Author:DWF Ventures

Compiled by: TechFlow

2024 has become a critical juncture for the development of cryptocurrencies - from the active participation of institutional investors to the significant growth in on-chain activities, this year has demonstrated important progress in the industry.

Here is a review of the data for this year:

Continued Growth in 2023

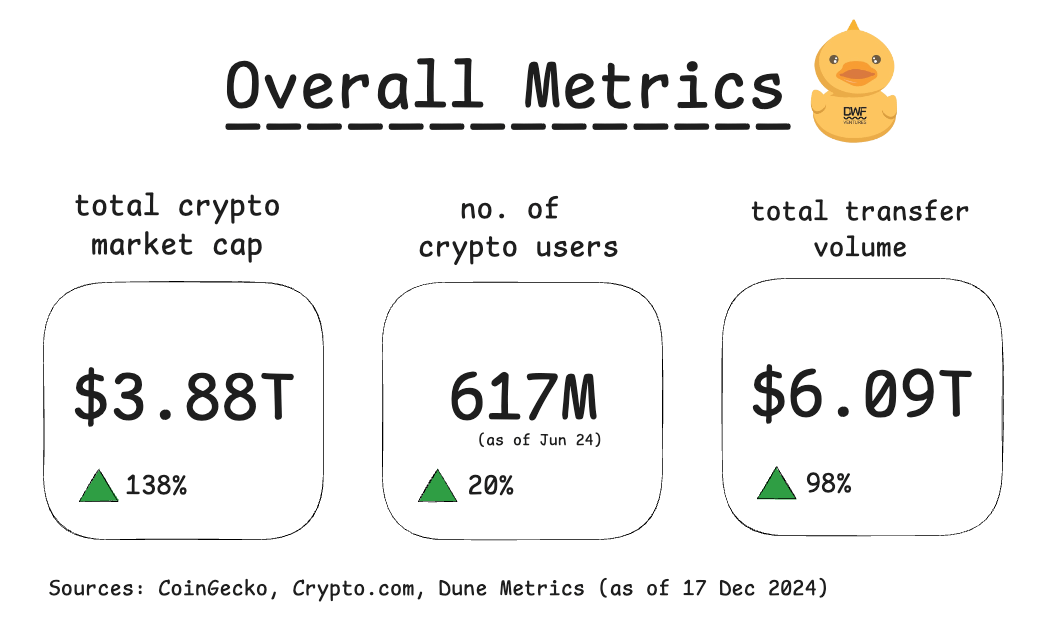

The market has rebounded strongly this year, with the total market capitalization surpassing the historical high (ATH) of 2021, reaching $3.7 trillion.

In addition to the significant increase in liquidity, the number of users and trading volume have also grown in tandem - these data indicate a healthy market development and an increase in actual usage.

