How Oracles in DeFi Create MEV Opportunities

Maximal Extractable Value (MEV) refers to the value that a block proposer (a node in the blockchain network) can extract by deciding which transactions to include, exclude, or reorder within a block. Today, these transaction ordering opportunities are typically discovered by "searchers" who compete through auctions to win the right to order transactions within blocks. This value is then captured by the participants in the block construction process, such as searchers, builders, and validators. As a subset of MEV, "Oracle Extractable Value" (OEV) refers to the MEV that arises during the process of oracle reports being uploaded on-chain and subsequently consumed by on-chain applications. The most common OEV opportunities arise in lending protocols, particularly during the liquidation process. Searchers compete in this process to claim the right to liquidate high-risk positions and earn the liquidation rewards. On Ethereum, this block space auction process is often facilitated through Flashbots' MEV-Boost, allowing searchers to bundle liquidation transactions with oracle report updates to achieve price backrunning. Currently, the value generated by MEV related to oracles (such as liquidations) is captured by the searchers, builders, and validators in the blockchain network, without this value returning to the DeFi protocols, end-users, and oracles that originally generated the oracle-related MEV. Recapturing this benign MEV can ultimately return the value to its original sources.Why Choose Chainlink SVR?

Chainlink Labs and the broader Chainlink community have been actively researching solutions around MEV for years, such as Fair Sequencing Services (FSS) and Protected Order Flow (PROF). As a subset of MEV, we have also focused our research on OEV, exploring how DeFi protocols can recapture this value and support the economic sustainability of oracles. Through our research, we have successfully developed an initial version of an OEV solution called Smart Value Recapture (SVR). Chainlink SVR is designed specifically for liquidation-related backrunning transactions and is not intended for use in frontrunning or sandwich attacks, which can harm the user experience and are issues the Chainlink network and community have been actively researching solutions to mitigate. We believe Chainlink SVR is the best choice for implementing a native MEV recapture solution because the Chainlink Price Feeds have already secured many of the largest DeFi protocols and have a proven track record of security and reliability. By integrating a Chainlink-based MEV recapture solution, DeFi protocols can not only retain the security and reliability provided by Chainlink but also further enhance the economic sustainability of their own and the Chainlink infrastructure they depend on. The key advantages of Chainlink SVR include: 1. Mature Decentralized Oracle Network (DON) Support 2. Reduced Unnecessary Third-Party Risk 3. No Intermediary Contract Integration Required 4. Economies of Scale Based on actual testing, we estimate the value recapture rate of Chainlink SVR to be around 40% in realistic scenarios (i.e., able to recapture $40 out of every $100 of liquidation MEV leakage). While some other solutions claim higher liquidation MEV recapture efficiency, we have not seen compelling real-world data to substantiate this, so we consider 40% a conservative but realistic estimate that will require more data collection through actual operation to verify. The initial version of Chainlink SVR is just the beginning. Over time, Chainlink SVR plans to evolve into a highly configurable, highly decentralized, generalized, and cross-chain OEV solution, fully built on Chainlink's battle-tested infrastructure. We look forward to maximizing MEV revenue recapture on any supported chains while eliminating the unnecessary risks and latency introduced by other OEV solutions.How the Initial Chainlink SVR Implementation Works

Chainlink Price Feeds provide the market-wide, volume-weighted average price of crypto assets by using decentralized oracle networks and multiple independent data sources. The initial Chainlink SVR implementation will include a set of parallel Chainlink Price Feeds, supported by the same mature DON (Decentralized Oracle Network) architecture currently used to secure the existing Price Feed services. The Chainlink Price Feeds enabled with SVR will be deployed to recapture liquidation-related MEV in the lending protocols that integrate this solution, while maintaining the standard Chainlink Price Feeds as a fallback. The "dual aggregator" price feed design allows a single Chainlink data DON to generate the same price report as the current setup, while transmitting the oracle report to the chain in a different way. The SVR feeds are based on the existing Chainlink contracts and interfaces, greatly reducing the integration burden for existing Chainlink users, as the required code changes are minimal (likely just pointing to the new aggregator or SVR feed). The oracle reports sent to the SVR-enabled price feeds will be auctioned off to searchers in a permissionless manner through Flashbots' MEV-Share, bundling the right to transmit the oracle report update with liquidation transactions. Simultaneously, the same oracle report will also be transmitted to the public mempool for the existing standard price feeds, serving as a fallback in potential risk scenarios. Standard price feed users will not be affected by anything related to SVR, as it is an optional feature.The smart contract infrastructure underpinning Chainlink Smart Application Recapture (SVR).

