Coinbase recently released a report outlining its predictions for the Bit cryptocurrency market in 2025. The report focuses on key areas such as stablecoins, tokenization, ETFs, DeFi, and regulatory developments.

Reports from other industry stakeholders also present a positive outlook for the Bit cryptocurrency market in 2025.

Favorable Regulatory Environment Driving Market Growth

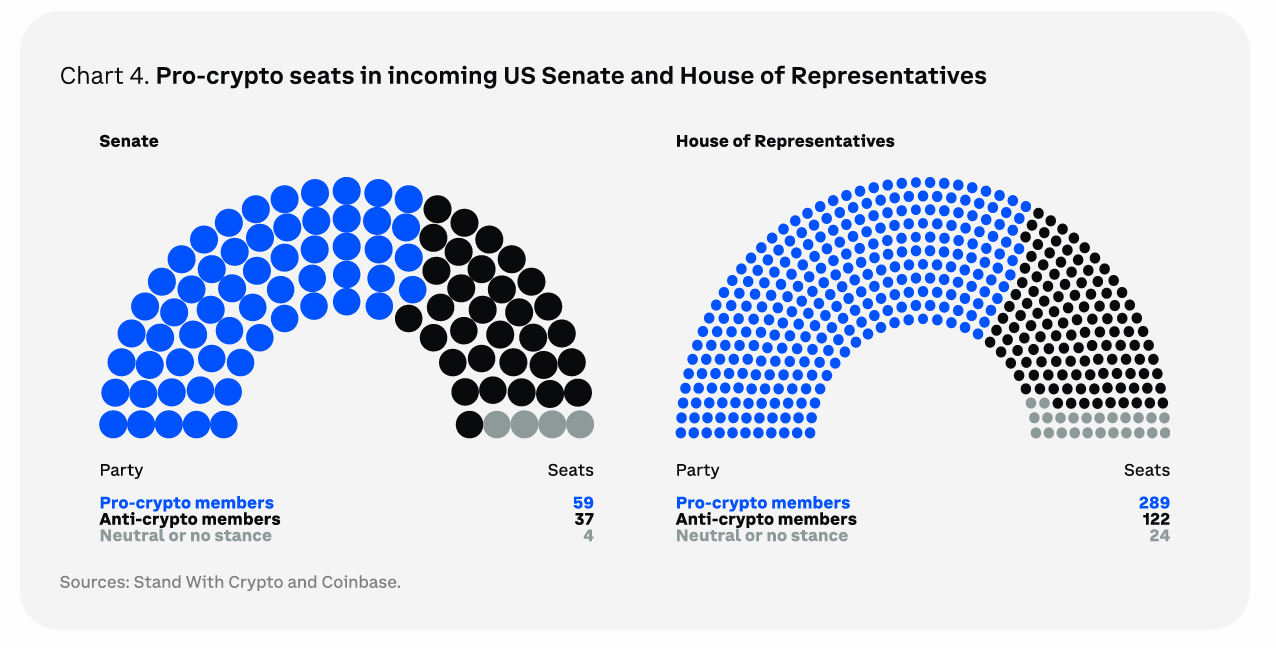

The first major prediction is that regulatory changes will benefit the overall Bit cryptocurrency market. Coinbase refers to the upcoming U.S. Congress as the "most pro-Bit Congress in history." One potential development that could materialize is the establishment of a strategic Bit reserve.

The pro-Bit movement is not limited to the U.S. alone. Regions such as Europe, the G20, the UK, the UAE, Hong Kong, and Singapore are actively developing regulations to support digital assets.

Binance CEO Richard Teng predicts that regulatory changes in the U.S. will act as a growth catalyst in 2025, and other countries are likely to follow suit.