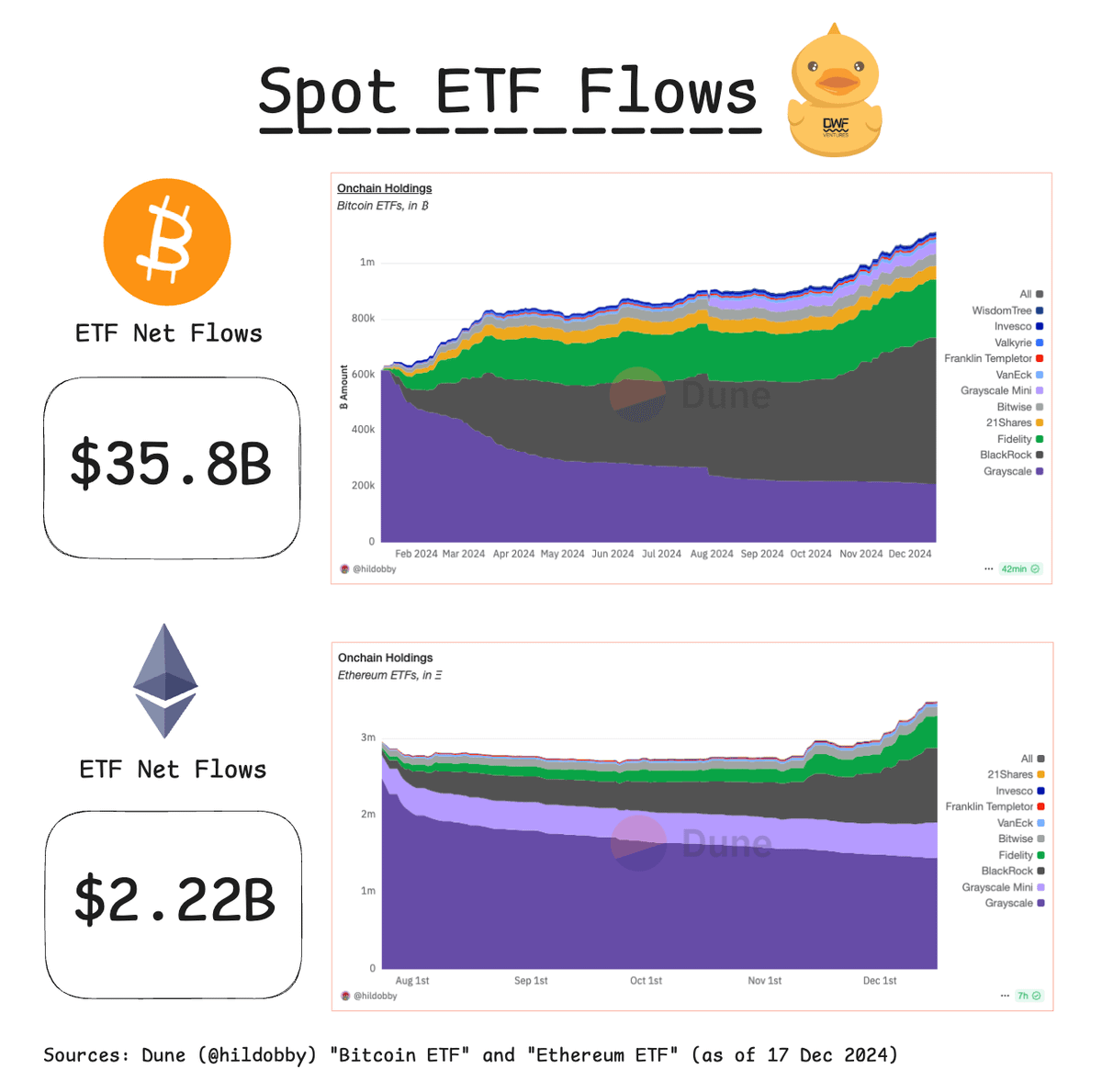

Influx of ETFs and Institutional Capital

One of the major market drivers in 2024 was the launch of the Bitcoin ETF in January and the Ethereum ETF in July. These financial products not only lowered the barrier for investors to enter the crypto market, but also reflected the rapidly growing demand for crypto assets from traditional investors.

It is estimated that the on-chain holdings of the Bitcoin ETF have grown to 1.1 million BTC, more than doubling since the beginning of the year.

