reflected in the token price.

Two: Developer Attention Method

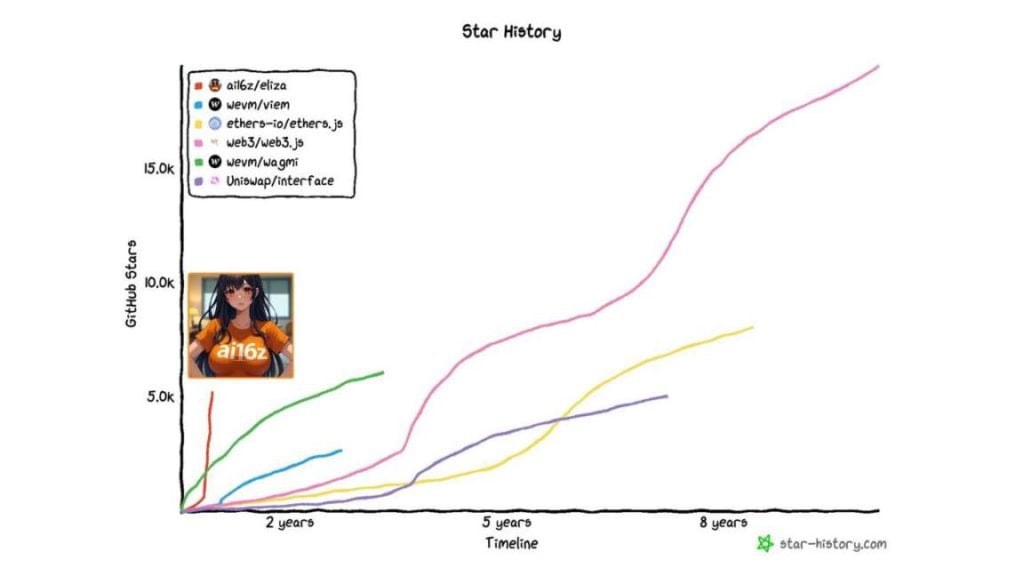

If a framework-type AI Agent has more stars on GitHub, it may mean that more developers are paying attention to and recognizing this framework. This method is more suitable for judging framework-type AI Agents, such as Eliza.

Search on GitHub to see how many stars the framework-type AI Agent has. For example, ai16z/Eliza has gained over 5,300 stars in less than a month, which is a very surprising figure.

As shown in the image, the developer attention to ai16z/Eliza has exceeded Uniswap in less than a month, indicating the high level of interest from developers in this framework. Another set of data for comparison: Sui currently has 6,400 stars, Solana has 13,000 stars, Ethereum has 50,000 stars, and Base has 70,000 stars.

However, it should be noted that the stars on GitHub can also be artificially inflated, although this behavior is not yet widespread. Therefore, this indicator can be used as an auxiliary reference for decision-making.

Three: KOL Follower Quantity Method

One of the more certain tracks for AI Agent is KOL (Key Opinion Leader).

Currently, some well-known AI Agent-style KOLs include: Terminal of Truths (210,000 followers), aixbt (160,000 followers), Zerebro (60,000 followers), Eliza (14,000 followers), and LUNA (30,000 Twitter followers, 500,000 TikTok followers).

One of the major differences in this round of AI revolution is the change in semantics. The author predicts that an AI Agent KOL leader may emerge, and the market capitalization of this leader's token may even exceed $5 billion. The change in follower count may become one of the important indicators.

Four: Leader Influence Method

There are constantly leaders in the AI industry entering the crypto space. Currently, there are representatives such as Marc Andreessen, the founder of a16z (supporting projects like ai16z), and Sam Altman (supporting projects like Worldcoin). They have brought multiple cryptocurrencies worth over $1 billion to the crypto circle. It can be expected that there will be more in the future, such as Musk and his Grok.

There are also less certain ones, such as Apple, Meta, TikTok, and AI vendors like Claude, Copilot, and Gemini. These AI companies may also bring something different to the crypto world.

It is particularly important to pay attention to those tech giants who are simultaneously researching AI and crypto, such as Musk, Marc Andreessen, Sam Altman, and Jensen Huang. Their leadership in the tech industry often translates to the crypto industry as well.

Five: Breaking Out of the Circle with the External World

If AI Agent is truly one of the biggest narratives of this cycle, it is necessary to pay extra attention to the influence of AI Agent on the external world. For example, Web2 developers have been attracted by the AI Agent framework and products of Web3. According to the author, Eliza is currently receiving attention from some AI practitioners outside the circle.

In terms of KOL products, such as Terminal of Truths and LUNA, they have also attracted the attention of people outside the circle, and they already have more than 200,000 followers, and their influence is still expanding. It is necessary to understand and judge whether this trend will further break through the circle and affect the wider external world.

Six: The "Listing Effect" of Top Exchanges

Early participants in Sandbox may know that some metaverse concepts soared after being listed on Binance. Top exchanges are called top exchanges because they need to ensure that the coins they list can lead the market. If they are led by other exchanges, they will gradually lose their status as top exchanges.

Pay more attention to the listing information and Launchpad information of Binance, Upbit, Coinbase, Bitget, and Hype, as they are in fierce competition for the "listing effect" this cycle.

Especially Coinbase and Hype, Americans are indeed leading in the field of general AI Agent, and they may have faster information advantages.

Seven: Public Chain Law

Some public chains are naturally suitable for the birth of AI Agent projects, naturally lowering the threshold for the birth of AI Agent. Finding a few good public chains and finding good AI Agent projects in these public chains can achieve twice the result with half the effort.

For example, Base, with 70,000 developer stars, surpassing Ethereum and far exceeding Solana and Sui, can be said to be a strong contender with late-mover advantages. Coinbase itself also attaches great importance to AI Agent and has laid out very early. This will give it a huge first-mover advantage in future competition.

The advantage of Solana is that it has done a good job in the meme platform, and AI Agent is highly dependent on meme to rise, which is a very big advantage for Solana.

Eight: AI Agent Community Law

Everyone has their own blind spots, but the power of a team is all-encompassing.

Establishing your own AI Agent exchange group and community, or finding one or two such high-quality communities, is very important. Opportunities for AI Agent are often born in corners that no one notices, and this is when the power of the community is needed.

Nine: Subdivision of Tracks

There are also various tracks within AI Agent, such as the KOL track, the beautiful anchor track, the investment research blogger track, the meme platform track, the VC track, the platform track, and the framework track...

There are many tracks within AI Agent, and not all tracks can be unrefuted. It is necessary to find the tracks that have a real chance of surviving to the end.

Ten: The Source Law

The beginning of the beginning, who started it? Which AI Agent opened up the narrative of the entire track, and it may be the leader of this track.

In the NFT track, CryptoPunks has always been in a transcendent position, Ape has created a new narrative for the entire track, and Bored Ape is one of the best NFTs combined with Web2; in the metaverse track, Sandbox and Decentraland were listed on top exchanges very early and occupied the leading position in the metaverse; Uniswap first realized the concept of automated market makers in decentralized exchanges (DEX), becoming a pioneer of the market... Those projects that achieve systemic innovation often get the biggest share of the track dividends.

It will be like BTC, making you always feel that it is expensive, but when you look back, it was really cheap at that time.