Positive Developments in Bit Cryptocurrency ETFs

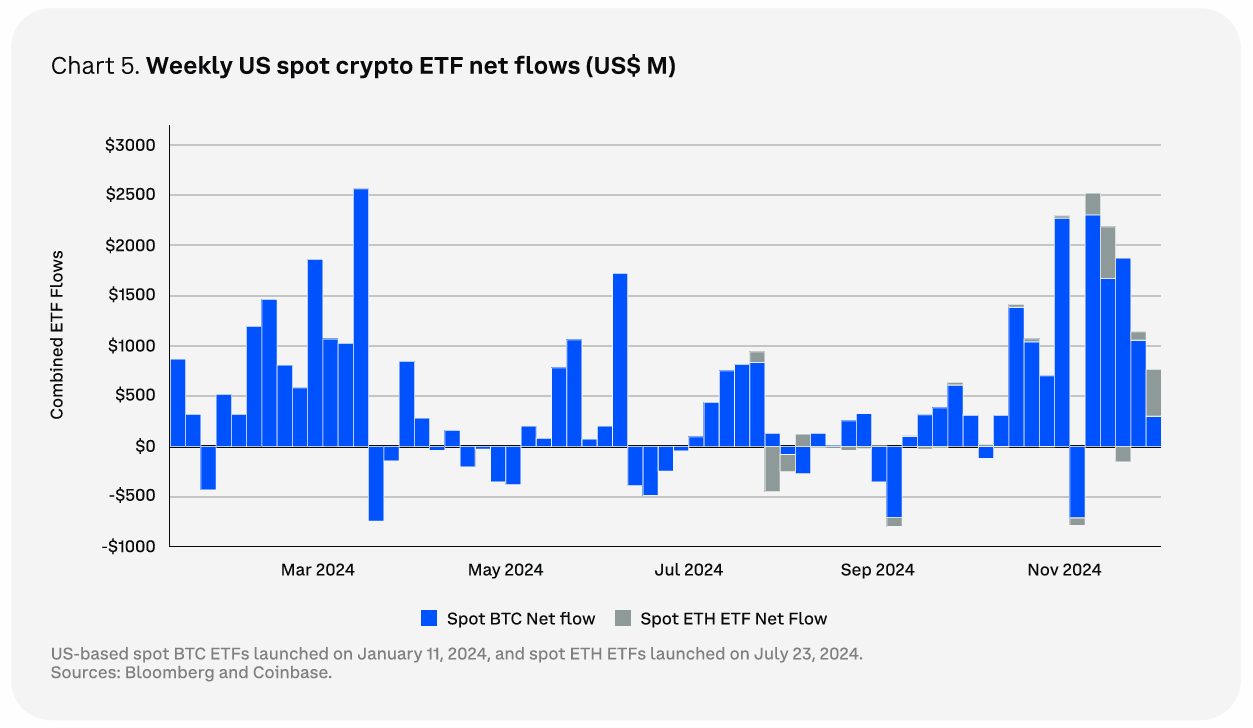

Coinbase emphasizes that Bit and Ethereum ETFs are crucial in attracting new capital. Data shows that net inflows have reached $30.7 billion since their introduction.

The report suggests that ETFs linked to assets such as XRP, SOL, LTC, and HBAR may be approved, and their benefits could be short-term.

Importantly, Coinbase speculates that the SEC may approve staking in ETFs or remove the requirement for cash creation and redemption of ETF shares, which could expand the ETF market. SEC Commissioner Hester Peirce has hinted that such developments could occur "early on."