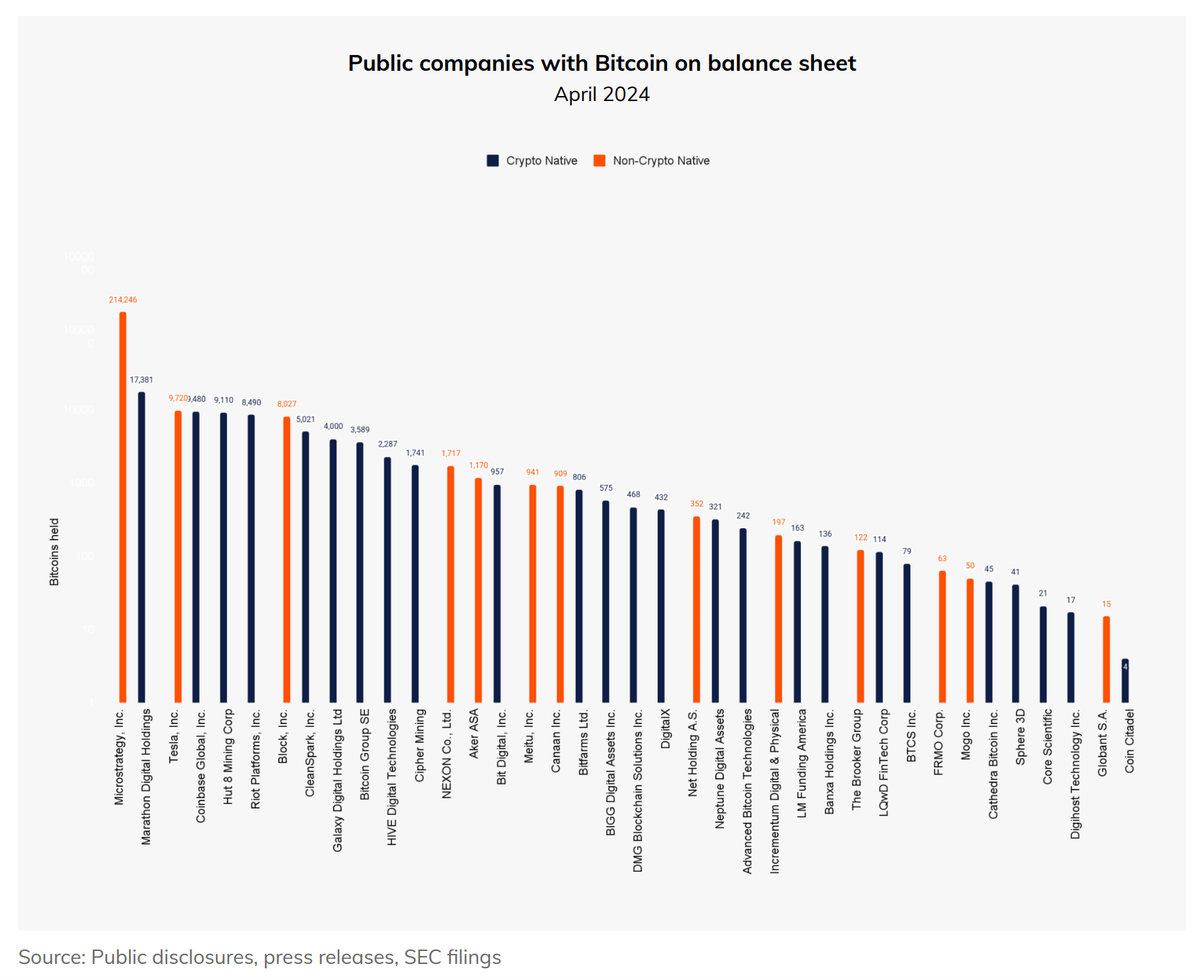

Not only crypto companies, but many traditional businesses have also been continuously increasing their investments in Bitcoin and other crypto assets. For example, MicroStrategy led by @MicroStrategy has continued to increase its Bitcoin holdings, which now stand at 439,000 BTC.

The Potential of Stablecoins

Stablecoins are a core tool in the crypto ecosystem, as they not only enable rapid exchange of assets, but are also seen as an important indicator of new capital inflows.