If the price oracle powering the SVR experiences a transmission failure (i.e., MEV-Share failure), there will be a failover mechanism to ensure that the oracle can still report prices to DeFi protocols. When the price oracle powering the SVR is deemed stale (based on a configurable time window), it will return the latest price report from the standard price oracle prior to the cutoff. This delay is necessary to prevent liquidators from bypassing the value recapture mechanism provided by Chainlink SVR and extracting value.

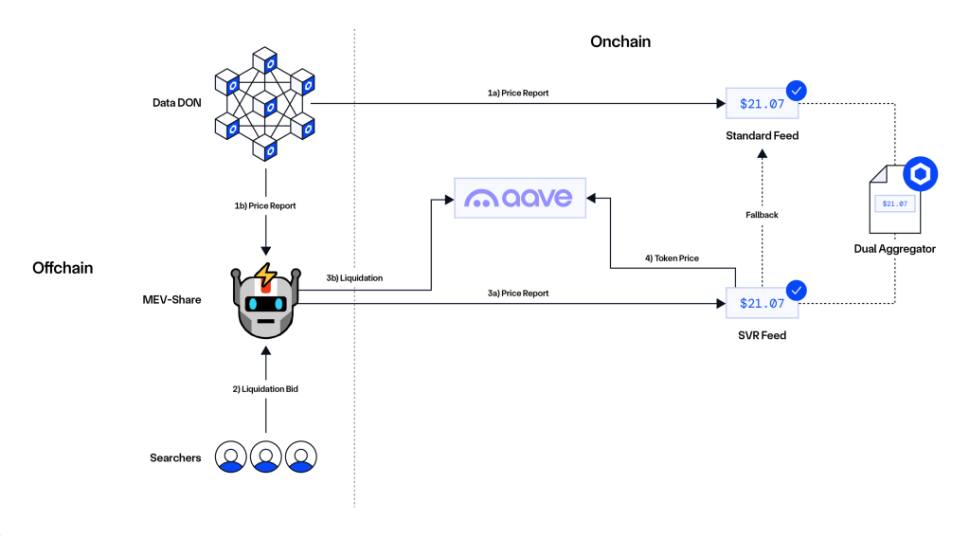

The diagram below provides an overview of how SVR is planned to integrate with Aave V3 on Ethereum.

The proposed implementation of Chainlink SVR with Aave v3 on Ethereum.

The flow in the diagram is as follows:

1. The Chainlink Data DON generates price oracle reports as it does today (i.e., via heartbeats or deviation thresholds). However, the price reports will be transmitted twice, from different accounts.

- One price report is transmitted to the standard price oracle via the public mempool (as it is today).

- Another price report is transmitted to the SVR price oracle contract via the Flashbots Protect RPC endpoint.

2. MEV-Share is an open-source protocol that selectively shares data about transactions, such as price oracle updates, with searchers who bid to have their transactions bundled into the builder's block. The builder then selects the highest searcher bid and includes the relevant backrun and liquidation transactions in a block. If there are no bids, the price oracle report will be published on-chain without any backrun liquidation transactions.

3. When the price report and backrun liquidation transactions are published on-chain:

- The price report updates the SVR price oracle.

- The backrun transactions use the updated price to liquidate relevant positions.

- The majority of the value is recaptured by Aave and Chainlink.

4. In the example described, the SVR oracle returns an updated price. However, if there is no new price available (e.g., if the MEV-Share fails), the oracle contract connected to Aave will have a failover mechanism that will return the price from the standard Chainlink price oracle after a configurable delay.

Economic Model

The MEV recaptured through Chainlink SVR is planned to be distributed between the integrating DeFi protocol and the Chainlink network according to a standard ratio, with 60% of the value going to the DeFi protocol and 40% going to the Chainlink ecosystem. This allocation scheme provides an additional revenue stream for DeFi protocols while supporting the economic sustainability of the Chainlink oracles by covering transaction gas fees and other ongoing infrastructure costs. Please note that these ratios may be subject to change in the future, with the goal of establishing a sustainable economic model between DeFi protocols and the oracles that support them.

Due to the long-standing and deep collaboration between the Chainlink and Aave communities, as well as Aave's role as a launch partner, the planned revenue allocation scheme for the initial Aave integration is: 65% to the Aave ecosystem and 35% to the Chainlink ecosystem for the first six months after going live in production - this scheme requires Aave community governance approval.

We expect Chainlink SVR to be one of the first Chainlink services to connect to the Payment Abstraction system, subject to the results of security audits and deployment status. Payment Abstraction is an on-chain smart contract system designed to significantly reduce billing and payment friction for users and developers interacting with Chainlink services. The system is designed to convert fee tokens to LINK through existing decentralized exchange (DEX) contracts.

Interested in recapturing MEV through Chainlink SVR?

If you are a DeFi protocol and are interested in integrating Chainlink SVR to recapture MEV, please reach out to us or follow us for future updates.