Global Adoption of Stablecoins

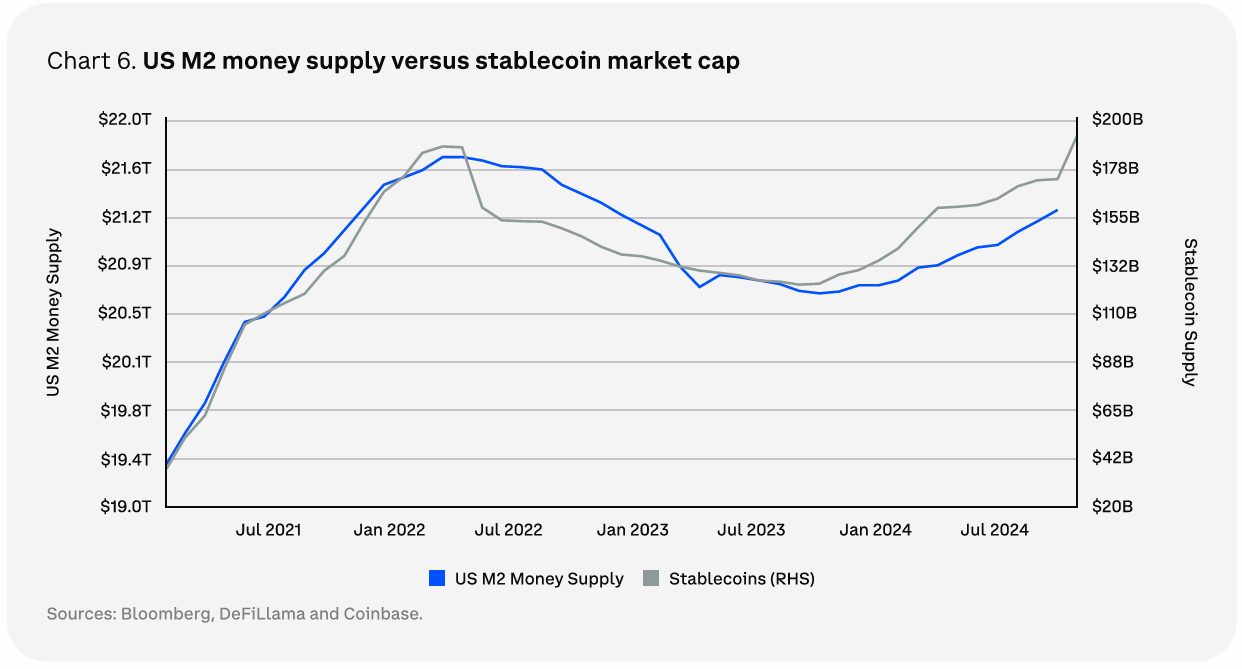

Coinbase has a very optimistic scenario for stablecoin adoption. The market capitalization exceeds $190 billion, and stablecoins currently account for 0.9% of the U.S. M2 money supply.

The report expects stablecoins to account for 14% of the $21 trillion U.S. M2 supply, driven by speed and cost-efficiency compared to traditional methods.

"In fact, the first and primary use case of stablecoins may well be for transactions, as well as global capital flows and commerce," Coinbase predicts.