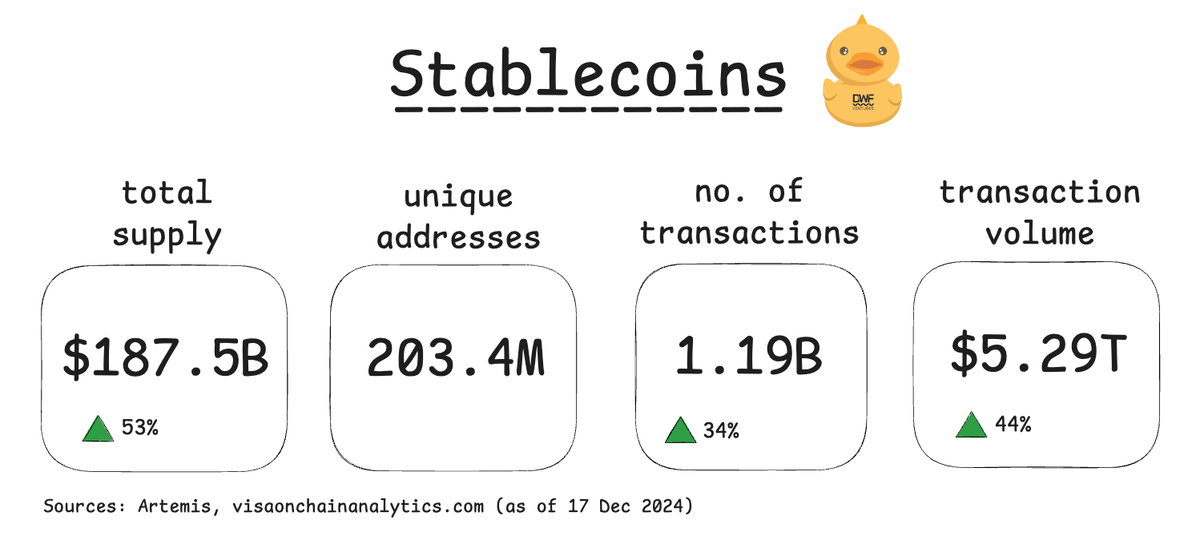

In 2024, the total supply of stablecoins reached a historic high of $187.5 billion. At the same time, the number of stablecoin transactions and trading volume have grown by 30%-40% respectively.

It is worth noting that even in the face of market volatility, the trading volume of stablecoins has remained at a high level - this indicates that stablecoins have important real-world use cases beyond just trading.

