Bit experienced a 15% correction in the third week of December, recording the largest weekly price drop since August. Experts cite the impact of global macroeconomic factors as the cause, warning that if this pressure intensifies, Bit could see further declines.

However, Bit also has internal factors that can offset the negative impact of the macroeconomy.

Global liquidity has plummeted in the past two months

According to the Kobeissi Letter, Bit prices have historically shown a 10-week lagged correlation with global M2 (money supply). Over the past two months, global M2 has decreased by $4.1 trillion, and if this trend continues, it suggests the possibility of further declines in Bit prices.

Global M2 is a key economic indicator that measures the total money supply in the global economy, including cash, demand deposits (M1), time deposits, and other liquid assets. Fluctuations in global M2 can impact stock and cryptocurrency markets.

"When global money supply hit a record $108.5 trillion in October, Bit prices reached an all-time high of $108,000. However, over the past two months, the money supply has decreased by $4.1 trillion to $104.4 trillion, the lowest since August. If this relationship still holds, it suggests Bit prices could drop up to $20,000 in the coming weeks." – Kobeissi Letter prediction.

A month ago, Joe Consorti, the growth manager at Bit custody company Theya, warned of the possibility of Bit experiencing a 20%-25% correction based on similar indicators. That prediction appears to be materializing.

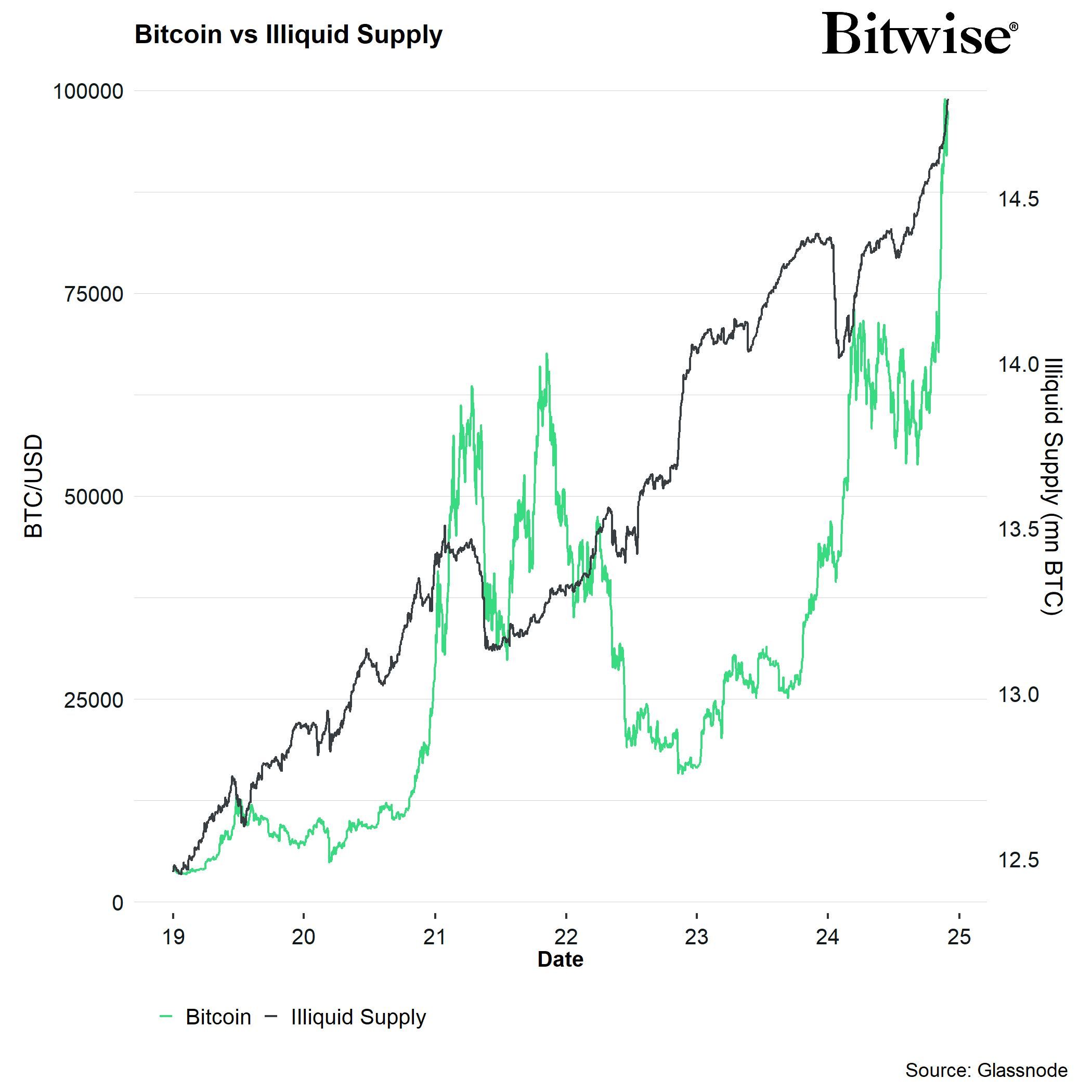

Andre Dragosch, the research director at Bitwise, also shares a similar outlook. He expects Bit to come under pressure due to the US liquidity tightening. However, he emphasizes internal Bit factors that can offset this liquidity pressure: the increasing illiquid supply of Bit.

The high illiquid supply can increase the scarcity of Bit, supporting the price through supply-demand dynamics.

"Bit is currently balancing a) the increasing macroeconomic headwinds from the US and global liquidity decline, and b) the continued on-chain tailwinds from the strong Bit supply shortage. Ultimately, the on-chain bullish factors are likely to outweigh the macroeconomic bearish factors, though this may introduce some volatility in early 2025 (and potentially provide an attractive buying opportunity)." – Andre Dragosch comment.

At the time of reporting, Bit is trading around $94,000, and according to BeInCrypto data, it has dropped nearly 6% over the weekend.