Real-World Assets (RWA), Regulatory Challenges & Growth Expectations

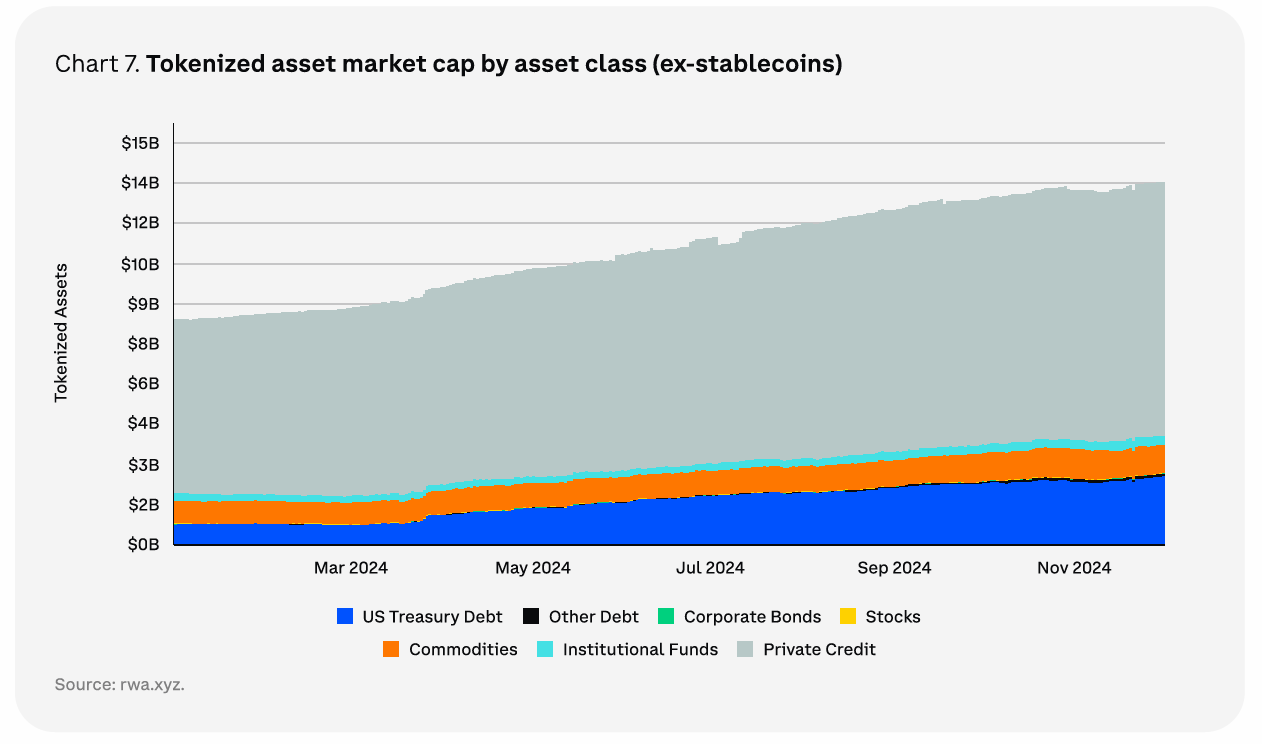

Coinbase expects tokenized assets to experience continued growth in 2025. The capitalization of Real-World Assets (RWA) has increased by over 60% in the past year, reaching nearly $14 billion.

Estimates suggest that RWA capitalization could grow by at least $2 trillion over the next 5 years, bolstered by traditional financial giants like BlackRock and Franklin Templeton.

The tokenization trend is expanding beyond traditional assets like U.S. Treasuries and money market funds to areas such as private credit, commodities, corporate bonds, real estate, and insurance.

"Ultimately, we believe tokenization can bring the entire portfolio composition and investment process on-chain, simplifying it. But this may be a few years out. Of course, these efforts face inherent challenges such as liquidity fragmentation across chains and ongoing regulatory hurdles," Coinbase predicts.

The Messari report reflects this view, forecasting that Bit and tokenized Real-World Assets (RWA) will dominate the discussion in 2025.

DeFi, Expecting a Rebound in 2025

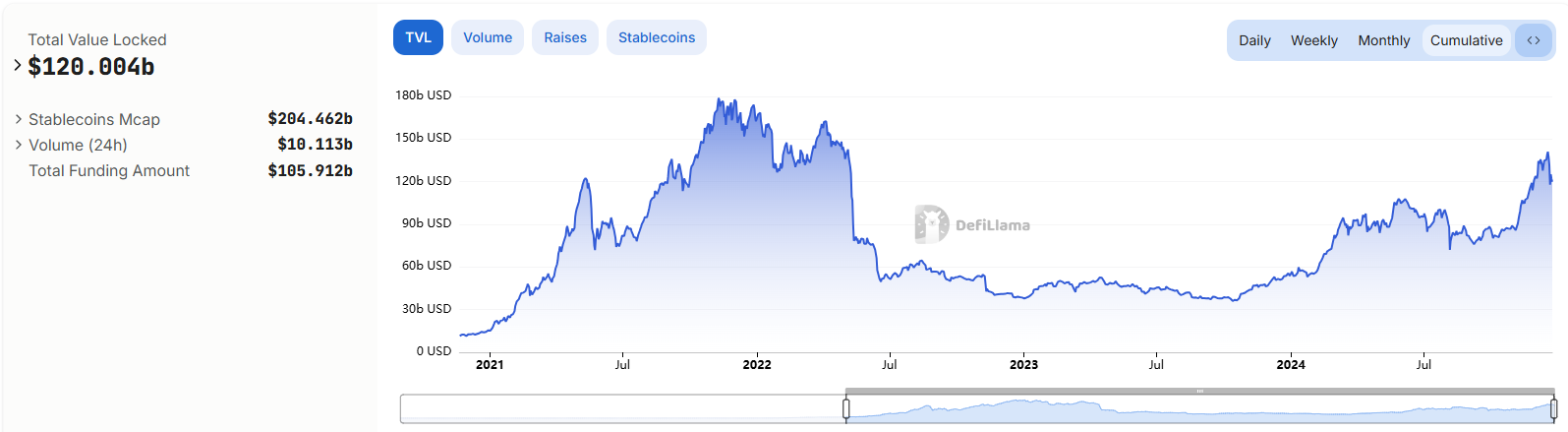

Despite the market's peak capitalization exceeding $3.7 trillion, DeFi's Total Value Locked (TVL) has not recovered its previous $200 billion high and currently stands at $120 billion.

Coinbase argues that DeFi faced significant challenges in the previous cycle, as many protocols provided unsustainable yields. However, regulatory changes in the U.S. could revive DeFi by enabling DeFi protocols to share tokens and rewards with token holders.

The report also cites comments from Federal Reserve Governor Christopher Waller, noting that DeFi can complement centralized finance (CeFi) by improving data storage efficiency using distributed ledger technology (DLT).