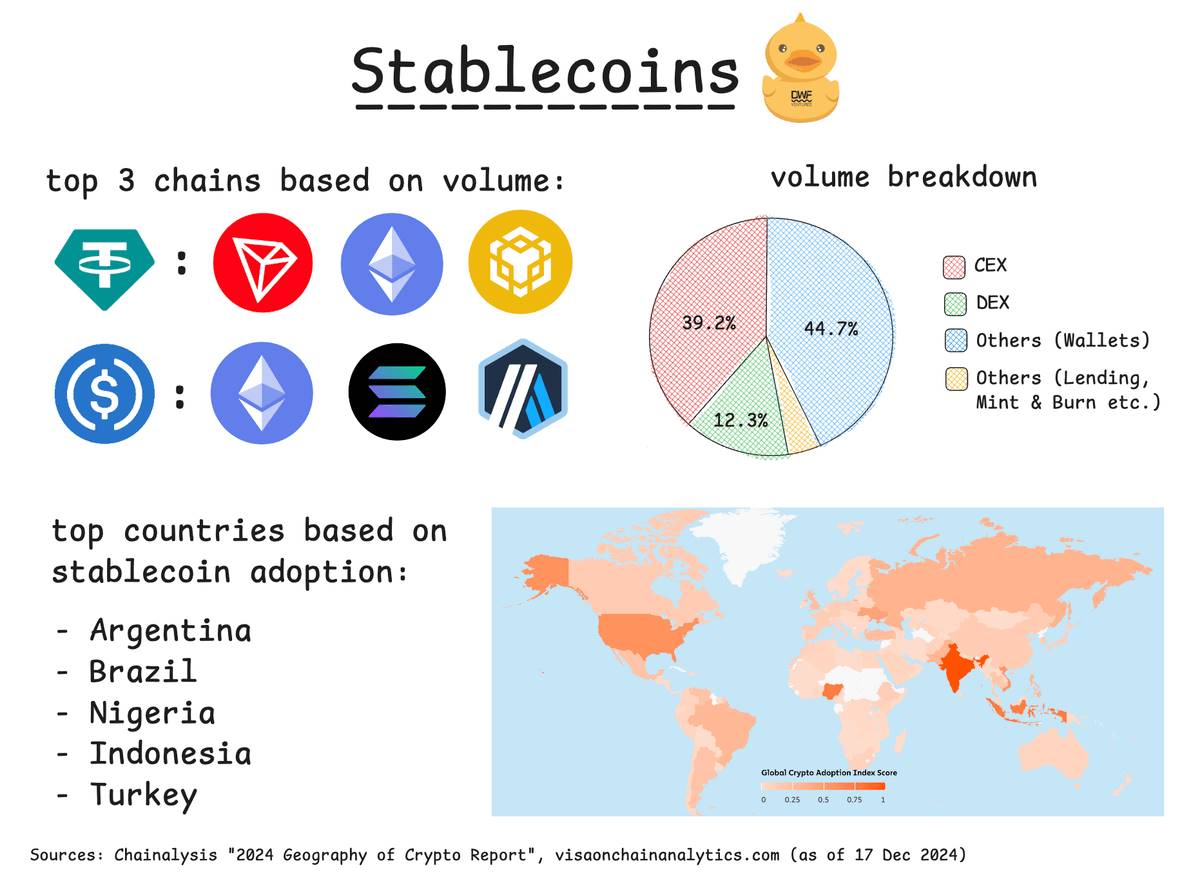

In terms of on-chain stablecoin trading volume, @trondao, @ethereum, @BNBCHAIN and @solana continue to dominate. Meanwhile, L2 networks like @arbitrum and @base have also shown strong momentum in USDC trading volume and user growth.

Although centralized exchanges (CEXs) still lead in trading activity compared to decentralized exchanges (DEXs), this landscape is changing.

The recently launched USDtb product by @BlackRock and @ethena_labs provides a secure and convenient entry point for traditional capital to enter DeFi. With the emergence of these regulated gateways, we may see more capital flowing into the on-chain ecosystem in the future.

The Rise of Stablecoin Markets in Latin America and Africa

Over the past year, the stablecoin market in Latin America and Africa has grown by 40%-50%. These regions have a strong demand for currency hedging tools that do not require third-party trust, and thus the stablecoin market has developed rapidly here.

More resources are flowing into these regions, such as the educational initiatives by @Tether_to and the expansion of payment services by @circle in Latin America. As a result, we expect this sector to continue its strong growth trajectory in 2025.

