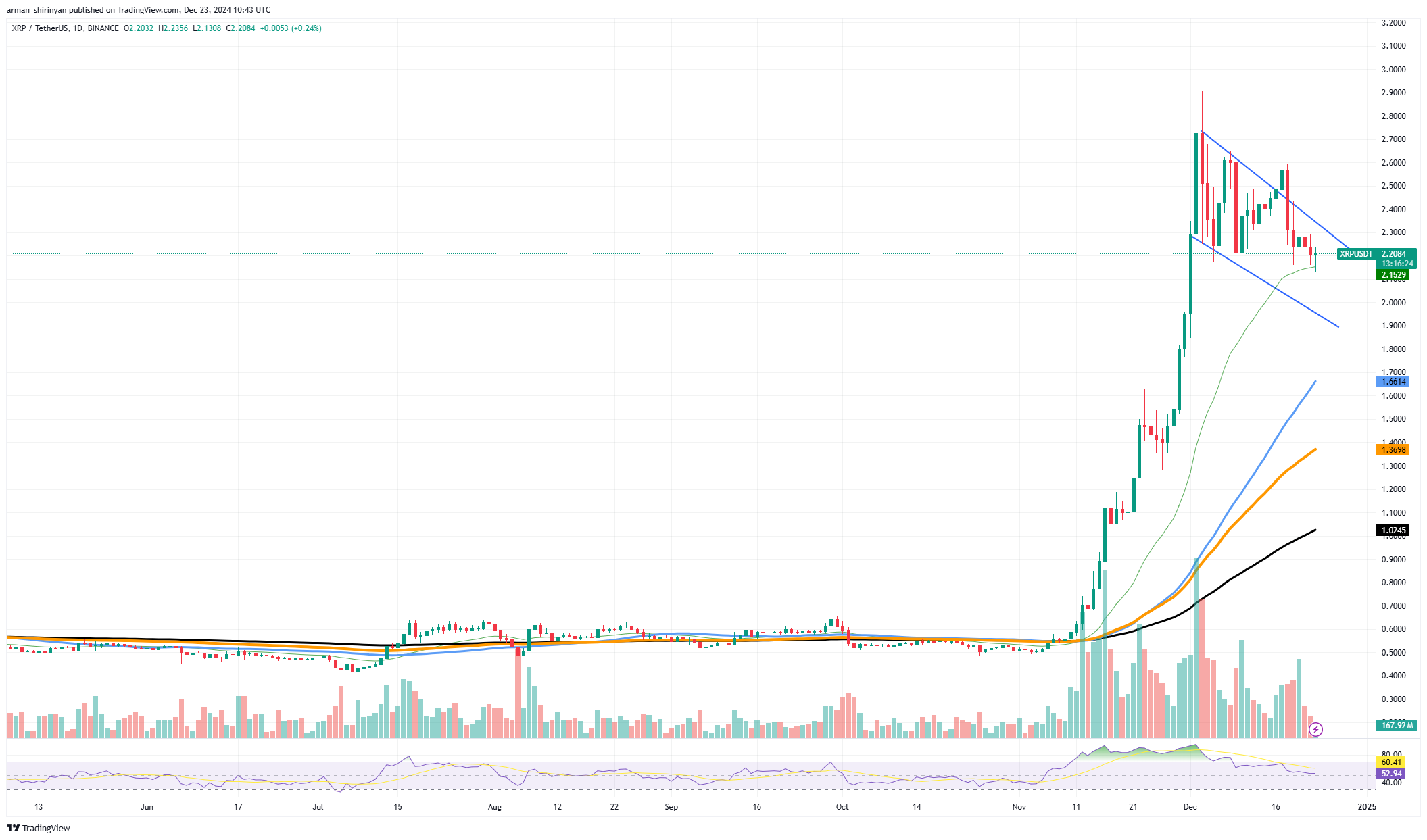

XRP has recently found support around the 26 EMA, a significant level often acting as a pivot for market sentiment. The asset’s price has shown consolidation in this area, indicating a potential reversal or further downside if the level fails to hold. With the 26 EMA acting as a critical support zone, XRP investors are closely monitoring price action to gauge the next move.

Payment volume: XRP’s transaction volume spiked earlier in December but has since tapered off, suggesting declining network activity.

Active accounts: The number of unique senders has decreased significantly, signaling reduced retail participation.

Fees burned: XRP burned as fees peaked during the initial surge but has since stabilized, aligning with reduced transactional activity.

If XRP holds above the 26 EMA, it could signal renewed buying interest, pushing the price toward $2.40 as the first resistance. An increase in transaction volume could validate a recovery, with a potential rally to $2.60 or beyond. A rebound in active accounts and payment volume might attract more buyers, fueling bullish momentum.

A close below the 26 EMA level could trigger a further drop to $2.00, testing the next support zone. Persistently declining network activity may erode market confidence, pushing XRP toward $1.90 or lower. If price action fails to align with increasing volume, it could indicate bearish divergence and further sell-offs.

XRP’s performance hinges on maintaining the 26 EMA and witnessing a recovery in on-chain activity. While current metrics suggest caution, a decisive move above $2.40 could reignite bullish sentiment. Conversely, a failure to hold critical support may lead to another wave of selling pressure, making $2.00 the next key level to watch. For now, XRP sits at a crossroads, with both upside and downside potential depending on market conditions.