Trends in On-Chain Activity

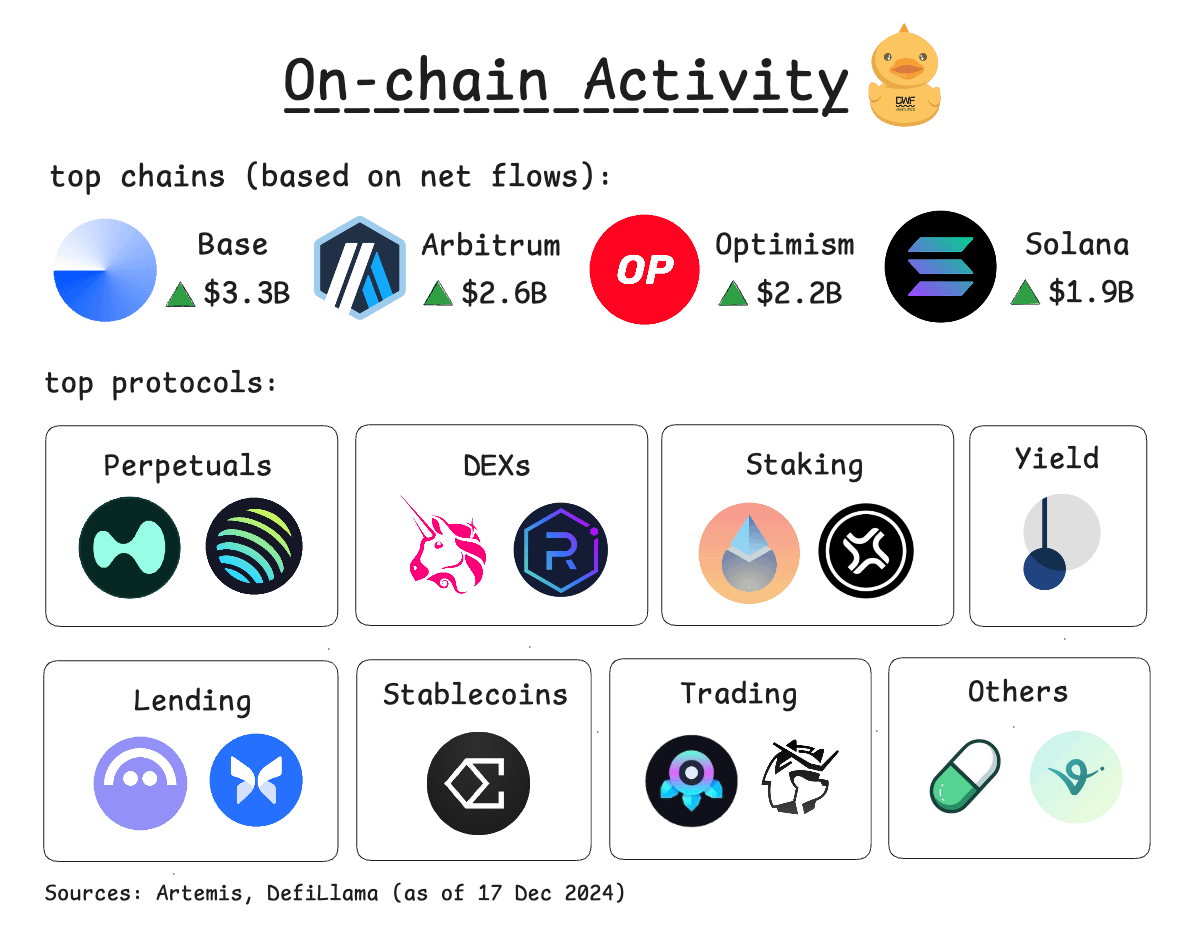

L2 networks like @base, @arbitrum and @Optimism, as well as the non-EVM chain @solana, have stood out in terms of net capital inflows this year. Users tend to prefer blockchain networks with lower transaction fees and faster speeds, and these chains have thus attracted more users.

The fastest growing areas are perpetual contracts and decentralized exchanges (DEXs). Trading volume in these two sectors has grown by over 150%, and their total value locked (TVL) has also seen 2-3 fold increases. The meme coin craze sparked by @pumpdotfun has greatly driven up trading volumes, with @RaydiumProtocol being one of the main beneficiaries, also boosting the development of other ecosystems. This trend has also led to the widespread use of trading bots (such as @tradewithPhoton and @bonkbot_io), which not only have high usage frequencies, but have also become one of the protocols with the highest fee income in the current crypto industry.

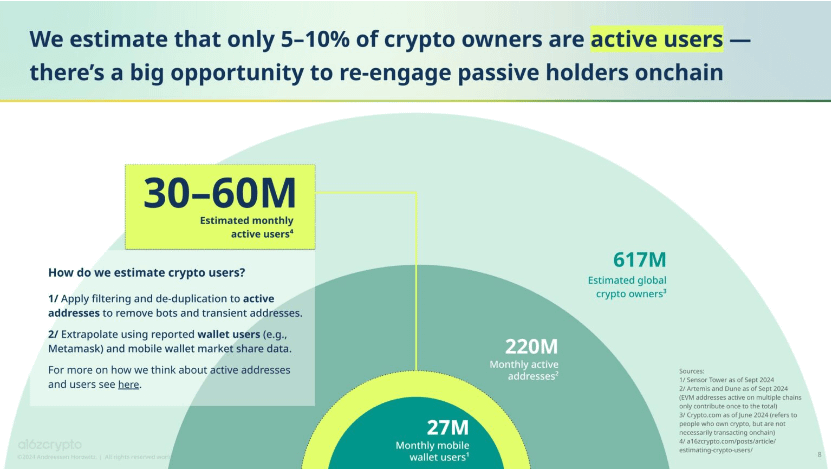

Nevertheless, there is still huge growth potential in on-chain activity. Currently, only 5%-10% of crypto holders are actively participating in on-chain operations, meaning there is a large untapped user base.

Mobile-friendly interfaces (such as TON's mini apps) have already achieved significant user growth success. For example, @ton_blockchain's mini apps have successfully attracted over 50 million users. Therefore, the future development of protocols will increasingly depend on mechanisms that optimize user experience (UX) and improve user retention.